Definition Scarcity refers to the fact that resources are finite – people and organizations need to allocate their finite resources between their infinite wants. Each year, the world produces more goods and services, along with better technologies and processes that can increase output farther. Even with this growth, there will always be scarcity, because there Read More…

Definition “Specialization” is when a labor force begins to divide total production, leading to a rise of experts or specialists. This is called the Division of Labor, and it typically results in much higher productivity of labor. How Does It Work? Specialization has two main parts – Division of Labor, and a rise of Experts. Read More…

Definition “Opportunity Cost” is what needs to be given up to get something. This is different from an item’s price. Imagine you want to buy some stock for your virtual portfolio – you can afford one share of either Apple () or Alphabet, Inc. (). Your Opportunity Cost of buying one is that you cannot also Read More…

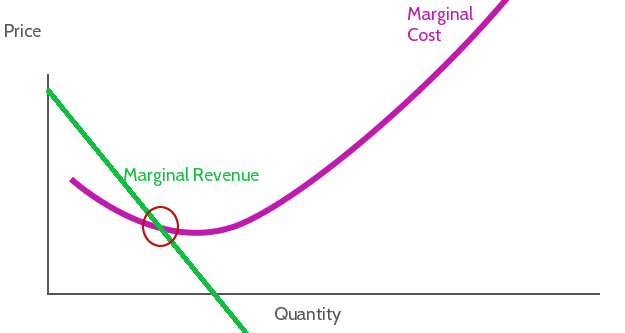

Everyone knows about costs and benefits of doing something – the pros and cons of making a choice. Marginal benefit and marginal cost are different – they look more closely at doing slightly more or less of different alternatives. Marginal costs and benefits are extremely important to producers when choosing their inputs and prices. [gtranslate] Read More…

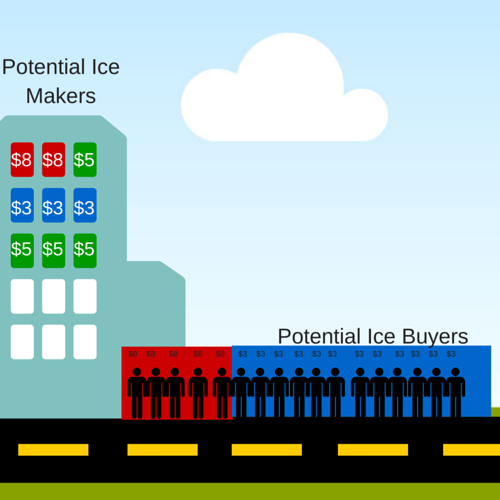

What is Competition? “Competition” is when many producers try to sell similar goods to the same set of consumers. The producers need to “compete” to try to attract more consumers, usually by lowering prices, offering better versions of the goods or services, or through marketing. Competition is the core concept of the Market Economy. Why Read More…

What Is The Business Cycle? The Business Cycle is the broad, over-stretching cycle of expansion and recession in an economy. The Business Cycle is concerned with many things – unemployment, industrial expansion, inflation rates, but the most important indicator is GDP (Gross Domestic Product) growth. Below you can see a graph of the GDP growth Read More…

What does it mean to be an Entrepreneur? An Entrepreneur is someone who takes a risk to start a new business. Nearly every business that exists (apart those created as spin-offs of other businesses, or by government intervention) was started by one or several entrepreneurs, who took a risk to launch a new company. Who becomes Read More…

Definition Economic Incentives includes anything that pushes people, businesses, and governments to do one thing or another. This includes what products you buy, what career you choose, what products businesses produce, and what government programs are put in place. Incentives for Individuals Each individual faces many economic incentives every day. If you are in school, Read More…

Definition In Economics, an “Externality” is a benefit or cost that is not reflected in the price of a good or service. Why do Externalities Exist? Prices are determined by the relationship between the supply and demand of a good or service (for details, see our article on Supply and Demand Examples in the Stock Read More…

What is Economic Growth? Economic Growth means that the economy is growing – more goods and services are being produced and consumed than they were before. The most common measurement of economic growth is the Gross Domestic Product (or GDP), which measures the total number of finished goods and services produced in an economy in Read More…

