Your home will probably be the biggest purchase you make in your lifetime. Buying a home not only saves money on rent, but is a serious asset that can appreciate over time. Since homes are so expensive, (almost) no-one buys them in cash. Instead, homes are typically purchased with a special type of loan, called Read More…

What Are Interest Rates? Interest rates are growth rates – it is a percentage that is used to calculate how much a loan or investment grows over time. Interest rates are most commonly associated with borrowing money, like a homeowner taking out a mortgage or a government selling a bond. The interest rate is how Read More…

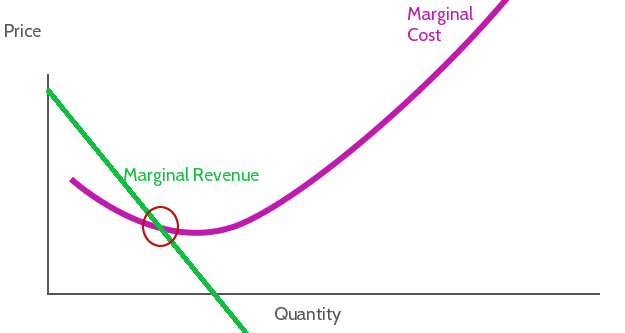

Everyone knows about costs and benefits of doing something – the pros and cons of making a choice. Marginal benefit and marginal cost are different – they look more closely at doing slightly more or less of different alternatives. Marginal costs and benefits are extremely important to producers when choosing their inputs and prices. [gtranslate] Read More…

Definition Economic Incentives includes anything that pushes people, businesses, and governments to do one thing or another. This includes what products you buy, what career you choose, what products businesses produce, and what government programs are put in place. Incentives for Individuals Each individual faces many economic incentives every day. If you are in school, Read More…

Definition When we think of money, stored value means anything that isn’t cash, but you can still use to transfer value – checks, debit cards, gift cards, and forms like that. These are used to transport some dollar amount which we can later exchange for goods and services. Each of these forms of stored value have their Read More…

Definition “Major Economic Indicators” are numbers that you can look at to try to get a picture of how well the economy is doing. Different indicators measure different parts of the economy, but their main characteristic is that they measure the same thing in the same way over time. This means that you can compare the Read More…

How Is Money Created? In the United States (and many other countries), the question “How is money created?” comes up a lot. The treasury isn’t just printing cash all day, if they were the government debt would be zero! In the US, money is created as a form of debt. Banks create loans for people Read More…

Definition Futures Contracts are a standardized, transferable legal agreement to make or take delivery of a specified amount of a certain commodity, currency, or an asset at the end of specified time frame. The price is determined when the agreement is made. Here are some useful terms for futures: Contract Size: This specifies the number Read More…

What are options? An option gives the owner the right, but not the obligation, to buy or sell the underlying instrument(we assume stocks here) at a specified price(strike price) on or before a specified date(exercise date) in the future. (this is different for European options as they can only be exercised at the end date). Read More…

Mutual Funds are a way you can buy into a wide range of stocks, bonds, money markets, or other securities all at once. They are professionally managed, so you are basically buying a piece of a larger portfolio. Definition Mutual Funds come in several different “flavors”, but the core concept is always the same: the Read More…

Definition: The Income Statement is one of the financial statements that all publicly traded companies share with their investors. The income statement shows the company’s sales, expenses, and net profit (or loss) over a period of time–usually 3 months, year-to-date, and twelve months. The income statement also comes with a lot of notes and discussions Read More…

An investment strategy is the set of rules and behaviors that you can adopt to reach your financial and investing goals. Choosing an investing strategy can be a daunting task when you are starting to learn about investments and finance. Here we will look at the larger overall strategies rather than very specific strategies. Given Read More…

The head-and-shoulders pattern is one of the most popular chart patterns in technical analysis. The pattern looks like a head (the middle peak) with two shoulders (two equal heiight peaks).

