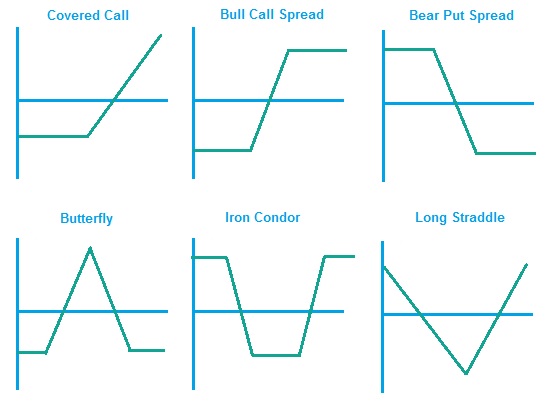

A covered call is an options insurance strategy where you simultaneously have an open position on a stock and sell a call option for the same symbol. Adding a short call in your open positions means that you are obligated to sell your stocks at the strike price contingent on the option buyer. However, you Read More…

A covered put is an options insurance strategy where you simultaneously have a short open position on a stock and sell a put option for the same underlying option. Adding a short put in your open positions means that you are obligated to buy your stocks at the strike price, contingent on the option buyer’s Read More…

A floor is an options insurance strategy where you simultaneously have a long open position on a stock and a long put for the same underlying asset. Adding a long put to your open position means that you are obligated to sell your stock at the strike price. The long put ensure that you can Read More…

A cap is an options protection strategy where you simultaneously have a short position on a stock and a long call for the same underlying asset. Adding a long call to your open position means that you are obligated to buy your stock at the strike price. However, you already have a short position on Read More…

A bull spread is a strategy where you simultaneously buy a long call at Strike Price 1, and sell a call for Strike Price 2. Recall that users will pocket the premium should the option not be exercised. By selling a call with a higher strike price, users can reduce their total transaction costs and Read More…

A bear spread is a strategy where you simultaneously sell a put at Strike Price 1, and buy a put at Strike Price 2. Recall that users will pocket the premium should the option not be exercised. By selling a put with a lower strike price, users can reduce their total transaction costs and create Read More…

Every year or two, most of us go to the doctor’s office to receive a check-up on the state of our physical health. The doctor typically checks several measurements (height, weight, blood pressure, etc.) in order to gauge how our health has progressed over the past year. They can then use their results to determine Read More…

Future Options are exactly what their name implies – an option on a futures contract. Futures and Options – Related Derivatives Futures and options are both derivatives – meaning a security whose value solely depends on the value of the underlying asset. A future derives its value from the commodities or currencies which it represents Read More…

There is an infinite number of strategies that can be used with the aid of options that cannot be done with simply owning or shorting the stock. These strategies allow you select any number of pros and cons depending on your strategy. For example, if you think the price of the stock is not likely Read More…

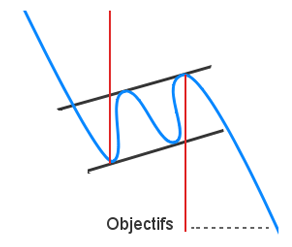

A straddle is an investment strategy that involves the purchase or sale of an option allowing the investor to profit regardless of the direction of movement of the underlying asset, usually a stock. There are two straddle strategies, a long straddle and a short straddle. How to create a Long Straddle position A long straddle Read More…

You can find the underlying stock price, along with the option strike price, expiration date, and whether it was a “Put” or “Call” right from the option symbol! AAPL1504L85 is the way we write our options and can differ from other websites or brokerages. Our options are written: Symbol Year Day (Call or Put and Read More…

Options are an important instrument for many traders, and to understand options you need to understand options tables and learn how to read option tables! Depending on the software or website you use, the actual information may vary, but all tables have these basic sets of information: Calls Puts Strike Vol Expiry Last Chg Bid Read More…

