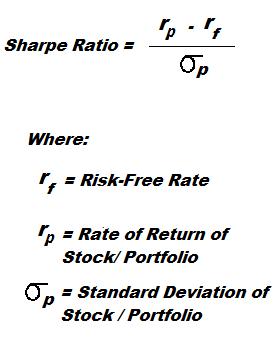

A Sharpe Ratio calculates the extra return you make compared to the extra risk you take on.

Capital Asset Pricing Model (CAPM) is a method used by investors to prioritize what stocks to invest in, given their limited cash.

The basic form of short selling is selling stock that you borrow from an owner and do not own yourself. In essence, you deliver the borrowed shares. Another form is to sell stock that you do not own and are not borrowing from someone. Here you owe the shorted shares to the buyer but “fail to deliver.”

The cash received from the short sale of a security. The interest return from investment of the short proceeds is usually divided between the short seller, who gets partial “use of proceeds,” and the securities lender.

In finance, short selling (also known as shorting or going short) is the practice of selling securities or other financial instruments, with the intention of subsequently repurchasing them (“covering”) at a lower price. In the event of an interim price decline, the short seller will profit, since the cost of repurchase will be less than the proceeds received upon the initial (short) sale. Conversely, the short seller will incur a loss in the event that the price of a shorted instrument should rise prior to repurchase.

Buying on margin is borrowing money from a broker to purchase stock.

Cash flow per share shows the after-tax earnings plus depreciation, on a per share basis. Many financial analysts place more emphasis on the cash flow per share value than on earnings per share values.

Form 10-Q, is also known as a 10-Q or 10Q, is a quarterly report mandated by the United States federal Securities and Exchange Commission, to be filed by publicly traded corporations.

Companies with more than $10 million in assets and a class of equity securities that is held by more than 500 owners must file annual and other periodic reports, regardless of whether the securities are publicly or privately traded. Up until March 16, 2009, smaller companies could use Form 10-KSB. If a shareholder requests a company’s Form 10-K, the company must provide a copy. In addition, most large companies must disclose on Form 10-K whether the company makes its periodic and current reports available, free of charge, on its website. Form 10-K, as well as other SEC filings may be searched at the EDGAR database on the SEC’s website.

An order placed with a broker to sell a security when it reaches a certain price. A stop-loss order is designed to limit an investor’s loss on a security position.

A stop order is an order to buy or sell a stock when the stock price reaches a specified price, which is known as a stop price. When the specified price is reached, the stop order becomes a market order.

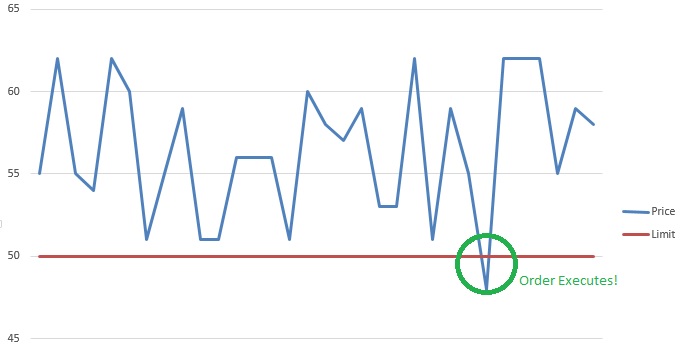

A limit order is an order to buy or sell a stock at a specific price or better. A buy limit order can only be executed at the limit price or lower, and a sell limit order can only be executed at the limit price or higher. A limit order is not guaranteed to execute. A limit order can only be filled if the stock’s market price reaches the limit price. While limit orders do not guarantee execution, they help ensure that an investor does not pay more than a pre-determined price for a stock.

A market order is an order to buy or sell a stock at the best available price. Generally, this type of order will be executed immediately. However, the price at which a market order will be executed is not guaranteed. It is important for investors to remember that the last-traded price is not necessarily the price at which a market order will be executed. In fast-moving markets, the price at which a market order will execute often deviates from the last-traded price or “real time” quote.

The price a seller is willing to accept for a security, also known as the offer price. Along with the price, the ask quote will generally also stipulate the amount of the security willing to be sold at that price.

Sometimes called “the ask.”

When you are selling your shares of a security, the bid price is what the buyer is willing to pay for your shares. This Bid Price offers you an exact price of how much you can sell your shares for.

A financial ratio that shows how much a company pays out in dividends each year relative to its share price. In the absence of any capital gains, the dividend yield is the return on investment for a stock. The formula is Annual Dividends Per Share divided by Price Per Share.

