Income Statement A formalized financial report prepared by a business in accordance with GAAP principles. The income statement shows the income earned and expenses incurred over a given period (usually a quarter or year), along with the total profit or loss from that period. Click Here for our lesson on Income Statements

Income Reports A report that shows the total income and total expenses from a person or business over a period of time, with a clear indication of the profit or loss over that time period. Related Lessons

Income The cash or other assets that are acquired by a person through work, or by a company through sale of their goods and services.

Import A good or service that a person or company from one country buys from another country.

Implied Volatility In options trading, this is the part of the movement in an option’s price based on how much investors think the underlying stock’s price will change over the life of the option. Related Lessons

Implied Rights Rights that a person has but are not specifically outlined in a contract or other document. The “Right to complain” is perhaps the most frequently used implied right – a company cannot stop you from complaining about their product or service (so long as your claims are true).

Identity Theft The act of a fraudulent person to use another person’s personal information to engage in financial transactions. One common form of identity theft is to use stolen social security numbers to take out credit cards in someone else’s name, max out those credit cards, then move on to a new victim. Related Lessons

Hyperinflation A type of runaway inflation where prices rise very rapidly, making savings useless. Countries experiencing hyperinflation typically have individual consumers resort to black markets dealing in some other currency or bartering.

Horizontal Management A type of management structure that has few layers of management and typically larger team sizes. Individual employees typically have a lot of freedom in how they carry out their work, with limited oversight from managers. This management structure works best in fields where most employees are experts or have vary widely in Read More…

Homeowner’s Insurance A type of insurance that protects against damage to a home, or damage caused by a home. For example, homeowner’s insurance can protect against burglaries, storm damage, or the medical bills if someone is injured in your home.

Homeowner’s Association A legal entity formed by the owners of condominiums in the same building, or houses in a subdivision. This entity is usually classified as a non-profit, and is charged with maintenance of common buildings, streets, sidewalks, and other areas.

High Pressure Selling The act of a salesperson to increase the stress level during a sales process, usually through limited time offers or heavily insisting that some harm will come to the person being sold to. This sales tactic is often used to convince the customer to buy something just to get out of the Read More…

High The maximum price a stock reaches during a given time period, usually the day or year.

Hedge The act of insuring against a risk.

Healthcare Durable Power of Attorney A binding document that grants someone else the ability to make critical, life-or-death decisions about your health care in the event that you are not able to yourself (for example, if you are in a coma).

Health Insurance A type of insurance that covers medical expenses for the insured person. Most health insurance still requires the insured person to pay some costs before the insurance kicks in, with some exceptions for preventative care. Click Here for our lesson on Health Insurance

Hazards Elements of a place, lifestyle, or business that can cause accidents or other damage. Hazards are recognized by insurance providers as a reason why an insurance policy may be risky.

Hardship Assistance Program An organized program provided by creditors to provide leniency for their clients experiencing temporary hardship. While these programs are not usually advertised, they are organized to allow clients to recover after a period of hardship then continue to make payments, rather than force the customer into bankruptcy. Click Here for our lesson Read More…

Hardship A term in finance to refer to an unexpected strain a person is experiencing that may temporarily make them unable to pay back their debts. An important part of a “hardship” is that it should be temporary, and so creditors may waive fees or grant leniency to original loan terms until the hardship has Read More…

Growth Hacking A field of marketing focused on rapidly growing the customer base of a small company. This often relies on networking effects from current customers to reach their contacts, attempts at the creation of viral content to rapidly expand brand awareness, and other low-cost, high-impact brand awareness strategies.

Growth At a Reasonable Price (GARP) An investing strategy that mixes concepts of Growth Investing (looking for companies with high potential to increase their price) and Value Investing (companies that likely are under-valued). GARP investors usually do not look at the most expensive blue-chip companies but show consistent earnings.

Group Health Insurance A type of health insurance that is purchased for a large group of people, usually a company purchasing a health plan that applies to all of their employees. Because Group Health Insurance brings together many different types of people into one plan, it is almost always significantly cheaper than purchasing individual health Read More…

Gross Profit This is the Total Revenue of a business, minus the total Cost of Goods Sold over the course of a specific time period (usually a quarter or year). This does not include taxes or other fixed costs.

