2-05 Market Timing and Moving Now that you know what the stock market is and what role the Stock exchanges are simply organizations that allow people the ability to buy and sell stocks. Stock Exchange plays, let’s take a step back and look at how stock prices and the economy move. As you might expect, Read More…

2-04 Public versus Private Companies & IPOs versus Secondary Market Securities Now that you know what an exchange is, it’s necessary to make a very important distinction between what shares trade on exchanges and what shares don’t. Most companies are private companies and don’t trade on exchanges. The barber shop and the florist on the Read More…

2-03 Other Stock Exchanges In addition to the New York Stock Exchange, there is also the American Stock Exchange (AMEX) and NASDAQ. In the past, the NASDAQ was for smaller companies that were just getting started, and it was prestigious for them to move up to the NYSE or AMEX. These smaller companies included a Read More…

2-02 A History Lesson – Wall Street Wall Street” is a street in New York City, near the southern end of Manhattan Island. It is the home of the New York Stock Exchange, and the biggest center of stock trading and finance in the world. History The first European colony in what we now know Read More…

2-01 What Are Stock Exchanges? In the last lesson, we used a simple example of 10 buyers and 10 sellers who got together in the same room to make trades of one company’s stock. In the real world, there are hundreds of millions of people and companies trading trillions of shares of millions of company’s Read More…

1-13 Resources Congratulations, you are through the first chapter! This is a glossary review and some extra resources for more information before we continue on to the chapter exam. Glossary Bank accounts – a depository account at a bank that acts as a secure way to store your money and withdraw it later. Checking Accounts Read More…

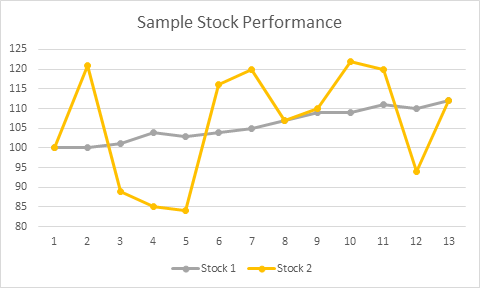

1-12 Recent Performance of Investments Now that we have looked at several different types of investments, we can compare how they have performed over time. In this case, we will pretend we invested $10,000 in Stocks, Gold, Commercial Real Estate, Residential Real Estate, and a Savings Account in January of 2010, and pulled our money Read More…

1-11 Real Estate If you are a homeowner, your home is probably where you keep most of your wealth. Everyone hopes to be able to sell their home for more than they paid for it – which means that every homeowner is a real estate investor! “Real Estate Investing” means making money based on buildings Read More…

1-10 Foreign Currency and Foreign Stocks You just got some insider information – Nintendo is about to announce a new Zelda game, coming out on their new console. Gamers are getting pumped up, this is a sure-fire hit. As a savvy investor, you think now might be a good time to invest in Nintendo! But Read More…

1-09 Gold and Other Precious Metals When we covered commodities, we mentioned iron and copper, but not Gold and Silver. That is because Precious Metals operate by different rules than other commodities – and are very different to investors. This is because unlike iron or copper, which is just used as inputs for other industry Read More…

1-07 Bonds Unlike Stocks are “equity investments” which means that individuals that own stock shares of a company actually own part of that company. stocks, which are equity instruments, A debt obligation of a company, the U.S. Treasury Department, or a city where the borrower receives funds (usually in increments of $1,000), makes semi-annual interest Read More…

1-06 ETFs (Exchange-Traded Funds) ETFs are a cross between mutual funds and stocks. ETFs are simply a portfolio of stocks or A debt obligation of a company, the U.S. Treasury Department, or a city where the borrower receives funds (usually in increments of $1,000), makes semi-annual interest payments based on the coupon rate, and eventually Read More…

1-05 Mutual Funds A mutual fund is a type of investment where a money manager takes your cash and invests it as he sees fit, usually following some rough guidelines. For example, the Fidelity Group has a fund that specializes in finding high dividend paying Stocks are “equity investments”, which means that individuals that own Read More…

