8-08 Short Squeze

In 2021, a group of investors on Reddit made investing history by coordinating together to cause a mania around GameStop (GME) stock. These investors were not necessarily trying to artificially “pump up” the stock’s price, but instead believed that the price was artificially being kept down by big investing firms, and by working together they wanted to bring the stock back up to its “True Price”.

This strategy had been tried before, but only by major investment banks fighting with each other. After the GameStop event, the “Short Squeeze” became something the average investor could participate in.

Institutional Short-Selling

If you remember back in chapter 2, “Short Selling” is when you borrow a stock from your broker, sell it immediately, and buy the stock later to return to your broker. If the stock’s price goes down between when you sell it and when you buy it back, you earn a profit.

We also discussed that with short selling, the maximum profit you can make happens if the company goes completely bankrupt, so it would cost $0 to buy it back. That means you keep the full price you originally sold it for as your profit. On the other hand, if the stock’s price starts going up, your losses could be infinite. The more the price goes up, the bigger your loss.

Short selling is not just used by single investors short selling a few shares in their portfolio. It is also used by many huge investing banks, short selling millions of dollars’ worth of stock at a time. Investment banks will short companies for two reasons:

- They think this stock is in a mania and they want to profit when the price starts to crash, or

- They think the company is no longer viable as a business and has a high chance of going bankrupt

In the case of GameStop, many investment firms were in that second bucket. GameStop was losing market share every year to online game sellers, and many investors doubted their ability to innovate to turn the business around. This meant huge institutional investors were shorting the stock by borrowing shares and selling them.

As we covered in the previous lessons, when there are many more sellers than buyers for a stock, the price gets pushed down due to supply and demand. When many investors are short selling all at once, it becomes its own “mania”. This is where the stock price is artificially low because so many people are short selling it.

What is a “Short Squeeze”?

When a business looks like it is really struggling and may need to close its doors soon, the institutional investors shorting the stock feel confident the company will continue to struggle and see no serious risk to keeping (or increasing) their short positions. However, their losses are still potentially infinite if the stock’s price starts to go up.

In a “Short Squeeze” other investors recognize there is a potential “reverse mania,” as the stock’s price is pushed down due to so many short sellers. These other investors, usually major investment firms, start buying up huge amounts of that stock specifically to force the short-sellers to start losing money. This is the “Squeeze”.

The gamble is that when the short sellers take a big enough loss, they are forced to cover their short by buying back shares of the stock at this higher price. And the only people willing to sell are the investors pulling the “squeeze”.

When the short sellers close their position by buying back all the shares from the squeezers, that “reverse mania” is cancelled out, and the stock’s price settles at the higher price. Both the short sellers and the squeezers move onto other stocks, and this stock’s price is now based just on the value of the company itself, not artificially low due to short selling. However, it is illegal for investment firms to coordinate their actions to manipulate a stock’s price, so “Short Squeezes” are fairly rare. In the past, it would normally be many small investment firms short selling, and one big investment firm pulling the squeeze to force them out.

The Case Of GameStop

In GameStop’s case, many huge investment firms were short-selling the company. They had been losing market share every year to internet based game retailers, and most investors doubted their ability to innovate to turn the business around. Short selling seemed like a pretty good bet.

However, tens of thousands of individual investors decided to work together to “pull the squeeze” on these institutional investors, creating a mania on purpose. Small individual investors are not bound by the same coordination rules as major investment banks, so long as there is no deception involved. It was a major gamble that caused the price to skyrocket, and many institutional investors were forced to cover their shorts.

This made a LOT of money for the squeezers in a very short time, but when they tried to sell their own shares there weren’t enough buyers. The institutional investors came back almost immediately, starting another wave of short-selling, which lost many of the late-comer small investors a small fortune.

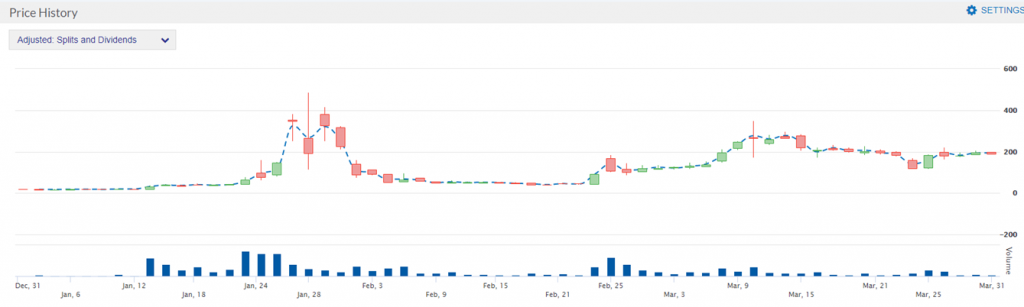

Interestingly, the squeeze was applied a second time, to force out this second wave of short sellers. This caused another price spike, but not to the same degree, before the stock’s price finally started to settle at a higher level.

You can see the chart below for the GME stock price for the 3 months of 2021 below. Note that you can see clearly where the manias began based both on where the price started to move, but also the huge spikes in volume (the blue bars at the bottom of the chart):

As an individual investor participating in a “short squeeze” is EXTREMELY risky, as it relies on a coordinated strategy with tens of thousands of other people, all of which are trying to think of the best time to “take the money and run”.