Your Credit Score and Report

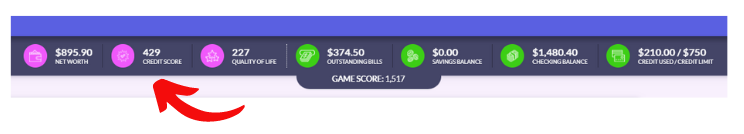

You’ve probably already taken note of your Credit Score at the top of the page – hopefully this has been steadily moving up as you play:

Your Credit Score is more than just a number, it is a single metric that has a huge impact on your ability to borrow, the interest rates and limits on your credit card, if you can take out a mortgage, and sometimes even getting a job.

Understanding a Credit Report

Your “Credit Report” is a larger document listing all of your creditors, past and present. Any time you need to borrow money, your lender will request your credit report to help determine if they think you can pay back the loan. This includes not just your credit cards and other debt, but sometimes also your utilities accounts, and especially any collections or judgements against you.

Every person can request a free copy of their credit report once per year, and there tons of apps and other services that can help you find it. Keeping up to date on your credit report is important – about 25% of people have at least one error that should be corrected.

Your Credit Score

Your Credit Score condenses down the information in your credit report to one simple number. The higher the number, the better your credit. No lender will make a decision based solely on your credit score, but it does play a large role.

A higher Credit Score leads directly to lower interest rates and higher spending limits on your credit card . Improving your credit score happens slowly over time as you show healthy spending patterns.

Your credit score goes up when you make payments on time, and goes down if you use more than 50% of your available credit limit. This is a big red flag for lenders – they get worried if they think you can’t make the payments!

Budget Game Tip