10-05 Develop an Investing Strategy That Feels Right for You

Throughout this course, we talked a lot about setting goals for yourself, the importance of diversification, and some concepts like “Swing Trading” and “Buy and Hold”. From this point forward, you need to build your own investing strategy – an approach to investing that is unique to you.

Where to Start

The first step takes us all the way back to chapter 3 – setting goals and targets. Start by asking yourself “What exactly do I want to do?” This will determine how you build your portfolio, and how you treat your investments. Understanding your future plans will inform your investing strategies so you can achieve them.

This does not mean you need one goal with everything falling into one bucket. It is very common for investors to maintain multiple portfolios, each with their own goal. An example of this would be a dedicated retirement account that utilizes a pure “Buy and Hold” strategy of index ETFs, plus a separate “Growth” portfolio for mid-term goals (like saving up for a house, or just putting your savings to work). If you plan on day trading or swing trading, this should also be in a completely separate portfolio from your other investments, if for no other reason than it makes filing your taxes much simpler.

You can also have different strategies within the same portfolio, which is an essential component of diversification. For example, you might move most of your savings into a “Growth” portfolio, where the overall goal is to beat the S&P 500 index. However, even inside this portfolio, you might want to allocate $1000 or more to low-risk dividend stocks to act as your “Emergency Fund”.

Start With Sectors

First, start with where you want to invest, before picking single stocks. By comparing the sectors as a whole, you can get a better feel of the balance of “Risk vs Reward”.

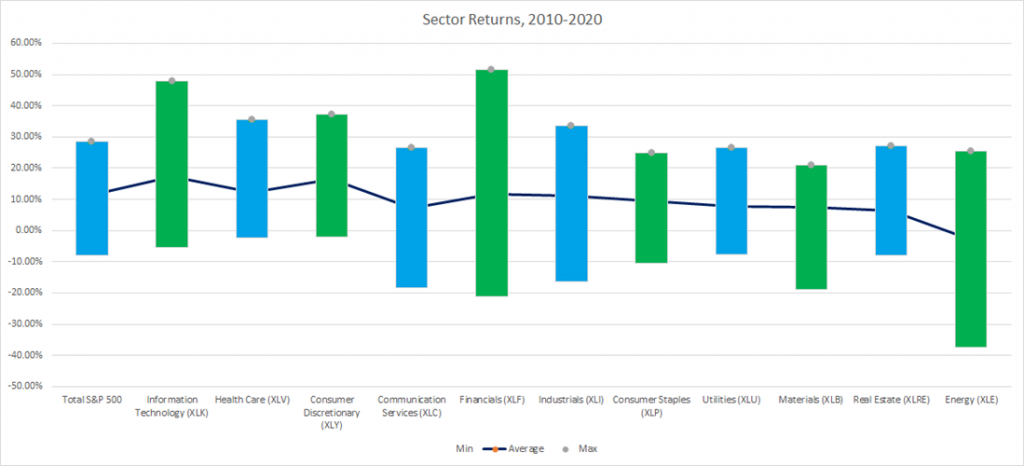

The chart below shows the annual returns of the different sectors in the S&P 500 from 2010 through 2020. The bars represent the spread between their lowest annual return and highest, with the line showing their average. The axis labels have both the sector name, and the most popular ETF.

Using this chart as a reference, you can get a feel of the risk and reward associated with each sector. Note that this is based on their historical returns – it does NOT mean that this trend will continue forever.

Here are some ways to think about where to start with your investing strategy:

Capital Preservation

A “Capital Preservation” portfolio wants a gain, but REALLY does not want a loss. This would be your “Emergency Fund”, or if you were about to retire, where you would put most of your stock assets, (in addition to bonds or other low-risk assets you have invested in).

