Options are one of the most misunderstood concepts in trading. Many people do not trade options because they have false beliefs that options are too risky. The truth is that they just don’t know how options really work. Options are actually the most beneficial for young traders because they don’t require nearly as much capital as stocks do. Options trade just like stocks; they just have a little bit of a different meaning behind them. We will use some different methods to trade options than we do in stocks, but the basis for all of our trading always goes back to the chart.

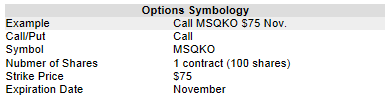

Options are financial derivatives that represent a contract sold by one party (option writer) to another party (option holder). The contract offers the buyer the right, but not the obligation, to buy (call) or sell (put) a security or other financial asset at an agreed-upon price (the strike price) during a certain period of time or on a specific date (exercise date). Options are called derivatives the option derives its value from something else (stocks in our case). Call options give the option to buy at a certain price, so the buyer would want the stock to go up. Put options give the option to sell at a certain price, so the buyer would want the stock to go down. An option contract is defined by the following elements: type (Put or Call), underlying security, unit of trade (number of shares), strike price and expiration date.

In this chart, we are buying one MSQKO call that expires in November. An important concept to understand is that each contract you buy is like controlling 100 shares of the underlying stock. So if we were to buy 10 contracts, we would control 1000 shares of stock. The expiration date can play a role in this option trade if we hold our option until expiration. Options trade just like stocks, so if we buy a call option on MSQKO, we can sell it at any time before the expiration date. However, if we do hold our option until expiration, we will have right to buy the stock at $75. If the stock has risen to $80, then of course we would choose to buy the stock at $75 because we would be making profit. If the stock has fallen to $70 at expiration, then we would choose to let our option expire worthless because we would be gaining no value by exercising our right to buy the stock. We will explain strike prices in greater detail in a few chapters.

[link name=”validlink” dest=”/account/validatecode?code=4000015″]If this was part of an assignment, Click Here to confirm you’ve read it[/link]