Why Invest in Stocks?

Investing in stocks can be a great way to make your money work for you and build long-term wealth, once you have set up your budget and emergency savings fund. In this lesson, we’ll explore why investing in stocks is a smart financial decision for anyone looking to secure their financial future.

When you have a longer time horizon that you intend to keep your money invested for, like 20 years or more, the stock market historically has provided the greatest return.

A time horizon is a term used in finance and accounting to describe the length of time that an investment is held for. It’s like a timeline that refers to the amount of time you have to save for something like retirement or buying a house.

Most people keep their savings in a savings account at their local bank. Banks usually pay interest on the cash held in your savings account. So, if you have $1,000 in your savings account, and the bank pays you 3% interest, then at the end of the year you’ll have about $1,030.

Once your savings balance gets larger, a lot of people hope to earn more money than what the bank is paying in interest. This is when they’ll invest their money in assets like real estate, stocks, bonds, and/or gold.

Historical Returns of Investments

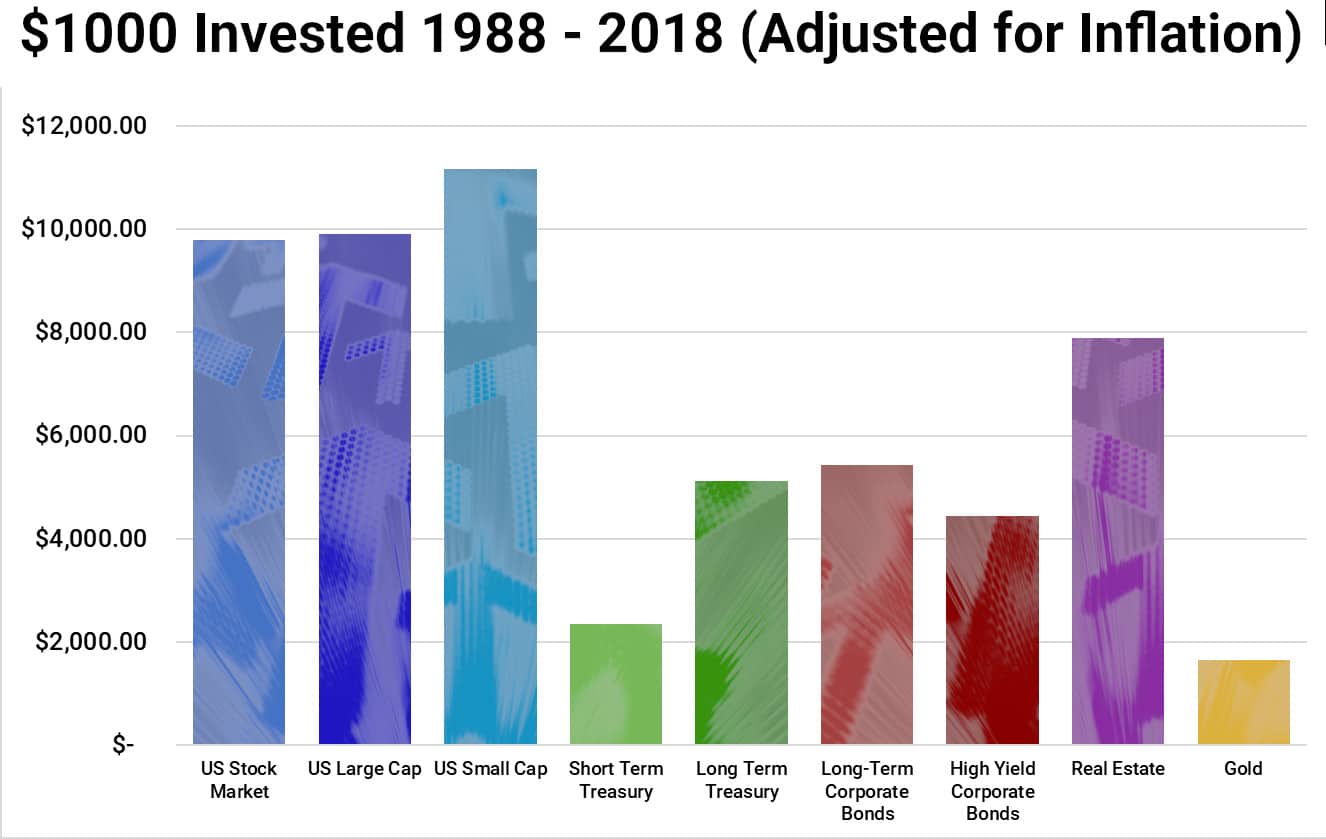

While no one knows for sure what will happen in the future, a look at historical returns shows how these different investments have performed over time.

Here’s a chart of average percentage returns for the 30-year period from 1988 to 2018.

| Investment | Description |

| US Stock Market | The average of all stocks trading in the United States. |

| US Large Cap | The average return of the biggest companies in the United states, (e.g. Apple Inc., Microsoft Corporation, Alphabet Inc. etc.) |

| US Small Cap | The average of start-up companies, these have higher risk than bigger companies, but can also provide bigger rewards. |

| Short-Term Treasury | Short-term government bonds that are issued or guaranteed by the United States, with maturity lengths of 4, 13 or 26 weeks. |

| Long-Term Treasury | US government debt securities with a maturity date of 5 or more years, issued to finance the operations and meet the country’s financial obligations. |

| Long-Term Corporate Bonds | Bonds issued by companies for more than 5 years. The return is lower than stocks, but is also less risky since if the company goes bankrupt, bond holders get paid before stock holders. |

| High Yield Corporate Bonds | Bonds with either a very short duration (usually less than 5 years), or bonds on companies that are considered risky (they have a high chance of going bankrupt). |

