What Is TD Bank’s Virtual Stock Market Simulation? It is a portfolio simulation tool for students to get familiar with real market data, buying and selling securities, and managing a portfolio in a controlled environment. Teachers or Instructors can set up a class by defining the “class rules” – what types of securities can be Read More…

Picking Stocks – The Basics The most challenging aspect of starting to invest is picking the first few stocks to add to a portfolio. Every investor has their own techniques and strategies, but we want to give you the tools you need to place your first trades, and get your portfolio off to a running Read More…

Fractions What is a fraction? A “Fraction” means one piece of a whole. You can use fractions in any case where it might be useful to look at something in parts, rather than the whole thing at once. The most delicious fractions are slices of pizza. If the pizza is in 8 slices, we know Read More…

In this article we will be looking at how you can use Excel to keep track of your account’s performance. This is meant as a basic guide for people who have little or no experience with Excel. Using Excel To Track Your Stock Portfolio – Getting Some Data Before we can do anything with Excel, Read More…

If you’ve started buying a few stocks, you will probably be interested in diversifying your portfolio between various sectors. This sounds easy, but it can be very challenging finding stocks from a wide range of sources that fit what you’re looking for. Thankfully, our [link name=”quote” dest=”/quotes”]Quotes Tool[/link] has all the information you need to Read More…

How Do I Build a Diversified Portfolio? Understanding what it means to build a diversified portfolio is one of the first concepts a new investor needs to understand. When talking about stocks, diversification means to make sure you don’t “put all of your eggs in one basket.” What Does It Mean To Diversify? Simply put, Read More…

Definition A stock quote gives essential information about a particular stock at a point in time. The quote normally includes information such as the name of the company, the ticker symbol, the price, the day’s high and low prices, and the trading volume. Details Usually when you get a stock quote, you see lots of Read More…

Why Invest in Stocks? Once you have built your budget and built up your emergency fund, you will start to build up extra savings that go towards your future – and that future should include investing. Simply put, when you have money to invest for an extended period of time (like 20 years or more), Read More…

Definition: The New York Stock Exchange (or NYSE) is the largest stock exchange in the world. Think of it as an organized, fast-paced flea market where buyers and sellers from all over the world come to trade U.S. stocks (and now some foreign shares as well). It is where over 2,800 of the biggest U.S. Read More…

What is a Stock? Stock is defined as a share of ownership in a company. If you own a company’s stock, you own a percentage of the company itself. This includes partial ownership of its assets (like equipment, vehicles, and buildings) and partial ownership if its income and profits. The main reason people purchase stock Read More…

The most challenging aspect of starting to invest is picking the first few stocks to add to a portfolio. Every investor has their own techniques and strategies, but we want to give you the tools you need to place your first trades, and get your portfolio off to a running start. Establish Goals Before choosing Read More…

Mutual Funds are a way you can buy into a wide range of stocks, bonds, money markets, or other securities all at once. They are professionally managed, so you are basically buying a piece of a larger portfolio. Definition Mutual Funds come in several different “flavors”, but the core concept is always the same: the Read More…

ETFs are a fairly new way that you can buy a large group of stocks, assets, or other securities all at once. ETFs trade just like stock; you can buy and sell shares of an ETF throughout the day on an exchange. Definition “ETF” stands for “Exchange Traded Fund”, which is exactly how it sounds; Read More…

Definition: The Dow Jones Industrial Average, more frequently known as the Dow or the Dow Jones, is a stock market index made up of 30 of the largest publicly-owned companies based in the United States. It’s a price weighted index meaning that the index’s price is an average of the price of the 30 stocks Read More…

What is a Balance Sheet? The Balance Sheet (or Statement of Financial Position) is one of the four financial statements required by the SEC based on the U.S. GAAP (Generally Accepted Accounting Principles). According to the SEC, the Statement of Financial Position presents “detailed information about a company’s assets, liabilities and shareholders’ equity.” In other Read More…

Definition: The Income Statement is one of the financial statements that all publicly traded companies share with their investors. The income statement shows the company’s sales, expenses, and net profit (or loss) over a period of time–usually 3 months, year-to-date, and twelve months. The income statement also comes with a lot of notes and discussions Read More…

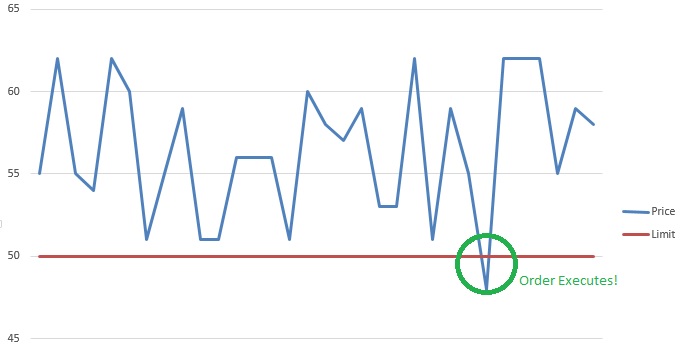

Definition A Stop (or stop loss) order and limit order are orders that try to execute (meaning become a market order) when a certain price threshold is reached. Limit and stop orders are mirrors of each other; they have the same mechanics, but have opposite triggers. When creating a limit or stop order, you will select Read More…