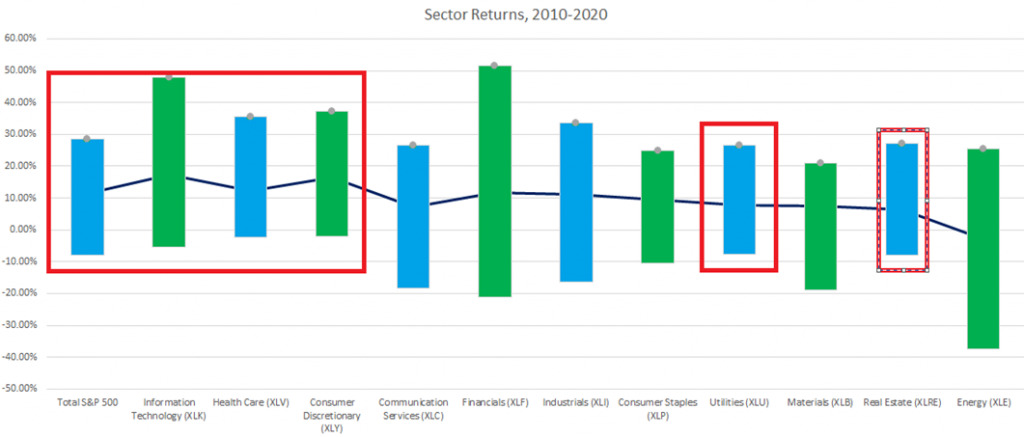

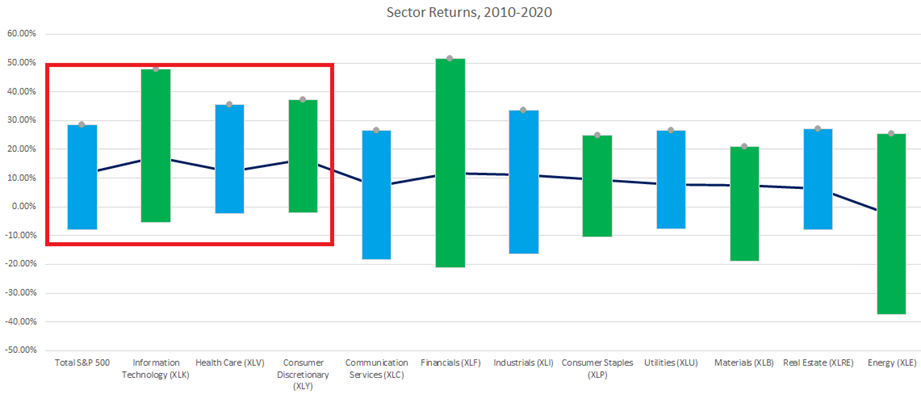

In a “Capital Preservation” portfolio, you would focus first on the bottoms of the bar charts. It looks like “Information Technology”, “Health Care”, “Consumer Discretionary”, “Utilities”, and “Real Estate” are good places to start looking, or just the S&P 500 as a whole:

From here, the next focus would be the highest average returns. “Information Technology”, “Consumer discretionary”, “Health Care”, and the S&P 500 as a whole all performed better than 10%, so this would be where we want to dig deeper.

The good news is that a capital preservation portfolio involves mostly ETFs and mutual funds, (occasionally dividend-yielding, low-growth stocks like utilities) with more of an emphasis on “Buy and Hold”.

Finally, a conservative portfolio is not looking for big gains, and really does not like big swings up and down. Even though Information Technology has the highest average and the biggest maximum, we might want to rule this out because the total difference between the minimum and maximum is so big. For this portfolio, we want to avoid big swings.

Because this “Capital Preservation” portfolio is not seeking the highest returns, we are not overly concerned with the maximums. If we wanted to make our lives easy, we could just buy these ETFs, which include a diversified basket of stocks within these sectors, or we could continue to do more research on the industries or specific companies inside each sector.

High Growth

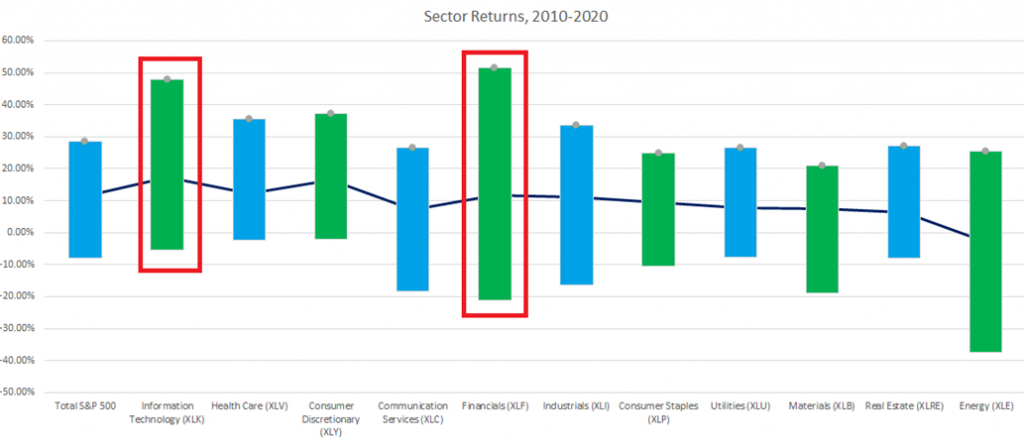

A “High Growth” portfolio is all about maximizing returns, with the goal of beating the S&P 500. If we want to beat the S&P, our first place to look are the sectors that have the highest maximums. In this case, our first place to look would be Information Technology and Financials, both of which had peaks over 40%.

Unlike our conservative portfolio, high-growth really needs to dig deeper, and cannot get away with buying a sector ETF and calling it a day. After identifying a sector you are interested in, you would want to dive deeper and look at an Industry ETF (an “Industry” being a subset of a sector), and repeat to find where to focus the rest of your research.

However, to get the best growth, you will need to dig down to the individual stocks and companies. Chasing gains means more active trading, and regularly updating your limit/stop orders. While you do not need to do swing trading or day trading, you should be monitoring your stocks at least on a weekly basis.

“Fun Money”

The “Fun Money” portfolio should be no more than 10-20% of your total investments, but it is where you will learn the most. “Fun Money” means that you can chase gains and try out different strategies, usually with a strong emphasis on utilizing a “Buy What You Know” investing strategy.

For a “Fun Money” portfolio, you would usually avoid ETFs, and really focus on specific stocks of companies you want to be part of. You would choose companies that either you think are poised for explosive growth based on a gut feeling (rather than your detailed research), or even companies that you believe might not necessarily be profitable, but you believe in their mission and want to be an investor.

Your “Fun Money” portfolio is one you should check on a daily basis, and not feel bad about buying and selling regularly. While turning a profit is always a primary goal, utilizing your “Fun Money” is the best way to get engaged with investing news, identify new companies, and get true experience with price movements, trading, and investing on your own.

Making It Your Own

The examples above are just a few cases of how you can start to approach building your portfolio (or portfolios) – no two investors have the exact same goals, and there is no guaranteed path to success. However, by keeping in mind the fundamentals from this course, and making sure to keep practicing, you will find a balance of investing strategies that is right for you!