Chart analysis is the same as Technical Analysis. It is mostly concerned with price and volume.

The Fed is the US central-banking system which is made up of 12 regional central banks

State regulations governing the sale of securities and mutual funds

Definition: An investment service that allows individuals to purchase a stock directly from a company or through a transfer agent. Not all companies offer DSPPs and the plans often have restrictions on when an individual can purchase shares. Example: The greatest benefit of using direct stock purchase plans for investors is the ability to avoid commissions by not Read More…

Since the bottom fell out of the stock market in 2008, investors have been shifting money from stocks into bond funds. Since 2007, there have been $1.39 trillion invested in Bond Funds versus $193 billion in stock funds. The most logical explanation is an attempt to find income and safety, but are bonds truly safe?

In the world of stock analysis, fundamental and technical analysis are on completely opposite sides of the spectrum. Earnings, expenses, assets and liabilities are all important characteristics to fundamental analysts, whereas technical analysts could not care less about these numbers and only focus on price and volume.

A phrase used for a stock where the price has dropped significantly in a short period of time. A falling knife security can rebound, or it can lose all of its value where the shares become worthless.

The total amount that the federal government has borrowed including internal debt (borrowed from national creditors) and external debt (borrowed from foreign creditors).

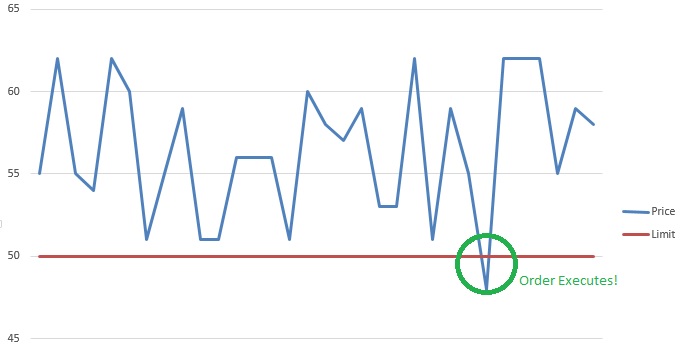

A Stop Limit is an order that combines the features of stop order with the features of a limit order. A stop limit order executes at a specified price (or better) after a specified stop price is reached. After the stop price is reached, the stop limit order becomes a limit order to buy (or sell) at the limit price or better.

The merger of companies at the same stage of production in the same or different industries.

US federal legislation of 1890 that prohibited the creation of monopolies by outlawing direct or indirect attempts to interfere with the free and competitive nature of the production and distribution of goods. Amended by the Clayton Act of 1914. Also called Sherman Act.

An order to buy or sell a stock at a fixed price. This order is active until 1) the trade is executed, 2) the investor decides to cancel it or 3) a specified time period elapses.

Stock prices are a direct result of supply and demand. All the other influences like debt, balance sheets, earnings and so on affect the desirability of owning (or selling) a stock.

Decreasing the long-run average and marginal costs that come from an increase in the size of a factory or plant.

A short call option position where the writer does not own the specified number of shares specified by the option nor has deposited cash equal to the exercise value of the call.

A high-risk bond with a low credit rating. Junk Bonds usually have a much higher yield than investment-grade bonds.

An alternative retirement plan to a 401(k) plan offered by non-profit organizations such as universities and charitable organizations, rather than corporations.

When a company offers to trade one security in return for another security.

Stock market prices are affected by business fundamentals, company and world events, human psychology, and much more.

You do not need anything else on a stock chart but the candles themselves to be a successful swing trader! And, there is nothing that can improve your trading more than learning the art of reading candlestick charts

Resistance and support levels are widely used by experienced traders to formulate trading strategies. For example, if a stock is approaching a very strong resistance level, a trader may prefer to close the position rather than take the risk of a significant decline if the stock uptrend reverses.

Analysis of ADX is a method of evaluating trend and can help traders to choose the strongest trends and also how to let profits run when the trend is strong.

If you perform four or more day trades in a 5 day period you may get flagged by the SEC as a “Pattern Day Trader.” This can cause you to lose your margin account status until you deposit enough cash to have $25,000 or more in your account. Many beginning traders have been bitten by this rule!

An inverted dead-cat bounce is quite the opposite of the dead-cat bounce. A quick look is if a trader owns a stock following a quick and large (5-20%) gain there is normally a gap up. If you sell on the next day after the gap up day, thus unlocking profits its because prices normally start falling before beginning a new move upward (Bulkowski, 2005).

