The Cash Flow Statement Explained

Businesses keep financial records to know how their company is performing financially. For publicly traded companies, (a business that offers ownership shares (stocks) to the public through organized stock exchanges), these records are also shared with investors. The three main financial statements companies use are income statements, balance sheets, and cash flow statements.

Just like how you manage your own personal finances by keeping track of the money coming in and going out to ensure you can cover all of your expenses, a business must do the same through a cash flow statement. A cash flow statement lets the company’s management see where the money is coming from and how it is being spent, just like you know which bills need to be paid regularly and how much money that will take.

For example, if a company knows it has a big expense coming up, such as replacing old equipment, they can use their cash flow statement to plan ahead and make sure they have enough money set aside to cover the cost. Similarly, you may set aside extra money for things like car repairs or medical expenses that you know may come up in the future. By completing a cash flow statement at least quarterly, a company can show its investors and stakeholders how well they are generating cash to pay their debts and fund their operating expenses.

Why are cash flow statements important?

The Securities and Exchange Commission (SEC) in the US mandates that companies prepare four financial statements, one of which is the cash flow statement. The cash flow statement shows how the cash balance of a company has changed over a specific period of time, rather than just a snapshot of their cash balance at one point in time. The period could be three months, six months or a year depending on the company’s preference. This statement reorders and uses information from the income statement and balance sheet of the company.

The cash flow statement is crucial because it helps to track all the cash movements of a company, where the actual cash comes from and where it is going. It gives insight into how a company utilizes and allocates their cash to manage debts, investments and expenditures. This is why investors, creditors, and management must review the cash flow statement to make sure the business is financially stable.

What are the components of a cash flow statement?

| ABC Inc.

Cash Flow Statement For the year ended December 31, 2999 |

||

| Cash Flow from Operating Activities | ||

| Net Income | $x,xxx,xxx | |

| Depreciation | xx,xxx | |

| Increase in A/R (accounts receivable) | (xx,xxx) | |

| Decrease in A/P (accounts payable) | xx,xxx | |

| Increase in Inventory | (xx,xxx) | |

| Net cash provided by Operating Activities | xxx,xxx | |

| Cash Flow from Investing Activities | ||

| Sale of Equipment, Machinery | xxx,xxx | |

| Purchase of land | (xx,xxx) | |

| Net cash provided by Investing Activities | xxx,xxx | |

| Cash Flow from Financing Activities | ||

| Notes Payable | xx,xxx | |

| New Equity Issued | xxx,xxx | |

| Net cash provided by Financing Activities | xxx,xxx | |

| Net change in cash flow | xxx,xxx | |

| Beginning Cash Balance | xx,xxx | |

| Ending Cash Balance | xxx,xxx | |

Cash flow statements are divided into three main parts. Each part reviews the cash flow from one of three types of activities: (1) operating activities; (2) investing activities; and (3) financing activities.

- Cash flow from operating activities: represents the amount of money a company brought in from its regular business activities. This includes cash generated through manufacturing and selling goods or providing services to customers. It also includes cash paid to suppliers and taxes paid.

- Cash flow from investing activities: reflects transactions that a company makes to invest in resources for growth and production that involve long-term uses of cash. This includes cash paid for the purchase of fixed assets like property, a factory, or equipment. On the other hand, it also includes cash received from selling property or equipment, or as a result of a merger.

- Cash flow from financing activities: focuses on how a company raises capital and how it pays it back to investors and creditors. This includes paying cash dividends, issuing or buying back more stock, and adding or changing loans.

Who is interested in a cash flow statement?

There are three main groups who are interested in a company’s cash flow statement:

- Investors: will review the cash flow statement to understand how well a company’s operations are running and to view their ability to generate cash and meet their obligations.

- Lenders/Creditors: will review the cash flow statement to determine how much cash is available for the company to fund its operation and pay its debts.

- Management: the accountants, the Chief Financial Officer (CFO), the Chief Executive Officer (CEO) are some of the management team who will review the numbers of the cash flow statement to know whether the company is prepared to cover their payroll and other expenses.

Where can I find the cash flow statement for a specific company?

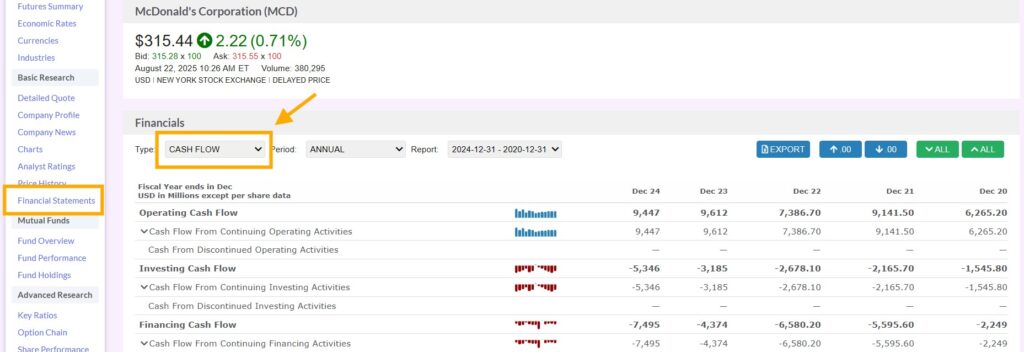

You can find the cash flow statements for any company in the United States by using the Quotes Tool from the investment research menu.