Short Term Financing

“Short Term” financing means taking out a loan to make a purchase, usually with the loan term at less than a year. There are many different types of short-term financing, the most common of which are “Buy Now, Pay Later”, “Unsecured Personal Loans”, and “Payday Loans”.

Short Term Financing VS Credit Cards

Short-term financing has many similarities with credit cards – there is usually a grace period, set interest rate, and minimum payments to make.

The biggest difference is that credit cards operate on revolving credit – meaning you can start to pay down your outstanding balance, then keep using your credit card. In fact, your credit card company will love you for keeping some outstanding balance, since you will continually pay them interest (which is how credit card companies make their money).

In contrast, Short Term financing is usually used for one specific purchase or one single sum of money, which is then expected to be paid off over a fairly short period of time. As a borrower, you probably would not be using the same source of short-term financing more than once or twice – if you do, this should be a red flag.

Types of Short Term Financing

There are three major types of short term financing – Buy Now, Pay Later, Unsecured Personal Loans, and Payday Loans

Buy Now, Pay Later

Many stores offer Buy Now, Pay Later loans, both in person and online. With this type of financing, you can typically walk out of the store with your purchase immediately, then pay for it later either in installments or after a set period of time. These loans can be attractive if you are low on cash, since it allows for instant gratification.

Many stores offer Buy Now, Pay Later loans, both in person and online. With this type of financing, you can typically walk out of the store with your purchase immediately, then pay for it later either in installments or after a set period of time. These loans can be attractive if you are low on cash, since it allows for instant gratification.

How do they work?

Like credit cards, many of these loans also have a “grace period” that allow you to pay off the full balance before any interest is charged, which is typically their main selling point (such as “No payments for 3 months!”).

At the end of the grace period, you will be charged interest for the full grace period, and be required to make at least minimum monthly payments until the full loan balance is paid off. The main difference between this type of financing and using a credit card is that the grace period is typically longer, and you will be expected to pay off the full amount of the loan after a set period of time.

Should I use these loans?

If a seller is offering you this type of financing, they generally are making money on selling you the item you are buying, not the interest on the loan itself, so these sellers would prefer if you pay off the full amount within the grace period. That does not mean these are always safe to use, since the seller will always prefer you to pay more in interest on top of the loan amount.

If you do hold the loan past the grace period, your interest charges will add up faster than if you made the same purchase with a credit card. This is because with a credit card, you have a shorter grace period, so you need to start paying down the loan amount faster. With a longer grace period, interest is able to build up on the full loan amount for a longer period of time, so you end up paying more over the life of the loan.

These loans are usually advertised to buyers who have low or bad credit, and may not have any other means of financing available. The bottom line is that if you are choosing between buying something with your credit card or using “Buy Now Pay Later”, you will probably be better off using your credit card.

Unsecured Personal Loans

Unsecured Personal Loans means any loan you take out without providing collateral. In fact, credit cards are one type of unsecured personal loan. You can also go to your bank or another financial institution for a one-time unsecured personal loan too, which works similarly to taking a cash advance out from your credit card.

Unsecured Personal Loans means any loan you take out without providing collateral. In fact, credit cards are one type of unsecured personal loan. You can also go to your bank or another financial institution for a one-time unsecured personal loan too, which works similarly to taking a cash advance out from your credit card.

How do they work?

Making an unsecured personal loan is fairly straightforward – you go to your bank or any other lender, and ask for a short-term line of credit. You will typically be approved for a set credit line, say $5,000, based on your credit history and income.

This type of short term financing is most common for emergency unplanned expenses, such as car repairs or medical expenses. These types of loans typically have a shorter grace period, about the same or less than a credit card. The interest rate varies, but is typically about the same or higher than a credit card.

Should I use these loans?

Taking a short term unsecured loan is usually not an easy choice to make, because you will most likely be faced with them during times of emergency for expenses higher than your credit card payment limit. If you can, you will usually be better off putting these purchases on your credit card, which may have a longer grace period and lower interest rate.