What are options? An option gives the owner the right, but not the obligation, to buy or sell the underlying instrument(we assume stocks here) at a specified price(strike price) on or before a specified date(exercise date) in the future. (this is different for European options as they can only be exercised at the end date). Read More…

What is a Balance Sheet? The Balance Sheet (or Statement of Financial Position) is one of the four financial statements required by the SEC based on the U.S. GAAP (Generally Accepted Accounting Principles). According to the SEC, the Statement of Financial Position presents “detailed information about a company’s assets, liabilities and shareholders’ equity.” In other Read More…

Definition: The Income Statement is one of the financial statements that all publicly traded companies share with their investors. The income statement shows the company’s sales, expenses, and net profit (or loss) over a period of time–usually 3 months, year-to-date, and twelve months. The income statement also comes with a lot of notes and discussions Read More…

Fibonacci Arc is a technical analysis indicator and is utilized to give hidden support and resistance levels for security. It is built by drawing a trend line between two swing points on a chart.

Definition “Asset Allocation” is how you have divided up your investments across different assets. You can have all your assets in one place, or you can use diversification to spread them around to reduce risk. Details Whenever you pick stocks, open a bank account, get paid, buy something, or do anything with any resources, you Read More…

In finance, Volume-Weighted Average Price (VWAP) is a ratio of the profit traded to complete volume traded over a distinct time horizon – normally one day. It’s a portion of the average price a stock traded at over the trading horizon.

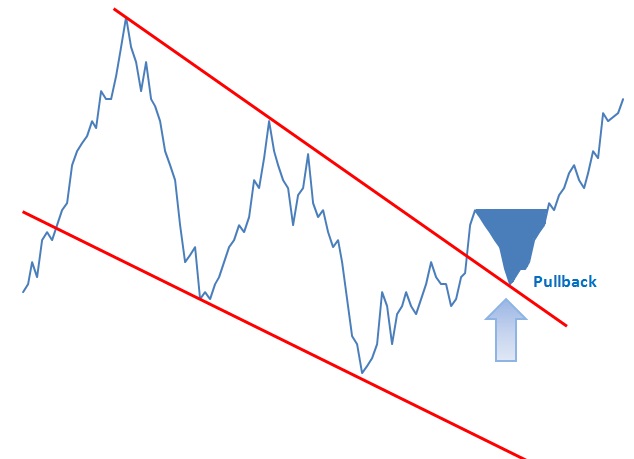

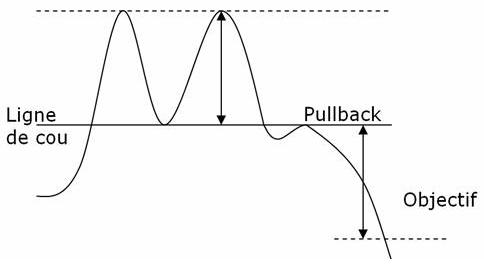

A pullback is a technical analysis term used frequently when a stock “pulls” back to a resistance and/or support line, usually after a breakout has occurred. Pullbacks can be in an uptrend or downtrend and can pull back upwards or downwards. In the example below we can see a pullback as it retraces back to Read More…

Double Bottoms are reversal patterns and often seem to be one of the most common (together with double top patterns) patterns for currency trading. Double Bottoms patterns are identified by two consecutive low prices of the same depth with a moderate pull back up in between (neckline peak).

The head-and-shoulders pattern is one of the most popular chart patterns in technical analysis. The pattern looks like a head (the middle peak) with two shoulders (two equal heiight peaks).

The Moving Average Convergence-Divergence (MACD) indicator is one of the easiest and most efficient momentum indicators you can get. It was developed by Gerald Appel in the late seventies. The MACD moves two trend following indicators and moving averages into a momentum oscillator by subtracting the longer moving average from the shorter moving average. The Read More…

Introduction The Black-Scholes formula is the most popular ways to calculate the true price of an option. It is easy to calculate the intrinsic value, but the extrinsic value can be very tricky to calculate. Black Scholes is used for calculating two types of options. Options on stocks Stock Options. Fisher Black, Robert Merton and Read More…

Technical analysis software automates the charting, analysis and reporting functions that support technical analysts in their review and prediction of financial markets (e.g. the stock market).

