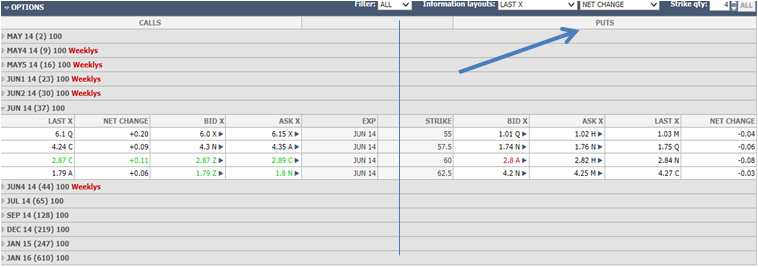

This chapter will basically be a mirror image to the last one. We have briefly gone over what a put option is, but let’s make it little clearer. When you buy a put option, you are betting that a stock will go down. Let’s move right to option chain this time, but now we are going to be looking at the right side of the screen at the put chain.

Everything and every rule is the same. The only difference we see besides the pricing of the options are the highlighted portions of the respective chains. I think to truly understand why the gray bars are oppositely highlighted for the call and put chain we have to know what intrinsic and extrinsic values are. If an option has intrinsic value, it is worth something and you would want to exercise it if you were at expiration. The JUN 14 55 calls have an intrinsic value of 5.05 because 60.05-55=5.05. If we owned a JUN 14 55 call and we were at expiration would we want to exercise our right to buy the stock at 55? Of course we would! We are getting the option to buy the stock for less than it is worth therefore giving us a profit. If we owned a JUN 14 62.5 call and we were at expiration would we want to exercise our right to buy the stock at 62.5? No. Why would we buy the stock at 62.5 when we can buy it for 60.05. This option has an extrinsic value of 2.45 because it is not actually worth anything right now. If we owned this option, we would let it expire worthless. We can think about this the same way for the put chain. If we owned a JUN 14 62.5 put and we were at expiration, would we exercise our right to sell 100 shares of FB at 62.5? Yes we would. Because we can sell the stock at 62.5 when it is only worth 60.05, we are then making a profit.

[link name=”validlink” dest=”/account/validatecode?code=4000018″]If this was part of an assignment, Click Here to confirm you’ve read it[/link]