How do I build a diversified portfolio?

Understanding what it means to build a diversified portfolio is one of the first concepts a new investor needs to understand. When talking about investing, diversification means to expose yourself to less risk by investing in different asset classes, industries etc. So if something bad happens to one of your investments, you don’t lose all your money.

One of the main goals of all investors is to beat the market. This concept means that investors want to earn a higher return on their portfolio than the S&P 500. If you achieve a return on your portfolio that is close or higher than the S&P 500, you’re doing really well. This implies that you’re following your trading plan and achieving your financial goals.

Most people lose money when they manage their own portfolio. 9 out of 10 investors will wipe out their portfolio in the first 6 month. They think it’s a game. They don’t know that they’re competing against big players, (banks, hedge funds, etc.). Retail investors lack the necessary money management rules such as position sizing, or stop losses to ensure they minimize their investment risk and maximize profits. At the end of the day, the key is to make consistent profits while enjoying trading.

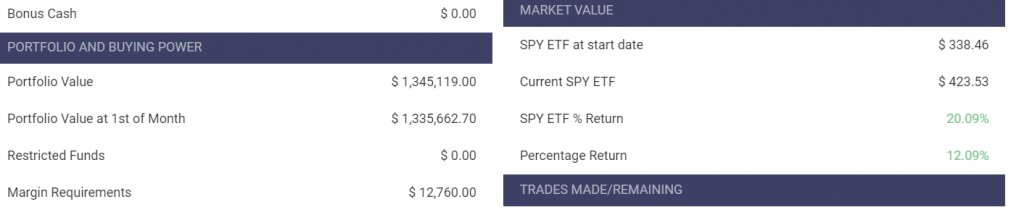

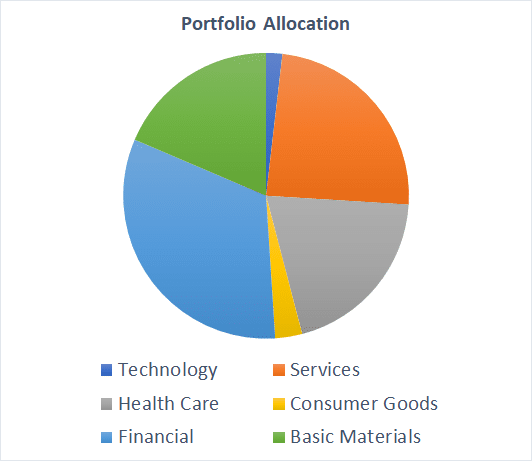

Here is an example of a diversified portfolio that started in September 2020 and up to this date, (June 2021) was yielding a 12% return, while the S&P 500 return was 20%.

What does it mean to diversify?

To diversify means to build a portfolio with a variety of assets classes in different industries or sectors. History shows that at different points in time, different parts of the market outperform the others. Depending on where we’re at in the business cycle, and many other factors, technology stocks will perform better, other times it will be banking stocks, international stocks, defense or medical stocks…

Since no one knows what will happen in the future, the best thing to do is to own a few stocks in each industry so that you always own some of the top performing stocks. This way your portfolio returns are less volatile and hopefully will stay positive over time.

With real money, most advisers would recommend you have about 30 stocks in your portfolio. With your virtual portfolio, you should try to have at least 10 stocks in your portfolio, and they should be from at least 5 different industries.

Why do people diversify?

Investors diversify because it helps to stabilize a portfolio’s return, and the more stocks you own, the more likely you are to own a stock that ends up doubling or tripling in price.

For example, if you own an equal dollar amount of 10 different stocks, and 9 of them stayed at the same price but one of them doubled, your portfolio would be up 10%.

People invest in the stock market because they want to make more money than they would make if they left their money in the bank. Investors especially don’t want to lose money. Capital Preservation is the idea that you want to preserve the money you invested. Investors never want to be in a position where they would have been better off not investing at all. To protect themselves from major price swings in any single stock or industry, investors try to maintain a fully diversified portfolio.

How does it work?

When you diversify your portfolio, you make sure to never have too many eggs in one basket. If one of the stocks you own goes down in price, you limit your exposure by having only a small percentage of your portfolio in that one company.

