Should You Rent or Should You Buy?

For many people, owning a home is the epitome of the American dream. Home ownership has long been a hallmark of financial stability, and the single largest component of many people’s net worth.

But over the last few decades, home ownership has seemed more and more out of reach, especially for young people. Saving up a big down payment, then dragging through a complex and high-pressure house hunting session, a nightmare of a closing process, and hoping that your home goes up in value can be a very stressful experience – not to mention the risk that something breaks in your new home (and you need to pay to have it fixed).

So how can you decide if it makes more sense to rent or buy?

The Fundamental Question – Opportunity Cost

At its simplest, buying a home means you lock in the mortgage payments for a long time, typically 30 years. The mortgage payments will (usually) be smaller than what you would pay to rent the same property – especially since rents go up every year (but mortgage payments are constant). This means over the course of the loan, you should be saving a lot of cash compared to renting. If/when you do choose to sell your home, you also get back the sale price (minus any outstanding loan amount). If property values go up, you will earn a return on your investment.

The flip side to the decision is that if you do NOT intend to live in the property you purchase for the entire length of the loan (or longer), your savings will be limited to only however long you are in your home. Purchasing a home also means needing to put a lot of money into the Down Payment – money you otherwise could be investing in a high-yield savings account or the stock market. Since this money is “locked up” in the home itself, there is no potential return on investment unless you sell your home.

This means whether you choose to rent or buy involves 5 factors:

- How much you have available for a down payment

- How long you intend to live in the home before moving

- How much you expect rent prices to increase over that time

- How much you think property prices will increase over that time

- And what return on investment you expect to earn by saving your investing your money elsewhere.

Down Payment – The First Factor

If you are considering to someday own a home, you almost certainly will buy it using a mortgage. This is a type of secured loan used to buy property. When you apply for a mortgage, one of the first questions you will be asked is how much you can put towards a down payment – cash you have today that you can put towards the purchase of the home.

The math behind a down payment is simple – the more cash you can put down to start with, the smaller your loan will be when you buy – and the smaller your monthly payments. This all sounds well and good – but remember that you COULD be renting an apartment instead of buying a home. This means that instead of putting all of that cash into the home itself, you could instead be investing in stocks or some other asset, earning a return on that investment.

The fundamental question when deciding between renting and buying a home is whether your money would grow faster:

- If you invested the down payment savings elsewhere,

- Or if you saved more money by owning a home (e.g., lower housing costs, potential appreciation).

Growth in savings/investing while renting? Profit from sale of home + money saved by not renting

Cash to Close – Expense to Buy

If you do go through with the purchase, the final “cash to close” on your new home will be the down payment, plus various closing costs (taxes, fees, and a lot of other nickel-and-dimes that can add up to 5% of the home’s purchase price). The amount of your loan will be the home’s purchase price, minus your down payment. Before the “closing” (the day you sign all the paperwork and take legal possession of the property), you will need to give the full “cash to close” to a 3rd party title company, who signs off that you are able to make the transaction and cannot show up with empty pockets at the last second.

Loan Amount = Home Purchase Price – Down Payment

Cash-To-Close = Down Payment + Closing Costs (2-5% of home purchase price)

The closing costs are not trivial. Your down payment is not money you are “spending”, it is just transferred into the equity of your home. If you later sell your home for exactly what you paid for it, you will get your down payment back (minus seller’s closing costs – another 2-5%). If your home has gone up in value (more than the closing costs), you will earn a profit.

But the closing costs themselves are a direct expense that you do not get back. Since there are different closing costs for both buyers and sellers (but both adding up to between 2-5% of the home’s value), if you buy and later sell a home you will have spent between 4% and 10% of the home’s value just in closing costs.

Home Sale Proceeds = Home Sale Price – Outstanding Loan Amount – Selling Closing Costs

