Future Options are exactly what their name implies – an option on a futures contract. Futures and Options – Related Derivatives Futures and options are both derivatives – meaning a security whose value solely depends on the value of the underlying asset. A future derives its value from the commodities or currencies which it represents Read More…

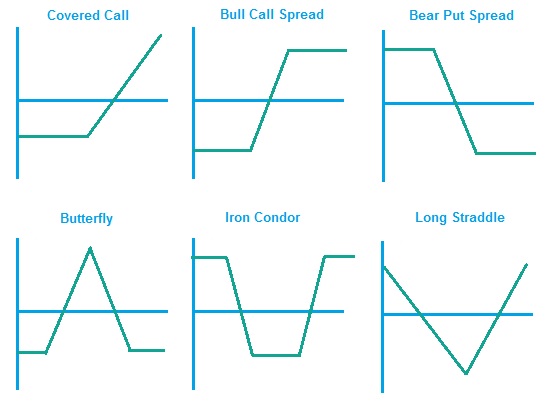

There is an infinite number of strategies that can be used with the aid of options that cannot be done with simply owning or shorting the stock. These strategies allow you select any number of pros and cons depending on your strategy. For example, if you think the price of the stock is not likely Read More…

A straddle is an investment strategy that involves the purchase or sale of an option allowing the investor to profit regardless of the direction of movement of the underlying asset, usually a stock. There are two straddle strategies, a long straddle and a short straddle. How to create a Long Straddle position A long straddle Read More…

You can find the underlying stock price, along with the option strike price, expiration date, and whether it was a “Put” or “Call” right from the option symbol! AAPL1504L85 is the way we write our options and can differ from other websites or brokerages. Our options are written: Symbol Year Day (Call or Put and Read More…

Options Spreads are option trading strategies which make use of combinations of buying and selling call and put options of the same or varying strike prices and expiration dates to achieve specific objectives (hedging, arbitrage, etc.). Option spreads are complex trades, but you can place two “legs” simultaneously using this trading platform. Trading Option Spreads To Read More…

What are options? An option gives the owner the right, but not the obligation, to buy or sell the underlying instrument(we assume stocks here) at a specified price(strike price) on or before a specified date(exercise date) in the future. (this is different for European options as they can only be exercised at the end date). Read More…

Definition: Option holders have the right, but not the obligation, to buy or sell the underlying instrument at a specified price(strike price) on or before a specified date(exercise date) in the future. (this is different for European options as they can only be exercised at the end date). Exercising the option is using that right Read More…

The CBOT is an exchange providing trading in derivatives contracts and clearinghouse functions. It allows traders to buy and sell contracts on several products in asset classes such as agriculture, energy, metals, equities, bonds, and exchange rates. The majority of its trades are conducted electronically.

A short call option position where the writer does not own the specified number of shares specified by the option nor has deposited cash equal to the exercise value of the call.

An options strategy by which an investor retains a long position in an asset and writes or sells a call options on an identical in an effort to produce an increased income from the asset.

A Call Option gives the holder the right, but not the need to purchase a fixed quantity of a particular stock at a specific price inside a particular time. Call Options are bought by investors who anticipate a price increase.

When an option’s strike price is identical to the price of the security. Both call and put options will be simultaneously “at the money.” For example, if the ABC stock is trading at 75, then the ABC 75 call option is at the money and so is the ABC 75 put option. An at-the-money option has no intrinsic value, but may have time value (value if the stock goes up during the period of the option). Options trading activity tends to be most active when options are at the money.

Strike Price is the price at which an option can be exercised to buy or sell the underlying stock or futures contract.

A Put Option gives the holder the right to sell the underlying stock or futures contract at a specified strike price.

Out-Of-The-Money refers to an option that is unfavourable to exercise. An example is a put option with a strike price lower than the underlying stock price, or a call option with a strike price higher than the underlying stock price.

In-The-Money refers to an option whose underlying’ asset’s price changes in such a way that it becomes profitable to exercise the option at the given strike price. For example: Stock price is lower than the strike price specified in a put option contract.

Expiration Date is the last day upon which an option or futures contract can be exercised or traded.

Derivative is a type of security whose value is “derived” from an underlying asset. (Eg; Futures and Options). Futures and options are both derivatives – meaning a security whose value solely depends on the value of the underlying asset. A future derives its value from the commodities or currencies which it represents An option derives Read More…

Options can be extremely lucrative, but also very dangerous if not properly understood. One of the first steps in learning how to trade options is to understand how to read an options table. Below is an example of a basic options table of Google (GOOG) expiring in October 2011: Calls and Puts: There are two types of Read More…

When would I use this strategy? A Covered Call Strategy is for investors who feel that the stock price will either remain stable or will grow. This strategy is NOT for investors who think the price of the stock will go down. How do I execute this strategy? The strategy entails two steps: Write a Read More…

If you have never traded options before, don’t worry; it’s easier than you might think. But before you can even begin trading options, you need to understand what an option is. Definition of an Option An option is the right to buy or sell an asset, not an obligation. In other words, the option does not force you Read More…