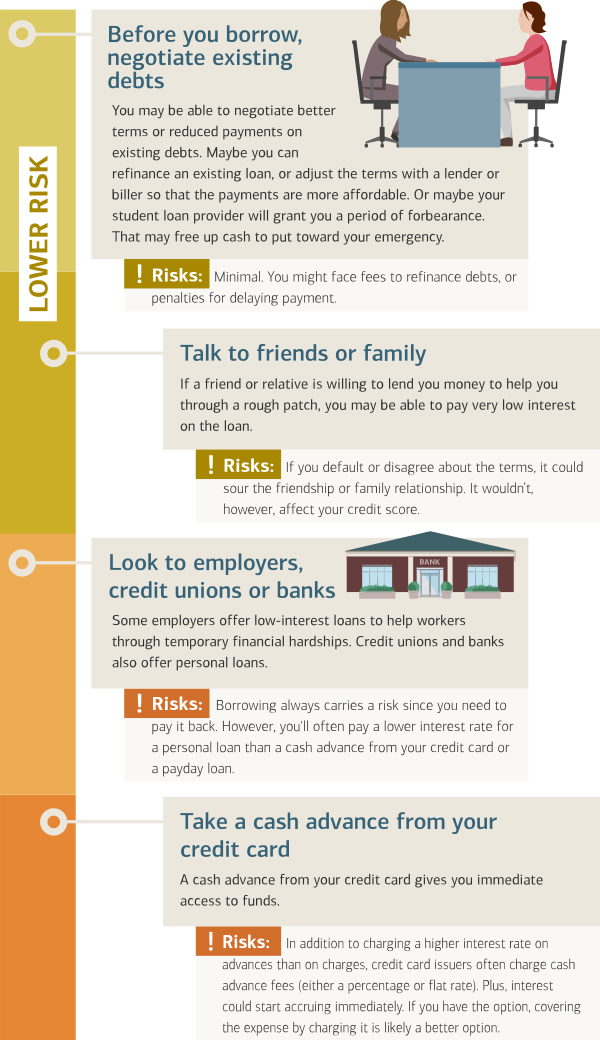

If the amount you need to borrow is higher than your credit limit on your credit card, you will be better off borrowing money from friends and family or taking an unsecured loan at a commercial bank, credit union, or savings & loan than you would be from taking it from alternative creditors. Remember: the more the creditor advertises that they work with people with low or bad credit, the worse deal you will probably get.

Payday Loans

Payday loans are the riskiest type of loan you can take. These loans are typically offered as a “bridge” between an expense (such as rent) and your next paycheck, usually with term lengths of less than 1 month. These loans can be either unsecured or secured – secured payday loans typically require a car title as collateral.

Payday loans are the riskiest type of loan you can take. These loans are typically offered as a “bridge” between an expense (such as rent) and your next paycheck, usually with term lengths of less than 1 month. These loans can be either unsecured or secured – secured payday loans typically require a car title as collateral.

These loans offer extremely high interest rates (often over 1000% APR), usually with little to no grace period. In theory, you could only pay a small finance charge if you take out the loan and immediately repay it within the next week or two, but over 80% of payday loans get “rolled over”.

Rolling over a payday loan is what happens if you cannot repay the full amount at the due date (averaging about 2 weeks). Payday loan offices make most of their money on these rollover finance charges.

For example, if you take out a $500 payday loan with a 2-week repayment and a $50 finance charge, you would need to pay $550 in 2 weeks. If you roll over the loan after 2 weeks, you can pay just the $50, and then another $550 in 2 more weeks. This loan went from 10% to 20% interest charged, which piles up fast.

Should I use these loans?

No. From a personal finance perspective, it is never a good idea to use payday loans. If you think you need one to make a rent or utilities payment, your landlord or utility company will charge you less in late fees than you will pay in interest.

Payday loan offices typically appear most often in communities with a shortage of commercial banks, credit unions, and savings & loan institutions. This means that those communities are often cut off of unsecured loans from those types of institutions, leaving just payday loan offices the only source of short-term credit for emergencies.

Even if you find yourself in this situation remember: from a personal finance perspective, you are almost certainly better off missing the payment entirely than taking a payday loan.

Short Term Financing – The Bottom Line

At the end of the day, if you need short term financing, your best bet will probably be your credit card instead of any of these methods. If you do have an urgent expense that your credit card cannot cover, see if your bank can help, or friends and family. If you want to keep your personal finances healthy, avoid Buy Now, Pay Later schemes and payday loans entirely.