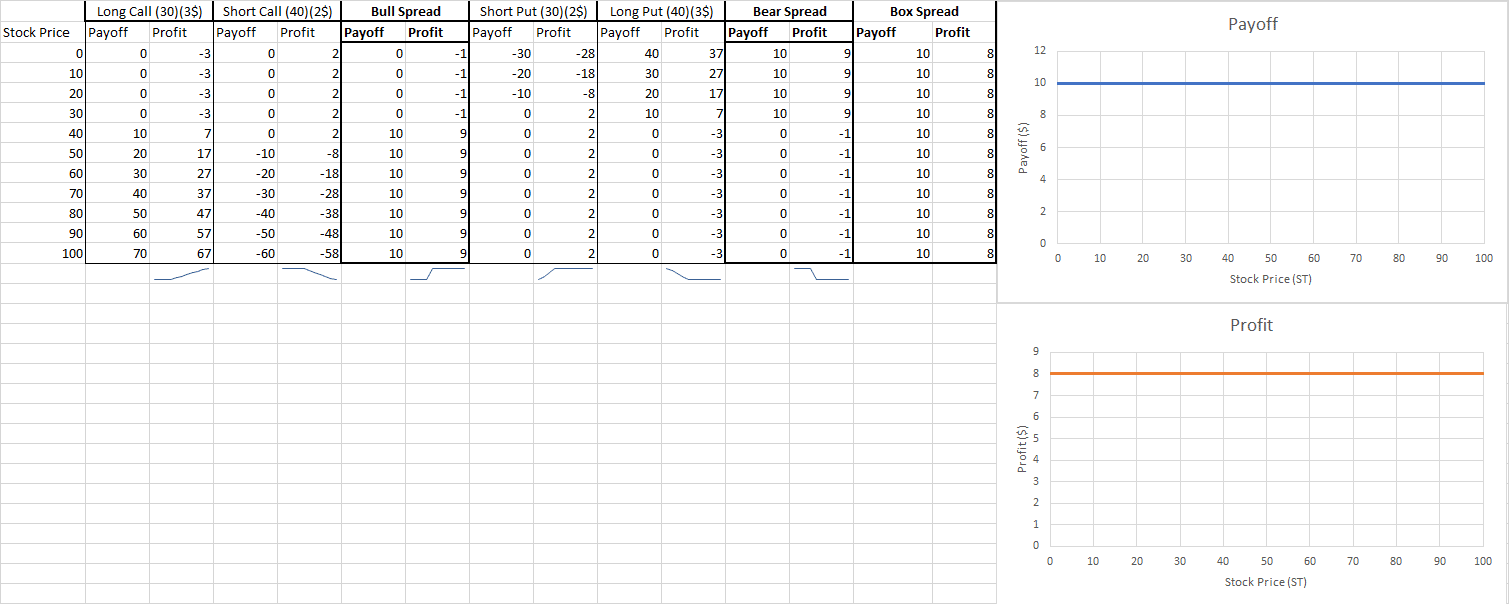

A box spread is an option strategy that is created by combining the components of the bull spread and the bear spread. By creating a box spread, you are creating a neutral riskless position that generates a return like a bond. A box spread can be used to borrow or lend funds.

What are its components?

A box spread has four components:

- Long call at strike price 1

- Short call at strike price 2

- Short put at strike price 1

- Long put at strike price 2

When and why should I have a bear spread?

You should have a box spread if you have a neutral view on the stock’s performance. The box spread will give the trader the ability to lend or borrow cash using a box spread.

What is the payoff and profit graph?

What is the break-even point?

Since the box spread has a payoff and profit structure like a bond, it does not have a break-even point.