What Your Credit Report Says About You

Understanding credit reports is crucial for managing your financial life. A credit report is a detailed summary of your credit history, used by creditors, landlords, and sometimes employers to assess your financial responsibility. It includes information on bill payments, loans, and any negative records like bankruptcies. In this lesson, we’ll review the basics so you understand your rights, and why it’s important to maintain a good credit report.

What is a credit report?

A credit report is a summary of how you handle your money. It shows if you pay your credit bills on time, how long you’ve used credit, how much debt you have, and what accounts you’ve paid off or closed.

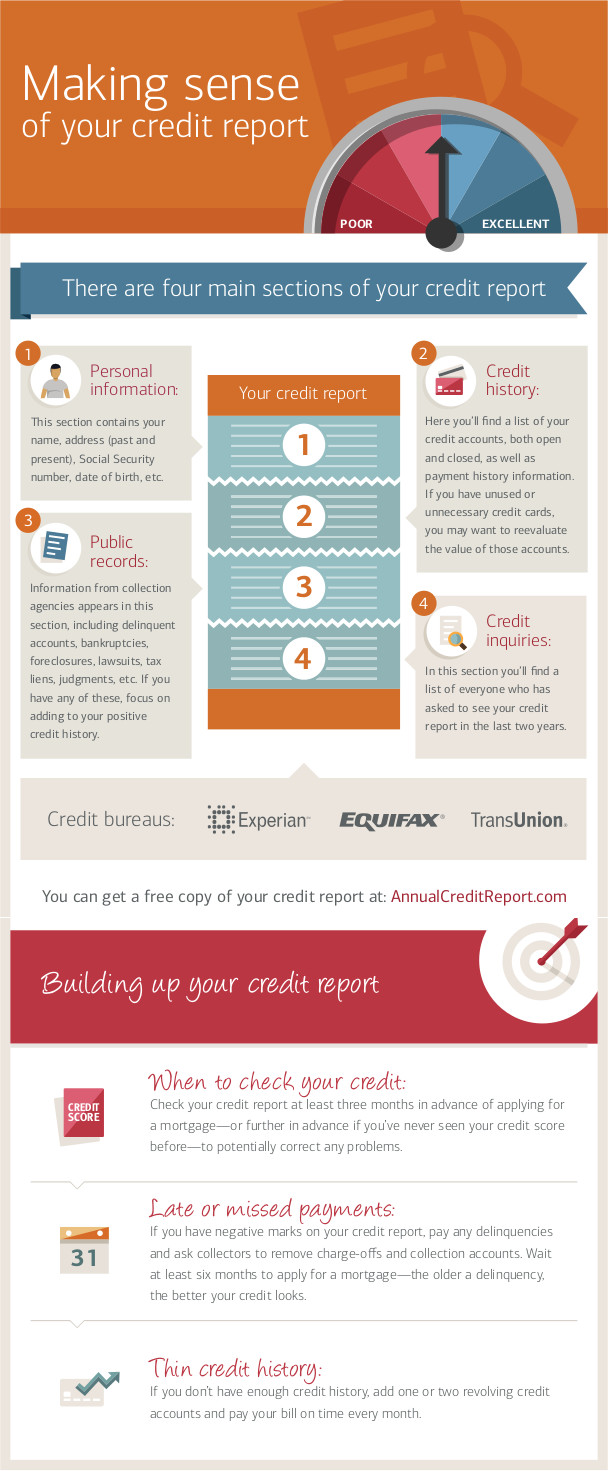

In the United States, there are three main companies that create credit reports: Experian, TransUnion, and Equifax. These companies collect information on people’s credit and payment history, criminal records, bankruptcies, and lawsuits. Your personal credit report shows this information for the past 7-10 years.

When you ask a company for credit, like a credit card or loan, you let them see your credit report. The company will then ask one of the three credit reporting agencies for your report to help decide if your application should be approved. Your report might be checked when you want to apply for a credit card, take out a loan, get insurance, or rent a home. Sometimes, potential employers may also want to see your credit report, but they need your written permission first.

What is the difference between a credit report and a credit score?

The difference between a credit report and a credit score lies in the information they provide. A credit report is a detailed record of your credit history, including information on bills you’ve paid, any late payments, missed payments, and their amounts. On the other hand, a credit score is a single number that represents how well you’ve managed your debts. A higher number means you’ve been more responsible with your credit.

Your credit report collects information from various sources, which is then used to calculate your credit score, commonly referred to as a “FICO score.” This score simplifies your credit history into one number. A larger number indicates that credit agencies trust you to pay your bills on time. If you have a clean credit report, you’ll have a high credit score. On the contrary, a low credit score suggests that you might have many late payments or negative information on your credit report.

Your income does not impact your credit score, but repeated requests to review your score do have a negative impact since the credit rating agencies assume that if you are trying to get credit from many different places, your financial position might be unstable.

Why should I care?

Both your credit report and credit score play crucial roles in your financial life. They are often evaluated by those who need to determine your financial reliability. Therefore, it’s essential to maintain a positive credit history to ensure your credit report and score reflect how you’ve managed your money.

Applying for a Credit Card

When you apply for a credit card, your credit report is often checked for the first time. Factors such as the length of your credit history, credit score, payment history, and income determine the credit options available to you.

Generally, people with poor credit history have lower spending limits, higher interest rates, fewer concessions (like late payment forgiveness), and fewer benefits. However, if your credit report is good, you’ll have more choices with credit card companies offering better terms to attract your business.

If you have negative marks on your credit report, your credit limit may be significantly lower, or you might not be able to get a credit card at all. Having and using a credit card is a basic way to build credit, so not having one can negatively affect you in the long run.