1-04 Stocks Stocks are “equity investments” which means that when you own shares of a company you own part of that company. For example, if you own 1,000 shares of Apple Computer stock and Apple has 1,000,000 shares that are “issued and outstanding,” then you own 0.1% of the company. If Apple were then to Read More…

1-03 Certificates of Deposit (CDs) With a An investment choice at most banks where you agree to deposit a specific amount of money for a fixed period of time (this is called the maturity). By agreeing to keep your money at the bank for a certain length of time, the bank usually pays you an Read More…

1-02 Basic Bank Accounts Bank accounts are issued by banks, credit unions, and savings & loan institutions as a secure way to store your money and make it easily accessible later (without carrying around all your cash everywhere you go). If you are sitting with your first $500, you usually have two options for accounts: Read More…

1-01 Understanding Investment Choices The first time Tiger Woods grabbed a golf club he couldn’t hit the ball perfectly straight 300 yards and the first time Michael Jordan touched a basketball he couldn’t dunk it, so don’t think that you will be able to earn a 100% return in the first year. Before Tiger could Read More…

These are the requirements for your semester project. Please ensure that you understand all components and work on your project throughout the semester. The complete project must be submitted by the end of week 14. Objectives To acquaint students with sources of market and price information available for personal investment that will help to make Read More…

You have $1,000,000 in your brokerage account and need to invest at least $100,000 in each of the following asset classes: (1) equities, (2) mutual funds including ETFs, (3) bonds, (4) options, and (5) futures. For this assignment I suggest 1) relax and enjoy this experience, 2) read the instructions and learn the portfolio limits Read More…

What is it? The primary purpose of the project is to gain an understanding of the investment process by becoming an interested participant. You can buy, sell, buy on margin, and sell short all NYSE, AMEX, and NASDAQ stocks (common and preferred) that are trading at $5.00 or more, as well as mutual funds, government Read More…

Abstract Stock-Trak Global Portfolio Simulations introduce a hands-on learning experience for students to understand investments and allow the instructor to integrate the variety of course contents into the simulation. Engages the integrated learning efforts from students Stimulate the interests of investment Build up a sound knowledge base for financial markets This article discusses my teaching model Read More…

Each student will run a $1,000,000 portfolio. Trading accounts will be active on Thursday, March 12TH and end on Thursday May 21st (10 weeks total). PLEASE ENSURE THAT YOU REGISTER BEFORE WEDNESDAY MARCH 11TH TO ENSURE YOU ARE ABLE TO ACCESS THE SYSTEM. Each student is to assume the role of hedge fund manager and Read More…

Objective: Beat the MSCI World Equity index (iShares ticker ACWI) through managing a long-only equity portfolio. Learn to manage a large X billion institutional portfolio. Risk Controls: Long only fund Minimum 20 stocks The general “5/10/40” rule requiring that no more than 10% of a UCITS net assets may be invested in transferable securities issued Read More…

Part One (Portfolio Management): Each student will run two $500,000 portfolios (described below.) Trading will begin on Monday, Jan. 25th and end on Friday, April 9th (11-week trading period.) Each portfolio must be “active” no later than Friday, February 5th. In order to be considered active, a minimum of 6 transactions in the trading portfolio Read More…

General guidelines: The objective of this course is to learn about SRI through readings, research and a hands-on application via a portfolio simulation program. This course includes analysis of mutual fund performances based on various criteria. These criteria emphasize components of SRI such as faith based and corporate social performance as well as financial performance. Read More…

Congratulations! You have just been hired to create a new mutual fund. The objective of this mutual fund is to outperform the S&P 500. This is an aggressive mutual fund that requires an active management strategy. As the founder of this mutual fund you must select an investment strategy that you expect to outperform the Read More…

The purpose of this assignment is to first select a specific industry (such as Clothing, Financial Services, Health Care, Restaurants, etc.) that you are interested in and/or believe will perform well in the current economy. From that industry, you will pick a specific company that you will follow throughout the semester. In this assignment, you Read More…

This research project accounts for 50% of the final mark. This will incorporate the use of StockTrak where you will ‘paper trade’ on a number of exchanges using a variety of derivatives and assets. You will set out targets for each trade, and interpret and evaluate the trading results in the context of the material Read More…

