6-07 Balance Sheet

We mentioned earlier in this chapter that a stock’s value is based on two things:

- The future earnings of the company

- The current value of the company

So far on this chapter, we have exclusively discussed the future earnings of the company. Future earnings is generally what dictates if a stock’s price rises or falls. This requires the most attention day-to-day for the average investor, but the Balance Sheet (the other half) represents the current value of the company.

What is a Balance Sheet?

The balance sheet provides an overview of the value of a company at a specific point in time. It includes a summary of the company’s assets, (what they own) liabilities, (what they owe) and the owner’s or shareholder’s equity (the amount of money invested by the owner in the business minus any money taken out by the owner). If the company is privately owned, the term “owner’s equity” will be used. If the company is publicly traded, then the term “shareholder’s equity” will be used. Equity represents the value of the company and is calculated by subtracting liabilities from assets.

The balance sheet is sometimes called the “Statement of Financial Position” because it shows a snapshot of the company’s financial condition at a single point in time. This report uses a simple calculation to determine the financial condition. The calculation is called the accounting equation.

The Accounting Equation

| What we own | What we owe | What we’re worth | ||

| Assets | – | Liabilities | = | Owner’s Equity |

What are the Components of a Balance Sheet?

A standard balance sheet has two sides. The assets are listed on the left side, and the financing is listed on the right. The financing includes liabilities and ownership equity. Assets are listed in order of liquidity. Liquidity means how easy it is to convert the asset into cash. Assets are also broken down into current assets, (any asset expected to be sold or used within the year) and fixed or non-current assets (a company’s long-term investments and assets that are expected to last many years and cannot be easily converted into cash).

Why This Matters To Investors

Owner’s Equity, also known as Shareholder’s Equity, is the current “value” of your stock. If this company closed up shop and sold off all of their assets tomorrow, the Owner’s Equity would be divided by the total number of outstanding shares and paid out to all the shareholders.

In other words, a stock’s “base” value is based completely on what investors THINK the “Owner’s Equity” will be in the future.

Negative Shareholder’s Equity

If a company has more liabilities than assets, it means that there is negative Shareholder Equity. This usually has investors worried, because it means their investment is based only on the expected future earnings.

The company itself is probably borrowing a lot of money to invest in future upgrades to make themselves more competitive, and so the stock’s price is based on whether investors think the gamble will pay off. For example, the ridesharing company Uber (ticker UBER) showed negative shareholder’s equity for the first two years they were trading on the stock market, as they were investing every penny on expanding their market share. Investors were not buying UBER stock because of the current company’s financial position, but because they expected the company to be worth a LOT more in the future. By 2019, this investment started paying off, and they had a positive Shareholder Equity.

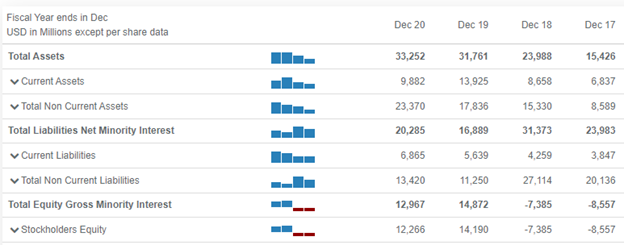

Uber’s Balance Sheet – annually from 2017 through 2020:

This is a “short” balance sheet – the full version breaks out every category into dozens of line-items to give investors a complete picture of where the value is.

Bankruptcy

If the company finds that they can no longer borrow enough money to meet their expenses, it means they will face bankruptcy. As an investor, a bankrupt company means your stock becomes worthless. Generally speaking, a publicly traded company will do everything it can to avoid total bankruptcy. Usually they try to find another company to buy them out (at a price favorable to their shareholders) before the financial situation gets desperate.