Tax Credits & Deductions You Need to Know

When you file your income taxes, you can “write off” certain expenses, and get extra tax credits based on your living situation. This means that if you had a qualifying expense over the course of the year, you basically get to subtract that expense from the income you report to the IRS, which will increase your tax return (or at least lower how much you owe).

Claiming these credits and deductions can be tricky. Many people miss out on them simply by not knowing they exist or how to claim them.

Deductions VS Credits

There are two ways to reduce your tax bill, as a “Deduction” or as a “Tax Credit”.

A “Deduction” means you can subtract this amount from your total taxable income, so it will then lower your taxes owed or increase your refund.

A “Tax Credit” is an amount subtracted from the amount of tax you are owed. There are also two types of Tax Credits:

- Refundable – if you already owe zero tax, claiming a refundable tax credit means you will get a tax return for that amount.

- Non-Refundable – These can reduce your total tax burden to zero, but if it goes lower you won’t get the excess as an extra tax return.

When you pay an income tax directly from your paycheck, your W-2 form will show how much tax has already been paid. By claiming only “Deductions” and “Non-refundable tax credits”, the most you could get back on your tax return is that full amount. If you also can claim “Refundable” tax credits, you could end up getting back a return for more than the total taxes you pay.

Think of it this way, with a Tax Deduction the government is saying “that income doesn’t count, so we will not tax you on it”, while a Tax Credit says “we are going to reduce your tax bill by this amount”. If you have a 20% income tax, this means that a $1,000 tax deduction would lower your tax bill by $200, but a $1000 tax credit would reduce it by a full $1000.

Tax Deductions

Tax Deductions are also called “Write-offs” because you write these off your total income before your tax is calculated. A “tax deduction” is something written into the tax code where the lawmakers said, “What you spent here is the exact kind of stuff we want to encourage. So we’re not going to tax you on it”.

Deductions are usually paired to specific things you spend money on that you need to show proof of (like receipts) in order to receive the deduction. If you have an expense that you think might be tax-deductible, it is extremely important to keep detailed records. This includes receipts, documentation on why the expense was required (like a contract or even a letter from an employer), and these records should be kept in a single place for easy reference (like a folder on your desk for later reference).

These are the most common types of tax deductions:

The Standard Deduction

To make it easier to file taxes, everyone has the option to choose between “Itemized Deductions” or “Standard Deduction”. If you file an “Itemized Deduction”, you need to provide evidence of each item you’re deducting (like receipts and proof it is eligible), which can be very time-consuming for small deductions.

Alternatively, if you don’t think you have very much to deduct, you can just claim the “Standard Deduction”, which is a flat $12,400 per person. If you take the Standard Deduction, you get it without having to provide any evidence of anything. Young people with lower incomes and no dependents generally find that their Standard Deduction is bigger than their itemized deduction, and is much easier to work with.

If you do take the standardized deduction, you can still claim other tax credits, but no other deductions. See the IRS page on the Standard Deduction. For the vast majority of people, taking the “Standard Deduction” is a better deal anyway than an itemized deduction, so you save a lot of time and effort, plus you get a lower tax bill. Everybody wins!

Dependents and Children

We will talk more about child tax credits later, but if you are in high school or just about to start your career, you might still be considered a dependent by your parents. What this means is that you do not get the full “standard deduction”. If you are still a dependent, your standard deduction goes down to just $1,100.

Click here to see the IRS page on Dependents.

Work Related

If you need to spend your own money because of your job, this is also usually tax-deductible. For work-related expenses, the key is that you MUST spend the money as part of your job.

Job Moving Expense

While you cannot write off any costs incurred in a job search, if you need to move between cities when you get a job, you can usually write off part of the moving expense. This is a deduction, subtracted from your taxable income.

Click Here for more information about deducting moving expenses.

Work Equipment

If you need to purchase a uniform or other work-related equipment for your job, you can also write off these expenses. This is a big deal if you are a contractor or self-employed. You may even be able to write off some of your rent, utilities, and other expenses if you work from home.

