A bear spread is a strategy where you simultaneously sell a put at Strike Price 1, and buy a put at Strike Price 2. Recall that users will pocket the premium should the option not be exercised. By selling a put with a lower strike price, users can reduce their total transaction costs and create a strategy that can generate a fixed income like in a bull spread.

What are its components?

A bear spread has two components:

- Short a put at strike price 1

- Buy a put at strike price 2

- (*A bear spread can also be created with puts)

When and why should I have a bear spread?

You should have a bear spread if you are moderately bearish on a stock and wish to enter a bearish position with protection. By having a long put, you will have a bearish position on a stock and a protection should the stock increase. This position entails that you will pay a premium, where the short option comes in play and reduces your costs. By doing this additional transaction, you are willing to reduce your gains for a lower transaction costs and a steady income stream once the stock performs at a price below strike price 1.

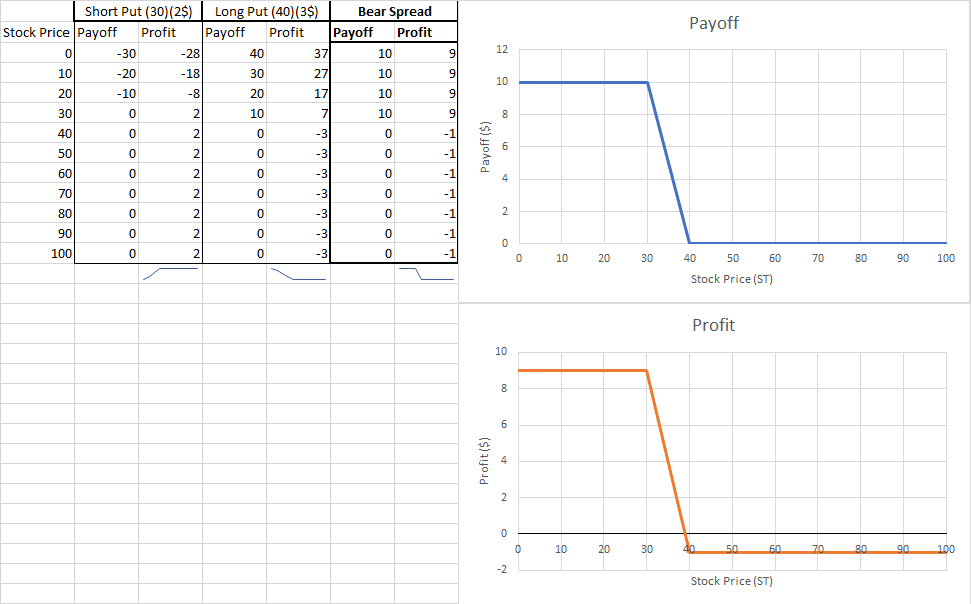

What is the payoff and profit graph?

What is the break-even point?

The break-even point of a bear spread can be defined by finding the stock price where the bear spread generates a zero-dollar profit. By adding both puts together and equating it to zero, you should solve for ST.