Serbia is a European country with an upper-middle income economy. It had one of the fastest growing economies of its region, in terms of GDP growth rates prior to the global recession, and attracted solid foreign direct investment. This article explores Serbia’s economic strengths along with the stock market, largest banks and ways one can invest in the country.

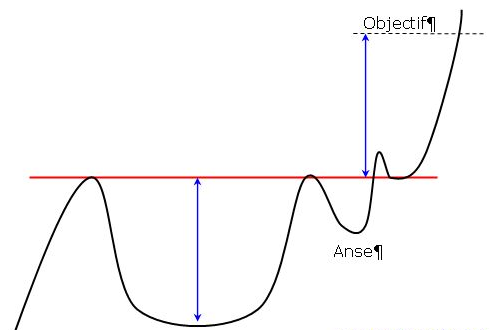

A cup-and-handle chart pattern resembles a cup of tea. These are bullish continuation patterns where the growth has paused. momentarily, it trades down and then continues its upward pattern. This pattern must always be at least 5 weeks long and can last up to a year.

Latvia is an EU member country that experienced superior GDP growth rates prior to the financial crisis in 2008. It underwent significant privatization, which resulted in large foreign direct investment inflows. Its economy was ranked first among developing countries until 2008.

Belgium is an EU member located in Western Europe. It has a strong industrialized economy, well-developed transportation infrastructure, and a highly productive work-force making it an attractive destination for foreign capital.

Italy is an EU member country and one of G-8 leading industrialized economies, having the seventh largest economy in the world. Its thriving small and medium enterprises play an important economic role.

Ireland is an EU member country with a knowledge-based economy and strong industries in services and technology. With attractive corporate tax rates, Ireland has been ideal destination for multinational corporations.

Hungary is an EU member country with a medium-sized, liberal economy that is rapidly developing. It has the 5th largest economy in Central and Eastern Europe, with major exports in machinery, chemicals, textiles, and agricultural products. Hungary’s Main Industries Hungary is economically known for its strength in: Agriculture Sector Wheat Corn Sunflower Potato Sugar Read More…

Peru is a Latin American country with an emerging, market-oriented economy that has been among the top performers in South America. Rich in natural resources, it is a major exporter of gold, copper, zinc, and fish.

Portugal is an EU member country with a high-income and service-based economy. It enjoys vast forests, has a strong industrial base, and is an important agricultural exporter.

Romania is an EU member country, which has experienced positive foreign direct investment and GDP growth following privatisation initiatives over the last decade. It has an upper-middle income economy strong in its industrial and agricultural sectors.

Argentina is a South American country that is one of the G-20 economies. It is the third largest economy in Latin America and has the highest GDP per capita in its region. It possesses plenty of natural resources, a strong agricultural sector, and a well-educated population.

Albania is one of south eastern European countries that have shown promising economic growth potential. It has been increasingly attracting foreign direct investment and possesses a strong agriculture and natural resources industry

Free Cash flow is the cash available to all the capital providers of a company. There are two types of free cash flows: 1) Cash flow available to pay out to all capital providers and 2) Free Cash Flow to Equity (FCFE).

The Form-8K is a SEC-mandated report filed by public companies to report unexpected events or transactions that are material in nature, and thus have an impact on the share prices of the company.

Fixed income analysis is the process of evaluating and analyzing fixed income securities for investment purposes.

In investment valuation, financial modeling refers to the procedure and methodology performed to determine the value of an asset or financial security. Fundamentally, a business or company’s current value can be viewed as being derived from its future cash flow streams. An investor deciding whether to purchase or sell a stock, therefore, will be interested in estimating such value.