A trading term called a dead cat bounce is used to when a stock is in a severe decline and has a sharp bounce off the lows. It occurs due to the huge amount of short interest in the market. Once the supply and demand has become unbalanced, any type of bear market rally will create a massive short covering which will lead to a swift price move up. This bounce will be short lived and followed up by heavy selling which will break the prior price low.

A gap in a chart is basically an empty space between one trading period and the one prior to that trading period. They normally form on account of an important and material event that will affect security, like an earnings surprise or a merger agreement.

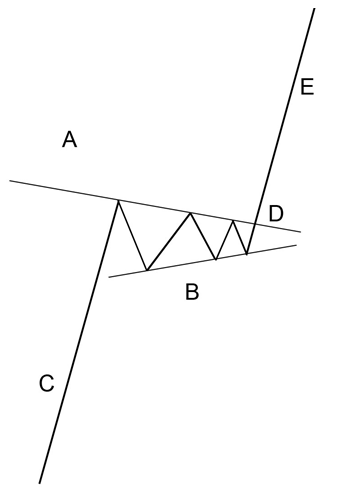

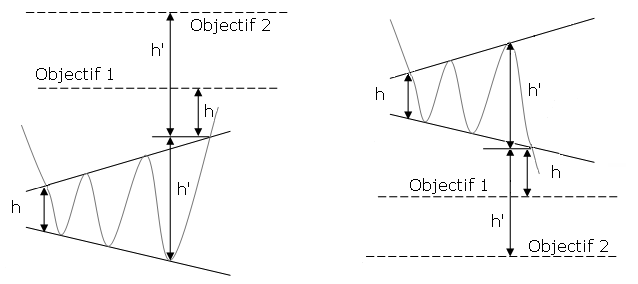

Flags and Pennants are categorized as a continuous pattern. They normally represent only brief pauses in a dynamic stock. They’re typically seen immediately after a quick move. The stock will then take off again in the same direction. Research shows that these patterns are many of the most reliable continuation patterns. Take a look at typical Flags and Pennant pattern.

The V top is a reverse V-shaped top thus the name. The top is quite sharp. It’s due to the irrationality of actors leading to a steep increase that will be corrected shortly afterwards. The V top will occur most often in an upward trend and will often signal a trend reversal. It can also appear in a downward trend, like when in an economic announcement.

The V bottom is shaped like a V thus the name. The dip will be quite sharp. It’s because the irrationality of actors leading to a steep fall which will be corrected shortly after. The V bottom will occur most often in a downward trend and will generally offer a signal trend reversal. It can also appear in an upward trend (like in an economic announcement).

A horizontal channel is a pattern that underlines investor’s indecisiveness. This horizontal channel is assembled by two horizontal and parallel lines that build the progress of the price. To confirm a line, there should be at least two points of contact with the price. The more contact points it will has, the more these will be durable and their breakout will give an substantial buy/sell signal.

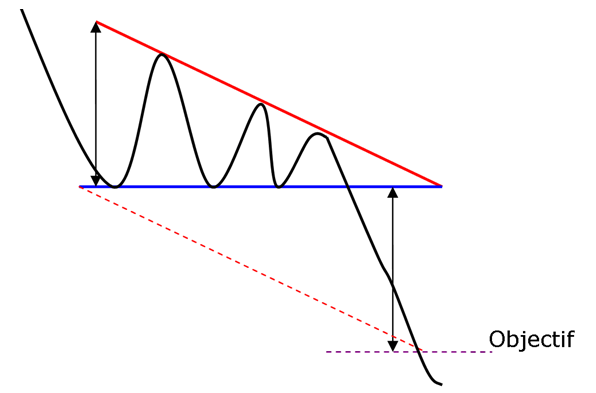

The descending triangle is a bearish continuation pattern. This pattern forms two converging lines. The initial is a downward slant which resistance and the other is a horizontal support. To validate the descending triangle, there must be oscillation between the two lines. The lines must be touched at least twice for validation.

The symmetrical triangle top is a bullish continuation pattern. This pattern forms two trend lines which are symmetrical to the horizontal and convergent. The initial pattern is a bearish slant that gives resistance and the other is a bullish slant that will be the support. To prove a symmetrical triangle top, one must have oscillation between the two lines. Each of these lines must be touched at least twice for validation.

