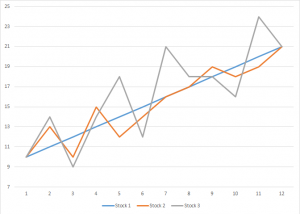

Stock and bond prices move up and down every day, sometimes by very large amounts. If you want to start investing, the first thing to understand is why these price movements happen, and how to plan for them. Stock Price Movements If you look at the stock for any public company you will often see Read More…

Future Options are exactly what their name implies – an option on a futures contract. Futures and Options – Related Derivatives Futures and options are both derivatives – meaning a security whose value solely depends on the value of the underlying asset. A future derives its value from the commodities or currencies which it represents Read More…

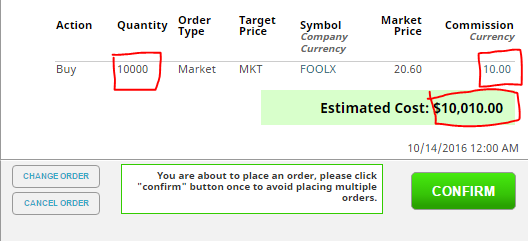

If your contest allows trading futures, you can find them on the [link name=”future” dest=”/trading/futures”]Futures trading page[/link]. Action: Here you can select: Buy, sell, short, cover just as you would for stocks. Quantity: Enter the quantity desired of options contracts. Remember even with 1 futures contract you can have huge exposure depending on the contract Read More…

Symbol Month Margin Multiplier Description Exchange Indices Z. HMUZ 5500 10 Dow Jones CBOT ES HMUZ 3850 50 e-Mini S&P 500 (Globex) CME ND HMUZ 12100 100 Nasdaq 100 CME NIY HMUZ 3400 5 NIKKEI 225/Yen CME NQ HMUZ 2420 20 e-Mini Nasdaq 100(Globex) CME TR HMUZ 5280 100 Russell 2000 Mini Index ICE SP Read More…

Grains Contract Sep Oct Nov Dec Jan Feb Mar Apr May Jun Jul Aug Wheat 08/31 11/30 02/28 04/28 06/30 Corn 08/31 11/30 02/28 04/28 06/30 Soybeans 08/31 10/31 12/30 02/28 04/28 06/30 07/31 Soybean Meal 08/31 09/30 11/30 12/30 02/28 04/28 06/30 06/29 Soybean Oil 08/31 09/30 11/30 12/30 02/28 04/28 06/30 07/31 Oats Read More…

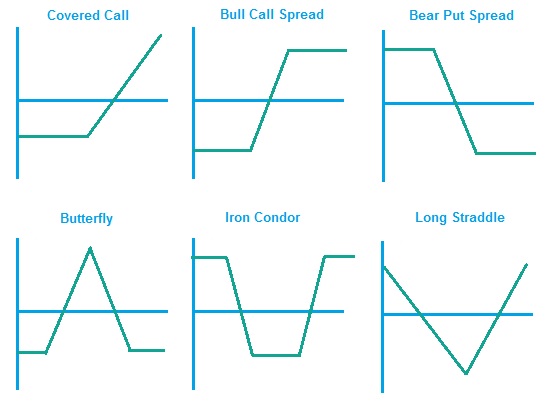

There is an infinite number of strategies that can be used with the aid of options that cannot be done with simply owning or shorting the stock. These strategies allow you select any number of pros and cons depending on your strategy. For example, if you think the price of the stock is not likely Read More…

A straddle is an investment strategy that involves the purchase or sale of an option allowing the investor to profit regardless of the direction of movement of the underlying asset, usually a stock. There are two straddle strategies, a long straddle and a short straddle. How to create a Long Straddle position A long straddle Read More…

You can find the underlying stock price, along with the option strike price, expiration date, and whether it was a “Put” or “Call” right from the option symbol! AAPL1504L85 is the way we write our options and can differ from other websites or brokerages. Our options are written: Symbol Year Day (Call or Put and Read More…

When trading mutual funds on this system, there are a few differences to keep in mind compared to trading stocks. Trading Tip 1: Quantity = Dollars! Unlike stocks, where you specify the number of shares you want to purchase, with Mutual Funds you specify how many dollar’s worth a mutual fund you want to buy. Read More…

Options Spreads are option trading strategies which make use of combinations of buying and selling call and put options of the same or varying strike prices and expiration dates to achieve specific objectives (hedging, arbitrage, etc.). Option spreads are complex trades, but you can place two “legs” simultaneously using this trading platform. Trading Option Spreads To Read More…

