A covered call is an options insurance strategy where you simultaneously have an open position on a stock and sell a call option for the same symbol. Adding a short call in your open positions means that you are obligated to sell your stocks at the strike price contingent on the option buyer. However, you Read More…

A covered put is an options insurance strategy where you simultaneously have a short open position on a stock and sell a put option for the same underlying option. Adding a short put in your open positions means that you are obligated to buy your stocks at the strike price, contingent on the option buyer’s Read More…

A floor is an options insurance strategy where you simultaneously have a long open position on a stock and a long put for the same underlying asset. Adding a long put to your open position means that you are obligated to sell your stock at the strike price. The long put ensure that you can Read More…

A cap is an options protection strategy where you simultaneously have a short position on a stock and a long call for the same underlying asset. Adding a long call to your open position means that you are obligated to buy your stock at the strike price. However, you already have a short position on Read More…

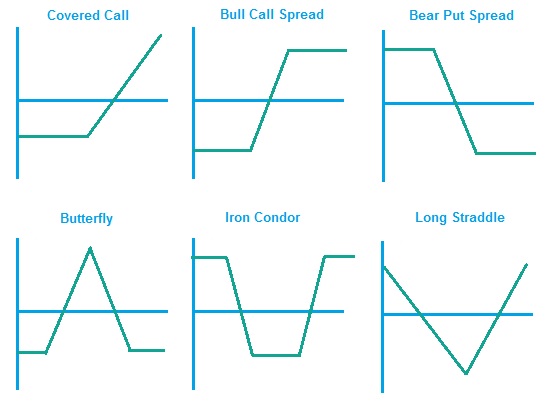

A bull spread is a strategy where you simultaneously buy a long call at Strike Price 1, and sell a call for Strike Price 2. Recall that users will pocket the premium should the option not be exercised. By selling a call with a higher strike price, users can reduce their total transaction costs and Read More…

A bear spread is a strategy where you simultaneously sell a put at Strike Price 1, and buy a put at Strike Price 2. Recall that users will pocket the premium should the option not be exercised. By selling a put with a lower strike price, users can reduce their total transaction costs and create Read More…

A box spread is an option strategy that is created by combining the components of the bull spread and the bear spread. By creating a box spread, you are creating a neutral riskless position that generates a return like a bond. A box spread can be used to borrow or lend funds. What are its Read More…

A ratio is an option strategy that is created by having X amount of call options at Strike Price 1 and shorting Y amount of call options at Strike Price 2. By creating a ratio, you are creating an option strategy where you can reduce your total option costs by shorting more call options are a higher strike price. Read More…

A bullish collar is a protection strategy where you simultaneously buy a call at strike price 1 and sell a put at strike price 2. This strategy is for investors who has a bullish perception on the underlying asset. We can also create a “bearish” collar by simultaneously buying a put at strike price 1 Read More…

A straddle is a volatility bet where you simultaneously long a call at Strike Price 1 and long a put at Strike Price 1. This creates a triangular shaped payoff and profit graph where the reward is based on the volatility of the stock. Traders can also bet against volatility by shorting a call at Read More…

A strangle is a volatility bet where you simultaneously long a call at Strike Price 2 and long a put at Strike Price 1. You will notice that the difference with a straddle is the difference strike price for the long call. By buying a call with a higher strike price, you are buying a Read More…

A butterfly is a volatility bet that the trader can implement to protect against large fluctuations, or to gain on volatility. You will notice that a butterfly is almost like a straddle, with a difference in the edges. The traders can add additional contracts to his/her strategy to reduce the risk of large losses or Read More…

See the full listing of available corporate and treasury bonds available on our platform!

Simulator Spot Trading Spots are very easy to trade (if your contest allows it). Simply choose the action like you would with a stock, select the quantity and the spot you wish to trade from the dropdown from the [link name=”spots” dest=”/trading/spots”]Spots trading page[/link]. Trading Details There are a few things to note with spot Read More…

Trading Bonds If they are allowed in your contest, you can use the [link name=”bonds” dest=”/trading/bonds”]Bonds Trading Page[/link]. Simply select the bond you want to buy or sell, how much you want to buy, and trade! Notes for trading bonds: All bonds, corporate and treasury, that we support are in one master list. We only Read More…

Trading Options If options trading is allowed in your contest, you can use the [link name=”option” dest=”/trading/options”]Options trading page[/link]. Trading options on your simulator is easy but there a few differences between the real world and a simulator. To trade options start by going to the Make a trade => trade options tab. Simple or Read More…

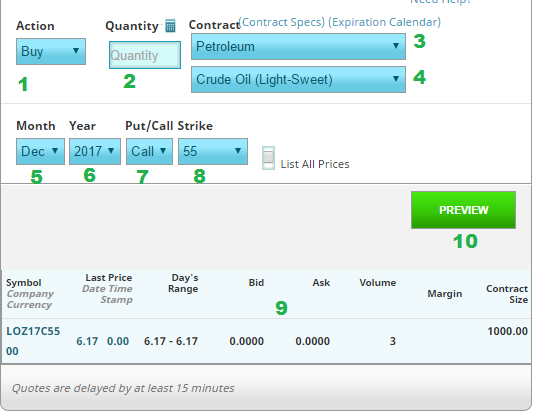

Trading Future Options acts like trading a normal option, but replacing the underlying stock with an underlying future. If your class or contest allows it, you can trade them from the [link url=”/trading/futureoptions” desc=”taradre”]Future Options Trading Page[/link]. Trading Pit Parts of the trading pit: Action – Only “Buy” and “Sell” is available for future options Read More…