NOTE: This assignment requires that the 1st part (steps 1-4) be performed and implemented during trading hours before the 2nd part (steps 5-6) can be performed. 1. Pick a stock or an index to develop an option strategy. This requires making a prediction of whether that stock or index will go up, go down, stay Read More…

NOTE: You must complete the first part of this assignment at least 2 days before the last part of the assignment. First Part (at least 2 days before the last part): For this assignment, you are to hedge the market risk of a one-stock portfolio. The stock will be of your choosing. You will use Read More…

• For this assignment, you will be analyzing a U.S. Treasury coupon bond and purchasing it on Stock-Trak. • Stock Trak trades only a very limited number of bonds. To trade bonds, you click on “Bonds” under “Trading” on the lower left of the screen. In the trading window, under “Symbol”, you will find a Read More…

1. Using at least 3 technical analysis tools, identify one stock to either buy or short sell. You must print out whatever charting you finally use. I recommend: www.bigcharts.com or www.stockcharts.com 2. Type a few coherent sentences explaining your choice of strategy and reasoning from these 3+ techniques (technical analysis). 3. As soon as you Read More…

The goal of this assignment is to apply the fundamental analysis tools that we have studied. We will use these tools to analyze a firm’s fundamentals and then come up with a trading strategy. First choose a publicly traded company that you would hypothetically want to analyze/track/invest in. Using a financial news website such as Read More…

Specifics • Point Value: 150 points • Groups of two or three • Trading occurs between 09/09/13 – 11/15/13 • Reports are due by 5:00 PM on Thursday, November 21, 2013 • Responsible TA: Anders Van Sandt will be your key contact for questions and issues relating to the StockTrak project, and how to use Read More…

The purpose of using Stock-Trak is to give you a better understanding of portfolio management. You will also learn a variety of financial instruments and their risks and rewards in the real world. The simulation will span the semester – hardly enough time for you to demonstrate your financial prowess to your classmates. Rather, the Read More…

SECURITY ANALYSIS PROJECT The requirements of the security analysis project are the following: 1. form a team of three students for the project 2. as a team choose a stock from the attached list of companies 3. complete an analysis of the stock to determine its acceptability as an investment 4. present your formal analysis Read More…

The primary goal of the project is to gain an understanding of the investment process by becoming an interested participant. Students will participate in a portfolio simulation exercise by trading an initial wealth of $500,000. Can we play the game in a group? You can form groups of two, or play the game on your Read More…

Want to find a new way to use the platform in your classes? This is a collection of projects utilizing Stock-Trak submitted from professors around the world. Find great project ideas for a variety of classes, from portfolio management and investments to agribusiness.

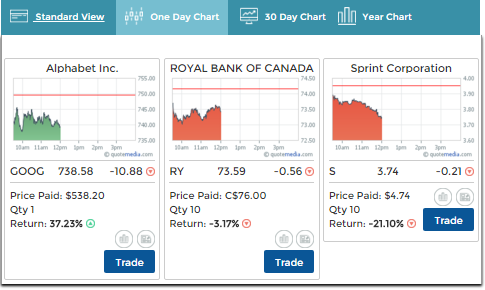

If you’ve started buying a few stocks, you will probably be interested in diversifying your portfolio between various sectors. This sounds easy, but it can be very challenging finding stocks from a wide range of sources that fit what you’re looking for. Thankfully, our [link name=”quote” dest=”/quotes”]Quotes Tool[/link] has all the information you need to Read More…

Definition “OHLC” stands for “Open, High, Low, Close”, and this is a chart designed to help illustrate the movement of a stock’s price over time (typically a trading day, hour, or minute) Details OHLC charts are also known as “Bar Charts” because they display the information as a series of line segments instead of as Read More…

Your [link name=”trans” dest=”/account/transactionhistory” ]transaction history page[/link] will show you all the orders you’ve placed that have gone through. Features Everything on this page is used to help you see your previous transactions. Action Button This will take you back to the trading page, set to repeat this action. This button will not fully pre-populate Read More…