Dividends are payments made by a corporation to its shareholder members. It is the portion of corporate profits paid out to stockholders. When a corporation earns a profit or surplus, that money can be put to two uses: it can either be re-invested in the business (called retained earnings), or it can be distributed to shareholders. There are two ways to distribute cash to shareholders: share repurchases or dividends. Many corporations retain a portion of their earnings and pay the remainder as a dividend.

Preferred stock is a special class of stock issued by a company that pays dividends. Preferred stock is more like a bond than true stock because the main appeal is dividend income. Most preferred stocks are limited in the total profit they can earn.

Common stock is a form of corporate equity ownership, a type of security. The terms “voting share” or “ordinary share” are also used in other parts of the world; common stock being primarily used in the United States. It is called “common” to distinguish it from preferred stock.

By law, every year, mutual funds must distribute that year’s net investment income (the total of dividends and interest received, less fund expenses) and net realized gain (gains less losses on securities sales) to its shareholders. These distributions are taxable income reported to the IRS on Form 1099. Investors must report the income on their tax returns. This poses a problem for some mutual fund investors who make initial purchases of mutual funds near the end of a calendar year. Because they receive a capital gains distribution, they immediately receive taxable income and face a mutual fund NAV that is reduced from the distribution.

Profit or loss resulting from the sale of certain assets classified under the federal income tax legislation as capital assets. This includes stocks and other investments such as investment property.

A Call Option gives the holder the right, but not the need to purchase a fixed quantity of a particular stock at a specific price inside a particular time. Call Options are bought by investors who anticipate a price increase.

Stocks of leading and nationally known companies that offer a record of continuous dividend payments and other strong investment qualities.

Trades greater than or equal to 10,000 shares in size and greater than or equal to $100,000 in value.

A measurement of the relationship between the price of a stock and the movement of the whole market. An asset has a beta of zero if it moves are not related to the benchmark’s moves. A positive beta means that the asset generally follows the benchmark, in the sense that the asset tends to move up when the benchmark moves up, and the asset tends to move down when the benchmark moves down. A negative beta means that the asset typically moves in the opposite direction as the benchmark: the asset tends to move up when the benchmark moves down, and the asset tends to move down when the benchmark moves up.

The tendency of the stock market to trend higher over time. It can be used to describe either the market as a whole or specific sectors and securities. The opposite of a Bull Market is a Bear Market when the market is moving lower over time.

The tendency of the stock market to trend lower over time. It can be used to describe either the market as a whole or specific sectors and securities.

When an option’s strike price is identical to the price of the security. Both call and put options will be simultaneously “at the money.” For example, if the ABC stock is trading at 75, then the ABC 75 call option is at the money and so is the ABC 75 put option. An at-the-money option has no intrinsic value, but may have time value (value if the stock goes up during the period of the option). Options trading activity tends to be most active when options are at the money.

When you place an order to buy stocks that must be filled completely, with the total quantity requested, or the trade should not execute at all.

Technical Analysis is the use of technical indicators comprising of statistics using past market information to predict which direction the security price will move.

Trailing Stop is a Stop Loss order which is placed as a percentage value as opposed to an absolute dollar value. The order will only execute if the price of the security falls by a certain percentage. The trailing stop adjusts automatically as the price of the security rises and bases itself on the new appreciated value. This type of order allows profits to be made while cutting losses simultaneously.

Margin is the amount of money supplied by an investor as a portion of the total funds needed to buy or sell a security, with the balance of required funds loaned to the investor by a broker, dealer, or other lender.

Current Ratio is the ratio of current assets divided by current liabilities. It provides A liquidity ratio that measures a company’s ability to pay short-term obligations. Also known as “liquidity ratio”, “cash asset ratio” and “cash ratio”.

Buy-side Firms are institutions that provide advice on buying securities and assets within their own organizations.

The Average True Range (ATR) is an indicator that measures volatility.

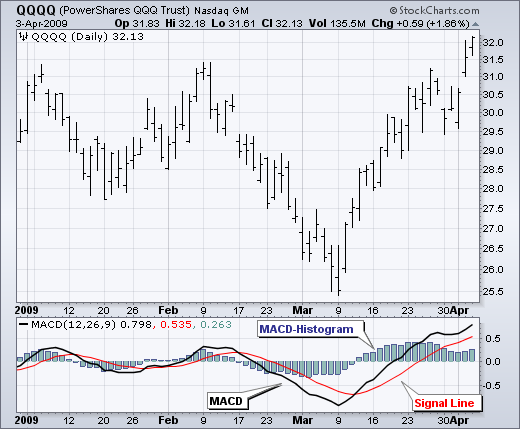

The Moving Average Convergence-Divergence (MACD) indicator is one of the easiest and most efficient momentum indicators you can get. It was developed by Gerald Appel in the late seventies.

