3-04 Order Terms

Now that you know some of the basic order terms, you can use Limit, Stop, and Trailing Stop orders to start building your portfolio, keeping an eye out for good deals and protecting yourself against loss.

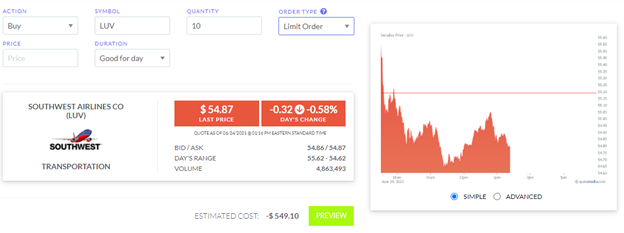

But when you go to actually place your order, there is one more option that pops up – “Duration”.

“Duration” is also called the “Order Term” – how long your order lasts. Any time you use a limit, stop, or trailing stop order, you will also need to decide how long this order lasts. After all, if I try to set a Limit – Buy for Southwest Airlines (LUV) for $1, this order probably will not execute any time soon.

If my order still has not executed at the end of my order term, it will be cancelled by your brokerage. There are three common order terms to keep in mind.

Good-Till-Day

“Good-Till-Day”, or “Good for day” means that if this order does not execute by the end of the trading day, it will automatically cancel. Traders utilizing limit and stop orders while day trading will use this order type so they do not experience the volatility that typically happens as soon as the market opens the next day.

“Good Till Day” order term is also used on all market orders. Just because you used a “Market” order does not mean it will always execute – particularly if you are trading uncommon or penny stocks. If the markets cannot find another person willing to trade with you by the end of the day, your order will be cancelled.

Good-Till-Cancelled

“Good-Till-Cancelled”, or “GTC” orders will stay open for a very long time, even if they do not fill. GTC orders are great to use for stop or trailing stop orders – you can rest easy that you are protected from big losses even without having to constantly “check in” on your investments.

The name “Good Till Cancelled” is a bit misleading though. Most brokerages will still cancel these orders automatically after enough time has passed, typically 90 days. Our system cancels GTC orders after 30 days. If you are using GTC orders, you still should check in on your portfolio and update your orders regularly.

Good-Till-Date

“Good-Till-Date”, or “GTD” orders will let you choose a specific date – if your order has not filled by then, it will automatically cancel. While both “Good Till Day” and “Good Till Date” have the same initials, the “Date” one gets to use “GTD” as its acronym.

An investor would use GTD orders when there is an important event coming up that they want to plan around. For example, let’s say I am interested in Microsoft stock (MSFT). I don’t own it yet, but they have a big announcement coming up in 2 weeks where they might be announcing a new product. If there is really good reception to the announcement, I want to buy the stock before the price goes up too much. I would place a “Stop-Buy” order so that if the price starts going up after the announcement, I will buy it automatically.

But if the announcement doesn’t get a lot of good feedback, I don’t want to keep this order open forever. In this case, I would use a “Good Till Date” order, and set it to execute a day or two after this major product announcement. That way if the announcement causes the price to go up, I buy it. If the announcement flops, my order will cancel automatically.

As a second example, let’s look at this from the other side – now I already own Microsoft stock, and I intend to own it for a long time. But if this product announcement goes well, I think it will cause a bunch of hype, the stock’s price will shoot up high for a couple days, then settle back down. I would prefer to “sell high”, and buy the stock after the excitement wears off. In this case, I would use a “Sell Limit” order, “Good Till Date”, expiring a couple days after the product announcement. Then if there is a price spike, I sell off my shares and keep the profit. But I don’t need to worry about my stock selling 3 months later due to slow and steady growth – I want to keep owning it.