Your [link name=”closed” dest=”/portfolio/closepositions”]closed positions page[/link] will show an estimated profit and loss from all positions you’ve “Closed” (bought then later sold, or shorted and later covered). Disclaimer The most important note about your Closed Positions is that it is only an estimate, and nothing on this page is used to calculate your portfolio value. Read More…

You can find your Open Positions page in two places: your [link name=”dash” dest=”/account/dashboard”]Dashboard[/link], or your [link name=”open” dest=”/portfolio/openpositions”]Open Positions[/link] page. The only difference between the two pages is that the “Dashboard” version will have all the security types as tabs you can switch between, while the “Open Positions” page will show each type separately. Read More…

Stock-Trak Project Requires weekly trades, explanations, and a final report (22% of total grade). Two portfolios are tracked for each student. One portfolio is passively managed after the first week, and the second portfolio is actively managed given weekly requirements. The portfolio has a total return objective. Week 1 (trades from Feb 8 through Feb Read More…

This user guide is intended for professors and site administrators as a primer on managing your classes and contests. Recorded Webinar This webinar is designed to get new professors introduced to the site and all of its components. It is just under 15 minutes long, and covers all of the aspects of creating your class, Read More…

Definition Spot and Futures contracts are a standardized, transferable legal agreement to make or take delivery of a specified amount of a certain commodity, currency, or an asset at the current date. The price is determined when the agreement is made. The only difference between spots and futures is the delivery date. The current date Read More…

Welcome to the Virtual-Stock-Exchange! This guide will show you everything you need to know for getting started, registering your class, setting up assignments, and monitoring your students’ progress, all in less than 10 minutes! Registration Step one is getting signed up for your free account. Just fill out the quick Registration Form, and you’ll be Read More…

Definition Futures Contracts are a standardized, transferable legal agreement to make or take delivery of a specified amount of a certain commodity, currency, or an asset at the end of specified time frame. The price is determined when the agreement is made. Here are some useful terms for futures: Contract Size: This specifies the number Read More…

Welcome to our investment simulator. This will be an overview on the different pages, navigation, and what features are available to all users. Video Tutorials If you prefer to watch short video tutorials on different parts of the site and trading, you’re in luck! [link name=”navvid” dest=”/content/navigationvideo”]Click Here For Tutorials Covering The Different Pages Of Read More…

We have a huge amount of research tools available on our [link name=”quote” dest=”/quotes”]Quotes Page[/link]. On this page, you’ll find a second level of navigation to move between different research tools right at the top. Basic Quotes And Beginner’s Research If you’re just getting started, most of the information you’ll need will be in the Read More…

What are options? An option gives the owner the right, but not the obligation, to buy or sell the underlying instrument(we assume stocks here) at a specified price(strike price) on or before a specified date(exercise date) in the future. (this is different for European options as they can only be exercised at the end date). Read More…

Definition: Option holders have the right, but not the obligation, to buy or sell the underlying instrument at a specified price(strike price) on or before a specified date(exercise date) in the future. (this is different for European options as they can only be exercised at the end date). Exercising the option is using that right Read More…

Calculating your buying power can be tricky, and it gets trickier with more complex contest rules. This will be a quick primer on how to see exactly how your buying power is calculated, what affects it, and how to recover it when you want to make more purchases. What is Buying Power? Your buying power Read More…

This resource will help teachers new to our stock game get familiarized with the registration process, student interactions, teacher reports, and how to use the game as part of their classes. Registration Registration is simple! If you are using the simulation for the first time, go to the registration link provided by your challenge administrator. Read More…

How Do I Build a Diversified Portfolio? Understanding what it means to build a diversified portfolio is one of the first concepts a new investor needs to understand. When talking about stocks, diversification means to make sure you don’t “put all of your eggs in one basket.” What Does It Mean To Diversify? Simply put, Read More…

Why Invest in Stocks? Once you have built your budget and built up your emergency fund, you will start to build up extra savings that go towards your future – and that future should include investing. Simply put, when you have money to invest for an extended period of time (like 20 years or more), Read More…

