8-10 ESG Investing

ESG Investing means investing not only on the fundamental and technical aspects of a stock, but also the social and environmental impacts of how the business is run. “ESG” means “Environmental, Social, and Corporate Governance” – a measure of sustainability and social impact of a business.

What is ESG Investing?

ESG Investing is the concept that investors should be doing more than just chasing returns on their portfolios, and should instead be “voting with their wallets” and investing in companies that are both profitable and working to improve the world. ESG Investing is becoming a major factor both for individual and institutional investors. Attracting ESG investors is a major goal for most large companies, and you can start to see ESG concepts already dominating business news.

In addition to the specifics we covered in our chapter on Fundamental Analysis, an ESG investor considers:

Environmental Impact

This comes down to pollution and climate change. An environmental score would rate oil and mining companies poorly, whereas companies focused on renewables and sustainability are rated highly. When comparing companies in the same industry, this metric focuses on “who is doing more to be sustainable”.

For a concrete example, Amazon’s 2-day shipping promise caused its ESG score to drop, because it meant more delivery trucks on the road with less efficient routes, leading to higher consumption of fossil fuels. On the other hand, when they promised to switch all of their warehouses to use 100% renewable electricity, it caused their environmental score to improve. This is a constant balancing act for big companies, and ESG investing pushes to make “environmentally sustainable” investments that might not otherwise be profitable.

Social Impact

Social Impact measures what the company is doing in the communities where they do business. Companies with a good “social” score would be engaged with supporting community development, speaking out in favor of social justice, focusing on diversity and equality inside the company, and will show a concern for human rights, particularly when doing business overseas.

The “Social” impact is actually the oldest aspect of ESG investing. Most finance professionals trace “Socially Responsible” investing to General Motors in South Africa in the 1970’s. During this time, South Africa was in what is known as “Apartheid”, an extreme form of segregation based on white supremacy that was condemned around the world. General Motors board member Leon Sullivan created a document called “Sullivan’s Principles” to guide how GM would do business with South Africa, leading GM to pull resources out of the country to put pressure on the government for social improvement and an end to Apartheid.

This concept spread to other companies doing business in South Africa as well that had support from GM’s investors. This was the first time that a company sacrificed profit opportunities for a social good in a formal and organized fashion. The success was felt in both a short-term stock price increase and long-term corporate profits for GM, and solidified “Socially Responsible Corporate Governance” as a major consideration in operations for all companies.

Corporate Governance

Corporate Governance refers almost exclusively to the upper management of the company. Is the upper management diverse, and how does the CEO’s pay compare to the average employee?

Companies with high Corporate Governance focus:

- On having a clear separation between the Board of Directors and the CEO of the company (so the CEO is not their own boss)

- How responsive the Board of Directors are to shareholders, (how often matters are put up to a vote to shareholders, or if everything is just decided by the board), and

- On the shareholders themselves, (do the largest investors in the company emphasize ESG principles, or do they just pressure the company to maximize profits and returns?)

ESG Investing Returns

The original concept for ESG investing was that investors would be willing to sacrifice some profits in exchange for sleeping better at night, knowing they are invested in companies “doing good”. However, one of the major reasons that ESG investing has started to really take off in the last few years is that it does not seem to be much of a sacrifice at all.

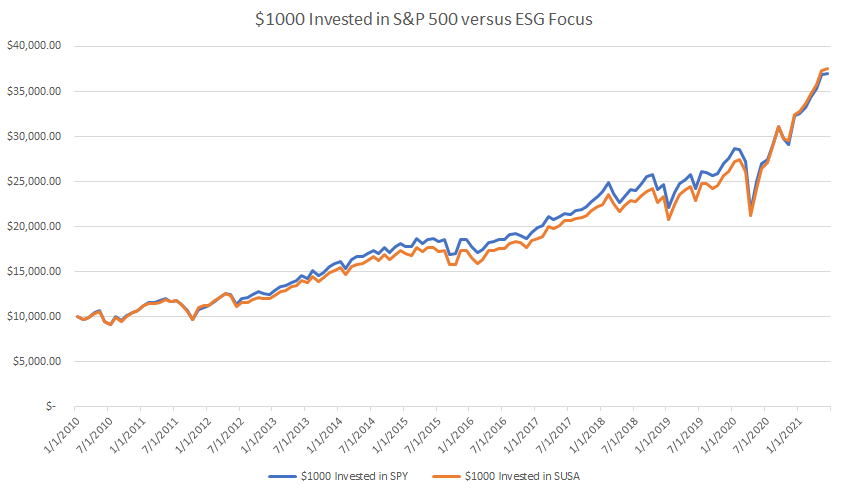

Here is a return comparison of iShare’s MSCI USA ESG Select ETF (the oldest ETF that focuses explicitly on ESG investing), against the S&P 500. The ESG ETF’s ticker symbol is SUSA, while the S&P 500 is tracked with SPY, the most popular S&P 500 ETF.

If you had invested $10,000 in January 2010, the returns of the market versus ESG-focused stocks was very tight. By June 2021, the ESG-focused ETF had a higher total return of $37,500, with the S&P 500 having grown to $37,030. Investors are starting to see that they can “have their cake and eat it too,” and can feel good about their investments while having great returns.

How To Base Your Investing Strategy In ESG

If you want to include ESG factors in your portfolio, your first problem would be how to actually calculate ESG. Unlike the other factors that we use in fundamental analysis, like PE ratios and cash flow statements, ESG is not reported by companies themselves, and they are not included as part of most standard research tools.

However, there are several agencies that release ESG ratings for most larger companies trading on major stock exchanges. Many of these ratings are hard for an individual investor to access, based on proprietary research that the agencies sell to large institutional investors. Luckily for you, currently the most widely-cited ESG ratings come from MSCI, which has a lookup tool on their website that individual investors can use for free.

This is not as easy to use as a basic stock screener, but this is one extra bit of information to include in your trading decisions.