8-03 Swing Trading

“Day Trading” we talked about in the last lesson is a full-time job, and you have to pay extremely close attention to make money. Most investors interested in profitable short-term trading use “Swing Trading” instead, which is based on price movements over a day, week, or month.

Done on an intra-day basis, swing trading is like day trading on steroids coupled with a safety net. It considers short-term price cycles caused by daily swings in market prices.

Most swing traders, however, are holding stocks for a few days or up to a week. Their idea is that minute-by-minute or hour-by-hour price movements are too random to predict, but when smoothed out over a few days, a better picture emerges of the trends, support and resistance levels:

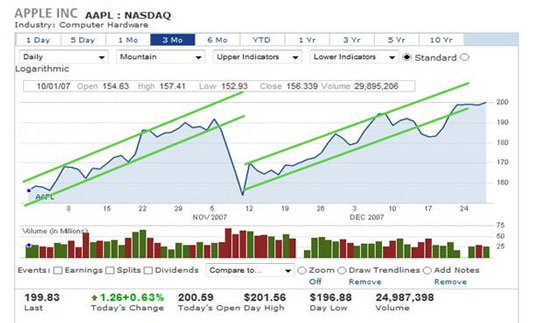

Apple’s (AAPL) share price bounced inside predictable “channels” that made weekly swing trading very profitable in late 2007. Two clear advantages of swing trading are that it doesn’t suffer as much as day trading in terms of commissions paid, and it is OK to step away from your computer for a few hours if you need to.

Most swing trading strategies consider the possibility of a price move in a short (two-to-four-day) period. Popular with individual traders, swing trading is seldom used by large, institutional traders since they typically cannot react quickly enough to make this strategy work in their favor. Smaller investors and individuals, however, can enjoy some excellent profits if their swing trading strategy is sound. Yet, you must understand, that there is substantial risk like there is with day trading.

Swing Trading Assumptions

Swing Trading is another strategy based on market timing, which, (as we discussed way back in chapter 2) is a very risky way to invest. If you spot a stock you think would be a good candidate for a swing trade, it requires a few strong assumptions:

The stock’s price has no real reason to move

Swing Trading is like trying to ride mini manias and crashes to turn a profit, where the stock’s price is going up and down based just on the supply and demand of other investors, not any fundamental change in the company’s value.

This means that if you want to profit from swing trading, you need to have a clear understanding of what this stock’s price SHOULD be. And there should be no reason for it to change from that point. Then if the stock is below that level, you buy it. When it rises above that level, you sell it. Most swing traders accomplish this by setting limit-buy orders at what they expect to be the bottom of the channel, and limit-sell orders near the top.

That way they do not need to sit in front of their computer watching their stocks all day.

The channels are consistent

The chart in the image above looks clear to us now, but it can be much harder to spot these kinds of patterns in the heat of the moment while trading. No news is good news for a swing trader. The last thing you want is some news story to pop-up that makes investors suddenly start paying attention to your stocks, fundamentally changing the tops and bottoms of the channels.

If the channels are not consistent, you will have a very hard time setting your limit orders. Taking on a much bigger risk that the price will drop more than you bargained for, right after you buy it.

I found that the pace is too quick in day trading, and that I couldn’t always place and manage realistic stop loss orders. But with swing trading, since you have a little more time to react and establish a trading plan, you can make better use of limits and stop loss orders to manage your portfolio and reduce risk. Also, with swing trading you can easily manage 5 to 8 simultaneous positions, something you could never do as a day trader.