Definition: “Wall Street” is a street in New York City, near the southern end of Manhattan Island. It is the home of the New York Stock Exchange, and the biggest center of stock trading and finance in the world. History Before New York was New York, it was a Dutch colony called New Amsterdam, which Read More…

Definition: The New York Stock Exchange (or NYSE) is the largest stock exchange in the world. Think of it as an organized, fast-paced flea market where buyers and sellers from all over the world come to trade U.S. stocks (and now some foreign shares as well). It is where over 2,800 of the biggest U.S. Read More…

ETFs have been one of the most popular investment vehicles in the world over the last decade or so, with investors of all types attracted to the low fees, but diverse holdings, falling somewhere between mutual funds and stocks in terms of how easy they are to manage in a portfolio. However, one of the Read More…

Fibonacci Arc is a technical analysis indicator and is utilized to give hidden support and resistance levels for security. It is built by drawing a trend line between two swing points on a chart.

Live Forex trading includes negotiating of national bills which is performed on a live basis at 24 hour, around-the-clock period. Forex is derived from the words Foreign Exchange which is known as the global market that does business in money trading.

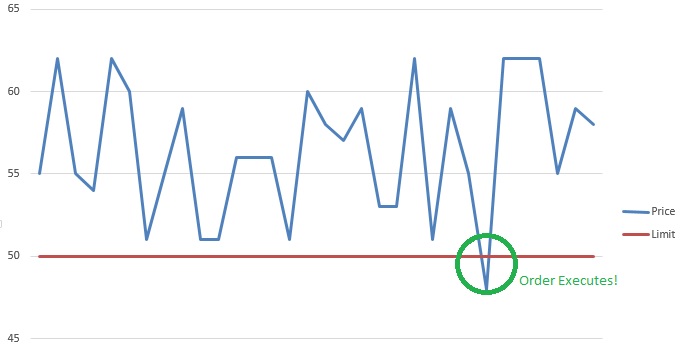

Definition A Stop (or stop loss) order and limit order are orders that try to execute (meaning become a market order) when a certain price threshold is reached. Limit and stop orders are mirrors of each other; they have the same mechanics, but have opposite triggers. When creating a limit or stop order, you will select Read More…

Definition An order type that allows to set a moving stop or limit target price. The target price moves based on the daily high. Trailing stops can be set either in percentage or in dollars and cents terms. When in dollar terms it will activate when the price has moved by the target you have Read More…

Promissory notes issued by a corporation or government to its lenders, usually with a specified amount of interest for a specified length of time. This is seen as a loan from the bond holder to the corporation. The value of Bonds traded are greater than the value of stocks traded.

Definition Your “Risk Level” is how much risk you are willing to accept to get a certain level of reward; riskier stocks are both the ones that can lose the most or gain the most over time. Risk Understanding the level of risk you need and want is a very important part of selecting a Read More…

Definition: An asset is anything that has monetary value and can be sold. Assets can be anything from a pencil (though it is not worth much) to a skyscraper to things like Stocks and ETFs. There can also be intangible assets such as the value of a brand name or logo. Details: Assets generally refer Read More…

Definition “Asset Allocation” is how you have divided up your investments across different assets. You can have all your assets in one place, or you can use diversification to spread them around to reduce risk. Details Whenever you pick stocks, open a bank account, get paid, buy something, or do anything with any resources, you Read More…

An investment strategy is the set of rules and behaviors that you can adopt to reach your financial and investing goals. Choosing an investing strategy can be a daunting task when you are starting to learn about investments and finance. Here we will look at the larger overall strategies rather than very specific strategies. Given Read More…

In finance, Volume-Weighted Average Price (VWAP) is a ratio of the profit traded to complete volume traded over a distinct time horizon – normally one day. It’s a portion of the average price a stock traded at over the trading horizon.