Discounted Cash Flow is a valuation technique or model that discounts the future cash flows of a business, entity, or asset for the purposes of determining its value. One aspect of investment decision-making entails discovering the fair value of investments.

The Debt-Snowball Method is a debt-management strategy aimed at reducing a borrower’s obligations. Borrowers can use this method to slowly eliminate their debt by focusing on their smallest debt balance, followed by larger ones until all obligations are paid off.

Covariance is a statistical measure of the extent that 2 variables move in tandem relative to their respective mean (or average) values. In the investment world, it is important to be able to measure how different financial variables interact together.

The options collar strategy is designed to limit the downside risk of a held underlying security. It can be performed by holding a long position in a security, while simultaneously going long a Put and shorting a Call.

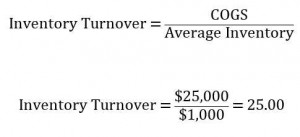

Measuring the cash conversion cycle is important to liquidity, working capital, and the operating cycle of a company. Good management of the CCC can also enhance a company’s cash flows, allowing it to effectively make sound investing and financing decision. Managing the CCC entails efficient inventory, receivables, and payables functions, and should be part of a company’s overall operational strategy.

Account Receivables Management refers to the set of policies, procedures, and practices employed by a company with respect to managing sales offered on credit.

Account Payables Management refers to the set of policies, procedures, and practices employed by a company with respect to managing its trade credit purchases.

A straddle is an investment strategy that involves the purchase or sale of an option allowing the investor to profit regardless of the direction of movement of the underlying asset, usually a stock.

Modern Portfolio Theory (MPT) is an investment theory whose purpose is to maximize a portfolio’s expected return by altering and selecting the proportions of the various assets in the portfolio.

If you own a bond or manage a bond portfolio, chances are that will you be following daily interest rates. You know that bond prices increase when rates rise, and decrease when rates fall. But how do you measure the bond’s price sensitivity to such rate fluctuations? The answer is duration.

Dupont Analysis breaks the Return on Equity into several different components in order to analyze where the returns are coming from.

Depreciation refers to the gradual and permanent decrease in value of the assets of a firm, nation or individual over its lifetime.

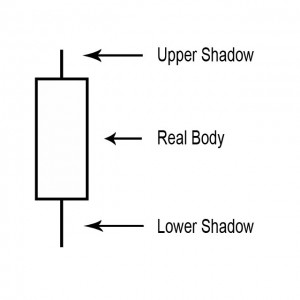

For a candlestick chart, the body or real body is the wide or colored part of a candle that represents the range between the opening and the closing prices over a specific time period (minute, hour, day, week or other). They are the most basic building block for candlestick charts.

A point on a candle stick chart representing a specific time period (a day, an hour, a minute, etc) in which the underlying stock price has moved. Candlesticks will have a body and usually two wicks – one on each end. For a white (could also be green) candlestick, the bottom of the body represents the opening price and the top of the body represents the closing price. For red candlesticks, it is just the other way around. The top and bottom tips of each wick are the day’s highest and lowest price respectively.

A small line (like a candle wick) found at the top or bottom of an individual candle in a candlestick chart.

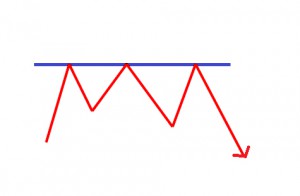

A point or range in a chart that caps an increase in the price of a stock or index over a period of time. An area of resistance, resistance line or resistance level indicates that the stock or index is finding it difficult to break through it, and may head lower shortly. The more times that the stock or index tries unsuccessfully to break through the resistance line, the stronger that area of price resistance becomes.

The price-to-sales ratio (Price/Sales or P/S) provides a simple approach: take the company’s market capitalization (the number of shares multiplied by the share price) and divide it by the company’s total sales over the past 12 months. The lower the ratio, the more attractive the investment.