A symmetrical triangle bottom is a bearish continuation pattern. This pattern forms two trend lines that are symmetrical to the horizontal and convergent. The initial one is a bearish slant that gives support and the other will be a bullish slant that will create a resistance. To prove a symmetrical triangle bottom there must have oscillation between the two lines. Each line has to touch at least twice for validation.

The ascending triangle is a bullish continuation pattern. This pattern is made by two converging lines. The first line is an upward slant which is the support and the other is a horizontal resistance line. To validate the ascending triangle, there has to be an oscillation between the two lines. Each line has to be Read More…

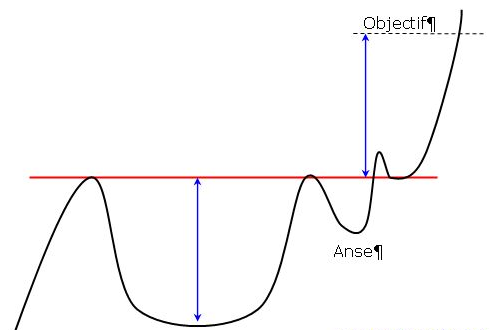

The cup with handle has a continuous pattern. This pattern is formed by two rounded bottoms, the first is deeper and wider than the second. The height of the cup and the handle will be aligned along a straight horizontal resistance. This is the neckline of the pattern.

The rounding top pattern is a reverse U-shape, also called a “reverse saucer. ” The top is rounded with a flat top. But as you’ll see in many cases there are several bullish peaks and they will not put in question the validity of the pattern.

The U-shaped bottom is a rounding bottom, also called a “saucer. ” The dip is rounded with a flat bottom. But we’ll see in many cases there are several bearish peaks, but they do not question the validity of that pattern.

The pennant resembles the symmetrical triangle, but it’s characteristics are not the same. The pennants is shaped like a wedge of consolidation. Its normally appears after a sudden upward or downward movement. The life of a pennant is short according to the time frame used.

The descending flag shows as a continuation pattern. The flag is built by two straight downward parallel lines which is shaped like a rectangle. It is oriented in the direction of that trend which it consolidates. Contrary to a bearish channel, this pattern is quite short term and shows the fact that buyers will need a break.

An ascending flag is a continuation pattern. The ascending flag is formed by two straight upward parallel lines which are shaped like a rectangle. It is adjusted in the direction of the trend that it consolidates. Contrary to a bullish channel, this pattern is quite short term and marks the fact the seller will need a break.

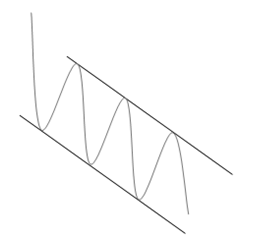

A bullish channel is called a continuation trend pattern. The bullish channel is assembled by two parallel lines that frame the upward price trend. A line is validated when there has been at least two points of contact with the price. The more contact points it has, the stronger the trend line is and the more their breakout will give a strong sell signal.

A bearish channel is a continuation trend pattern. The bearish channel is arranged by two parallel lines that frame the downward price trend. To certify a line, there has to be at least two points of contact with the price. The more contact points it has, the more the trend line is stronger and their breakout will give a stronger buy signal.

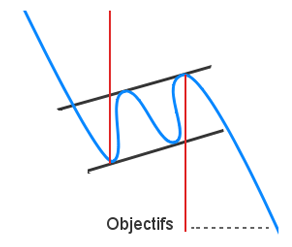

The triple top is a bearish pattern with an MN shape. Three bottoms will come in succession, reflecting an important resistance. This marks a reversal will.

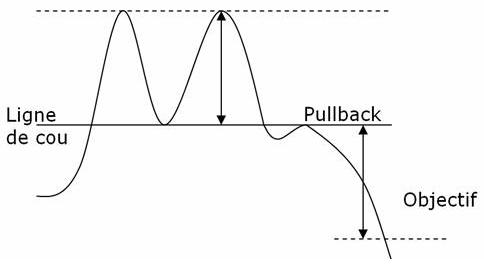

Reverse head and shoulders is a trend reversal pattern. It will mark a desire to make a bullish reversal. The theory is the same as a triple bottom other than the second bottom will be lower than the others, which are technically at the same height. The reverse head and shoulders pattern will be formed by three bottoms that will succeed.