Definition Your “Risk Level” is how much risk you are willing to accept to get a certain level of reward; riskier stocks are both the ones that can lose the most or gain the most over time. Risk Understanding the level of risk you need and want is a very important part of selecting a Read More…

Definition: An asset is anything that has monetary value and can be sold. Assets can be anything from a pencil (though it is not worth much) to a skyscraper to things like Stocks and ETFs. There can also be intangible assets such as the value of a brand name or logo. Details: Assets generally refer Read More…

Good Till Date Order Terms If you have ever placed a limit or stop order, you have see the “Good Till Day” order term on the trading menu: A “Good-Till-Day” order is simply one that will cancel at the end of the trading day if it does not fill. So, for example, if you have Read More…

How Do I Build a Diversified Portfolio? Understanding what it means to build a diversified portfolio is one of the first concepts a new investor needs to understand. When talking about stocks, diversification means to make sure you don’t “put all of your eggs in one basket.” What Does It Mean To Diversify? Simply put, Read More…

Over-The-Counter (OTC) Stocks Most investors are familiar with NASDAQ, the NYSE (New York Stock Exchange), TSX (Toronto Stock Exchange), and most other large national stock exchanges. However, there are also thousands of companies that want to sell shares to the general public, but are not able to sell on these exchanges. Stock traded on these Read More…

There are a couple of different strategies that you can employ to build a stock portfolio: 1) You can take the risk that the products will not be good, and buy the cheapest brands of everything on the list; 2) You can buy half the things on the list from the discount aisle, while splurging on good brand names for the other half; or 3) You can avoid the risk of disappointment and buy just big brand names.

A portfolio is a collection of assets that contribute collectively to an overall return. There are many different reasons you could create a portfolio, and you need to define your reason or objective from the very beginning before adding stocks and other securities to your account.

A basic material used in manufacturing or commerce that is interchangeable with other the same commodities coming from a different source. The quality of a specific commodity may differ slightly, but it is essentially uniform across producers. When they are traded on an exchange, commodities must also meet specified minimum standards, also known as a basis grade. Typical types of commodities are corn, gold, silver, steel, etc.

The fee charged by a broker or investment advisor in exchange for investment advice and/or handling the purchase or sale of a security. Commissions vary from brokerage to brokerage.

When an investor takes an account with a licensed brokerage firm that allows the investor to deposit money and place investment orders through the brokerage firm. There are several different types of brokerage accounts. Full-service brokers provide investment advice and charges high fees for their services. Most online brokers provide less services at a far Read More…

The question of when to sell stocks is not easily answered. On the one hand, you know a correction is coming but the question of “when” isn’t so clear. Anyone who has ever sold early only to stand by and watch others reap in huge profits have felt the pain of premature sales.

It is impossible to predict what the market will do today, tomorrow or next year, but there is one thing that is definite: markets go up, they go down, and they stay the same.

The golden rule of stock investing dictates cutting your losses when they fall 10 percent from the price paid, but common wisdom just might be wrong. Instead, use some common sense to determine if it’s time to hold or fold.

Buying what you know takes advantage of your familiarity with a product or market and translates that knowledge into potential earnings. Think of it this way; good investors understand opportunity and risk.

Small cap stock investing is volatile. That is one of first things you should know and understand. So, why risk your money by investing in what is typically considered risky business?

In a cap-weighted index, large price moves in the largest components (companies) can have a dramatic effect on the value of the index.

Diversification to reduce risk should seem obvious to most investors but a surprising number of people follow their instinct rather than intellect when it comes to investing.

The buy and hold strategy is essentially just what it sounds like: Purchase stocks and then hold them for an extended period of time. The underlying assumption for the buy and hold strategy is that stocks tend to go up in price over extended periods of time.

Learn the classic market cycles of accumulation, mark up, distribution and mark down so that you can time the market -consistently – and make steady profits any time.

It is only an offer and will not be accepted if the seller is not willing to let go at the offer price. This offer price pertains to all traded investments.

The difference between the ask price and the sell price is called the “spread” and it is kept by the broker.

If you are brand new to investing then take time to understand what you are reading when viewing a Stock Exchange Symbol and learn Stock Market Investing Basics.

A national government that owes money to international financial institutions such as the World Bank, foreign governments, or to foreign lenders.

An entity that abides by specific legal requirements that sets it apart as having a legal existence, as an entity separate and distinct from its stockholders (owners).