Moving Averages Moving Averages are one of the most popular and important technical analysis tools. The ease of use and simple calculation make it a great tool to get information quickly. They also provide the basics for more advanced technical analysis tools like MACD and Bollinger Bands and can be useful for removing some of Read More…

Volatility is founded on the standard deviation, which modifies as volatility expands and declines. The bands spontaneously widen when volatility expands and narrow when volatility declines.

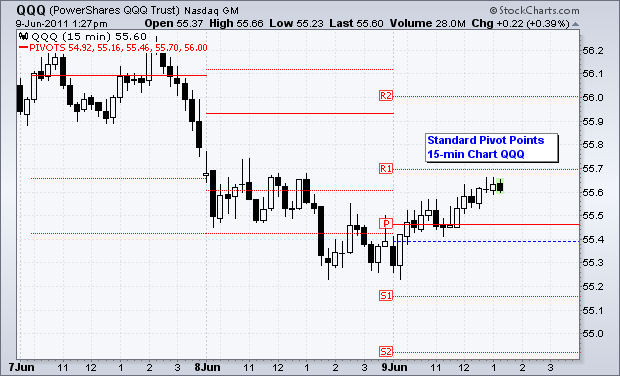

Pivot Points use the previous period’s high, low and close which will define future support and resistance. Pivots Points are important levels chartists utilize to decide directional movement, resistance and support

An action is the type of trade that you would like to place. It includes: Buy Sell Short Cover

A Trailing Stop is an order to close out your position if the price goes against you by a certain percentage or dollar value. It is different to a normal stop order as the stop price moves in your favour if the price of the stock moves in the direction you want it to. This Read More…

A dollar Trailing Stop is a Stop Loss order which is placed as a dollar value. The order will only execute if the price of the security falls by that dollar amount. The trailing stop adjusts automatically as the price of the security rises and bases itself on the new appreciated value. This type of Read More…

A zero coupon bond is a bond sold without interest-paying coupons. Instead of paying periodic interest, the bond is sold at a discount and pays its entire face amount upon maturity, which is usually a one year period or longer. A Treasury Bond is a good example.

Yield To Maturity is the interest rate that will make the present value of a bond’s remaining cash flows (if held to maturity) equal to the price (plus accrued interest, if any). It is basically what you will earn if you buy and hold the bond till maturity. On of the major assumptions is that all the Read More…

Yield is the return investors can expect on a security based on all the outflows and inflows they incur related to that security.

Volume is the quantity of shares/contracts of a security that is traded within a specific time period.

Unsystematic Risk is also called diversifiable risk, residual risk, or company-specific risk. It is the risk that is unique to a company such as a strike, the outcome of unfavorable litigation, or a catastrophe that affects its production. This risk can be mitigated away by diversification.

Treasury bills, often referred to as T-bills, are short-term securities (maturities of less than one year) offered and guaranteed by the federal government. They are issued at a discount and pay their full face value at maturity.

A percentage Trailing Stop is a Stop Loss order which is placed as a percentage value as opposed to an absolute dollar value. The order will only execute if the price of the security falls by a certain percentage. The trailing stop adjusts automatically as the price of the security rises and bases itself on Read More…

Tick refers to a change in price, either up or down.

Strike Price is the price at which an option can be exercised to buy or sell the underlying stock or futures contract.

S&P 500 Index (Standard and Poor’s 500 Index) is a composite of the 500 most actively traded public companies in all ten economic sectors of the U.S. It is maintained by Standard and Poor’s, a division of the Parent company McGraw-Hill.

Selling Short is a trade in which the investor borrows a security and sells it to another investor in the market. To close the short position an investor has to cover (purchase the same security from the market) and return it to the person they borrowed it from.

Security is any financial instrument that represents a financial value

Recession is generally described as a slowdown of economic growth over a sustained period of time.

Quick Ratio is the ratio that measures the ability of a firm to cover its current liabilities with their most liquid current assets. Quick Ratio = (Current Assets – Inventory) / Current Liabilities

A Put Option gives the holder the right to sell the underlying stock or futures contract at a specified strike price.