| Real Estate | Investing in property and buildings, either to rent out or to re-sell at a higher price. |

| Gold | Buying physical gold (bullion coins, bars, jewelry), gold ETFs, gold mutual funds, gold futures etc. |

From this chart we see that the stock market has performed the best, between a 900% and 1,100% increase, depending on the security types. Gold performed the worst, one major reason being that gold tends to go up in price during years where there is low inflation, and down in years with high inflation.

So what does that mean? Over time there is a huge difference between 10% and 2%. Here is another way to look at it. This chart shows the growth of $100 for the 46 years from 1972 to 2018.

So, would you rather have $401 or $1,612! That’s a big difference for just $100.

For $10,000 the results would be exactly 100x. So, instead of $40,100, you would have $161,200!

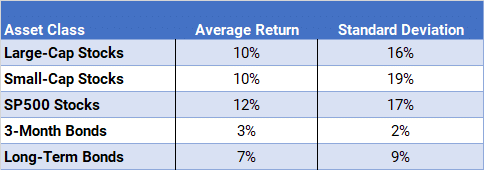

Finally, this chart looks at average returns from 1986 through 2018 and shows that the S&P 500 stocks had the best return, with a 12% average annual return. Performing better than both the large-cap stocks in the Dow Jones Industrial Average, and the small-cap stocks in the Russell 2000 Index.

In this table, please note the Standard Deviation column measures the variance or volatility of the returns. Volatility means how much the stock’s price goes up and down over a short period of time. Long-term investors do not like volatility. Most investors prefer to have their retirement account grow at a slow, but constant rate, rather than have huge spikes followed by huge losses.

It shows that small stocks also have the highest variance. This is why we say that historically stocks have the highest returns. If you looked at just one year or even five years, you might not see the same results because stocks are so volatile. However, the longer the time horizon you have to keep the money invested, the better it is to invest in stocks.

Summary

If you want to maximize your personal net worth, if you want to be rich, if you want to be a millionaire, if you want to retire early, you must start saving and investing today.

The earlier you get started, the more time your money has to grow. And the more time it has to grow, the bigger it will become.

Understanding how the stock market works, and how to invest is so important because it determines how much your net worth will be when you retire. Are you going to leave your cash in your savings account all your life, and earn an average of 3%? Or are you going to invest it in the stock market and try to earn 11%?