Time Living In The Home – The Second Factor

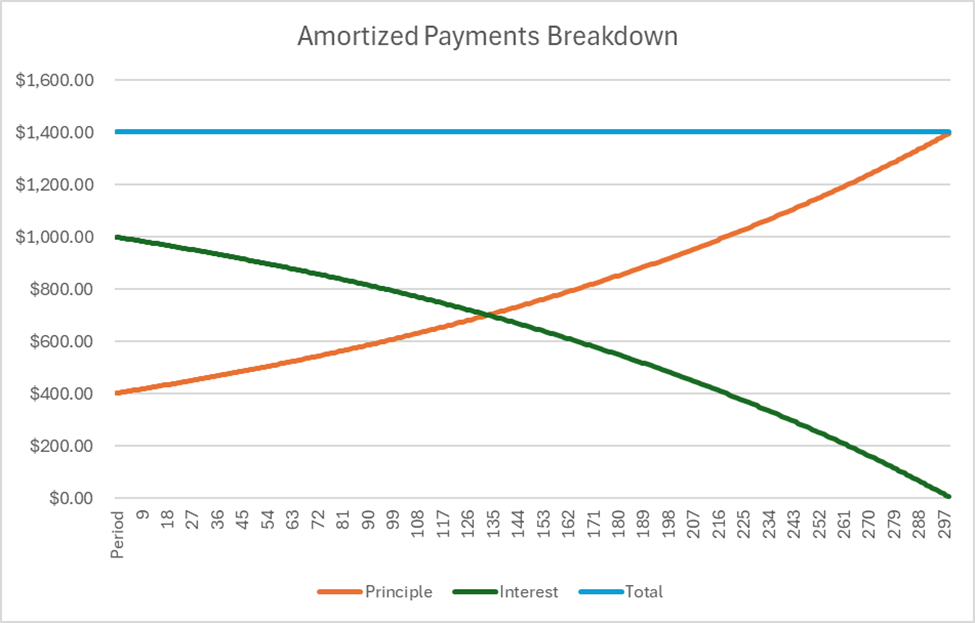

When you make payments towards a mortgage loan, the payments you make each month stay the same but what those payments are applied towards changes. Early in a mortgage loan, most of your monthly payment is just going towards interest, meaning you are not building much equity (or percentage of your original loan that is paid off). The later you are in the mortgage period, the higher percentage of your payment goes towards the principle – building your equity.

Think of it this way – every time you make a mortgage payment, some percentage of the payment goes towards the principle (also known as building equity). You can think of this like a deposit into a bank account – you will get this money back later when you sell your home because this is the amount that is decreasing the outstanding loan amount. The other portion of your payment goes towards interest – which is just money spent.

You can sell your home at any time – but when you do, you will need to pay off any remaining balance of your loan out of the home sale proceeds.

Your take-away cash when selling = Home sale price – Outstanding loan balance – Closing Costs

The longer you stay in the purchased home, the greater the principle you will have paid off, and the more cash you will walk away with when you sell.

“Time living in the home” can be the greatest factor when deciding between renting and buying – if you plan to live in this home for 50 years, buying will almost certainly be cheaper than renting. But if you plan to move within 5 years, the balance might not be so clear.

Rent and Property Prices

Once you have an idea of how long you plan to live in the home, next you can start to estimate how much you expect both rents and property prices to increase between now and the next time you want to move.

This can involve a lot of guesswork, but online research companies frequently publish annual rental and property price increases per city (or state), giving you a great place to start. The change in prices has two factors on your decision:

- If the price of rent is going up fast, you will be less able to save (and invest that savings) over time – making buying a home more attractive (since mortgages have fixed payments)

- If property prices are going up fast, you can expect to earn a bigger profit when you sell your home. This can make owning more attractive than renting too.

Return on Investment

The last key to the rent vs buy decision is how much you expect to earn on your other investments – savings accounts, stock brokerage accounts, and other options of what you could be doing with your money. This is the key to the real trade-off, and why all of the other factors matter.

Putting It All Together

To see whether it makes more financial sense to rent or buy, you will work through the following steps:

Step 1: Gather Information

Find all of the items above:

- Your desired home purchase price, and mortgage interest rate

- How much cash you have for a down payment

- How much it costs to rent an equivalent property

- How long you intend to live in your new home before selling

- How much you expect rents to increase during that time

- How much you think property prices will increase during that time

- And how much you expect to return on any other investment

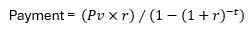

Step 2: Calculate Mortgage Payments + Home Maintenance

Now we start our head-to-head comparison. First step, we need to know how much we are spending each month in mortgage payments. The calculation for your monthly mortgage payment is:

Where:

- PV is the loan amount (Purchase Price + Closing Costs – Down Payment)

- r is the monthly interest rate (annual interest rate / 12)

- t is the total term of the loan, in months (loan term x 12)

We also want to add in the other costs of owning a home to this monthly cost, so we can compare apples-to-apples. This includes:

- Home maintenance costs, or approximately 1.5% (0.125% per month) of the value of the home

- Property tax, or approximately 1% of the home’s value per year

- Homeowner’s insurance, or approximately 0.7% of the home’s value per year

Using a spreadsheet like excel or Google Sheets, this can also be calculated with the PMT function, or this mini-calculator:

Payment Calculator

Result

Step 3: Calculate Your Sale Proceeds

Next, you will need to find the cash you will get from your home when you sell it. This is a two-step calculation.

Finding Equity

First, you will need to calculate what your outstanding loan balance will be. This is a complex formula – so we will need a calculator.

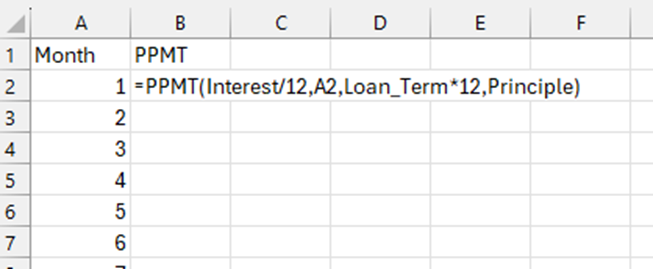

Using Excel, create a column with a number for every month that you will have the loan. For example, if you plan to live in the home for 10 years before selling it, you will create a column with a series of numbers from 1 to 120 (10 years in months).