Definition Open Interest is the total number of options or futures contracts that are “open”, meaning currently owned by an investor and not yet expired. Details Think first in terms of options contracts: by owning an option, it signifies that there is interest in actually trading that stock, although at a different price. Since this Read More…

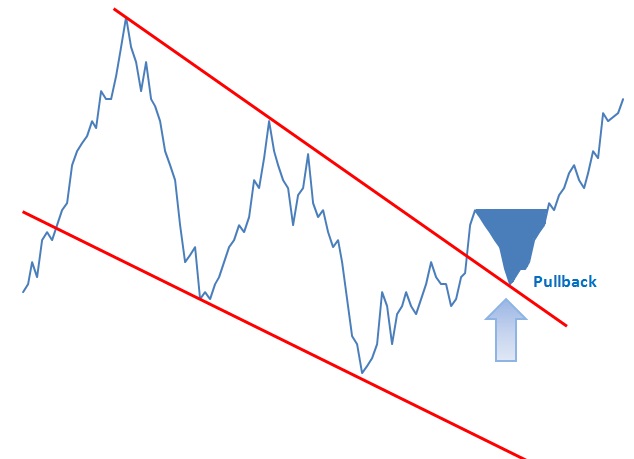

A pullback is a technical analysis term used frequently when a stock “pulls” back to a resistance and/or support line, usually after a breakout has occurred. Pullbacks can be in an uptrend or downtrend and can pull back upwards or downwards. In the example below we can see a pullback as it retraces back to Read More…

Double Bottoms are reversal patterns and often seem to be one of the most common (together with double top patterns) patterns for currency trading. Double Bottoms patterns are identified by two consecutive low prices of the same depth with a moderate pull back up in between (neckline peak).

Definition When you are looking at a sequence of related numbers (for example, the price of a single stock over time, the height of all students in a classroom, or how many breakfasts you will get out of a box of a particular cereal), the “variance” is how far away the numbers get from the Read More…

ETFs are collections of assets into bundles you can invest in all at once, the most popular ones follow indecies (such as SPY following the S&P 500), which is one way for an investor to build a diverse portfolio without holding dozens of individual positions. However, using financial derivatives and debt, there are also “Leveraged Read More…

The S&P 500, or the Standard & Poor’s 500, is a stock market index based on the common stock prices of 500 top publicly traded American companies, as determined by S&P. It differs from other stock market indices like the Dow Jones Industrial Average and the Nasdaq Composite because it tracks a different number of stocks and weights the stocks differently. It is one of the most commonly followed indices and many consider it the best representation of the market and a bellwether for the U.S. economy.

Good Till Date Order Terms If you have ever placed a limit or stop order, you have see the “Good Till Day” order term on the trading menu: A “Good-Till-Day” order is simply one that will cancel at the end of the trading day if it does not fill. So, for example, if you have Read More…

How Do I Build a Diversified Portfolio? Understanding what it means to build a diversified portfolio is one of the first concepts a new investor needs to understand. When talking about stocks, diversification means to make sure you don’t “put all of your eggs in one basket.” What Does It Mean To Diversify? Simply put, Read More…

Sharpe Ratio for Beginners Introduction The Sharpe Ratio is an important tool for evaluating a stock, or a portfolio, based on how risky it is to get a higher return. You can use the Sharpe Ratio to determine how consistent the returns of a stock or portfolio are, so you can determine if the returns Read More…

The head-and-shoulders pattern is one of the most popular chart patterns in technical analysis. The pattern looks like a head (the middle peak) with two shoulders (two equal heiight peaks).

The Moving Average Convergence-Divergence (MACD) indicator is one of the easiest and most efficient momentum indicators you can get. It was developed by Gerald Appel in the late seventies. The MACD moves two trend following indicators and moving averages into a momentum oscillator by subtracting the longer moving average from the shorter moving average. The Read More…

Fixed income analysis is the process of evaluating and analyzing fixed income securities for investment purposes. Fixed Income represents a distinct asset class. Investors and analysts perform fixed-income analysis to Evaluate the risk characteristics underlying debt securities and to assess the capacity of the borrowing entity to meet its financial obligations (credit analysis) Identify which Read More…

Introduction The Black-Scholes formula is the most popular ways to calculate the true price of an option. It is easy to calculate the intrinsic value, but the extrinsic value can be very tricky to calculate. Black Scholes is used for calculating two types of options. Options on stocks Stock Options. Fisher Black, Robert Merton and Read More…