Click here to learn more about work expense write-offs.

However, it is important that you MUST spend this specific money for your job. For example, if your job requires a standard uniform this would be a tax-deductible expense. If instead you work in an office, and you just need to have “business clothes” to match a company dress code, this would NOT be tax-deductible. The famous band from the 1970’s ABBA is a great example of this – their stage costumes were extremely flashy and flamboyant, which they successfully argued meant that they were solely a business expense, and could deduct the costume cost from their income because they were useless outside of work.

Car Mileage

If you are self-employed and use your personal vehicle for business, you can claim a tax deduction for your mileage. Instead of tracking actual expenses like gas and maintenance, the IRS allows you to use a standard mileage rate. This rate, which changes annually, is designed to cover the cost of gas, insurance, and general “wear and tear” on your vehicle.

- For 2024, the business mileage rate is 67 cents per mile.

- For 2025, the rate is 70 cents per mile.

It is crucial to remember that this deduction is for driving for your business—for example, driving to meet a client or to a job site. You can never deduct the mileage for your daily commute to and from your primary place of work.

Student Loan Interest

You can deduct the interest you pay on student loans, up to a maximum of $2,500 per year. This is an “adjustment to income,” which means you can claim it even if you don’t itemize your deductions.

To qualify, you must be legally obligated to pay the loan and cannot be claimed as a dependent on someone else’s tax return. This deduction is also gradually reduced and eventually eliminated at higher income levels.

If your parents help with your student loan payments (on a loan that’s in your name), you can still claim the interest they paid. You will typically receive a Form 1098-E from your loan servicer showing how much interest you paid during the year.

Click Here for more information about the Student Loan Interest Deduction.

Investment Losses

Your investment portfolio has been doing terribly this year. All of your stop orders were triggered, and you finished the year with a $1000 loss. The silver lining is that this is tax-deductible – and unlike some of the other items on this list, you can write off your investment losses even if you claimed the standard deduction! Do not go overboard with your losses though – you can only write off up to $3000 in losses each year.

Tax Credits

Tax Credits are easier to work with than deductions – you typically just need to prove that you qualify, instead of providing receipts or other documentation. There is also no “standard credit” every person should try to get any tax credits they qualify for because each one comes directly off your tax bill.

