Getting Out of Debt: Debt Snowball and Debt Avalanche

Most financial literacy topics are dedicated to helping you stay out of debt and build wealth – but what do you do if you already find yourself deep in debt with no obvious way out?

This is where accelerated debt repayment strategies can come into play – and the two most popular strategies have a chilly, wintery theme: the Debt Snowball and the Debt Avalanche.

Snowball and Avalanche – The Main Idea

Both the debt snowball and debt avalanche methods involve concentrating your efforts on one debt at a time. You’ll make minimum payments on all your debts, then put any extra money toward aggressively paying down a single debt until it’s gone.

As soon as you fully pay off one debt, you would take what you were paying monthly (both its minimum payment and any extra payments), and apply it to the next debt. Then, one after another, you pay off each debt in full.

Debt Snowball

With the Debt Snowball strategy, you would focus on paying off your debt with the lowest outstanding balance first – tackle your smallest foes first, then build momentum with each smaller debt to pay off your bigger debt.

It’s called the “Debt Snowball” because each larger debt payment rolls up the payment from the smaller payments, causing your payments to grow as you tackle your smallest debts to your biggest debts.

The Debt Snowball is sometimes considered easier to follow for people who have accumulated large amounts of debt because it provides clear milestones where each smaller debt is paid off, giving a boost of confidence that real progress is being made.

Debt Avalanche

The Debt Avalanche focuses instead on paying off your debts with the highest interest rate first, regardless of the outstanding balance. Paying off debts with the highest interest rates usually means you pay less in total interest charges over the entire course of the debt repayment, since you are tackling your most expensive debt first.

Since your debt with the highest interest rate might not be debt with the lowest balance (especially if you have multiple credit cards), it means that it usually takes longer to fully pay off your first debt before the payment rolls over into the next-highest-interest-rate debt. But because you save so much on interest charges in the long run, the smaller debts that get paid later get paid off MUCH quicker – like a snow avalanche all coming down a mountainside in one big deluge.

The Debt Avalanche is sometimes considered harder for beginners to follow, because it can take much longer to fully repay the first high-interest debts, especially if you have high credit card debt. This can be discouraging, and make the plan harder to follow (unless you have high willpower to stick to the plan).

Why They Work

Without either of these strategies, most people’s default debt repayment would be to make the minimum payments towards all of their debts, and any extra payments they would divide between debts (either evenly or randomly). This means that you would be accumulating interest charges across all of your debts until they get paid off, usually not much sooner than if you had only made the minimum payments for all of them.

This is especially true for credit card debt, where minimum payments decrease as your outstanding balance decreases. Therefore, making only the minimum payments means you will be making payments for a very long time before the debt is fully paid off, and most of each payment will go toward interest charges, not toward actually reducing your debt.

Things to Consider

There are some special things to consider with both the debt snowball and debt avalanche, if they are to be used effectively.

Credit Cards and Minimum Payments

If you have high credit card debt, making regular payments will continually reduce your total outstanding debt, reducing your future minimum payments. This is in contrast to amortized loans (like student loans, car loans, and mortgages), which have constant payments over the life of the loan.

With an accelerated debt payment plan, you should continue to make the same monthly payment on all credit cards. Even if that payment is above the minimum, and even if you’re not currently focused on paying that particular debt. The goal is to keep your total monthly debt payments as consistent as possible until all your debt is paid off. Maintaining consistent credit card payments is an important part of that strategy.

Mortgages

Mortgage loans for buying a home are usually by far the biggest loan in someone’s finances. Mortgage debt is typically NOT part of any accelerated debt repayment plan (snowball or avalanche), and is excluded from the debts tackled with these methods.

Example

As an example, consider Chet and his current debts:

- A car loan for $32,000. The loan is on a 5-year (60-month) term at 8% interest. He is currently 2 years (24 months) into the loan, with 3 years (36 months) to go.

- A student loan for $35,000. The loan is on a 20-year (240-month) term at 5% interest. He is currently 5 years (60 months) into the loan, with 15 years (180 months) to go.

- A personal loan for $5,000. The loan is on a 3-year (36-month) term and 10% interest. He currently is 6 months into the loan, with 30 months to go.

- One credit card, maxed out with a $15,000 credit limit, and 21% interest.

- Another credit card with a $2,500 balance, and 19% interest

Making minimum payments, Chet would continue paying his amortized loans (car loan, student loan, personal loan) until their final payments, and continue making payments on each credit card until the balance went under $25 – then make a final minimum payment to pay off the balance. This would mean he pays:

| Debt | Time To Pay Off | Total Payments from Now till Payoff | Total Interest from Now till Payoff |

|---|---|---|---|

| Car Loan | 3 Years | $23,358 | $2,652 |

| Student Loan | 15 Years | $41,577 | $12,368 |

| Personal Loan | 2.5 Years | $2,742 | $1,758 |

| Credit Card 1 | 15.7 Years | $27,722 | $12,722 |

| Credit Card 2 | 8.25 Years | $4,125 | $1,625 |

| Total | 15.7 Years | $99,525 | $31,126 |

This would take almost 16 years to fully pay off – and over $31,000 in interest!