Definition: The simultaneous purchase of a security on one stock market and the sale of the same security on another stock market at prices which yield a profit. In Depth Description: In economics and finance, arbitrage is the practice of taking advantage of a price difference between two or more markets: striking a combination of Read More…

Over-The-Counter (OTC) Stocks Most investors are familiar with NASDAQ, the NYSE (New York Stock Exchange), TSX (Toronto Stock Exchange), and most other large national stock exchanges. However, there are also thousands of companies that want to sell shares to the general public, but are not able to sell on these exchanges. Stock traded on these Read More…

Home Budget Calculator! The most difficult thing people think of with personal finance is building your monthly budget, and sticking to it. There are tons of different expenses and payments to consider, so we put all the big ones in one place! This tool will also help you see exactly how much you can set Read More…

Car Loan Calculator! The first BIG purchase many people make is when they buy their first car. This calculator will help show the impact of many of the biggest factors people need to consider when taking out their first loan for a big purchase. If you have used our Credit Card Payment Calculator to see Read More…

Credit Card Minimum Payments Calculator! Credit Cards! These are usually the first “loans” a person takes out, and the first monthly payments! Tens of thousands of young people dig themselves deep into credit card debt before they even realize it, so have fun with this payments calculator to see how much these bits of plastic Read More…

Compound Interest Calculator The first thing to consider with all personal finance is the idea of compound interest! This is what separates the “Piggy Bank” savers from the Warren Buffets; making use of interest compounding is how you can really make your savings grow! If you have already used our Investment Return Calculator, you can Read More…

Advanced Investment Return Calculator Find out the difference between Simple and Compound Interest! See how big an impact your tax rates and inflation have on your savings over time! If you have already used our Becoming A Millionaire Calculator, you can use your targeted Expected Investment Return numbers in this calculator to see how to Read More…

How to Become a Millionaire Calculator Want to be a millionaire? Everyone does, but do you know how much you need to save and what rate of return you need to get on your investments to reach that million level? This financial calculator helps you learn how your savings grows over time and how Read More…

Buy Vs Lease Calculator! The biggest expense most people have is the place they live, one of the biggest decisions young people face is whether to buy their home, or continue to rent. Conventional wisdom says that buying will pay off in the long term, but believe it or not this is not always the Read More…

Use this calculator to find Net Present Value, based off expected annual growth, cash flow over a variable number of years, and separations of cash flow between investments and operations. This calculator will help you determine the attractiveness of a company by seeing how much it would be worth if you wanted to buy it Read More…

Use this calculator to calculate an Internal Rate of Return! Inputs include regular deposits and withdrawals, up to 20 irregular withdrawals, and whether to calculate based on deposits at the beginning or end of the period. The Internal Rate of Return or “IRR” is an important concept in math, finance and economics. It is frequently Read More…

Technical analysis software automates the charting, analysis and reporting functions that support technical analysts in their review and prediction of financial markets (e.g. the stock market).

Serbia is a European country with an upper-middle income economy. It had one of the fastest growing economies of its region, in terms of GDP growth rates prior to the global recession, and attracted solid foreign direct investment. This article explores Serbia’s economic strengths along with the stock market, largest banks and ways one can invest in the country.

A cup-and-handle chart pattern resembles a cup of tea. These are bullish continuation patterns where the growth has paused. momentarily, it trades down and then continues its upward pattern. This pattern must always be at least 5 weeks long and can last up to a year.

Latvia is an EU member country that experienced superior GDP growth rates prior to the financial crisis in 2008. It underwent significant privatization, which resulted in large foreign direct investment inflows. Its economy was ranked first among developing countries until 2008.

Belgium is an EU member located in Western Europe. It has a strong industrialized economy, well-developed transportation infrastructure, and a highly productive work-force making it an attractive destination for foreign capital.

Italy is an EU member country and one of G-8 leading industrialized economies, having the seventh largest economy in the world. Its thriving small and medium enterprises play an important economic role.

Ireland is an EU member country with a knowledge-based economy and strong industries in services and technology. With attractive corporate tax rates, Ireland has been ideal destination for multinational corporations.