Future Options are exactly what their name implies – an option on a futures contract. Futures and Options – Related Derivatives Futures and options are both derivatives – meaning a security whose value solely depends on the value of the underlying asset. A future derives its value from the commodities or currencies which it represents Read More…

If your contest allows trading futures, you can find them on the [link name=”future” dest=”/trading/futures”]Futures trading page[/link]. Action: Here you can select: Buy, sell, short, cover just as you would for stocks. Quantity: Enter the quantity desired of options contracts. Remember even with 1 futures contract you can have huge exposure depending on the contract Read More…

Symbol Month Margin Multiplier Description Exchange Indices Z. HMUZ 5500 10 Dow Jones CBOT ES HMUZ 3850 50 e-Mini S&P 500 (Globex) CME ND HMUZ 12100 100 Nasdaq 100 CME NIY HMUZ 3400 5 NIKKEI 225/Yen CME NQ HMUZ 2420 20 e-Mini Nasdaq 100(Globex) CME TR HMUZ 5280 100 Russell 2000 Mini Index ICE SP Read More…

Grains Contract Sep Oct Nov Dec Jan Feb Mar Apr May Jun Jul Aug Wheat 08/31 11/30 02/28 04/28 06/30 Corn 08/31 11/30 02/28 04/28 06/30 Soybeans 08/31 10/31 12/30 02/28 04/28 06/30 07/31 Soybean Meal 08/31 09/30 11/30 12/30 02/28 04/28 06/30 06/29 Soybean Oil 08/31 09/30 11/30 12/30 02/28 04/28 06/30 07/31 Oats Read More…

There is an infinite number of strategies that can be used with the aid of options that cannot be done with simply owning or shorting the stock. These strategies allow you select any number of pros and cons depending on your strategy. For example, if you think the price of the stock is not likely Read More…

A straddle is an investment strategy that involves the purchase or sale of an option allowing the investor to profit regardless of the direction of movement of the underlying asset, usually a stock. There are two straddle strategies, a long straddle and a short straddle. How to create a Long Straddle position A long straddle Read More…

You can find the underlying stock price, along with the option strike price, expiration date, and whether it was a “Put” or “Call” right from the option symbol! AAPL1504L85 is the way we write our options and can differ from other websites or brokerages. Our options are written: Symbol Year Day (Call or Put and Read More…

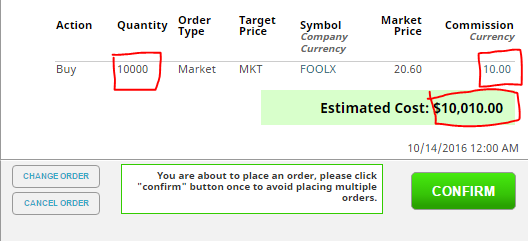

When trading mutual funds on this system, there are a few differences to keep in mind compared to trading stocks. Trading Tip 1: Quantity = Dollars! Unlike stocks, where you specify the number of shares you want to purchase, with Mutual Funds you specify how many dollar’s worth a mutual fund you want to buy. Read More…

Options Spreads are option trading strategies which make use of combinations of buying and selling call and put options of the same or varying strike prices and expiration dates to achieve specific objectives (hedging, arbitrage, etc.). Option spreads are complex trades, but you can place two “legs” simultaneously using this trading platform. Trading Option Spreads To Read More…

In this article we will be looking at how you can use Excel to keep track of your account’s performance. This is meant as a basic guide for people who have little or no experience with Excel. Using Excel To Track Your Stock Portfolio – Getting Some Data Before we can do anything with Excel, Read More…

If you’ve started buying a few stocks, you will probably be interested in diversifying your portfolio between various sectors. This sounds easy, but it can be very challenging finding stocks from a wide range of sources that fit what you’re looking for. Thankfully, our [link name=”quote” dest=”/quotes”]Quotes Tool[/link] has all the information you need to Read More…

Your [link name=”trans” dest=”/account/transactionhistory” ]transaction history page[/link] will show you all the orders you’ve placed that have gone through. Features Everything on this page is used to help you see your previous transactions. Action Button This will take you back to the trading page, set to repeat this action. This button will not fully pre-populate Read More…

Your [link name=”closed” dest=”/portfolio/closepositions”]closed positions page[/link] will show an estimated profit and loss from all positions you’ve “Closed” (bought then later sold, or shorted and later covered). Disclaimer The most important note about your Closed Positions is that it is only an estimate, and nothing on this page is used to calculate your portfolio value. Read More…