Price to Earnings is the most usual way to compare the relative value of stocks based on earnings since you calculate it by taking the current price of the stock and divide it by the Earnings Per Share (EPS).

A series of technical indicators used by traders to predict the direction of the major financial indexes.

A national government that owes money to international financial institutions such as the World Bank, foreign governments, or to foreign lenders.

A technical analysis tool that represents the total difference between the number of advancing and declining security prices. This index is considered one of the best indicators of market movements as a whole. Stock indexes such as the Dow Jones Industrial Average only tell us the strength of 30 stocks, whereas the advance/decline index can provide much more insight into the movements of the market.

Margin calls happen when your account value drops to a value below that allowed by a broker.

Chart analysis is the same as Technical Analysis. It is mostly concerned with price and volume.

In the world of stock analysis, fundamental and technical analysis are on completely opposite sides of the spectrum. Earnings, expenses, assets and liabilities are all important characteristics to fundamental analysts, whereas technical analysts could not care less about these numbers and only focus on price and volume.

A phrase used for a stock where the price has dropped significantly in a short period of time. A falling knife security can rebound, or it can lose all of its value where the shares become worthless.

You do not need anything else on a stock chart but the candles themselves to be a successful swing trader! And, there is nothing that can improve your trading more than learning the art of reading candlestick charts

Resistance and support levels are widely used by experienced traders to formulate trading strategies. For example, if a stock is approaching a very strong resistance level, a trader may prefer to close the position rather than take the risk of a significant decline if the stock uptrend reverses.

If you perform four or more day trades in a 5 day period you may get flagged by the SEC as a “Pattern Day Trader.” This can cause you to lose your margin account status until you deposit enough cash to have $25,000 or more in your account. Many beginning traders have been bitten by this rule!

An inverted dead-cat bounce is quite the opposite of the dead-cat bounce. A quick look is if a trader owns a stock following a quick and large (5-20%) gain there is normally a gap up. If you sell on the next day after the gap up day, thus unlocking profits its because prices normally start falling before beginning a new move upward (Bulkowski, 2005).

A trading term called a dead cat bounce is used to when a stock is in a severe decline and has a sharp bounce off the lows. It occurs due to the huge amount of short interest in the market. Once the supply and demand has become unbalanced, any type of bear market rally will create a massive short covering which will lead to a swift price move up. This bounce will be short lived and followed up by heavy selling which will break the prior price low.

A gap in a chart is basically an empty space between one trading period and the one prior to that trading period. They normally form on account of an important and material event that will affect security, like an earnings surprise or a merger agreement.

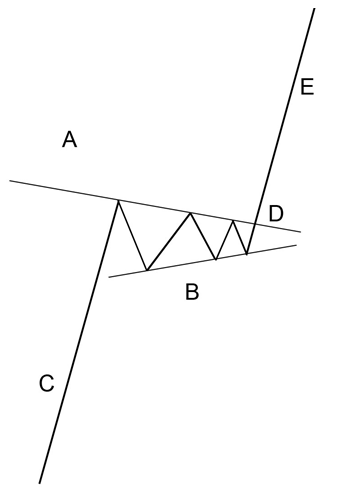

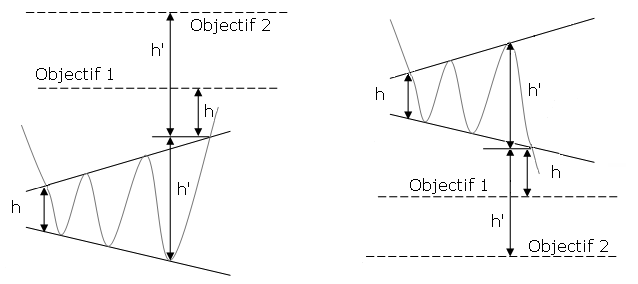

Flags and Pennants are categorized as a continuous pattern. They normally represent only brief pauses in a dynamic stock. They’re typically seen immediately after a quick move. The stock will then take off again in the same direction. Research shows that these patterns are many of the most reliable continuation patterns. Take a look at typical Flags and Pennant pattern.