Definition A “Contract” is a legally binding agreement between two parties (people, companies, or both). Having a contract means that if one party does not keep their word, the other can sue them in court to either force them to fulfill their side of the agreement, or pay back compensation. What Makes A Contract Binding? Read More…

Definition “Economics” is often called the Dismal Science – it studies the trade-offs between making choices. The purpose of economics is to look at the different incentives, assets, and choices facing people, businesses, schools, and governments, and see if there is any way to improve outcomes. This is done by looking at how supply and Read More…

Have you ever wanted to start a business? Maybe you want to know the difference between a lemonade stand and Minute-Maid, besides just the size of the companies. Different types of companies have different levels of liability (meaning level of responsibility) for the owner or owners. What this means is that the more liability an owner has, Read More…

When talking about Banking, people generally group Banks, Credit Unions, and Savings & Loan companies all in one group. They do provide similar services, but they each have specific differences that might make them a better or worse fit for your financial needs. What They Have In Common All three of these institutions can do Read More…

Definition of Spending Plan A “Spending Plan” is exactly as it says – a plan of what you will be spending each month. There are usually two parts – your “fixed” spending and your “variable” spending. The fixed part is usually the same every month, with things like rent/mortgage payments, grocery bills, insurance, and car Read More…

Definition When we think of money, stored value means anything that isn’t cash, but you can still use to transfer value – checks, debit cards, gift cards, and forms like that. These are used to transport some dollar amount which we can later exchange for goods and services. Each of these forms of stored value have their Read More…

Definition of Wealth “Wealth” means having an abundance of something desirable. This can be tangible, like money and property, or intangible, like good health or freedom. Intangible Wealth Just because something does not have a monetary value does not mean it is worthless. Having strong connections with friends and family is often considered a major Read More…

As you begin working with financial institutions to secure your money and process your financial transactions, it is important that you learn to keep good financial records. These records, both on paper and electronic, will allow you to know where your money and assets are and exactly how much you have at a given time. Read More…

Definition “Major Economic Indicators” are numbers that you can look at to try to get a picture of how well the economy is doing. Different indicators measure different parts of the economy, but their main characteristic is that they measure the same thing in the same way over time. This means that you can compare the Read More…

The stock market determines prices by constantly-shifting movements in the supply and demand for stocks. The price and quantity where supply are equal is called “Market Equilibrium”, and one major role of stock exchanges is to help facilitate this balance. We can use the stock market to give some great supply and demand examples with Read More…

Comparing Economic Systems There are many different economic systems that try to result in more equality or faster growth. The structure of a country’s economy has a lot to do with the country’s politics and the values of its population. However, the economy of every country also changes over time, and how it falls between Read More…

Definition The Federal Reserve Bank, or the “Fed”, is the central banking system of the United States. It serves as the primary regulator of the US dollar, as well as the “lender of last resort” for other banks. Regulating Currency The Federal Reserve works to maintain the interest rates that banks use to lend money to Read More…

What is a Balance Sheet? The Balance Sheet (or Statement of Financial Position) is one of the four financial statements required by the SEC based on the U.S. GAAP (Generally Accepted Accounting Principles). According to the SEC, the Statement of Financial Position presents “detailed information about a company’s assets, liabilities and shareholders’ equity.” In other Read More…

Definition: The Income Statement is one of the financial statements that all publicly traded companies share with their investors. The income statement shows the company’s sales, expenses, and net profit (or loss) over a period of time–usually 3 months, year-to-date, and twelve months. The income statement also comes with a lot of notes and discussions Read More…

An investment strategy is the set of rules and behaviors that you can adopt to reach your financial and investing goals. Choosing an investing strategy can be a daunting task when you are starting to learn about investments and finance. Here we will look at the larger overall strategies rather than very specific strategies. Given Read More…

Gross National Product is the value of all goods and services produced by a country’s residents.

In investment valuation, financial modeling refers to the procedure and methodology performed to determine the value of an asset or financial security. Fundamentally, a business or company’s current value can be viewed as being derived from its future cash flow streams. An investor deciding whether to purchase or sell a stock, therefore, will be interested in estimating such value.

