Hungary is an EU member country with a medium-sized, liberal economy that is rapidly developing. It has the 5th largest economy in Central and Eastern Europe, with major exports in machinery, chemicals, textiles, and agricultural products. Hungary’s Main Industries Hungary is economically known for its strength in: Agriculture Sector Wheat Corn Sunflower Potato Sugar Read More…

Peru is a Latin American country with an emerging, market-oriented economy that has been among the top performers in South America. Rich in natural resources, it is a major exporter of gold, copper, zinc, and fish.

Portugal is an EU member country with a high-income and service-based economy. It enjoys vast forests, has a strong industrial base, and is an important agricultural exporter.

Romania is an EU member country, which has experienced positive foreign direct investment and GDP growth following privatisation initiatives over the last decade. It has an upper-middle income economy strong in its industrial and agricultural sectors.

Argentina is a South American country that is one of the G-20 economies. It is the third largest economy in Latin America and has the highest GDP per capita in its region. It possesses plenty of natural resources, a strong agricultural sector, and a well-educated population.

Albania is one of south eastern European countries that have shown promising economic growth potential. It has been increasingly attracting foreign direct investment and possesses a strong agriculture and natural resources industry

Gross National Product is the value of all goods and services produced by a country’s residents.

Free Cash flow is the cash available to all the capital providers of a company. There are two types of free cash flows: 1) Cash flow available to pay out to all capital providers and 2) Free Cash Flow to Equity (FCFE).

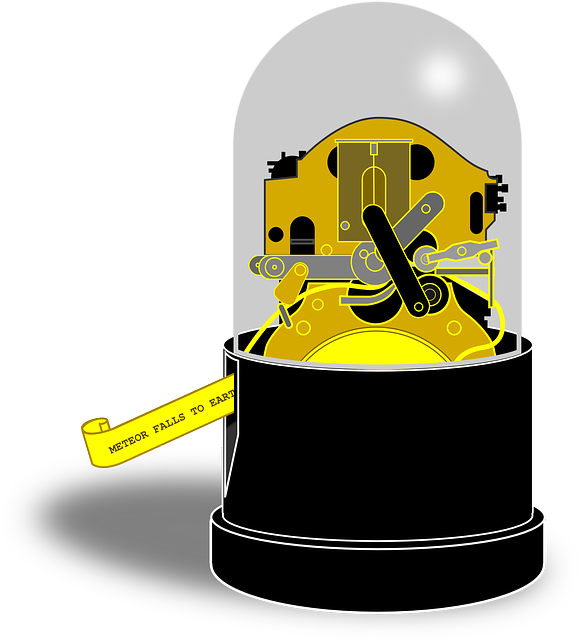

The Form-8K is a SEC-mandated report filed by public companies to report unexpected events or transactions that are material in nature, and thus have an impact on the share prices of the company.

Fixed income analysis is the process of evaluating and analyzing fixed income securities for investment purposes.

In investment valuation, financial modeling refers to the procedure and methodology performed to determine the value of an asset or financial security. Fundamentally, a business or company’s current value can be viewed as being derived from its future cash flow streams. An investor deciding whether to purchase or sell a stock, therefore, will be interested in estimating such value.

The earnings reports released by companies can be invaluable in providing such information. Released by public companies on a quarterly and annual basis, they can be used to assess and gauge a company’s: financial condition, strategic plans, industry and competitive position, Key performance drivers and risk factors and Future performance.

Discounted Cash Flow is a valuation technique or model that discounts the future cash flows of a business, entity, or asset for the purposes of determining its value. One aspect of investment decision-making entails discovering the fair value of investments.

The Debt-Snowball Method is a debt-management strategy aimed at reducing a borrower’s obligations. Borrowers can use this method to slowly eliminate their debt by focusing on their smallest debt balance, followed by larger ones until all obligations are paid off.

Covariance is a statistical measure of the extent that 2 variables move in tandem relative to their respective mean (or average) values. In the investment world, it is important to be able to measure how different financial variables interact together.

The use of correlation analysis extends to numerous important fields. For example, in finance, correlation analysis can be used to measure the degree of linear relationships between interest rates and stock returns, money supply and inflation, stock and bond returns, and exchange rates.

Comprehensive insurance to a form of insurance policy which includes a broad range of coverage or protection.

The options collar strategy is designed to limit the downside risk of a held underlying security. It can be performed by holding a long position in a security, while simultaneously going long a Put and shorting a Call.

The CME Group is an order-driven exchange that facilitates the trading of forward, futures, and options contracts on numerous products within key asset classes such as agriculture, energy, metals, equities, interest rates, and exchange rates.