An order to buy or sell a stock at a fixed price. This order is active until 1) the trade is executed, 2) the investor decides to cancel it or 3) a specified time period elapses.

Stock market prices are affected by business fundamentals, company and world events, human psychology, and much more.

Charting Software is an analytical, computer-based tool used to help equity (stock) traders with trading analysis by charting the price stock price for various time periods along with various indicators. Equity charting software packages are used by many traders to determine the direction on any given stock price.

Bear ETFs short stocks to achieve their goals. Bear ETFs show gains when the underlying stocks loose value. Bull ETFs use long positions and show gains when the underlying stocks show gains.

Expirations determine when your order gets placed on the market.

Order Types offered in our Stock Market Game: Market Orders, Limit Orders, Stop Market Orders, Stop Limit Orders and Trailing Stop Orders

Real-life and virtual trading hours for our site (all times Eastern).

Note: Stock Market trading is Monday-Friday, except on holidays.

Stock market prices are affected by business fundamentals, company and world events, human psychology, and much more

Penny stocks are stocks with a share price of $5 or less.

Day traders buy and sell the same stock (or other investment type) within a single trading day.

A list of the 25 most popular (largest) mutual funds.

The following strategies are used to trade ETFs.

What are the differences between investing in Exchange Traded Funds verses stocks? This article will discuss the pros and cons …

There are many investment errors that are easy to avoid. This list of Common Investment Mistakes will help the beginner save money.

A stock investing tactic where you purchase the ten DJIA stocks with the highest dividend yield at the start of each year.

There are many research tools available and many of them are free. Of course, there are some very sophisticated tools that come with hefty price tags; however, for most investors all the research they’ll need is free or available for a modest subscription.

Steps to consider as you make your first trade.

Everyone has their favorite stock market myths but here are a few you might like to add to the collection:

Factors that contribute to selecting your trading strategy include: personality, goals, amount of investment capital and comfort zone.

The cash received from the short sale of a security. The interest return from investment of the short proceeds is usually divided between the short seller, who gets partial “use of proceeds,” and the securities lender.

A market order is an order to buy or sell a stock at the best available price. Generally, this type of order will be executed immediately. However, the price at which a market order will be executed is not guaranteed. It is important for investors to remember that the last-traded price is not necessarily the price at which a market order will be executed. In fast-moving markets, the price at which a market order will execute often deviates from the last-traded price or “real time” quote.

The price a seller is willing to accept for a security, also known as the offer price. Along with the price, the ask quote will generally also stipulate the amount of the security willing to be sold at that price.

Sometimes called “the ask.”

When you are selling your shares of a security, the bid price is what the buyer is willing to pay for your shares. This Bid Price offers you an exact price of how much you can sell your shares for.

Preferred stock is a special class of stock issued by a company that pays dividends. Preferred stock is more like a bond than true stock because the main appeal is dividend income. Most preferred stocks are limited in the total profit they can earn.

Common stock is a form of corporate equity ownership, a type of security. The terms “voting share” or “ordinary share” are also used in other parts of the world; common stock being primarily used in the United States. It is called “common” to distinguish it from preferred stock.

Stocks of leading and nationally known companies that offer a record of continuous dividend payments and other strong investment qualities.

The tendency of the stock market to trend higher over time. It can be used to describe either the market as a whole or specific sectors and securities. The opposite of a Bull Market is a Bear Market when the market is moving lower over time.

The tendency of the stock market to trend lower over time. It can be used to describe either the market as a whole or specific sectors and securities.

Traders, investment firms and fund managers use a trading strategy to help make wiser investment decisions and help eliminate the emotional aspect of trading.

An action is the type of trade that you would like to place. It includes: Buy Sell Short Cover

Selling Short is a trade in which the investor borrows a security and sells it to another investor in the market. To close the short position an investor has to cover (purchase the same security from the market) and return it to the person they borrowed it from.

Learning different methods to do your own stock market research will enable you to make a better decision whether to, or not to enter into specific trading and investing positions. Keep the brokers in check In the past, many people relied on investment brokers to provide recommendations and whatever they said, was the way to go, or Read More…

Most investors don’t know the significance of a stock’s daily volume. Learn the four wonders of high volume and the four dangers of low volume. Volume plays a very important role in stock trading especially, when day trading. For those of you who don’t know what volume is, it’s the total amount of shares traded of Read More…

For each model stock portfolio that is created by Lady Luck, there are thousands that are designed using a valid and well thought-out investment strategy. What is taught about the Model Stock Portfolio? Financial Portfolio Management training all over the world stresses adopting a market game strategy that fits the investor’s: Personality (Who are you? Read More…

If you have never traded options before, don’t worry; it’s easier than you might think. But before you can even begin trading options, you need to understand what an option is. Definition of an Option An option is the right to buy or sell an asset, not an obligation. In other words, the option does not force you Read More…