5 Ways to Get Investing Ideas

The most challenging aspect of starting to invest is picking the first few stocks to add to a portfolio. Every investor has their own techniques and strategies, but we want to give you the tools you need to place your first trades and get your portfolio off to a running start.

Establish Goals

Before choosing your first stock, the first step is deciding what your goals are for your portfolio.

Risk and Reward

The biggest choice you will make will be balancing risk and reward – investing all your cash in very risky assets with high growth (or loss) potential, or focusing on companies that you believe can be strong in the long run.

Riskier stocks are ones that have a lot of price movement. This can include biotech companies that are trying to develop a new product, companies that have just IPO’d, or many tech stocks that move up and down depending on today’s news. Less risky stocks include utility companies and old, established businesses with relatively stable revenues over time.

Diversification

Once you consider how risky you are feeling, next decide how you want to diversify your portfolio, which will help you decide how much cash to invest in each symbol. If you are building a portfolio in the stock game, your teacher might have a rule forcing you to diversify with a “position limit,” meaning you can only invest a certain percentage of your cash in any single stock. You can check if your contest has a Position Limit rule on the Account Balances page.

Once you establish the minimum number of securities you need, you can start handpicking stock symbols by using a trading strategy. You can also create a mix of these strategies to get the best of each one.

5 Strategies to Find Your First Stock

Here are five investing strategies you can use to discover new investment ideas.

1. The “Invest in What You Know” Strategy

The best way to start when buying stocks is to buy what you know, not trying to follow stock tips or read a bunch of technical analysis that you cannot follow. Think of it this way: if you already know a company, they have done well enough in the past to already become a household name today. This gives you, as the investor, a big advantage; you can see how that company is doing just by looking at their stores and reading normal business news.

Ask yourself the following questions:

- Have they started to open new stores around me lately, or are they closing some shops?

- Does there seem to always be a lot of people you know using their products, or are they still more obscure?

- Does their current news look positive or negative?

If all three of these are positive, then this might be a good place to invest.

2. The Earnings Report Strategy

An investor can always handpick stocks based on the earnings calendar. To do so, you would have to know your investment time horizons, and flip through the earnings calendar to find gems (i.e. stocks that you can buy and that will soar during its earning season, or stocks that will tank and that can be shorted beforehand).

The Earning Strategy is somewhat of an evolution of the “Invest in what you know” strategy – you will be looking for companies that you believe will have high earnings announcements coming up soon, which can cause their stock price to rise.

Once you have found your stocks, it is very important to analyze them and back up your assumption of how the market will react to their earnings report. Here are some real-world examples:

A Miss: Netflix’s Growth Scare (2018)

For a company like Netflix (NFLX), the most important number in its earnings report is often subscriber growth. In July 2018, the company reported that it had added fewer new subscribers than everyone—including Netflix itself—had predicted. The company was still profitable, but it had missed its key growth target.

The market’s reaction was immediate and harsh. Investors worried that Netflix’s incredible growth was slowing down. As a result, the stock price plunged over 14% in a matter of hours. This is a classic example of how failing to meet expectations, especially on a critical metric, can cause investors to rapidly sell their shares.

A Beat: Apple’s iPhone-Powered Surge (2012)

In July 2012, Apple (AAPL) reported earnings that blew past Wall Street’s predictions. The key driver was a 28% jump in iPhone sales, which was far better than anyone had anticipated.

This positive surprise showed investors that Apple’s most important product was selling even faster than hoped, signaling massive future profits. In response, the stock jumped over 5% in after-hours trading, reaching a new record high. This demonstrates how a company that significantly exceeds expectations can see its stock price rise quickly as investor confidence and optimism builds.

Zoom’s AI-Fueled Pop (2025)

A recent example shows how a strong beat combined with a popular industry trend can excite the market. Zoom (ZM) reported earnings that were 60% higher than what analysts had estimated. The CEO directly credited the success to the company’s new Artificial Intelligence features.

The stock popped 5% following the news. The key here wasn’t just the impressive numbers, but the reason for them. By connecting its success to AI, Zoom gave investors a new, exciting story about its future growth prospects. This shows how a company can use its earnings report to not only share results but also shape a powerful narrative that gets investors excited about what’s next.

3. The Passive Strategy

If you are not sure which specific stock to select, you can always invest in Exchange Traded Funds (ETFs) and market indices. These products are already diversified for you and will track a specific market or theme.

As an example, let’s say you want to invest in a gaming company but don’t know which one in specific. You can invest in an ETF that will track the gaming market for you, like the PureFunds Video Game Tech ETF (GAMR). Based on their website, they have invested in gaming software firms such as Ubisoft, Activision, Konami, etc., which means the stock picking and allocation has already been taken care of by the Fund Managers.

You can find a specific ETF by using the screener at etfdb.com.