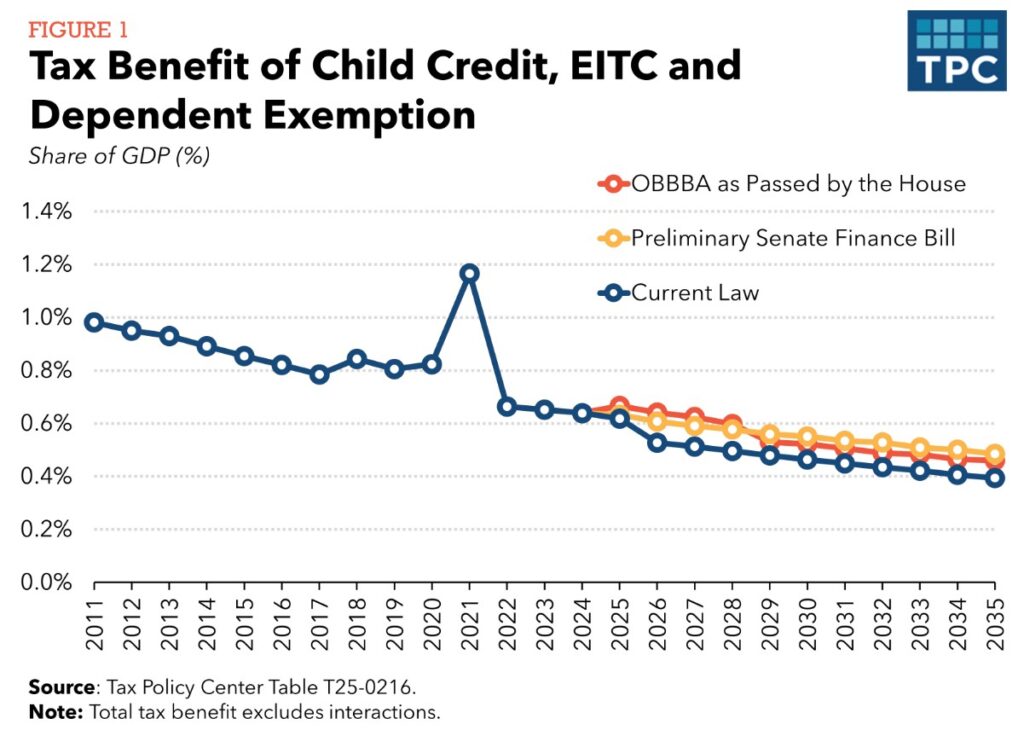

Child Tax Credits

The Child Tax Credit (CTC) helps families with the costs of raising children. To claim a child for this credit, they must generally:

- Be under the age of 17 at the end of the year.

- Be your son, daughter, stepchild, foster child, sibling, or a descendant of one of these.

- Have lived with you for more than half the year.

- Not provide more than half of their own financial support.

Click here to learn more about the Child Tax Credit.

The Child Dependent Care Tax Credit

This credit helps offset the cost of care for a child or dependent that you paid for so that you could work or look for work. It applies to care for:

- A spouse or other dependent who was physically or mentally incapable of self-care.

- A qualifying child who was under age 13.

This is a nonrefundable credit. You can use it to lower your tax bill to zero, but you won’t get any of it back as a refund beyond that. You can count up to $3,000 in care expenses for one qualifying person or up to $6,000 for two or more.

Click Here for the IRS FAQ for the Child Dependent Care Tax Credit.

Earned Income Tax Credit

The Earned Income Tax Credit (EITC or EIC) is a federal tax credit for low- to moderate-income working individuals and families. It is a refundable credit, which means even if you don’t owe any federal income tax, you can get the credit amount back as a refund. The primary goal of the EITC is to reduce poverty for working families.

The EITC is designed to encourage and reward work. To qualify, you must have earned income, which is money you received from a job or from being self-employed. The amount of credit you receive is based on your income and the number of children you claim.

The credit works like a curve.

- Phase-In: As you begin earning income, the credit amount increases with each dollar you earn, up to a certain point.

- Plateau: The credit stays at its maximum amount over a specific range of income.

- Phase-Out: After your income passes a certain threshold, the credit amount begins to decrease until it reaches zero.

This structure is intentional. It incentivizes work for those with very low earnings and provides the largest benefit to those in the “working poor” category. As income rises to a more sustainable level, the credit gradually phases out.

While you do not need to have a qualifying child to claim the EITC, the credit amount increases dramatically if you do. The difference is significant and highlights the program’s focus on supporting families.

To qualify for the Earned Income Tax Credit, you generally must meet these five core requirements:

- You Must Have Earned Income: You need to have income from a job or self-employment.

- Your Income Must Be Below the Limit: Both your earned income and your Adjusted Gross Income (AGI) must be less than the threshold for your filing status and family size (e.g., under $55,768 for a single parent with two children).

- Investment Income Must Be Low: Your investment income for the year must be $11,600 or less.

- You Can’t Be Someone’s Dependent: You cannot be claimed as a dependent or a qualifying child on anyone else’s tax return.

- You Must Meet the “People” Rules:

- If claiming a child: The child must meet specific relationship, age, and residency tests.

- If not claiming a child: You must be between the ages of 25 and 64 and live in the U.S. for more than half the year.

Click Here to see the IRS page for the Earned Income Tax Credit.