Definition Futures Contracts are a standardized, transferable legal agreement to make or take delivery of a specified amount of a certain commodity, currency, or an asset at the end of specified time frame. The price is determined when the agreement is made. Here are some useful terms for futures: Contract Size: This specifies the number Read More…

What are options? An option gives the owner the right, but not the obligation, to buy or sell the underlying instrument(we assume stocks here) at a specified price(strike price) on or before a specified date(exercise date) in the future. (this is different for European options as they can only be exercised at the end date). Read More…

Definition: Option holders have the right, but not the obligation, to buy or sell the underlying instrument at a specified price(strike price) on or before a specified date(exercise date) in the future. (this is different for European options as they can only be exercised at the end date). Exercising the option is using that right Read More…

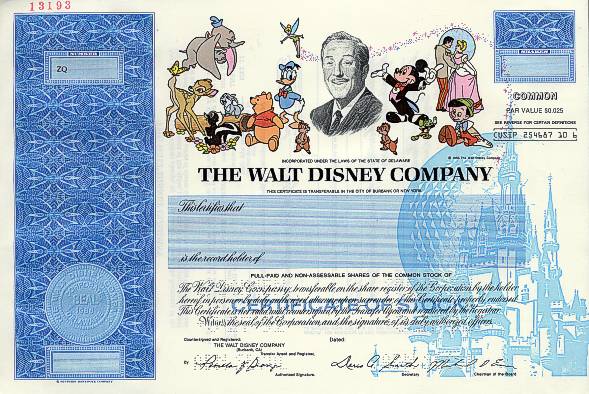

What is a Stock? Stock is defined as a share of ownership in a company. If you own a company’s stock, you own a percentage of the company itself. This includes partial ownership of its assets (like equipment, vehicles, and buildings) and partial ownership if its income and profits. The main reason people purchase stock Read More…

Mutual Funds are a way you can buy into a wide range of stocks, bonds, money markets, or other securities all at once. They are professionally managed, so you are basically buying a piece of a larger portfolio. Definition Mutual Funds come in several different “flavors”, but the core concept is always the same: the Read More…

ETFs are a fairly new way that you can buy a large group of stocks, assets, or other securities all at once. ETFs trade just like stock; you can buy and sell shares of an ETF throughout the day on an exchange. Definition “ETF” stands for “Exchange Traded Fund”, which is exactly how it sounds; Read More…

ETFs have been one of the most popular investment vehicles in the world over the last decade or so, with investors of all types attracted to the low fees, but diverse holdings, falling somewhere between mutual funds and stocks in terms of how easy they are to manage in a portfolio. However, one of the Read More…

Promissory notes issued by a corporation or government to its lenders, usually with a specified amount of interest for a specified length of time. This is seen as a loan from the bond holder to the corporation. The value of Bonds traded are greater than the value of stocks traded.

ETFs are collections of assets into bundles you can invest in all at once, the most popular ones follow indecies (such as SPY following the S&P 500), which is one way for an investor to build a diverse portfolio without holding dozens of individual positions. However, using financial derivatives and debt, there are also “Leveraged Read More…

Fixed income analysis is the process of evaluating and analyzing fixed income securities for investment purposes. Fixed Income represents a distinct asset class. Investors and analysts perform fixed-income analysis to Evaluate the risk characteristics underlying debt securities and to assess the capacity of the borrowing entity to meet its financial obligations (credit analysis) Identify which Read More…

The CME Group is an order-driven exchange that facilitates the trading of forward, futures, and options contracts on numerous products within key asset classes such as agriculture, energy, metals, equities, interest rates, and exchange rates.

The CBOT is an exchange providing trading in derivatives contracts and clearinghouse functions. It allows traders to buy and sell contracts on several products in asset classes such as agriculture, energy, metals, equities, bonds, and exchange rates. The majority of its trades are conducted electronically.

If you own a bond or manage a bond portfolio, chances are that will you be following daily interest rates. You know that bond prices increase when rates rise, and decrease when rates fall. But how do you measure the bond’s price sensitivity to such rate fluctuations? The answer is duration.

Direxion Small Cap Bear3X – Triple-Leveraged ETF is an index fund ETF (Exchange Traded Fund) designed to seek a daily result of 300% of the INVERSE of the performance of the Russell 2000 Small Cap Index.

