End Of The First Month

We are coming up to the end of the first Month of the game – it is time to take stock on some of your objectives that have come up so far, and some final things to consider before the next month starts!

Did You Hit Your Savings Goal?

At the start of the month, after you reviewed your expected Income and Expenses, we asked you to set a Savings Goal.

Setting – and hitting – your savings goals every month is the most important factor in determining your overall game score (and you should try to set a goal of 10% of your income). You can check your progress towards your savings goal at any time by clicking “Account Summary“, which appears above the die used to progress through the game. Make sure to transfer enough money into your Savings Account to hit your savings goal before the month ends!

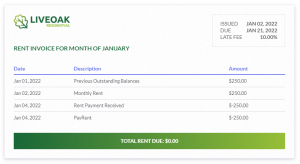

Are All Of Your Bills Paid?

Once you hit your savings goal, make sure you have paid off as many of your outstanding bills as possible. The left side of the page has your list of bills – if any still have a (!) next to the bill name, you still have some amount due.

If you are late paying a bill, you will be charged a late fee, and it will hurt your Credit Score.

Have You Improved Your Credit?

You should always be careful with your credit card. If you use more than 50% of your credit limit, it can start to hurt your credit score. If you carry a balance past the due date, you will also be charged interest.

But there is a flip side too – if you never use your credit card, your Credit Score will never improve. A better credit score will give a higher credit limit, making it easier to stay within your credit limit.

Besides setting – and hitting – your savings goals, improving your Credit Score is the biggest factor in determining your total Game Score!

How is your Quality of Life?

Once you have hit your Savings Goal, your bills are paid, and your credit is looking healthy, you also need to focus on yourself too – just taking the cheapest option and always trying to save every penny is not a winning strategy.

You also earn points through your Quality of Life. You can improve this by Socializing on the weekends, having a nicer apartment/cell phone plan/meal plan/TV plan in your fixed expenses, and when you have spending decisions come up on the events that happen throughout the month.

You also have an Apartment – you’ll be going there for the first time at the end of this month. You can buy furniture, decorations, and other neat stuff to fill your Apartment to improve your Quality of Life as well. Just remember – make sure to hit your savings goals first!