The Debt-Snowball Method is a debt-management strategy aimed at reducing a borrower’s obligations. Borrowers can use this method to slowly eliminate their debt by focusing on their smallest debt balance, followed by larger ones until all obligations are paid off.

Covariance is a statistical measure of the extent that 2 variables move in tandem relative to their respective mean (or average) values. In the investment world, it is important to be able to measure how different financial variables interact together.

The use of correlation analysis extends to numerous important fields. For example, in finance, correlation analysis can be used to measure the degree of linear relationships between interest rates and stock returns, money supply and inflation, stock and bond returns, and exchange rates.

Insurance is protection from losing or damaging something. It is defined as the transfer of loss risk in exchange for payment. Basically, if we damage or lose something that was insured, the insurance will cover the cost of having it fixed or replaced.

We will teach you how to save money so that you can afford your future now. There are two main questions you need to ask yourself to effective save money: A.“How much will I need?”, and B.“What can I afford?”

Price ceiling is a government-mandated limit on the price that can be charged for a given product, such as a utility or electricity. The intended purpose of a price ceiling is to protect the consumers from conditions that would make a vital product from being financially unattainable for consumers.

An oligopoly is characterized by a small number of sellers who dominate an entire market.

Monopoly, in economic terms, is used to refer to a specific company or individual has a large enough control of a particular product or service that allows them to influence it’s price or certain characteristics.

Monopolistic Competition is characterized as a form of imperfect competition.

Money supply is the total amount of money available in an economy at any particular point in time.

Monetary Policy refers to the process by which the Monetary Authority of a given country implements a variety of measures to control the supply of money.

Fiscal policy is the use of government spending to influence the economy.

A good way to evaluate a manager is to ask many relevant questions pertaining to your own personal financial situation and your financial goals. Examples of questions to ask are:

Elasticity is one of the most important terms in economics, and has a plethora of uses. Economists define elasticity as the ratio of the percent change in one variable to the percent change in another valuable.

Depreciation refers to the gradual and permanent decrease in value of the assets of a firm, nation or individual over its lifetime.

A consumer price index (CPI) is the relative measure of a market basket of consumer goods and services purchased by households.

High inflation and high unemployment occurring simultaneously.

Hyperinflation refers to out of control or extremely rapid inflation, where prices increase so quickly that the concept of real inflation becomes meaningless.

Market risk is a measure of how much of a loss an investor is facing while trading.

Your ideal investment or investment portfolio gives you the most opportunity for the risk you can bear. In this sense, it is important to understand the risk inherent in an investment before you look for the opportunity.

Many people start trading stocks and never learn about stock trading risk management. The one’s that do learn, usually learn after they have been trading for a while, not before they start trading.

Simplest, oldest, and most common form of business ownership in which only one individual acquires all the benefits and risks of running an enterprise. In a sole-proprietorship there is no legal distinction between the assets and liabilities of a business and those of its owner. It is by far the most popular business structure for startups because of its ease of formation, least record keeping, minimal regulatory controls, and avoidance of double taxation.

Retained earnings is calculated by adding net income to (or subtracting any net losses from) the beginning retained earnings and then subtracting the dividends that were paid to shareholders

The Fed is the US central-banking system which is made up of 12 regional central banks

The total amount that the federal government has borrowed including internal debt (borrowed from national creditors) and external debt (borrowed from foreign creditors).

The merger of companies at the same stage of production in the same or different industries.

Stock prices are a direct result of supply and demand. All the other influences like debt, balance sheets, earnings and so on affect the desirability of owning (or selling) a stock.

Decreasing the long-run average and marginal costs that come from an increase in the size of a factory or plant.

Stock market prices are affected by business fundamentals, company and world events, human psychology, and much more

Recession is generally described as a slowdown of economic growth over a sustained period of time.

Delta is also called the hedge ratio, which is the ratio of the change in price of an option to the change in price of the underlying stock.

Currency Risk is the risk an investor is exposed to when investing in international markets. Currency risk is mainly associated with the fluctuations in exchange rates of the various world currencies.