The V top is a reverse V-shaped top thus the name. The top is quite sharp. It’s due to the irrationality of actors leading to a steep increase that will be corrected shortly afterwards. The V top will occur most often in an upward trend and will often signal a trend reversal. It can also appear in a downward trend, like when in an economic announcement.

The V bottom is shaped like a V thus the name. The dip will be quite sharp. It’s because the irrationality of actors leading to a steep fall which will be corrected shortly after. The V bottom will occur most often in a downward trend and will generally offer a signal trend reversal. It can also appear in an upward trend (like in an economic announcement).

A horizontal channel is a pattern that underlines investor’s indecisiveness. This horizontal channel is assembled by two horizontal and parallel lines that build the progress of the price. To confirm a line, there should be at least two points of contact with the price. The more contact points it will has, the more these will be durable and their breakout will give an substantial buy/sell signal.

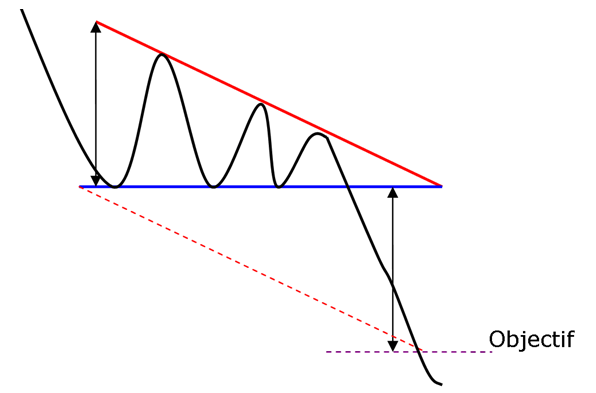

The descending triangle is a bearish continuation pattern. This pattern forms two converging lines. The initial is a downward slant which resistance and the other is a horizontal support. To validate the descending triangle, there must be oscillation between the two lines. The lines must be touched at least twice for validation.

The symmetrical triangle top is a bullish continuation pattern. This pattern forms two trend lines which are symmetrical to the horizontal and convergent. The initial pattern is a bearish slant that gives resistance and the other is a bullish slant that will be the support. To prove a symmetrical triangle top, one must have oscillation between the two lines. Each of these lines must be touched at least twice for validation.

A symmetrical triangle bottom is a bearish continuation pattern. This pattern forms two trend lines that are symmetrical to the horizontal and convergent. The initial one is a bearish slant that gives support and the other will be a bullish slant that will create a resistance. To prove a symmetrical triangle bottom there must have oscillation between the two lines. Each line has to touch at least twice for validation.

The ascending triangle is a bullish continuation pattern. This pattern is made by two converging lines. The first line is an upward slant which is the support and the other is a horizontal resistance line. To validate the ascending triangle, there has to be an oscillation between the two lines. Each line has to be Read More…

The cup with handle has a continuous pattern. This pattern is formed by two rounded bottoms, the first is deeper and wider than the second. The height of the cup and the handle will be aligned along a straight horizontal resistance. This is the neckline of the pattern.

The rounding top pattern is a reverse U-shape, also called a “reverse saucer. ” The top is rounded with a flat top. But as you’ll see in many cases there are several bullish peaks and they will not put in question the validity of the pattern.

The U-shaped bottom is a rounding bottom, also called a “saucer. ” The dip is rounded with a flat bottom. But we’ll see in many cases there are several bearish peaks, but they do not question the validity of that pattern.

The pennant resembles the symmetrical triangle, but it’s characteristics are not the same. The pennants is shaped like a wedge of consolidation. Its normally appears after a sudden upward or downward movement. The life of a pennant is short according to the time frame used.