Pink Sheets refer to the trading of stocks that are not listed on a major exchange or the OTCBB due to a lack of minimum listing requirements or filing financial statements with the SEC (Securities Exchange Commission)

Par Value is the amount that the issuer of a bond agrees to pay at the date of maturity.

Out-Of-The-Money refers to an option that is unfavourable to exercise. An example is a put option with a strike price lower than the underlying stock price, or a call option with a strike price higher than the underlying stock price.

An Options Contract is a contract which specifies how much of the underlying asset can be bought or sold at a specific price. An option contract to buy the underlying is a call option, and to sell the underlying is a put option. Most stock options contracts represent 100 underlying shares.

Market Risk is the general risk for investing in the any security. Every industry in the market is affected by this risk. Examples of market risk: depression, war, inflation etc.

Initial Public Offering, or IPO for short, represents the first opportunity for the public to purchase shares of a company. It is also referred to as a private company “going public”.

Futures Contracts are a standardized, transferable legal agreement to make or take delivery of a specified amount of a certain commodity, currency, or an asset at the end of specified time frame. The price is determined when the agreement is made. Future contracts are always marked to market.

Expiration Date is the last day upon which an option or futures contract can be exercised or traded.

Excess Return is the return in excess of that required by shareholders based on the beta of the company.

Equity is the residual interest of an owner in an asset after all debt and tax payments have been taken care of.

An ECN or Electronic Communication Network is a computer network that facilitates the trading of stocks outside of the regular market hours.

Discount refers to the price of a bond when it is below its par value. An example is if the par value of the bond is $1,000 and the bond is selling for $980, the bond is selling at a discount of ($1,000 – $980) =$20.

Derivative is a type of security whose value is “derived” from an underlying asset. (Eg; Futures and Options). Futures and options are both derivatives – meaning a security whose value solely depends on the value of the underlying asset. A future derives its value from the commodities or currencies which it represents An option derives Read More…

A depression is a recessionary decline in real GDP (taking inflation into account) greater than 10% lasting at least 3 years.

Delta is also called the hedge ratio, which is the ratio of the change in price of an option to the change in price of the underlying stock.

Coupon Rate is the rate of interest paid on a bond, expressed as a percentage of the bond’s face value.

A Coupon is the periodic interest payment made to a bondholder during the life of the bond. (Usually semi-annual)

Convertible Preferred Stock are Preferred stock that can be converted into common stock at a particular time frame.

Convertible Bonds are bonds that can be converted into Common Stock usually at the maturity of the bond.

A Contract is term that describes the unit of trading for a stock option, future option or future. It lists all the obligations and particulars related to the security.

Buy-Sell Agreement is an agreement between shareholders or business partners where both parties agree to purchase or sell a stock.

Book Value is the price at which the buyer purchases the asset for.

What are they doing with your money? Have you ever wondered how well your money is really being managed by the corporations you hand it over to? After all, the media is full of stories about CEO compensation reaching new heights, buy-outs of non-profitable holdings, million dollar birthday parties and other horror stories. Formula for Read More…

EPS (Earnings-Per-Share) measures how much of a company’s net income actually trickles down to each outstanding share. Any preferred dividends are first taken out of the net income before calculating EPS. Interpreting EPS Earnings Per Share can be used to compare the earnings of two or more companies in a similar industry. Just because one Read More…

A Sharpe Ratio calculates the extra return of an investment in return for the extra risk taken on. It is used to compare different investments to see which one did better given the different risk of each. It is measured as taking the difference between a risk-free and a risky asset, and then dividing the difference by the Standard Deviation (which Read More…

Class B Shares are a form of common stock that may have more or less voting rights that Class A shares. Generally Class B shares have lesser voting rights, but be vary of some companies that trick investors by using the perception of Class “B” (compared to “A”) shares to attach more voting rights to them Read More…

Class A Shares are a form of common stock that may have more or less voting rights that Class B shares. Generally Class A shares have more voting rights, but companies sometimes trick investors by using the perception of “Class A” shares to attach fewer voting rights to them than Class B shares.

Balanced Fund is a type of Mutual Fund whose main objective is to diversify risk by holding a defined percentage of different security types including stocks, bonds, and money market instruments

An Aggressive Growth Fund is a form of Mutual Fund whose main investment objective is to achieve capital gains. These funds are perceived to generate high returns, and are catered to investors who have a high tolerance for risk.