The CBOT is an exchange providing trading in derivatives contracts and clearinghouse functions. It allows traders to buy and sell contracts on several products in asset classes such as agriculture, energy, metals, equities, bonds, and exchange rates. The majority of its trades are conducted electronically.

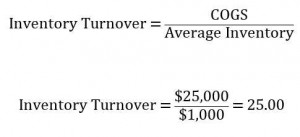

Measuring the cash conversion cycle is important to liquidity, working capital, and the operating cycle of a company. Good management of the CCC can also enhance a company’s cash flows, allowing it to effectively make sound investing and financing decision. Managing the CCC entails efficient inventory, receivables, and payables functions, and should be part of a company’s overall operational strategy.

Capital funding is the provision of monetary resources or capital for productive uses. Capital provided by investors or other parties is used by various entities such as governments, companies, organizations, and individuals in order to fund their functions and operations. In most cases, capital provided is compensated by some form of return to the provider. Two important types of capital are equity and debt. Equity capital represents an ownership stake, while debt capital is a form of lending.

Account Receivables Management refers to the set of policies, procedures, and practices employed by a company with respect to managing sales offered on credit.

Account Payables Management refers to the set of policies, procedures, and practices employed by a company with respect to managing its trade credit purchases.

Insurance is protection from losing or damaging something. It is defined as the transfer of loss risk in exchange for payment. Basically, if we damage or lose something that was insured, the insurance will cover the cost of having it fixed or replaced.

A Commercial Bank is a type of financial institution that is responsible for catering to everyday banking needs. Commercial Banking is also sometimes referred to as Retail Banking. This is the kind of bank that individuals go to for their everyday financial needs.

We will teach you how to save money so that you can afford your future now. There are two main questions you need to ask yourself to effective save money: A.“How much will I need?”, and B.“What can I afford?”

There are a couple of different strategies that you can employ to build a stock portfolio: 1) You can take the risk that the products will not be good, and buy the cheapest brands of everything on the list; 2) You can buy half the things on the list from the discount aisle, while splurging on good brand names for the other half; or 3) You can avoid the risk of disappointment and buy just big brand names.

A portfolio is a collection of assets that contribute collectively to an overall return. There are many different reasons you could create a portfolio, and you need to define your reason or objective from the very beginning before adding stocks and other securities to your account.

Price ceiling is a government-mandated limit on the price that can be charged for a given product, such as a utility or electricity. The intended purpose of a price ceiling is to protect the consumers from conditions that would make a vital product from being financially unattainable for consumers.

A “Poison Pill” creates a strong defense mechanism for a “targeted takeover company” allowing the company to properly identify legitimate and beneficial acquisitions and weed out the actions of corporate raiders. The “Poison Pill” is also useful in slowing down the speed of potential raids.

A straddle is an investment strategy that involves the purchase or sale of an option allowing the investor to profit regardless of the direction of movement of the underlying asset, usually a stock.

An oligopoly is characterized by a small number of sellers who dominate an entire market.

Monopoly, in economic terms, is used to refer to a specific company or individual has a large enough control of a particular product or service that allows them to influence it’s price or certain characteristics.

Monopolistic Competition is characterized as a form of imperfect competition.

Money supply is the total amount of money available in an economy at any particular point in time.

Monetary Policy refers to the process by which the Monetary Authority of a given country implements a variety of measures to control the supply of money.

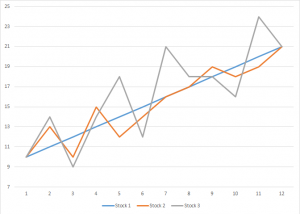

Modern Portfolio Theory (MPT) is an investment theory whose purpose is to maximize a portfolio’s expected return by altering and selecting the proportions of the various assets in the portfolio.

Fiscal policy is the use of government spending to influence the economy.

The Expected Return is a weighted-average outcome used by portfolio managers and investors to calculate the value of an individual stock, or an entire stock portfolio.

A good way to evaluate a manager is to ask many relevant questions pertaining to your own personal financial situation and your financial goals. Examples of questions to ask are:

Elasticity is one of the most important terms in economics, and has a plethora of uses. Economists define elasticity as the ratio of the percent change in one variable to the percent change in another valuable.

If you own a bond or manage a bond portfolio, chances are that will you be following daily interest rates. You know that bond prices increase when rates rise, and decrease when rates fall. But how do you measure the bond’s price sensitivity to such rate fluctuations? The answer is duration.

Dupont Analysis breaks the Return on Equity into several different components in order to analyze where the returns are coming from.

