4-06 Stock Screeners

Now we have covered some of the concepts that fit into planning your portfolio, heard from some of the experts, and covered how to Buy What You Know.

Now we need to focus on polishing off your first portfolio. After you’ve made your plan and got your eye on a few stocks, you will still probably have some gaps that need to be filled. Maybe you want to find a dividend-bearing utilities stock and are not sure if your local electric company is the best option. Or maybe you want to invest in biotech, but you aren’t sure where to even start.

This is where Stock Screeners come in. Stock Screeners are tools that draw off a massive database of stocks, and give you filters to narrow it down just to companies that fit your criteria, giving you a “short list” of stocks to compare. Using stock screeners is important to every investor in order to make sure they have a healthy, diversified, balanced portfolio that meets their original investing goals.

You can find a stock screener under the “Research” tools on the main menu of your virtual portfolio, but we will also embed it here to give some examples of how we can use it to find stocks.

Using A Stock Screener

Stock Screeners have a wide range of filters to use, and this can be overwhelming at first. We will cover what many of these settings do later on in the course when we talk about Fundamental and Technical Analysis, but for now we just want to finish building our first portfolio.

In the introduction to his chapter, we talked about some investors looking for different stocks:

- An index fund ETF

- A biotech stock with high growth

- A utilities stock that pays a dividend

We can use a stock screener to get a short list of potential stocks to invest in. Here is what we would do for each:

Finding an Index Fund

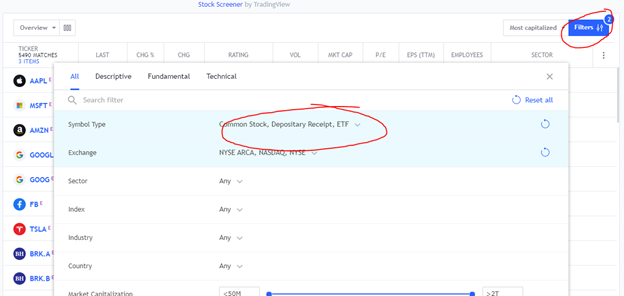

First, go to “Filters” in the top left. We are only interested in ETFs right now, so change the “Symbol Type” to include “ETF”, “ETN”, and “Closed-Ended Funds” (all of which broadly cover what we considered an “ETF” in Chapter 1).

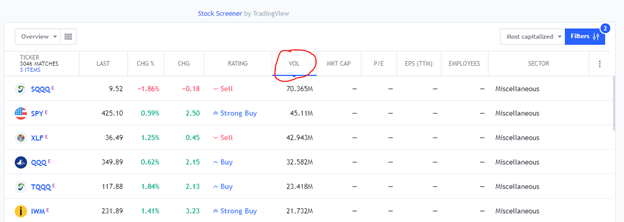

Next, we only want to focus on the most popular ETFs, since we want something with very broad appeal for our first purchase. To do this, we want to sort our screener by “Volume”, meaning the total number of shares this ETF has traded today:

We now have a short-list of the most popular ETFs to consider. You can click the symbol for each one to get more information to consider your research.

This stock screener also includes analyst ratings to help your search. Of the ETFs listed, the two high-volume, highly-recommended ones are SPY and IWM, both of which are ETFs that track the S&P 500 index – great choices if I wanted to invest in an index fund.

Finding A Biotech Stock

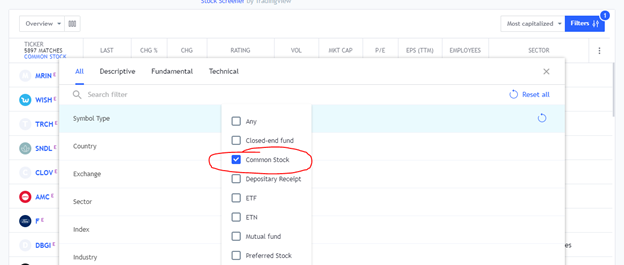

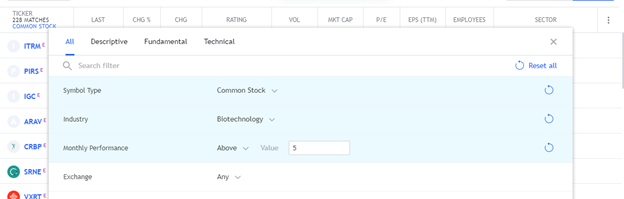

Next, I wanted to find a stock in the biotechnology sector, but I want to make sure it has a lot of growth potential. To do this, first I reset my filters, and then specify the “Symbol Type” should be a common stock:

