7-07 Wedges and Flags

A Wedge in the financial universe describes a triangular shape formed by the intersection of two trendlines. They come together to form an apex. The Wedge doesn’t need to be upward facing, it can also be an inverted triangle. The “falling” Wedge is often called a Flag because it looks like a a pointed flag or pennant.

A bearish Wedge consists of two converging trendlines that are slanted upward. Unlike the triangles where the apex is pointed down, the apex of this pattern is slanted upwards at an angle. In this pattern, prices edge steadily higher in a converging pattern. This means there are higher highs and higher lows. A bearish signal occurs when prices break below the lower trendline.

A bullish Flag consists of two converging trend lines that are slanted downward. This is the opposite of the Wedge, (as you may have guessed). In this pattern, the prices are converging as they steadily go down. There will be lower highs and lower lows in this case. A bullish signal occurs when prices break above the upper trendline.

What you are looking out for is a break in the trend. A descending Flag pattern is considered a bullish indicator, because as the prices consolidate on their way down, you’re looking for the point where it will break and prices will go up. While a Wedge is viewed as a bearish predictor. A typical Wedge or Flag lasts longer than one month but less than three months. Longer trends will often create designs other than a Wedge or a Flag.

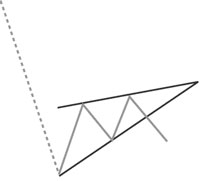

Take a look at this chart that contained a bullish Flag formation that preceded a strong rally:

Pennants are popular with Day Traders because this chart pattern rarely shows up in longer time frames. If you like to trade shorter term, you should be looking at charts closely for pennants and you may start seeing them in your dreams at night because they are so reliable and common.

Flag

A falling wedge in an upward trend as shown in the chart for AAP stock below. You can see lower highs and higher lows in this Flag as the prices consolidate. The new lows are weak, and the sellers do not have the advantage to start a strong downward trend. At the end of the Flag, the price fails to make a new low and starts to rise. Traders are looking for these opportunities so they can implement their breakout strategies as the upward trend continues.

Wedge

A rising wedge in a downward trend is shown in the 30 minute chart below for Gold, (yes you can find wedges in any market!). You can see higher lows and lower highs in this Wedge, as once again we see a consolidation in price moving upward. However, the new highs are weak, and the buyers do not have the advantage to start a strong uptrend. At the end of the Wedge, the price fails to make a new high and descends instead. The longer-term downtrend resumes and traders looking for short trend-trading opportunities use a breakout strategy to enter the trade.