Home Ownership

There are also many tax credits available to help offset the cost of renovations you do to your house if those renovations help it become more energy efficient. These credits were put in place to help homeowners upgrade old insulation and windows, reducing the total energy cost to keep the house warm in the winter and cool in the summer. The tax credit is typically for around 10% of the purchase cost, but this can vary year to year.

Bigger energy credits are available if you add green energy equipment to your house, like solar panels or residential wind turbines. These credits are typically for about 30% of the purchase cost.

Click Here for more information about energy efficiency tax credits.

Education

There are several major tax credits if you attend college, or get extra work training. These are in place to encourage people to keep building more valuable work skills.

American Opportunity Tax Credit

The American Opportunity Tax Credit (AOTC) is a valuable tax credit designed to help students and families pay for the first four years of higher education.

The AOTC provides a maximum annual credit of $2,500 per eligible student. It is calculated as:

- 100% of the first $2,000 of qualified education expenses.

- 25% of the next $2,000 of qualified education expenses

This means you need to spend $4,000 on qualified expenses to get the full $2,500 credit. The AOTC is also partially refundable. If the credit reduces your tax liability to zero, you can get 40% of the remaining credit (up to $1,000) back as a refund.

To qualify, the student must:

- Be pursuing a degree or other recognized credential.

- Be enrolled at least half-time for at least one academic period during the tax year.

- Not have completed the first four years of higher education.

- Not have claimed the AOTC for more than four tax years.

- Not have a felony drug conviction at the end of the tax year.

To claim the credit, you generally must receive a Form 1098-T, Tuition Statement, from the school. You will then need to complete Form 8863, Education Credits, and attach it to your tax return. It is important to keep records of all tuition payments and school documentation.

Click Here for the IRS page on the American Opportunity Tax Credit.

Lifetime Learning Tax Credit

The Lifetime Learning Credit (LLC) is another tax credit designed to help pay for higher education. While the American Opportunity Tax Credit (AOTC) is for a student’s first four years of college, the LLC is much more flexible. The LLC can be used for a wider range of education, including:

- Undergraduate and graduate degree programs.

- Professional degree courses.

- Courses taken to acquire or improve job skills.

A key benefit is that there is no limit on the number of years you can claim the LLC.

How the Credit is Calculated

The LLC is worth up to $2,000 per tax return (not per student). The credit is calculated as 20% of the first $10,000 in qualified education expenses.

Unlike the AOTC, the LLC is nonrefundable. This means it can reduce your tax liability to zero, but you will not get any of it back as a refund if you don’t owe any tax.

Key Differences from the AOTC:

- Who it’s for: The LLC can be used for graduate school and individual courses to improve job skills, whereas the AOTC is limited to the first four years of a degree program.

- Duration: The LLC can be claimed for an unlimited number of years.

- Refundable? The LLC is nonrefundable, while the AOTC is partially refundable.

Click Here to learn more about the Lifetime Learning Tax Credit.

Insurance and Investments

There are also many breaks you can get for some insurance and investment costs, designed to help offset these costs for lower-income workers.

Advanced Premium Tax Credit

If you purchased health insurance through the healthcare.gov exchange, you can claim some of your premiums as a tax credit. The actual amount you can claim will vary greatly based on your income and premiums, but the credit is also refundable.

Click Here for the IRS FAQ for the Advanced Premium Tax Credit.

Saver’s Credit

The “Saver’s Credit,” officially called the Retirement Savings Contributions Credit, is a valuable tax credit designed to help low- and moderate-income individuals save for retirement. It’s a nonrefundable credit that essentially gives you a bonus for contributing to a retirement account like an IRA or a 401(k).

The credit is a percentage (50%, 20%, or 10%) of the first $2,000 you contribute to a retirement account ($4,000 for those married filing jointly). This means the maximum credit you can receive is $1,000 for an individual (50% of $2,000) or $2,000 for a married couple (50% of $4,000).

The percentage you get depends on your Adjusted Gross Income (AGI). The lower your income, the higher your credit rate.

Click Here for the IRS information on the Saver’s Credit.