What is a Cash Flow Statement?

The Cash Flow Statement is one of the four financial statements required by the SEC based on the U.S. GAAP (Generally Accepted Accounting Principles). According to the SEC, cash flow statements “report a company’s inflows and outflows of cash.” In other words, this statement presents where the cash and its equivalents are coming from and where they are being allocated.

Why is the Cash Flow Statement Important?

Understanding the CF statement can be useful in understanding a firm’s financials. The Cash Flow statement is important because it tracks all the monetary activities of a company. In other words, it measures where the actual cash comes from, and where it is going. It allows the readers to define how a firm manages and allocates its cash to their debts, investments and expenditures. Thus, for management, investors and creditors, it will be essential to review the CF statement to ensure that the business is financially fruitful.

Who are interested in these statements and why?

There are many players who are interested in the Cash Flow statements:

- Investors

- Current and future investors will review the CF statement to view the company’s ability to generate cash and meet their obligations.

- Lenders/Creditors

- Lenders and creditors will investigate the cash flow statement to define if the firm will be able to repay their debts.

- Management

- Whether it’s the accountants or CEO of the firm, management will need to define if they can cover the workforce’s compensation and other expenses.

What does a Cash Flow statement look like? What are the components?

| ABC Inc.

Cash Flow Statement For the year ended December 31 2999 |

||

| Cash Flow from Operating Activities | ||

| Net Income | $x,xxx,xxx | |

| Depreciation | xx,xxx | |

| Increase in A/R (accounts receivable) | (xx,xxx) | |

| Decrease in A/P (accounts payable) | xx,xxx | |

| Increase in Inventory | (xx,xxx) | |

| Net cash provided by Operating Activities | xxx,xxx | |

| Cash Flow from Investing Activities | ||

| Sale of Equipment, Machinery | xxx,xxx | |

| Purchase of land | (xx,xxx) | |

| Net cash provided by Investing Activities | xxx,xxx | |

| Cash Flow from Financing Activities | ||

| Notes Payable | xx,xxx | |

| New Equity Issued | xxx,xxx | |

| Net cash provided by Financing Activities | xxx,xxx | |

| Net change in cash flow | xxx,xxx | |

| Beginning Cash Balance | xx,xxx | |

| Ending Cash Balance | xxx,xxx | |

The main components of the Cash Flow Statements are the cash flows from the operating, investing and financing activities:

- The cash flow from Operating activities are any transactions that relates to the business operations of the firm. This entails that you would have to adjust the net income with all the non-cash transactions. As an example, an increase in accounts receivable means that no cash was received, but simply an obligation from customers, so you would have to subtract this value from your net income, because you are not holding the physical cash value. The same logic would be applied to all operational transactions.

- The cash flow from Investing activities are any transactions that are related to the firm’s investments in resources for growth and production. For example, a cash payment for a new machine or a plant is considered a negative cash flow in the “investing activities” section.

- The cash flow from Financing activities includes all transactions on how the company raised its capital and payments to their investors/creditors. Cash dividends, issuing or buying back more stocks, an inflow from debt issuance are examples of financial activities.

Where can I find the Cash Flow Statement for a specific company?

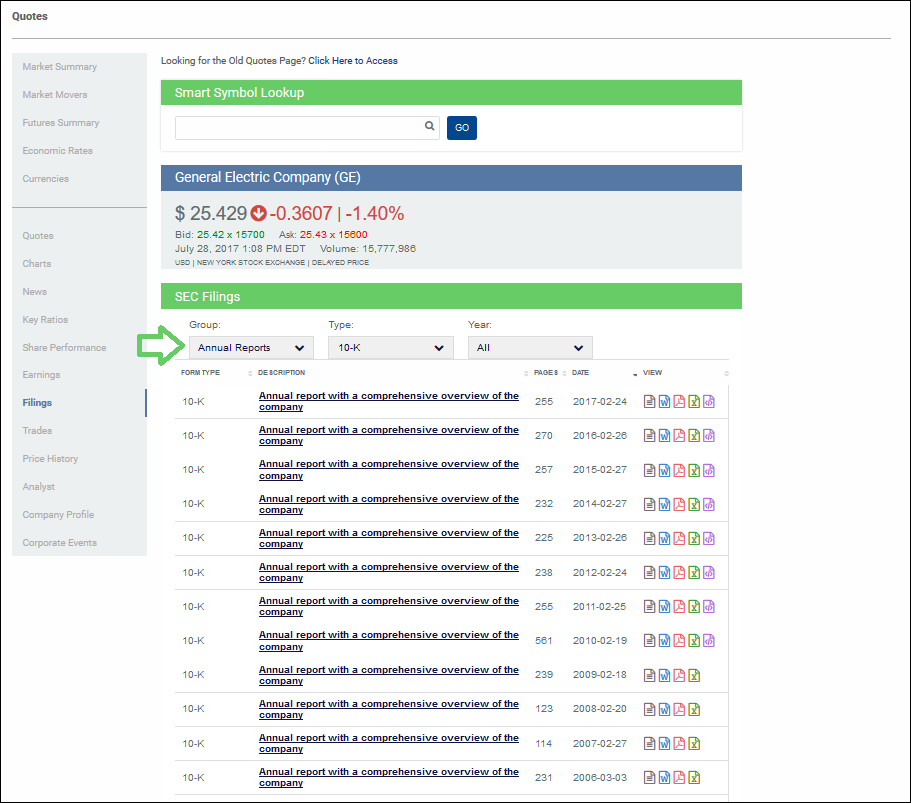

You can find the Cash Flow Statements for any company in the United States in our Quotes Tool:

Pop Quiz

[mlw_quizmaster quiz=176]