Direxion Small Cap Bear3X – Triple-Leveraged ETF is an index fund ETF (Exchange Traded Fund) designed to seek a daily result of 300% of the INVERSE of the performance of the Russell 2000 Small Cap Index.

Straight line depreciation is the most commonly used and simplest form of depreciation.

Depreciation refers to the gradual and permanent decrease in value of the assets of a firm, nation or individual over its lifetime.

A consumer price index (CPI) is the relative measure of a market basket of consumer goods and services purchased by households.

A basic material used in manufacturing or commerce that is interchangeable with other the same commodities coming from a different source. The quality of a specific commodity may differ slightly, but it is essentially uniform across producers. When they are traded on an exchange, commodities must also meet specified minimum standards, also known as a basis grade. Typical types of commodities are corn, gold, silver, steel, etc.

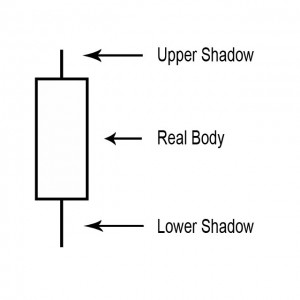

For a candlestick chart, the body or real body is the wide or colored part of a candle that represents the range between the opening and the closing prices over a specific time period (minute, hour, day, week or other). They are the most basic building block for candlestick charts.

A point on a candle stick chart representing a specific time period (a day, an hour, a minute, etc) in which the underlying stock price has moved. Candlesticks will have a body and usually two wicks – one on each end. For a white (could also be green) candlestick, the bottom of the body represents the opening price and the top of the body represents the closing price. For red candlesticks, it is just the other way around. The top and bottom tips of each wick are the day’s highest and lowest price respectively.

A small line (like a candle wick) found at the top or bottom of an individual candle in a candlestick chart.

An investment strategy that aims to capitalize on the continuance of existing trends in the market. The momentum investor believes that large increases in the price of a security will be followed by additional gains and vice versa for declining values.

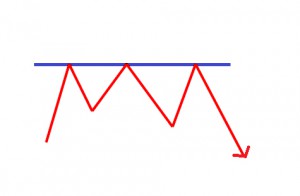

A point or range in a chart that caps an increase in the price of a stock or index over a period of time. An area of resistance, resistance line or resistance level indicates that the stock or index is finding it difficult to break through it, and may head lower shortly. The more times that the stock or index tries unsuccessfully to break through the resistance line, the stronger that area of price resistance becomes.

The price-to-sales ratio (Price/Sales or P/S) provides a simple approach: take the company’s market capitalization (the number of shares multiplied by the share price) and divide it by the company’s total sales over the past 12 months. The lower the ratio, the more attractive the investment.

High inflation and high unemployment occurring simultaneously.

A security with a guarantee of a return rate that is higher than the rate of inflation if it is held to maturity

The fee charged by a broker or investment advisor in exchange for investment advice and/or handling the purchase or sale of a security. Commissions vary from brokerage to brokerage.

When an investor takes an account with a licensed brokerage firm that allows the investor to deposit money and place investment orders through the brokerage firm. There are several different types of brokerage accounts. Full-service brokers provide investment advice and charges high fees for their services. Most online brokers provide less services at a far Read More…

Earnings estimates provide one strong measure of potential future performance and are a mainstay of stock investing research.

Return on Equity (ROE) is used to measure how much profit a company is able to generate from the money invested by shareholders.

Price to Earnings is the most usual way to compare the relative value of stocks based on earnings since you calculate it by taking the current price of the stock and divide it by the Earnings Per Share (EPS).

The question of when to sell stocks is not easily answered. On the one hand, you know a correction is coming but the question of “when” isn’t so clear. Anyone who has ever sold early only to stand by and watch others reap in huge profits have felt the pain of premature sales.

Stock volatility information can be used in many different ways but here is a quick and easy bit of stock volatility information that you can begin using today.

It is impossible to predict what the market will do today, tomorrow or next year, but there is one thing that is definite: markets go up, they go down, and they stay the same.

The golden rule of stock investing dictates cutting your losses when they fall 10 percent from the price paid, but common wisdom just might be wrong. Instead, use some common sense to determine if it’s time to hold or fold.

A hedge fund is one of the investment tools you will aspire toward as a serious investor. The first hedge fund came out in 1949 as a strategy to neutralize the effect of overall market movements on a portfolio.

Buying what you know takes advantage of your familiarity with a product or market and translates that knowledge into potential earnings. Think of it this way; good investors understand opportunity and risk.