The double top is a bearish pattern shaped like an M. Two tops must succeed, imaging an important resistance. This marks a reversal. The pattern may also be in WV shape. We can consider a triple top as well.

A reversal pattern is called a diamond bottoms. This pattern is formulated by two juxtaposed symmetrical triangles. It is shaped like a diamond.

A falling wedge is a bullish reversal pattern made by two converging downward slants. To prove a falling wedge, there has to be oscillation between the two lines. Each of the lines must be touched at least twice for validation.

A bearish reversal pattern formed by two assembled upward slants is called a rising wedge. To validate rising wedge there must be oscillation between the two lines. These lines must be touched at least twice for validation.

Stock charts print different topping formations. Some are classics, like the Descending Triangle, which can be understood and traded with little effort. However the emotional crowd additionally generates many undependable patterns while greed slowly evolves into mindless fear. Complex Rising Wedges will challenge a technician’s best effort at prediction while the unusual Diamond pattern burns trading capital swinging randomly back and forth.

The formation, ascending broadening wedge is called this because of its similarity to a rising wedge formation and then has a broadening price pattern.

The right-angled and ascending broadening chart pattern is not one you might choose to trade. Other chart patterns perform much better. Downward breakouts have a big break even failure rate which may disqualify them from your trading tools. Upward breakouts have only a middling average rise, and that is if you trade them perfectly.

The broadening bottom is one of those chart patterns that appears often, but you might want to avoid trading. The performance rank approaches the bottom of the list with a comparatively high break even failure rank and low average rise in a bull market. Its only redeeming value is the partial decline which does an excellent job of predicting an upward breakout.

Charting Software is an analytical, computer-based tool used to help equity (stock) traders with trading analysis by charting the price stock price for various time periods along with various indicators. Equity charting software packages are used by many traders to determine the direction on any given stock price.

With ETFs, you can scaled down the size of the transaction for small investors.

Bear ETFs short stocks to achieve their goals. Bear ETFs show gains when the underlying stocks loose value. Bull ETFs use long positions and show gains when the underlying stocks show gains.

The DIA -DIAMONDS Trust, Series 1 ETF invest in a basket of Dow Jones Industrial Average stocks that will track the price and performance of the Dow Jones Industrial Average (DJIA) Index.

A trailing stop loss is calculated in a manner like the way we calculated our initial stop loss. The only difference being that while we calculated our stop loss from the entry price, we’re calculating our trailing stop loss from the highest price since entry.

Had the American Indians sold their beads and trinkets they received from selling Manhattan Island, invested their $16 and received 8% compounded annual interest, not only would they have enough money to buy back all of Manhattan, they would still have several hundred million dollars left over. That is the power of compound interest over time.

Expirations determine when your order gets placed on the market.

Order Types offered in our Stock Market Game: Market Orders, Limit Orders, Stop Market Orders, Stop Limit Orders and Trailing Stop Orders

Real-life and virtual trading hours for our site (all times Eastern).

Note: Stock Market trading is Monday-Friday, except on holidays.

Stock market prices are affected by business fundamentals, company and world events, human psychology, and much more

An investor’s instructions to a broker or brokerage firm to purchase or sell a security. Orders are typically placed over the phone or online. Orders fall into different available types which allow investors to place restrictions on their orders affecting the price and time at which the order can be executed.

Penny stocks are stocks with a share price of $5 or less.

Definition: The amount of sales generated for every dollar’s worth of assets. It is calculated by dividing sales in dollars by assets in dollars. Formula: Asset Turnover = Revenue / Assets Also known as the Asset to Turnover Ratio. More Detail: Asset turnover measures a firm’s efficiency at using its assets in generating sales or revenue – the Read More…

Day traders buy and sell the same stock (or other investment type) within a single trading day.

A list of the 25 most popular (largest) mutual funds.

Mutual Fund screeners are available on countless websites and trading platforms. They allow users to choose trading instruments that are suitable for certain criteria profile.

American investors, covering the past decade, have conclusively come around to mutual funds so they may save towards their retirement as well as other financial targets.

The possible choices for investing in a mutual fund is less complicated than you think.

Mutual fund charges and costs are fees that may be acquired by investors who possess mutual funds

The following strategies are used to trade ETFs.