Gross Output The total value of all outputted goods and services in an economy in a given year. This is different from Gross Domestic Product because Gross Output includes unfinished products as well. For example, a mine producing iron ore would be included in Gross Output, but not Gross Domestic Product because iron ore is Read More…

Gross Margin This is the simple profit margin a company has on its sales, defined as “(Revenue – Cost of Goods Sold) / Revenue”. The gross margin can be a good indicator on how much profit a business is earning on the average transaction, but it does not include taxes or other expenses and so Read More…

Gross Income The total income a company took in over a given period of time, usually a quarter or year. Gross Income does not take out any expenses or taxes.

Gross Domestic Product Deflator A measure of inflation that compares the prices of goods and services traded in one year compared to the year before, weighted by how many of those goods and services were exchanged. Many economists prefer to use the GDP Deflator to measure inflation instead of the Consumer Price Index.

Gross Domestic Product (GDP) A measure of all finished goods and services have been exchanged in an economy over the period of one quarter or one year. This is the most frequently used measure of economic activity to determine if the economy is expanding or shrinking.

Grace Period For certain types of unsecured credit (like credit cards), the grace period is the time between the end of a billing cycle and when the full amount of the amount borrowed must be paid off before financing charges are applied. Related Lessons

Government Bond A type of debt that is issued by a government to finance large expenses that must be paid back over time. Government bonds are sold to investors, who receive the regular interest payments until the bond is paid off at its expiration date. Click Here for our lesson on Bonds

Government A public institution with the power of taxation. Governments can be national, state, local, or even sub-local (like a school board).

Good Till Day A type of order term placed to purchase stock or other securities at a brokerage, with instructions that if it does not execute by the end of the current (if the markets are open) or next (if the markets are closed) trading day, it should be cancelled. All market orders are Good Read More…

Good Till Date A type of order term placed to purchase stock or other securities at a brokerage, with instructions that if it does not execute by a certain date, the order should be cancelled at the end of that date. Good Till Date, or GTD, orders cannot be used on Market Orders.

Good Till Cancelled A type of order term placed to purchase stock or other securities at a brokerage, with instructions that it should remain open until it executes, or the investor manually cancels the order. Good Till Cancelled, or GTC, orders cannot be used on Market Orders.

Good Debt Debt that was taken out to fuel growth or appreciation. For example, a mortgage to buy a house is typically considered “good debt”, since it allows the purchaser to stop paying rent and build value in their home. Related Lessons

Gold Standard A type of monetary standard where every unit of paper money is directly redeemable for a specific amount of gold that is held in the issuing country’s National Bank. A country adopting the Gold Standard cannot issue any money if they do not have more gold held in reserves to back it up.

Gold A precious metal with the atomic symbol Au. Gold has been prized since ancient times for jewelry because it does not rust or corrode and is easily forged with basic tools. It is also useful in the manufacturing of electronics. Because of its useful value, gold is frequently purchased as an investment under the Read More…

Going Concern An accounting concept where a business is assumed to be continuing to operate for the foreseeable future. If a business is not assumed to have a “going concern” (for example, if they intend to dissolve on a specific date), different accounting method are required.

Gift Cards A medium of exchange that converts cash into a certificate that can only be redeemed at specific stores or outlets. A gift card usually has the same value as cash at those businesses that accept it, but no value outside those businesses.

Geographic Segmentation A marketing concept where different types of marketing campaigns or promotions are presented to different geographic areas (for example, countries, states, or cities).

Gambling An act where a person makes a wager on a game of chance, without having a direct impact on the outcome of the wager. Investing is different from gambling because an investor purchases a part of a company, and so gets a vote in that company’s corporate structure. A gambler would have no direct Read More…

Gains The increase in value of an asset since the time it was purchased. In GAAP accounting, all assets are logged at the price they were purchased (minus depreciation). Only when the asset is sold can the company record a “gain” due to increased value.

GAAP Generally Accepted Accounting Practices, GAAP is the industry standard for how companies need to prepare their financial statements. Adherence to GAAP standards ensures that an outsider can compare the financial statements from different companies apples-to-apples.

Futures A type of contract for a commodity or other asset to be delivered at some specified date in the future. Futures contracts are frequently used so producers know the exact price of what their inputs will be when they need them, to “lock in” favorable pricing.

Future Value The cash value of an asset at some future date, usually calculated by using interest rates to project growth. See our full lesson on Future Value by clicking here.

Fundamental Analysis A type of investment research that focuses on analyzing a business’s financial statements and operations to determine if it is worth buying. This is sometimes considered “researching what to buy”, as opposed to trying to time when exactly to buy or sell.

Fund Expenses The percentage of a fund’s total value that is spent on managing the fund itself over the course of a year.

