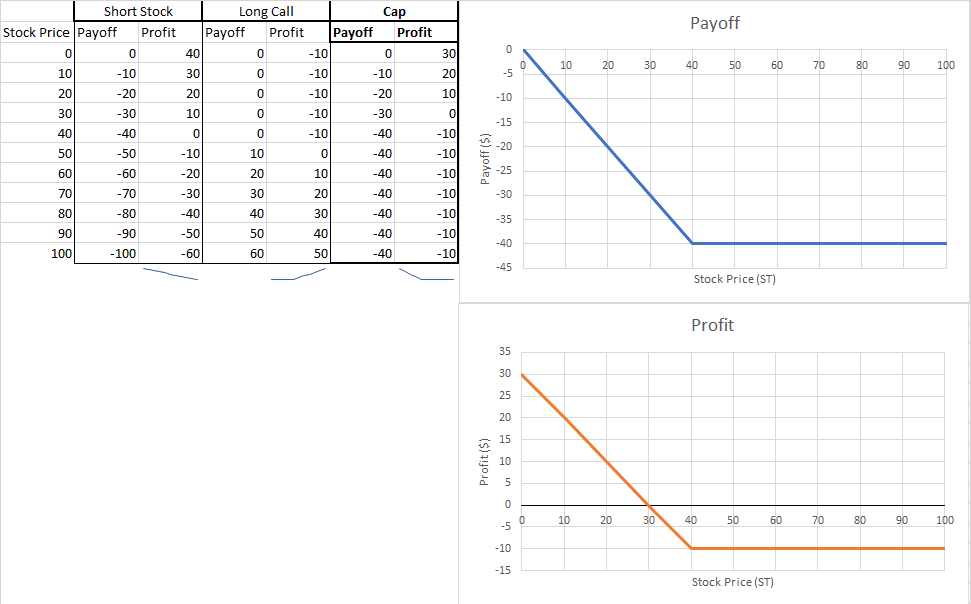

A cap is an options protection strategy where you simultaneously have a short position on a stock and a long call for the same underlying asset. Adding a long call to your open position means that you are obligated to buy your stock at the strike price. However, you already have a short position on the asset, which means this call option will help you close your position on the stock by buying back the shares at a fixed price. You will gain the difference from the short stock and the long call. The combination of those two products creates a payoff that is like a long put. However, the profit is not the same since you spent more on a cap versus a put option.

What are its components?

A cap has two components:

- Short Stock

- Long Call

When and why should I have a cap?

You should have a cap if you are bearish on a stock and wish to have an extra protection in case the price of the stock goes up. By adding a long call to your long position, you are willing to reduce your profit should the stock price decrease to create a ‘cap’, which is the lowest profit you can attain if the price is higher than the strike price.

What is the payoff and profit graph?

What is the break-even point?

The break-even point of a cap can be defined by finding the stock price where the cap generates a zero-dollar profit. By adding the short stock and long call together and equating it to zero, you should solve for ST.