For beginners, this can mean having no more than 20% of your portfolio in any one stock, ETF, or mutual fund. As you add more money to your portfolio, and it grows in value, you should keep buying different stocks to eventually have less than 10% of your money in any one stock, and less than 20% of your money in any one industry.

For example, if you buy stocks in the banking, energy, healthcare, manufacturing, luxury and IT industries, you would try to spread your money as evenly as possible across each of them. This way, if the energy industry as a whole starts to have problems (for example, if the price of oil falls quickly), you don’t have to worry about your entire portfolio. You limited the losses you are exposed to from a single market shock.

Types of Diversification

There are 2 main types of diversification to think about as you first start investing:

1. Sector/Industry Diversification

To diversify by sector means that you split your investments across companies based on the type of business they do. Energy companies include oil producers, electricity companies, and companies that specialize in transporting materials needed for energy production. Manufacturing companies are firms that build everything from toys to airplanes.

The idea behind sector diversification is that if there is some larger trend that negatively affects an entire industry, you would want to make sure not all of your investments are affected at once. For example, low oil prices could cause a general decline in energy stocks; with some companies still growing, and others hit especially hard.

2. Stock Diversification

This is the basic type of diversification, where you don’t put too much money in any one stock. For example, if you want to put 10% of your money in the banking sector, that doesn’t mean you should put 10% of your money in Bank of America (BAC). You should have a few different bank stocks in case one of your bank stocks is poorly managed and goes bankrupt. Individual stocks are more volatile than sectors, and sectors are more volatile than entire security types, so this is the core of all diversification.

Asset Allocation

Asset allocation means owning a variety of investments like real estate, stocks, bonds, mutual funds, ETFs, gold/silver and cash. Yes, cash is an investment too! For many years, the rule of thumb was to subtract your age from 100, and have that percentage of your overall portfolio value invested in stocks. So, an 18-year-old would invest 82% of their portfolio in stocks.

The idea is that over time stocks have consistently outperformed other investments; therefore the younger you are, the more you should be invested in stocks. As you get older and closer to retirement, you have less time to recover if your investments suddenly plummet in value. At that time in your life, you would prefer the low but consistent returns of bonds or cash. Another way of putting this, is that younger investors are more risk-tolerant and older investors are more risk-adverse.

This concept is a little outdated, especially with the rising popularity of ETFs, the variety of mutual fund options, and the ability to invest in riskier bonds; but the idea of making your portfolio more risk-averse over time can still be a good idea.

Asset allocation is different from diversification. You could have a wide asset allocation with almost no diversification!

For example, if you divided a $10,000 portfolio between 3 asset classes (Stocks, ETFs, and Mutual Funds), you could have the following holdings:

- Stocks – Celgene Corporation (CELG) and UnitedHealth Group (UNH)

- ETF – SPDR S&P Biotech ETF (XBI)

- Mutual Fund – Vanguard Health Care Fund (VGHCX)

You might be divided between 3 asset classes, but the entire portfolio is still concentrated on healthcare and biotechnology, so it’s not diversified at all.

Ways to Stay Diversified

Exchange Traded Funds (ETFs) and mutual funds are good places to start investing because the securities are diversified themselves. ETFs and mutual funds take money from investors and invest that money in a variety of securities that meet the stated objective of that fund.

Depending on the theme or focus of the fund, your money could be invested in large companies, European companies, utilities, or commodities like gold and oil, etc. For example, the ETF FHLC is a collection of healthcare stocks. If you’re looking for an easy way to invest in a particular industry, without having to research which particular companies you want to choose, this is an easy way to achieve that goal.

Warning About Over-Diversification

Diversifying is good, but don’t go too far! If you start diversifying too much, your portfolio will get thin. You might not lose much money if one company starts to go down, but you also won’t gain much if another company you own starts doing very well.

Beginners should build their first portfolio with between 8 to 10 stocks, ETFs, or Mutual Funds at a time. You can always switch the investments you have, but try to avoid having too many, or two few, investments at a time.

Over-diversification can also make it more difficult to manage your investments. If you’re not able to follow up with company news and stay on top of your investments, things could start turning bad, and you’ll start losing money before you even know why!