Full-Service Brokerage A type of stock broker that offers advisory services and personalized financial planning in addition to just the ability to buy and sell investments. Click Here for our lesson on What is a Brokerage?

Front Load A type of mutual fund when the advisor’s fees for managing the fund is paid when an investor first buys their shares.

Fringe Benefit A type of employment benefit that may not be expressed in dollars. This may be things like on-site childcare, extra vacation time, paid lunches, and other perks. Related Lessons

Frictional Unemployment A type of unemployment caused by a transition of a single person between jobs – after they leave one job and while they are searching for the next. Click Here for our lesson on Unemployment

Free Trade Agreement An agreement between two or more countries to remove trade barriers like tariffs to facilitate trade between the countries.

Free Application for Federal Student Aid A free form that applies a student to a variety of federal financial assistance programs to subsidize the cost of education.

Fraud Purposeful misleading of another person or individual to secure one’s own financial gain.

Franchise A type of business that offers a “template” to individual business owners. The “Franchisee” wholly owns and operates their own establishment but must operate within the rules of the “Franchisor” in order to receive marketing, logistical, training, and other support services (and the right to use the brand’s name). Most McDonald’s restaurants operate on Read More…

FOREX The foreign exchange markets, where individual investors and financial institutions buy and sell currencies.

Forensic Accounting A type of accounting practice that is concerned with tracing individual transactions through various accounts, usually to identify fraud.

Foreign Exchange An exchange of currencies that trade in a financial market. Foreign Exchange, or FX, markets determine the exchange rate of one currency to another based on global supply and demand.

Foreign Corrupt Practices Act An ethics law in the United States that formally prohibits US citizens or corporations from issuing bribes to foreign governments. This was already illegal to bribe officials in the United States, but this law made it legal to bribe anyone, anywhere.

Foreclosure An event that can happen on a home or building if a mortgage is unpaid. A foreclosure is the act of your bank or creditor taking legal possession of the property and selling it to settle the outstanding debt. Related Lessons

Flat Rate A type of fee that is a set dollar amount regardless of the size of the transaction. This is commonly used in the context of commission fees for trades.

Fixed Rate Mortgage A type of mortgage that uses a fixed interest rate over the entire duration of the mortgage. Click Here for our lesson on Mortgages

Fixed Interest An interest rate that stays constant over the entire duration of a loan. Click Here for our lesson on Mortgages

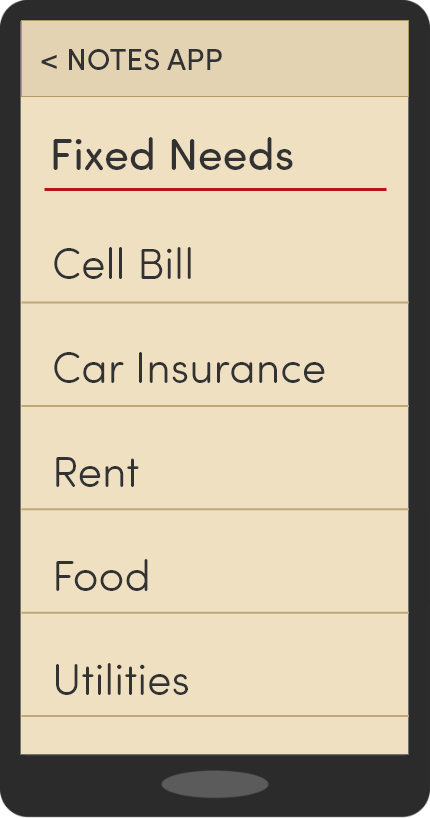

Fixed Expense An expense a business must pay for every month or other fiscal period regardless of how much it outputs. An example of a “fixed expense” would be rent on office space.

Fiscal Policy The economic policy of a government concerned with how government money is spent to fuel economic growth.

FINRA The Financial Industry Regulatory Authority, a professional organization that issues requirements for stock brokers and financial advisors. It is not an official government body but does collaborate with the SEC and other government organizations.

Financing Activities Activities a company undertakes to raise funds to launch a business or fund expansion. This can include taking out loans, issuing bonds, or selling stocks. Related Lessons

Financial Statements The collection of a company’s Income Statement, Cash Flow Statement, and Balance Sheet that is prepared annually and quarterly, and distributed to investors. Related Lessons

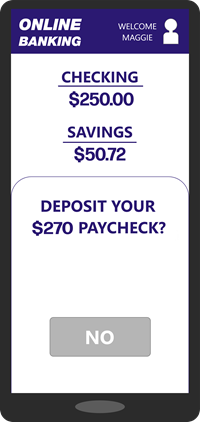

Financial Records Paper or digital records of financial accounts and transactions. This can be as simple as a purchase receipt, or as complicated as insurance policies and bank statements.

