9-06 Volatility

Volatility is a concept that involves all types of securities. For good reasons, high volatility is most often viewed as a negative in the investment world since rapid movements in market prices inherently involve both wins and losses. In investment language, volatility implies two scary conditions for you uncertainty and risk.

If you are smart (and lucky) enough to buy at a stock’s “bottom,” positive volatility (a rapid price rise) could generate wonderful profits for you. Negative volatility on the other hand, could make you less than pleased as the price of a stock swiftly falls.

Avoid a common misunderstanding that volatility also equals a trend up or down. It does not. Volatility is neither good nor bad, nor does it automatically indicate a trend. It simply measures the speed of price movement.

High Volatility Could Be Good or Bad

A great example of how volatility could have a positive impact for one group and a negative one for another happened when GameStop Corporation (GME) was trading around $40 in 2021. Individual investors on trading forums organized a massive buying frenzy to push out the hedge funds who were betting that the stock would go down. This created a highly volatile buying frenzy in GME which led to a Short Squeeze and the stock surged almost to 1500% in 4 to 5 days. This is visible on the chart where we can see that the stock surged up extremely fast!!

There is of course a flipside to volatility, as we saw in February 2020 when the news about the COVID pandemic stormed the world. The markets took a tumble as all social and economic activity grinded to a halt, and everything was put on hold! Investors took this as an opportunity to buy put options on the VIX Index to hedge and protect their portfolios.

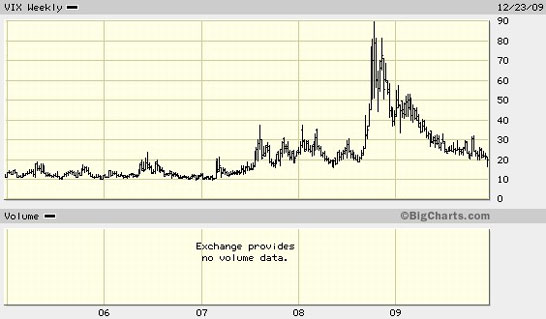

Note: The VIX index is often called the “fear index” because it will rise when the stock market is falling. This reflects the higher premium option writers are demanding when they write put options as investors scramble to buy insurance policies (put options) for their stocks.

Historically, the VIX has been in a range between 10 and 20, but during the rocky stock market swoon in late 2008 and 2009, the VIX was more frequently in the 20- 30 range and even hit a high of 90 in October 2008 when investors feared the world was ending and the financial system was said to be at the brink of collapse.

Look at the chart below to see how the VIX went up as the S&P wen down during COVID time.

As you’ll see, volatility is a key component in pricing options since the option writer has a great deal of interest in the likelihood of a large price swing (up or down) in the underlying security.

The important thing to remember about the VIX is, when it is high, options become expensive to buy as the implied volatility in the options price rises. We’ll look at implied volatility next…