A security with a guarantee of a return rate that is higher than the rate of inflation if it is held to maturity

The question of when to sell stocks is not easily answered. On the one hand, you know a correction is coming but the question of “when” isn’t so clear. Anyone who has ever sold early only to stand by and watch others reap in huge profits have felt the pain of premature sales.

Stock volatility information can be used in many different ways but here is a quick and easy bit of stock volatility information that you can begin using today.

A hedge fund is one of the investment tools you will aspire toward as a serious investor. The first hedge fund came out in 1949 as a strategy to neutralize the effect of overall market movements on a portfolio.

If you are brand new to investing then take time to understand what you are reading when viewing a Stock Exchange Symbol and learn Stock Market Investing Basics.

A REIT or Real Estate Investment Trust may be the perfect investment vehicle. REITs own, and often operate, real estate but are publicly traded like stock.

The U.S. Dollar has lost more than 30 percent of its value relative to other world currencies. Shorting the U.S. dollar and buying other world currencies is one way to make money from this trend.

Since the bottom fell out of the stock market in 2008, investors have been shifting money from stocks into bond funds. Since 2007, there have been $1.39 trillion invested in Bond Funds versus $193 billion in stock funds. The most logical explanation is an attempt to find income and safety, but are bonds truly safe?

Stock prices are a direct result of supply and demand. All the other influences like debt, balance sheets, earnings and so on affect the desirability of owning (or selling) a stock.

A short call option position where the writer does not own the specified number of shares specified by the option nor has deposited cash equal to the exercise value of the call.

A high-risk bond with a low credit rating. Junk Bonds usually have a much higher yield than investment-grade bonds.

With ETFs, you can scaled down the size of the transaction for small investors.

Bear ETFs short stocks to achieve their goals. Bear ETFs show gains when the underlying stocks loose value. Bull ETFs use long positions and show gains when the underlying stocks show gains.

The DIA -DIAMONDS Trust, Series 1 ETF invest in a basket of Dow Jones Industrial Average stocks that will track the price and performance of the Dow Jones Industrial Average (DJIA) Index.

Real-life and virtual trading hours for our site (all times Eastern).

Note: Stock Market trading is Monday-Friday, except on holidays.

A list of the 25 most popular (largest) mutual funds.

Mutual Fund screeners are available on countless websites and trading platforms. They allow users to choose trading instruments that are suitable for certain criteria profile.

American investors, covering the past decade, have conclusively come around to mutual funds so they may save towards their retirement as well as other financial targets.

The possible choices for investing in a mutual fund is less complicated than you think.

Mutual fund charges and costs are fees that may be acquired by investors who possess mutual funds

The following strategies are used to trade ETFs.

A closed-end fund is a publicly traded investment company that raises a fixed amount of capital through an initial public offering (IPO). The fund is then structured, listed and traded like a stock on a stock exchange.

An open end mutual fund don’t have limits on the quantity of shares the fund will issue. Provided that demand is requested often, the fund will continue to issue shares no matter the number of investors.

A load mutual fund comes with a sales charge or commission.

A no-load mutual fund in which shares are sold without a commission or sales fee. The notion for this is that the shares are allocated directly by the investment company, rather than going through a alternate party.

A Spider ETF is a summary of Standard & Poor’s depositary receipt, an exchange-traded fund (ETF) administered by State Street Global Advisors.

Exchange-traded funds that invest in physical commodities such as natural resources, agricultural goods as well as precious metals.

A group of risks combined with investing in a foreign country.

A type of mutual fund with a portfolio constructed to match or track the components of a market index, such as the Standard & Poor’s 500 Index (S&P 500). An index mutual fund is said to provide broad market exposure, low operating expenses and low portfolio turnover.

What are the differences between investing in Exchange Traded Funds verses stocks? This article will discuss the pros and cons …

Your goal should be to build and manage a diversified portfolio of stocks and bonds with the lowest possible fees and the greatest possible tax efficiency. ETFs offer seven advantages over index mutual funds: lower cost, greater tax efficiency, better tax management, easier asset allocation, easier portfolio rebalancing, no fraud and you can short ETFs.

An options strategy by which an investor retains a long position in an asset and writes or sells a call options on an identical in an effort to produce an increased income from the asset.

Stocks are shares in ownership of a company. Stocks represents a claim on the company’s assets and earnings. As you increase your holdings of a stock, your ownership stake in the company increases. Whether you say shares, equity, or stock, it all means the same thing.