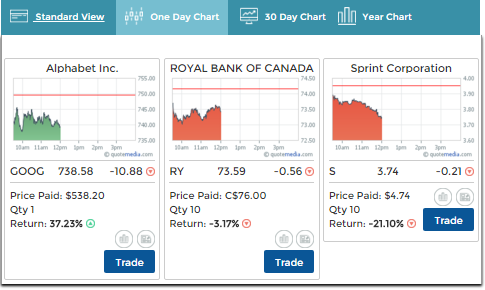

You can find your Open Positions page in two places: your [link name=”dash” dest=”/account/dashboard”]Dashboard[/link], or your [link name=”open” dest=”/portfolio/openpositions”]Open Positions[/link] page. The only difference between the two pages is that the “Dashboard” version will have all the security types as tabs you can switch between, while the “Open Positions” page will show each type separately. Read More…

Definition Spot and Futures contracts are a standardized, transferable legal agreement to make or take delivery of a specified amount of a certain commodity, currency, or an asset at the current date. The price is determined when the agreement is made. The only difference between spots and futures is the delivery date. The current date Read More…

Definition Futures Contracts are a standardized, transferable legal agreement to make or take delivery of a specified amount of a certain commodity, currency, or an asset at the end of specified time frame. The price is determined when the agreement is made. Here are some useful terms for futures: Contract Size: This specifies the number Read More…

Welcome to our investment simulator. This will be an overview on the different pages, navigation, and what features are available to all users. Video Tutorials If you prefer to watch short video tutorials on different parts of the site and trading, you’re in luck! [link name=”navvid” dest=”/content/navigationvideo”]Click Here For Tutorials Covering The Different Pages Of Read More…

We have a huge amount of research tools available on our [link name=”quote” dest=”/quotes”]Quotes Page[/link]. On this page, you’ll find a second level of navigation to move between different research tools right at the top. Basic Quotes And Beginner’s Research If you’re just getting started, most of the information you’ll need will be in the Read More…

What are options? An option gives the owner the right, but not the obligation, to buy or sell the underlying instrument(we assume stocks here) at a specified price(strike price) on or before a specified date(exercise date) in the future. (this is different for European options as they can only be exercised at the end date). Read More…

Definition: Option holders have the right, but not the obligation, to buy or sell the underlying instrument at a specified price(strike price) on or before a specified date(exercise date) in the future. (this is different for European options as they can only be exercised at the end date). Exercising the option is using that right Read More…

Calculating your buying power can be tricky, and it gets trickier with more complex contest rules. This will be a quick primer on how to see exactly how your buying power is calculated, what affects it, and how to recover it when you want to make more purchases. What is Buying Power? Your buying power Read More…

Definition A stock quote gives essential information about a particular stock at a point in time. The quote normally includes information such as the name of the company, the ticker symbol, the price, the day’s high and low prices, and the trading volume. Details Usually when you get a stock quote, you see lots of Read More…

What is a Stock? Stock is defined as a share of ownership in a company. If you own a company’s stock, you own a percentage of the company itself. This includes partial ownership of its assets (like equipment, vehicles, and buildings) and partial ownership if its income and profits. The main reason people purchase stock Read More…

Mutual Funds are a way you can buy into a wide range of stocks, bonds, money markets, or other securities all at once. They are professionally managed, so you are basically buying a piece of a larger portfolio. Definition Mutual Funds come in several different “flavors”, but the core concept is always the same: the Read More…

ETFs are a fairly new way that you can buy a large group of stocks, assets, or other securities all at once. ETFs trade just like stock; you can buy and sell shares of an ETF throughout the day on an exchange. Definition “ETF” stands for “Exchange Traded Fund”, which is exactly how it sounds; Read More…

Promissory notes issued by a corporation or government to its lenders, usually with a specified amount of interest for a specified length of time. This is seen as a loan from the bond holder to the corporation. The value of Bonds traded are greater than the value of stocks traded.

ETFs are collections of assets into bundles you can invest in all at once, the most popular ones follow indecies (such as SPY following the S&P 500), which is one way for an investor to build a diverse portfolio without holding dozens of individual positions. However, using financial derivatives and debt, there are also “Leveraged Read More…

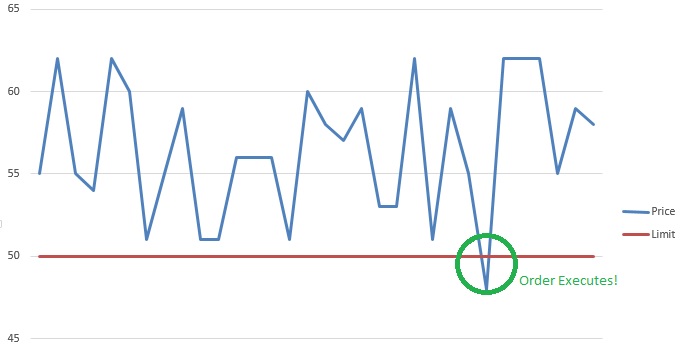

Order Types offered in our Stock Market Game: Market Orders, Limit Orders, Stop Market Orders, Stop Limit Orders and Trailing Stop Orders