Small cap stock investing is volatile. That is one of first things you should know and understand. So, why risk your money by investing in what is typically considered risky business?

Hyperinflation refers to out of control or extremely rapid inflation, where prices increase so quickly that the concept of real inflation becomes meaningless.

Inflation refers to the general rising of prices for goods and services in the economy, due to an increase in the amount of money and/or credit available.

A CD or Certificate of Deposit is one of the safest and liquid forms of investment available. Insured by the FDIC (Federal Deposit Insurance Corporation), CDs are a type of interest earning deposit account.

In a cap-weighted index, large price moves in the largest components (companies) can have a dramatic effect on the value of the index.

Market risk is a measure of how much of a loss an investor is facing while trading.

Your ideal investment or investment portfolio gives you the most opportunity for the risk you can bear. In this sense, it is important to understand the risk inherent in an investment before you look for the opportunity.

Diversification to reduce risk should seem obvious to most investors but a surprising number of people follow their instinct rather than intellect when it comes to investing.

The buy and hold strategy is essentially just what it sounds like: Purchase stocks and then hold them for an extended period of time. The underlying assumption for the buy and hold strategy is that stocks tend to go up in price over extended periods of time.

Learn the classic market cycles of accumulation, mark up, distribution and mark down so that you can time the market -consistently – and make steady profits any time.

Everywhere you turn there is another proprietary stock market timing system being sold. Let’s take a few minutes to review these claims against common sense.

It is only an offer and will not be accepted if the seller is not willing to let go at the offer price. This offer price pertains to all traded investments.

The difference between the ask price and the sell price is called the “spread” and it is kept by the broker.

If you are brand new to investing then take time to understand what you are reading when viewing a Stock Exchange Symbol and learn Stock Market Investing Basics.

Many people start trading stocks and never learn about stock trading risk management. The one’s that do learn, usually learn after they have been trading for a while, not before they start trading.

A REIT or Real Estate Investment Trust may be the perfect investment vehicle. REITs own, and often operate, real estate but are publicly traded like stock.

The U.S. Dollar has lost more than 30 percent of its value relative to other world currencies. Shorting the U.S. dollar and buying other world currencies is one way to make money from this trend.

By measuring the compilation of similar stocks instead of just one or two stocks, a stock index provides information about that particular market or segment.

A non-bank organization that regularly trades large blocks of stocks.

A series of technical indicators used by traders to predict the direction of the major financial indexes.

A national government that owes money to international financial institutions such as the World Bank, foreign governments, or to foreign lenders.

Many stock analysts have identified market trends related to specific times of the year. The success ratios of these trends are often far stronger than most other indicators.

A technical analysis indicator that compares advancing and declining stock issues and trading volume as an indicator of overall market sentiment. The Arms Index, or TRIN (Traders Index), is used as a predictor of future price movements in the market primarily on an intraday basis.

A market indicator used to determine volatility levels in the market without factoring in price direction. It is calculated by taking the absolute value of the difference between the number of advancing issues and the number of declining issues. Typically, large numbers suggest volatility is increasing, which is likely to cause significant changes in stock prices in the coming weeks.

A technical analysis tool that represents the total difference between the number of advancing and declining security prices. This index is considered one of the best indicators of market movements as a whole. Stock indexes such as the Dow Jones Industrial Average only tell us the strength of 30 stocks, whereas the advance/decline index can provide much more insight into the movements of the market.

By aggregating the value of a related group of stocks or other investment vehicles together and expressing their total values against a base value from a specific date. Market indexes help to represent an entire stock market and thus give investors a way to monitor the market’s changes over time.

Simplest, oldest, and most common form of business ownership in which only one individual acquires all the benefits and risks of running an enterprise. In a sole-proprietorship there is no legal distinction between the assets and liabilities of a business and those of its owner. It is by far the most popular business structure for startups because of its ease of formation, least record keeping, minimal regulatory controls, and avoidance of double taxation.

Definition The minimum amount of equity that must be maintained in a margin account. In the context of the NYSE and FINRA, after an investor has bought securities on margin, the minimum required level of margin is 25% of the total market value of the securities in the margin account. Keep in mind that this Read More…

Margin calls happen when your account value drops to a value below that allowed by a broker.

An entity that abides by specific legal requirements that sets it apart as having a legal existence, as an entity separate and distinct from its stockholders (owners).

Retained earnings is calculated by adding net income to (or subtracting any net losses from) the beginning retained earnings and then subtracting the dividends that were paid to shareholders

A plan offered by a corporation that allows investors to reinvest their cash dividends by purchasing additional shares or fractional shares on the dividend payment date.