Dividends are payments made by a corporation to its shareholder members. It is the portion of corporate profits paid out to stockholders. When a corporation earns a profit or surplus, that money can be put to two uses: it can either be re-invested in the business (called retained earnings), or it can be distributed to shareholders. There are two ways to distribute cash to shareholders: share repurchases or dividends. Many corporations retain a portion of their earnings and pay the remainder as a dividend.

A Call Option gives the holder the right, but not the need to purchase a fixed quantity of a particular stock at a specific price inside a particular time. Call Options are bought by investors who anticipate a price increase.

When an option’s strike price is identical to the price of the security. Both call and put options will be simultaneously “at the money.” For example, if the ABC stock is trading at 75, then the ABC 75 call option is at the money and so is the ABC 75 put option. An at-the-money option has no intrinsic value, but may have time value (value if the stock goes up during the period of the option). Options trading activity tends to be most active when options are at the money.

A zero coupon bond is a bond sold without interest-paying coupons. Instead of paying periodic interest, the bond is sold at a discount and pays its entire face amount upon maturity, which is usually a one year period or longer. A Treasury Bond is a good example.

Yield To Maturity is the interest rate that will make the present value of a bond’s remaining cash flows (if held to maturity) equal to the price (plus accrued interest, if any). It is basically what you will earn if you buy and hold the bond till maturity. On of the major assumptions is that all the Read More…

Strike Price is the price at which an option can be exercised to buy or sell the underlying stock or futures contract.

A Put Option gives the holder the right to sell the underlying stock or futures contract at a specified strike price.

Par Value is the amount that the issuer of a bond agrees to pay at the date of maturity.

Out-Of-The-Money refers to an option that is unfavourable to exercise. An example is a put option with a strike price lower than the underlying stock price, or a call option with a strike price higher than the underlying stock price.

In-The-Money refers to an option whose underlying’ asset’s price changes in such a way that it becomes profitable to exercise the option at the given strike price. For example: Stock price is lower than the strike price specified in a put option contract.

Futures Contracts are a standardized, transferable legal agreement to make or take delivery of a specified amount of a certain commodity, currency, or an asset at the end of specified time frame. The price is determined when the agreement is made. Future contracts are always marked to market.

Expiration Date is the last day upon which an option or futures contract can be exercised or traded.

Discount refers to the price of a bond when it is below its par value. An example is if the par value of the bond is $1,000 and the bond is selling for $980, the bond is selling at a discount of ($1,000 – $980) =$20.

Derivative is a type of security whose value is “derived” from an underlying asset. (Eg; Futures and Options). Futures and options are both derivatives – meaning a security whose value solely depends on the value of the underlying asset. A future derives its value from the commodities or currencies which it represents An option derives Read More…

Coupon Rate is the rate of interest paid on a bond, expressed as a percentage of the bond’s face value.

A Coupon is the periodic interest payment made to a bondholder during the life of the bond. (Usually semi-annual)

Options can be extremely lucrative, but also very dangerous if not properly understood. One of the first steps in learning how to trade options is to understand how to read an options table. Below is an example of a basic options table of Google (GOOG) expiring in October 2011: Calls and Puts: There are two types of Read More…

Class B Shares are a form of common stock that may have more or less voting rights that Class A shares. Generally Class B shares have lesser voting rights, but be vary of some companies that trick investors by using the perception of Class “B” (compared to “A”) shares to attach more voting rights to them Read More…

When would I use this strategy? A Covered Call Strategy is for investors who feel that the stock price will either remain stable or will grow. This strategy is NOT for investors who think the price of the stock will go down. How do I execute this strategy? The strategy entails two steps: Write a Read More…

Class A Shares are a form of common stock that may have more or less voting rights that Class B shares. Generally Class A shares have more voting rights, but companies sometimes trick investors by using the perception of “Class A” shares to attach fewer voting rights to them than Class B shares.

Balanced Fund is a type of Mutual Fund whose main objective is to diversify risk by holding a defined percentage of different security types including stocks, bonds, and money market instruments

An Aggressive Growth Fund is a form of Mutual Fund whose main investment objective is to achieve capital gains. These funds are perceived to generate high returns, and are catered to investors who have a high tolerance for risk.

If you have never traded options before, don’t worry; it’s easier than you might think. But before you can even begin trading options, you need to understand what an option is. Definition of an Option An option is the right to buy or sell an asset, not an obligation. In other words, the option does not force you Read More…