Financial Leverage The act of a person or business to take out a loan to purchase additional assets to fuel growth. Using leverage increases risks involved in expansion, but it also unlocks more capital and potential rewards.

Financial Durable Power of Attorney A person who is granted the legal authority to act on another person’s behalf for all financial matters in the case that they are incapacitated but does not have say over medical care. This is typically part of a Living Will.

Financial Advisor A licensed professional who can assist a person with financial planning and investing.

Financial Accounting Standards Board The governing board of accounting standards in the United States, but also recognized globally. FASB sets the rules under which accountants prepare financial statements to ensure a high degree of consistency and ethical standards.

Financial Accounting A type of accounting that focuses on producing financial statements and reports, typically for investors to identify the profit or loss of a business over time.

Finance Charge The cost of using borrowed money. “Finance Charges” can include fees, but typically refers to the interest charge on a loan. Click Here for our lesson on Credit Cards

FIFO The “First In, First Out” method of accounting gains and losses where the cost of the first-purchased assets is considered first when calculating profit or loss when selling.

FICA A federal payroll tax that pays for Social Security and Medicare.

Fiat Currency A type of currency that is not backed by a hard asset like gold. Fiat currencies have value because people in that economy give them value.

FHA Loan A type of loan backed by the Federal Housing Administration, which assumes some of the risk of the borrower defaulting on the loan. FHA loans are a type of subsidized loan. Click Here for our lesson on Mortgages

Feudalism An economic system based on land ownership of large estates by high nobility, which are sub-divided into smaller estates with lower nobility in exchange for loyalty, all the way down to small plots for peasants.

Federal Trade Commission The regulatory body in the United States largely responsible for regulating large businesses to ensure healthy competition is preserved.

Federal Reserve A government institution in the United States charged with managing the country’s money supply and fostering economic growth through management of interest rates.

Federal Income Tax Income tax in the United States that is paid to the federal government. Related Lessons

Family Planning The act of a family planning when and how many children they plan to have, along with how to manage a household’s budget.

Fair Debt Collection Practices Act The Fair Debt Collection Practices Act is a consumer protections measure that helps protect individuals from unfair harassment by their creditors. Click Here for our lesson on Credit Reports

Fair Credit Reporting Act The Fair Credit Reporting Act is a law that provides all consumers with certain rights to their credit report, and it includes restrictions on what businesses can include in the report and how they can use that information.

Extrinsic Incentives Extrinsic incentives are incentives that come from outside – the most common example is price.

Externality A benefit or cost to some economic activity that is not reflected in the price of the transaction. An example would be pollution causing environmental damage or hiring new employees contributing to local economic development.

External Controls A type of risk management concerned with threats from outside the business. This is usually an exercise undertaken by a company’s upper management to assess their strategic position and potential weaknesses.

Export The act of a country selling goods or services it has produced to buyers in another country.

Explicit Rights Rights a person or corporation have that are enshrined in law, written out explicitly what these rights are and how they can be used.

Expiration Date The date at which an order to trade a security would expire. Expiration Dates are used for limit and stop orders to prevent them from remaining open forever.

Experian One of the three major credit rating agencies that issues consumer credit reports.

Expenses A cost that a company or person incurs over a period of time. All cash outflows, other than investments, are considered “expenses”.

Expansion An economic phenomenon when the total economic activity increases over a period of time.

Exit Plan A strategy an investor should create when purchasing a stock or other asset of when the right time is to “sell”. This usually includes a minimum price (to protect against loss) and a maximum price (to lock in gains).

Exercising An Option The act of taking advantage of the rights of an option to either buy or sell a stock at an agreed-upon price, depending on the type of option. Click Here for the Investing101 Chapter on an Introduction to Options (30 min)

Executor Of Estate A person responsible for fulfilling the terms of another person’s will after they die.

Execute The act of an order being sent to the market, a trade being conducted with another investor, and both investor’s accounts being settled afterwards.

Ex-Div Date The effective date for a dividend to be paid. If you hold the stock at the end of the ex-div date, you are entitled to receive the dividend payment even if you sell the stock before the dividend is actually paid.