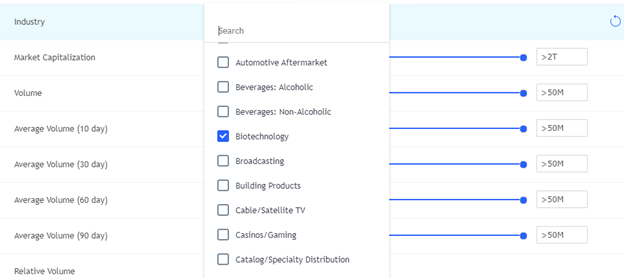

Next, you can see that I also have the option to filter by “Sector” and “Industry”. Sectors are less specific (there are about a dozen “Sectors” in a given stock screener), while Industries are more specific (usually over 50 different industries).

Biotechnology is fairly specific, so I will look in the Industry section:

Finally, I want only stocks that have had more than 5% growth in the last month. If I go a bit lower, this screener has the option to filter “Monthly Performance”, meaning percentage price change in the last month. I will say “Above 5%”:

Notice that there are many price filters, including down to the minute, so it might take a some practice to get it right.

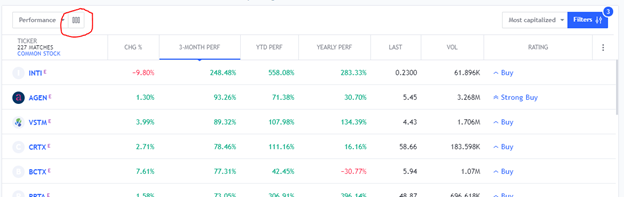

Now I have a list of biotech stocks that fit my criteria. However, I want to see their performance for the last year before I decide which one to buy. To do this, I can change what columns are showing in the screener:

This screener has some pre-sets, but I know what I want to see:

- Today’s price change

- 3 month and 1 year price change

- Stock’s current price (called “Last”)

- Today’s trading volume

- And the analyst ratings

This time, I sorted by 3-month performance to see who has done the best over the last quarter, and I see many attractive investing options, all of which have an analyst rating of “Buy” or “Strong Buy”.

I might not be ready to decide on which stock to purchase yet, but we’ve gone down from hundreds, if not thousands, of options down to a short list that I can start to research in detail.

A Utilities Stock with a Dividend

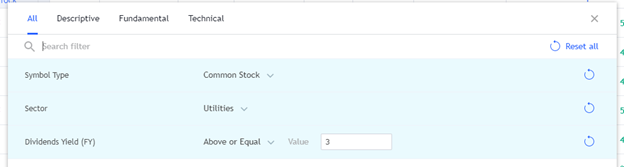

Last, I want to find a solid utilities stock with a strong dividend.

To do this, I am going to clear out my filters again. While I still only want common stocks, this time I will choose the “Utilities” – which is under “Sectors” (since it is a far broader category).

Last, I am concerned with earning at least a 5% dividend. To find this, I will look for the “Dividend Yield” filter and set that I want at least 5%.

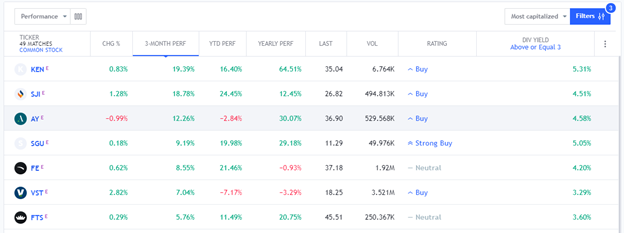

Finally, I add one more column so I can see the dividend yield along with the change in the stock’s price over time:

These stocks have a much lower return than the biotech stocks – but that is not a bad thing (I wanted this stock for a less-risky dividend return, not as a growth stock).

I have several good options with “Buy” or “Strong Buy” ratings. With utilities, I would again focus on Buy what you Know, and look for companies I have heard of before jumping off and looking for anything.

Now that we know how to use a basic stock screener, you can fill up the rest of your first portfolio until you are fully invested!

The rest of the course will focus on how to conduct more in-depth research on each investment, but now we are starting from a strong foundation.