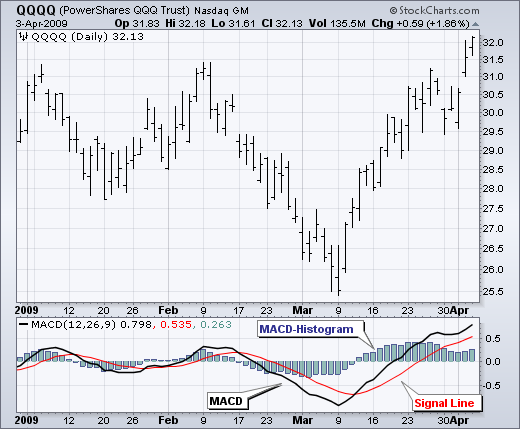

The Moving Average Convergence-Divergence (MACD) indicator is one of the easiest and most efficient momentum indicators you can get. It was developed by Gerald Appel in the late seventies. The MACD moves two trend following indicators and moving averages into a momentum oscillator by subtracting the longer moving average from the shorter moving average. The Read More…

Insurance is protection from losing or damaging something. It is defined as the transfer of loss risk in exchange for payment. Basically, if we damage or lose something that was insured, the insurance will cover the cost of having it fixed or replaced.

Monopoly, in economic terms, is used to refer to a specific company or individual has a large enough control of a particular product or service that allows them to influence it’s price or certain characteristics.

Monopolistic Competition is characterized as a form of imperfect competition.

Money supply is the total amount of money available in an economy at any particular point in time.

Monetary Policy refers to the process by which the Monetary Authority of a given country implements a variety of measures to control the supply of money.

An investment strategy that aims to capitalize on the continuance of existing trends in the market. The momentum investor believes that large increases in the price of a security will be followed by additional gains and vice versa for declining values.

A security with a guarantee of a return rate that is higher than the rate of inflation if it is held to maturity

A hedge fund is one of the investment tools you will aspire toward as a serious investor. The first hedge fund came out in 1949 as a strategy to neutralize the effect of overall market movements on a portfolio.

Hyperinflation refers to out of control or extremely rapid inflation, where prices increase so quickly that the concept of real inflation becomes meaningless.

Inflation refers to the general rising of prices for goods and services in the economy, due to an increase in the amount of money and/or credit available.

In a cap-weighted index, large price moves in the largest components (companies) can have a dramatic effect on the value of the index.

Your ideal investment or investment portfolio gives you the most opportunity for the risk you can bear. In this sense, it is important to understand the risk inherent in an investment before you look for the opportunity.

A non-bank organization that regularly trades large blocks of stocks.

By aggregating the value of a related group of stocks or other investment vehicles together and expressing their total values against a base value from a specific date. Market indexes help to represent an entire stock market and thus give investors a way to monitor the market’s changes over time.

Definition The minimum amount of equity that must be maintained in a margin account. In the context of the NYSE and FINRA, after an investor has bought securities on margin, the minimum required level of margin is 25% of the total market value of the securities in the margin account. Keep in mind that this Read More…

Margin calls happen when your account value drops to a value below that allowed by a broker.

The merger of companies at the same stage of production in the same or different industries.

A high-risk bond with a low credit rating. Junk Bonds usually have a much higher yield than investment-grade bonds.

A load mutual fund comes with a sales charge or commission.

The first sale of stock by a private company to the public. IPOs are often issued by smaller, younger companies seeking the capital to expand, but can also be done by large privately owned companies looking to become publicly traded.

A limit order is an order to buy or sell a stock at a specific price or better. A buy limit order can only be executed at the limit price or lower, and a sell limit order can only be executed at the limit price or higher. A limit order is not guaranteed to execute. A limit order can only be filled if the stock’s market price reaches the limit price. While limit orders do not guarantee execution, they help ensure that an investor does not pay more than a pre-determined price for a stock.

A market order is an order to buy or sell a stock at the best available price. Generally, this type of order will be executed immediately. However, the price at which a market order will be executed is not guaranteed. It is important for investors to remember that the last-traded price is not necessarily the price at which a market order will be executed. In fast-moving markets, the price at which a market order will execute often deviates from the last-traded price or “real time” quote.

Margin is the amount of money supplied by an investor as a portion of the total funds needed to buy or sell a security, with the balance of required funds loaned to the investor by a broker, dealer, or other lender.

The Moving Average Convergence-Divergence (MACD) indicator is one of the easiest and most efficient momentum indicators you can get. It was developed by Gerald Appel in the late seventies.

Moving Averages Moving Averages are one of the most popular and important technical analysis tools. The ease of use and simple calculation make it a great tool to get information quickly. They also provide the basics for more advanced technical analysis tools like MACD and Bollinger Bands and can be useful for removing some of Read More…

Market Risk is the general risk for investing in the any security. Every industry in the market is affected by this risk. Examples of market risk: depression, war, inflation etc.

Initial Public Offering, or IPO for short, represents the first opportunity for the public to purchase shares of a company. It is also referred to as a private company “going public”.