A covered call is an options insurance strategy where you simultaneously have an open position on a stock and sell a call option for the same symbol. Adding a short call in your open positions means that you are obligated to sell your stocks at the strike price contingent on the option buyer. However, you Read More…

A covered put is an options insurance strategy where you simultaneously have a short open position on a stock and sell a put option for the same underlying option. Adding a short put in your open positions means that you are obligated to buy your stocks at the strike price, contingent on the option buyer’s Read More…

A floor is an options insurance strategy where you simultaneously have a long open position on a stock and a long put for the same underlying asset. Adding a long put to your open position means that you are obligated to sell your stock at the strike price. The long put ensure that you can Read More…

A cap is an options protection strategy where you simultaneously have a short position on a stock and a long call for the same underlying asset. Adding a long call to your open position means that you are obligated to buy your stock at the strike price. However, you already have a short position on Read More…

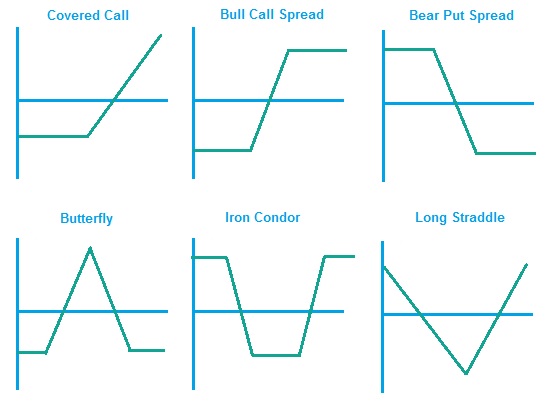

A bull spread is a strategy where you simultaneously buy a long call at Strike Price 1, and sell a call for Strike Price 2. Recall that users will pocket the premium should the option not be exercised. By selling a call with a higher strike price, users can reduce their total transaction costs and Read More…

A bear spread is a strategy where you simultaneously sell a put at Strike Price 1, and buy a put at Strike Price 2. Recall that users will pocket the premium should the option not be exercised. By selling a put with a lower strike price, users can reduce their total transaction costs and create Read More…

A box spread is an option strategy that is created by combining the components of the bull spread and the bear spread. By creating a box spread, you are creating a neutral riskless position that generates a return like a bond. A box spread can be used to borrow or lend funds. What are its Read More…

A ratio is an option strategy that is created by having X amount of call options at Strike Price 1 and shorting Y amount of call options at Strike Price 2. By creating a ratio, you are creating an option strategy where you can reduce your total option costs by shorting more call options are a higher strike price. Read More…

A bullish collar is a protection strategy where you simultaneously buy a call at strike price 1 and sell a put at strike price 2. This strategy is for investors who has a bullish perception on the underlying asset. We can also create a “bearish” collar by simultaneously buying a put at strike price 1 Read More…

A straddle is a volatility bet where you simultaneously long a call at Strike Price 1 and long a put at Strike Price 1. This creates a triangular shaped payoff and profit graph where the reward is based on the volatility of the stock. Traders can also bet against volatility by shorting a call at Read More…

A strangle is a volatility bet where you simultaneously long a call at Strike Price 2 and long a put at Strike Price 1. You will notice that the difference with a straddle is the difference strike price for the long call. By buying a call with a higher strike price, you are buying a Read More…

A butterfly is a volatility bet that the trader can implement to protect against large fluctuations, or to gain on volatility. You will notice that a butterfly is almost like a straddle, with a difference in the edges. The traders can add additional contracts to his/her strategy to reduce the risk of large losses or Read More…

Trading Options If options trading is allowed in your contest, you can use the [link name=”option” dest=”/trading/options”]Options trading page[/link]. Trading options on your simulator is easy but there a few differences between the real world and a simulator. To trade options start by going to the Make a trade => trade options tab. Simple or Read More…

There is an infinite number of strategies that can be used with the aid of options that cannot be done with simply owning or shorting the stock. These strategies allow you select any number of pros and cons depending on your strategy. For example, if you think the price of the stock is not likely Read More…

A straddle is an investment strategy that involves the purchase or sale of an option allowing the investor to profit regardless of the direction of movement of the underlying asset, usually a stock. There are two straddle strategies, a long straddle and a short straddle. How to create a Long Straddle position A long straddle Read More…

You can find the underlying stock price, along with the option strike price, expiration date, and whether it was a “Put” or “Call” right from the option symbol! AAPL1504L85 is the way we write our options and can differ from other websites or brokerages. Our options are written: Symbol Year Day (Call or Put and Read More…

Options Spreads are option trading strategies which make use of combinations of buying and selling call and put options of the same or varying strike prices and expiration dates to achieve specific objectives (hedging, arbitrage, etc.). Option spreads are complex trades, but you can place two “legs” simultaneously using this trading platform. Trading Option Spreads To Read More…

Definition: Option holders have the right, but not the obligation, to buy or sell the underlying instrument at a specified price(strike price) on or before a specified date(exercise date) in the future. (this is different for European options as they can only be exercised at the end date). Exercising the option is using that right Read More…