The descending flag shows as a continuation pattern. The flag is built by two straight downward parallel lines which is shaped like a rectangle. It is oriented in the direction of that trend which it consolidates. Contrary to a bearish channel, this pattern is quite short term and shows the fact that buyers will need a break.

An ascending flag is a continuation pattern. The ascending flag is formed by two straight upward parallel lines which are shaped like a rectangle. It is adjusted in the direction of the trend that it consolidates. Contrary to a bullish channel, this pattern is quite short term and marks the fact the seller will need a break.

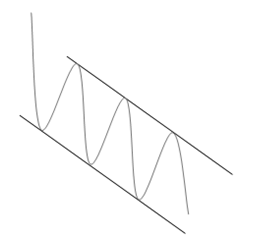

A bullish channel is called a continuation trend pattern. The bullish channel is assembled by two parallel lines that frame the upward price trend. A line is validated when there has been at least two points of contact with the price. The more contact points it has, the stronger the trend line is and the more their breakout will give a strong sell signal.

A bearish channel is a continuation trend pattern. The bearish channel is arranged by two parallel lines that frame the downward price trend. To certify a line, there has to be at least two points of contact with the price. The more contact points it has, the more the trend line is stronger and their breakout will give a stronger buy signal.

The triple top is a bearish pattern with an MN shape. Three bottoms will come in succession, reflecting an important resistance. This marks a reversal will.

Reverse head and shoulders is a trend reversal pattern. It will mark a desire to make a bullish reversal. The theory is the same as a triple bottom other than the second bottom will be lower than the others, which are technically at the same height. The reverse head and shoulders pattern will be formed by three bottoms that will succeed.

The double top is a bearish pattern shaped like an M. Two tops must succeed, imaging an important resistance. This marks a reversal. The pattern may also be in WV shape. We can consider a triple top as well.

A reversal pattern is called a diamond bottoms. This pattern is formulated by two juxtaposed symmetrical triangles. It is shaped like a diamond.

A falling wedge is a bullish reversal pattern made by two converging downward slants. To prove a falling wedge, there has to be oscillation between the two lines. Each of the lines must be touched at least twice for validation.

A bearish reversal pattern formed by two assembled upward slants is called a rising wedge. To validate rising wedge there must be oscillation between the two lines. These lines must be touched at least twice for validation.

Stock charts print different topping formations. Some are classics, like the Descending Triangle, which can be understood and traded with little effort. However the emotional crowd additionally generates many undependable patterns while greed slowly evolves into mindless fear. Complex Rising Wedges will challenge a technician’s best effort at prediction while the unusual Diamond pattern burns trading capital swinging randomly back and forth.

The formation, ascending broadening wedge is called this because of its similarity to a rising wedge formation and then has a broadening price pattern.

The right-angled and ascending broadening chart pattern is not one you might choose to trade. Other chart patterns perform much better. Downward breakouts have a big break even failure rate which may disqualify them from your trading tools. Upward breakouts have only a middling average rise, and that is if you trade them perfectly.

The broadening bottom is one of those chart patterns that appears often, but you might want to avoid trading. The performance rank approaches the bottom of the list with a comparatively high break even failure rank and low average rise in a bull market. Its only redeeming value is the partial decline which does an excellent job of predicting an upward breakout.

Definition: The amount of sales generated for every dollar’s worth of assets. It is calculated by dividing sales in dollars by assets in dollars. Formula: Asset Turnover = Revenue / Assets Also known as the Asset to Turnover Ratio. More Detail: Asset turnover measures a firm’s efficiency at using its assets in generating sales or revenue – the Read More…

A revenue or expense stream that changes a cash account over a given period. Cash inflows usually arise from one of three activities – financing, operations or investing – although this also occurs as a result of donations or gifts in the case of personal finance. Cash outflows result from expenses or investments. This holds true for both business and personal finance.

Fundamental analysis is the process of looking at the basic or fundamental financial level of a business, especially sales, earnings, growth potential, assets, debt, management, products, and competition.