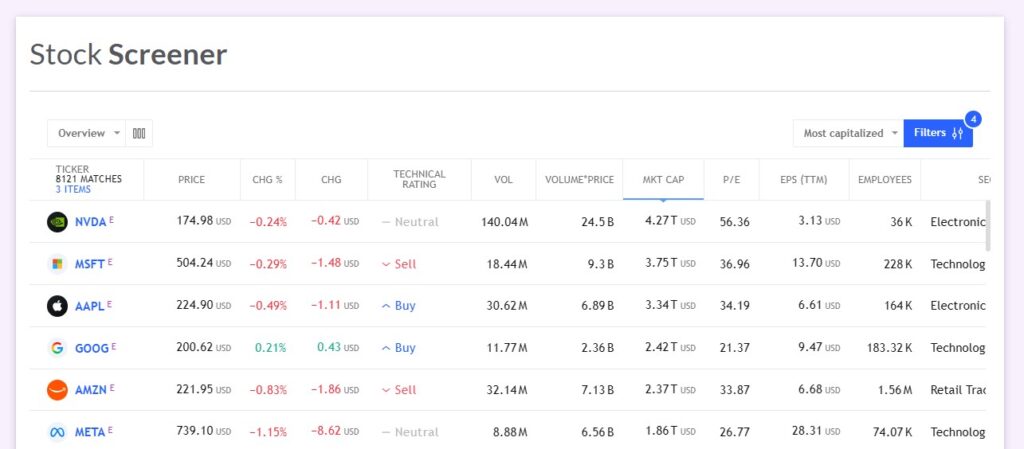

4. The Stock Screeners Strategy

You can also use stock screeners to find good purchases and short sales. A Stock Screener is a program or website that asks you questions about what you are looking for in a stock and returns a list of stocks that match your criteria. You can set filters for things like industry, price, and market capitalization. Once you have a list, you can do extra research on these stocks to determine if they should be added to your portfolio. You can find our stock screener under “Research” on the main menu.

To help you learn how to compare companies in the same industry, check out our interactive activity: How to Research & Compare Stocks.

5. The Market Follower Strategy

Another great way to get ideas is to see what the market is already paying attention to. You can use built-in tools to see which stocks are making big moves and what Wall Street experts think. There are several tools available from the Investing Research tab on the main menu to help you get started.

- Market Movers

The “Market Movers” page is a great place to look for some quick stock picks. These are the stocks that have gone up the most or down the most so far today. You can filter by NYSE, NASDAQ, or other exchanges. If you see a ticker symbol you recognize, look up its quote to see the news on why it is moving – it might be a great opportunity to buy (or short). - Analyst Ratings

If you look up the quote for any company, there is also a tab called “Analyst Ratings.” This will give you information about what professional analysts on Wall Street are saying – along with whether they think it is time to buy, hold, or sell the stock. This gives you a quick snapshot of expert opinion. - Top Performing ETFs

If you do not like picking individual stocks, ETFs might be a better match. Exchange Traded Funds, or ETFs, are “themed” funds – there are ETFs specializing in oil, video game companies, the entire market as a whole, and everything in between. Check the top performing ETFs page to see which types of ETFs are “hot”, and which types to avoid.

Today’s Market Summary

This page is very useful for the start of your research. It presents the day’s market summary. It is useful because it tells you how the overall market is doing today. This can be used as a signal to certain investors to buy more. It is always important to review how the overall market is doing and the market news today. This can help you to capture the perfect timing to buy stocks at their lowest price (or to short sell them at their peak).

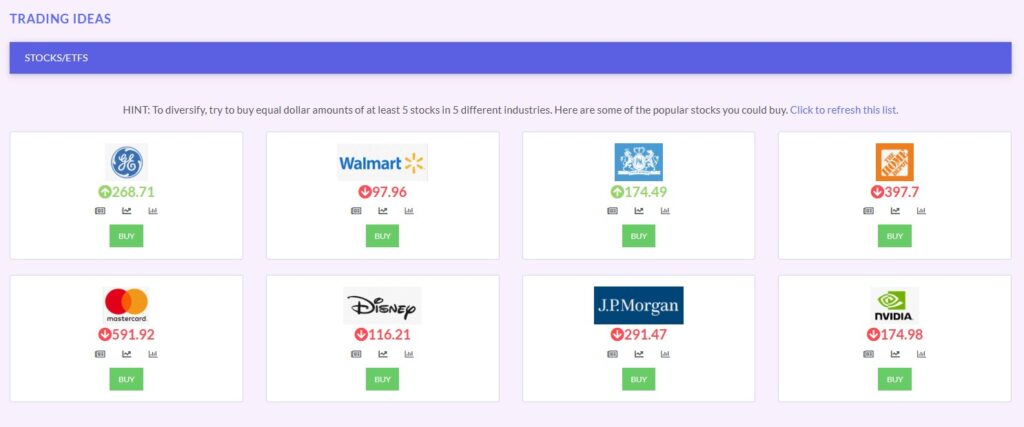

Getting Trading Ideas

We also have a “Trading Ideas” page that has a rotating list of the most popular stocks and mutual funds from other students (along with links to get more information on each!).