A closed-end fund is a publicly traded investment company that raises a fixed amount of capital through an initial public offering (IPO). The fund is then structured, listed and traded like a stock on a stock exchange.

An open end mutual fund don’t have limits on the quantity of shares the fund will issue. Provided that demand is requested often, the fund will continue to issue shares no matter the number of investors.

A tool that investors and traders can use to filter ETFs based on user-defined metrics. ETF screeners are offered on many websites and trading platforms, and they allow users to select trading instruments that fit a certain profile set of criteria.

A load mutual fund comes with a sales charge or commission.

A no-load mutual fund in which shares are sold without a commission or sales fee. The notion for this is that the shares are allocated directly by the investment company, rather than going through a alternate party.

A Spider ETF is a summary of Standard & Poor’s depositary receipt, an exchange-traded fund (ETF) administered by State Street Global Advisors.

Exchange-traded funds that invest in physical commodities such as natural resources, agricultural goods as well as precious metals.

A group of risks combined with investing in a foreign country.

A type of mutual fund with a portfolio constructed to match or track the components of a market index, such as the Standard & Poor’s 500 Index (S&P 500). An index mutual fund is said to provide broad market exposure, low operating expenses and low portfolio turnover.

What are the differences between investing in Exchange Traded Funds verses stocks? This article will discuss the pros and cons …

Your goal should be to build and manage a diversified portfolio of stocks and bonds with the lowest possible fees and the greatest possible tax efficiency. ETFs offer seven advantages over index mutual funds: lower cost, greater tax efficiency, better tax management, easier asset allocation, easier portfolio rebalancing, no fraud and you can short ETFs.

An options strategy by which an investor retains a long position in an asset and writes or sells a call options on an identical in an effort to produce an increased income from the asset.

There are many investment errors that are easy to avoid. This list of Common Investment Mistakes will help the beginner save money.

A revenue or expense stream that changes a cash account over a given period. Cash inflows usually arise from one of three activities – financing, operations or investing – although this also occurs as a result of donations or gifts in the case of personal finance. Cash outflows result from expenses or investments. This holds true for both business and personal finance.

Dollar Cost Averaging is the method of purchasing a fixed dollar amount of one particular investment at regular period of times, regardless of the share price.

Fundamental analysis is the process of looking at the basic or fundamental financial level of a business, especially sales, earnings, growth potential, assets, debt, management, products, and competition.

A stock investing tactic where you purchase the ten DJIA stocks with the highest dividend yield at the start of each year.

The first sale of stock by a private company to the public. IPOs are often issued by smaller, younger companies seeking the capital to expand, but can also be done by large privately owned companies looking to become publicly traded.

There are many research tools available and many of them are free. Of course, there are some very sophisticated tools that come with hefty price tags; however, for most investors all the research they’ll need is free or available for a modest subscription.

Steps to consider as you make your first trade.

Stocks are shares in ownership of a company. Stocks represents a claim on the company’s assets and earnings. As you increase your holdings of a stock, your ownership stake in the company increases. Whether you say shares, equity, or stock, it all means the same thing.

A Trading Halt is the temporary suspension of trading of a security for a specific period of time. Trading Halts typically last for an hour, but can extend into days.

Time Decay is the inclination for options to decrease in worth as the expiration date draws near. The extent of the time decay is inversely connected to the changeability of that option.

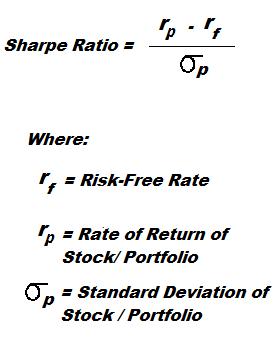

A Sharpe Ratio calculates the extra return you make compared to the extra risk you take on.

Everyone has their favorite stock market myths but here are a few you might like to add to the collection:

Factors that contribute to selecting your trading strategy include: personality, goals, amount of investment capital and comfort zone.

Capital Asset Pricing Model (CAPM) is a method used by investors to prioritize what stocks to invest in, given their limited cash.

The basic form of short selling is selling stock that you borrow from an owner and do not own yourself. In essence, you deliver the borrowed shares. Another form is to sell stock that you do not own and are not borrowing from someone. Here you owe the shorted shares to the buyer but “fail to deliver.”