Next, use the PPMT function for each month, with inputs being the initial loan amount, interest rate, and the current period. For the current period, refer to the specific month number. What the PPMT function will show us is how much of that month’s payment will be applied to the principle of the loan.

Note: this will return a negative result by default. Use -PPMT to get the result as positive numbers.

To get your total equity, add up all of the PPMT for each month before you sell the home, and add in your down payment. This will show your equity that you have built when the home is sold.

Finally, to find our outstanding loan balance, subtract the equity from the original loan amount (not the purchase price).

Outstanding loan balance = Original loan amount – Equity

The calculator below can also be used to get the final equity for any period, given initial loan amounts.

Equity Calculator

Result

Sale Proceeds

The final cash you will get when you sell your home will be:

Sale Proceeds = Home Sale Price – Outstanding Loan Amount – Closing Costs

Where we will calculate the Home Sale Price based on your expected increase in property values by using the Future Value formula:

- FV is the future value of the home

- PV is the original purchase price of the home

- r is the property value growth rate, in months

- n is how many months you will own the home before selling it

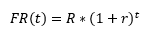

Step 4: Calculate Future Rent

Now that we know how much we are spending each month on our mortgage, we need to do the same thing for rent for the same length of time.

Since you already created an assumption of how much rent will go up each year, we can use this to calculate how much rent you will need to pay each month in the future by using a future value formula (for simplicity, we will assume your rent increase is spread across the full year, instead of all at once). This also uses the Future Value formula:

Where:

- FR(t) is the future rent you will need to pay t months in the future

- R is the rent today

- r is the growth rate you expect rents to increase by, per month (annual increase / 12)

- And t is how many months in the future we are looking at.

If we are calculating with a 10 year loan, you will need to make this calculation for 120 months (12 months x 10 years), so we know exactly how much rent is spent each month in the future. This is made much simpler by using a spreadsheet – ideally right next to the column you used to calculate your principle payments for the hypothetical mortgage.

Step 5: Compare Future Rent vs Mortgage Payment For Every Month

Now that we know all of our monthly payments (plus monthly maintenance), we need to identify which months we will be saving money renting or buying for every month in the future. Subtract each month’s mortgage payment from how much you are spending in each month of rent.

This is telling us that for each month, we can save this extra amount if we buy a home – and invest it.

Step 6: Calculate Future Value of Investments

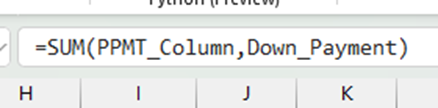

We are almost at the finish line! The last step is to calculate the future value of the investments for each month, then add in the future value of the down payment itself and the home sale proceeds.

Future Value of Investments

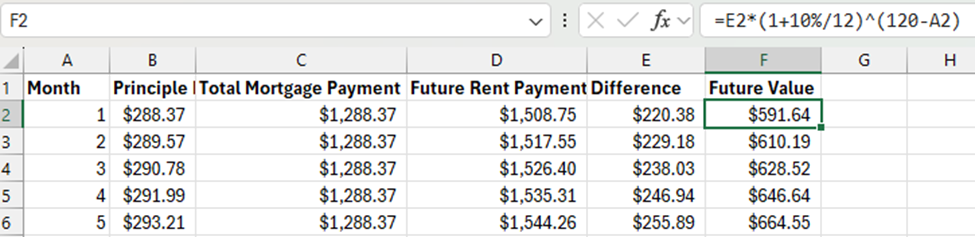

For each month’s difference we calculated above, we now need to calculate its future value at the end of the comparison (when we sell the home).

Where:

- FV is how much this month’s savings will be worth at the end of the loan

- PV is this month’s savings

- r is the interest rate you expect your savings to grow monthly

- n is how many periods there are between this period and the last period.

So if I expect a 10% annual rate of return on my investments, r would be 10%/12 (to convert 10% to a monthly rate). If I am calculating based on moving in 10 years, then n for the 1st month would be 120 – 1 = 119, the second month would be 120-2 = 118, etc.

Future Value of Down Payment

If I chose to rent instead of buy, I would have had my down payment available to invest from day 1. This means I need to calculate the future value of the down payment for the entire time period using the same formula, where:

- PV is the amount I have available as a down payment today

- n is the total months I would be living in the home

Adding It All Up

Now that we calculated all of our future values, the math is simple: add up the future value from every month, plus the Sale Proceeds from when the home is sold. If this is greater than the future value of the down payment (had it been invested), it makes more sense to buy than rent.

Try It!

This calculator will ask the same factors that we covered above, and handle all the future value calculations. Try out some different purchase prices, returns on investment, and time before moving and see when it makes more sense to rent or buy!

Home Purchase To Compare

Home Rental To Compare

Result