Applying for a Mortgage

When you’re looking to buy a house, it’s important to shop around for a lender. Since the amount you borrow will be much larger, more lenders may be willing to work with you. This means more options for borrowing, better interest rates compared to credit cards (which could save you a significant amount of money over the loan’s term), and possibly more flexible down payment options.

However, if you have negative marks on your credit history when applying for a mortgage, you may be required to make a larger down payment and accept a higher interest rate. This could cost you tens of thousands of dollars more over the life of the loan.

Renting an Apartment

When renting an apartment, your potential landlord will likely check your credit report. Landlords use credit reports to compare applicants and decide the security deposit they’ll require. Their main concern is ensuring the rent gets paid on time. If a potential renter has a poor credit report, the landlord may prefer to wait for another applicant instead of taking a risk on someone who appears less financially responsible.

Getting Insurance

Although insurance companies don’t provide credit, your credit report can still play a role in their decision-making process. Insurers may use your credit report information to determine your premiums and deductibles, as they want to make sure clients pay on time. In the insurance industry, providers need to collect as much money from premiums as they pay out in claims. If you don’t pay your premiums on time, it negatively affects their business.

If you fail to pay on time for a few consecutive months, the insurance company may cancel your policy. Moreover, if you don’t pay for a few months and then suddenly catch up before filing a claim, the insurance company may charge you higher premiums to compensate for your inconsistent payment history.

Applying for a Job

In recent years, more employers are reviewing the credit history of potential job applicants. This trend first started in the finance and banking industry but has been spreading to other employment sectors as well. Potential employers see your credit history as your overall professional trustworthiness, particularly if you have a long history of late payments.

What is included in a credit report?

Your credit report follows your basic payment history to creditors. This includes:

- Credit card payments

- Cell phone payments

- Cable/Internet payments

- In-store financing for large purchases

- Unpaid parking tickets

- If you have been sued

- Any other outstanding debt

- Mortgage payments

- Rent

- Utilities (gas, electricity, water)

- Car payments

- Unpaid taxes

- If you have declared bankruptcy

- Pay Day loan payments

Items on your credit report don’t remain there indefinitely, which means that early credit mistakes won’t haunt you forever. Generally, missed bill payments, collections, and most other items are removed after 7 years. Bankruptcies and other civil judgments, such as unpaid taxes, may have a longer duration, staying on your report for up to 10 years.

How does this information get in my credit report?

The three credit reporting agencies receive their information from your creditors. Everything in your report comes from businesses you’ve dealt with or those who’ve sued you. However, not all creditors provide this information. For instance, your apartment rental payment history might not be in your credit report unless your landlord reports it. Also, rental information could be negatively biased, as landlords may not consistently report timely or late payments, yet they will likely report judgments and collections.

Creditors report information linked to you through your social security number and your address. While your social security number is the primary method for connecting information, your address also plays a role in preventing fraud and identity theft.

Your Rights Under the Law: The Fair Credit Reporting Act

The information in your report is so important that there’s a federal law to protect you: The Fair Credit Reporting Act (FCRA). This law grants you specific rights to ensure the information used by businesses is accurate, private, and fair.

Your four key rights under the FCRA are:

1. You Have the Right to Access Your Information

You are entitled to a free copy of your credit report from each of the three main agencies (Equifax, Experian, and TransUnion) once every 12 months. The only official, government-authorized website to get these is annualcreditreport.com. Additionally, you have the right to a free report if a company takes adverse action against you (like denying you a loan or a job) based on information in your report.

2. You Have the Right to Accuracy (And to Dispute Errors)

You have the right to dispute any information on your credit report that you believe is inaccurate. To do this, you must contact both the credit reporting agency and the company that provided the information.

- Provider Responsibility: The data provider (the creditor) must investigate your claim.

- Agency Responsibility: By law, the credit reporting agency generally has 30 days to investigate the dispute. If the information is found to be incorrect, it must be removed or corrected.

Even if an item is accurate (like a collection for an unpaid bill), you can still contact the business. If you pay the outstanding amount, they may agree to remove the negative mark from your report.

3. You Have the Right to Privacy

Your credit report is not public information. Businesses must have a legally permissible purpose to view your report, such as when you apply for credit, insurance, or housing. A potential employer must get your written permission before they can access your credit report. They must also inform you if they decide not to hire you based on the report’s contents and give you a chance to dispute any information.

4. You Have the Right to Know How Your Information is Used

If you are denied credit, a job, or insurance because of information in your report, the company that denied you must tell you. They are required to provide the name, address, and phone number of the credit reporting agency they used, allowing you to follow up and verify the information.

Fixing Mistakes

All credit reporting agencies have a dispute process, which usually begins with an online form you can fill out. If you want to dispute something on your credit report, you’ll likely need to provide financial records to support your argument. The agency will then contact the creditor that originally filed the claim to get their perspective. They have 30 days to verify and correct the mistake, and if a correction is made, you can request that they send an updated copy of your report to everyone who has asked for it in the past 6 months.

If you can’t get an item fully removed, you can also request that the agency add a remark to that specific entry explaining your side of the story. This way, anyone who reviews your report will at least see your comments alongside the disputed item.

The Bottom Line

Your credit report is essential, so don’t overlook it. You’re entitled to a free credit report every year, and you should make sure to use this opportunity. Some studies have shown that up to 30% of credit reports contain inaccurate information, so addressing these issues as soon as possible is in your best interest. Remember, your free annual credit report doesn’t include your credit score.

Challenge Questions

- How is a credit score calculated?

- What is the difference between a credit report and a credit score?

- How important is it for you to build your score? Give examples of how this will help you financially.

- List 3 credit reporting agencies.

- How might fraud affect your credit score?