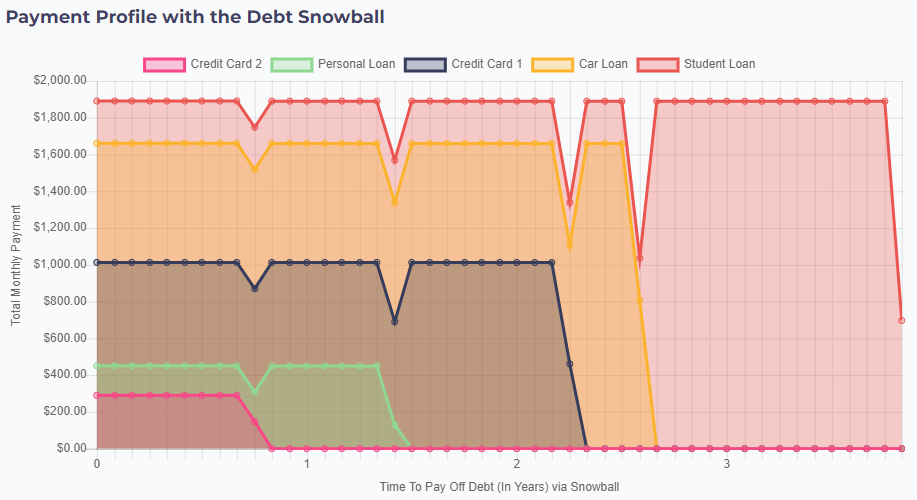

Debt Snowball

With a Debt Snowball approach, Chet would focus on paying off his lowest balances first – and put in additional cash that he can spare in his current budget. If Chet can afford an extra $200 per month, his payments would be:

- Adding $200 per month to his existing minimum payment of $89 for on his second credit card (with a $2,500 starting balance). For his other bills, continue making his minimum payments.

- After 10 months, this credit card would be fully paid off. His next lowest balance is his Personal Loan, which has a minimum payment of $161. So from the 12th month onward, Chet would pay $450 ($289 payment he was making towards the credit card, plus $161 minimum) towards his Personal Loan.

- After 17 months, his personal loan would be paid off. His next lowest balance is his other credit card, with a minimum payment of $563. So from the 18th month onward, he would add $451 to his $562 payment, making a total monthly payment of $1,013

- After 28 months, his credit card would be paid off. His next lowest balance is his car loan, with a minimum payment of $648. So from month 29 onwards, he would add his previous $1,013 “snowball” payment, for a total monthly payment of $1,660.

- With these bill snowball payments, his car loan is paid off just a couple months later. He adds the $1,660 snowball payment to student loan minimum payment of $230, for a total monthly payment of $1,890, until his student loan is fully paid off just shy of 4 years from when he started his payment plan.

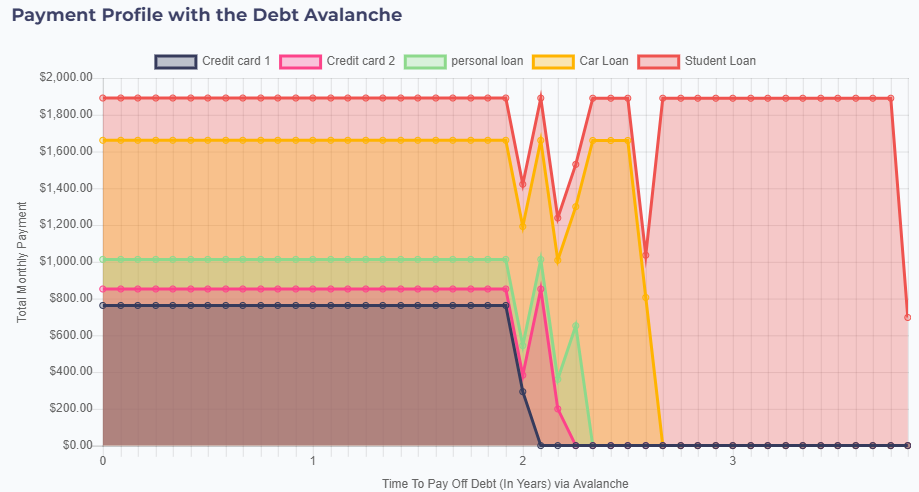

Debt Avalanche

Chet could instead try the Debt Avalanche – where he focuses on paying off debts with the highest interest first. In this case, he would target his first credit card – with its interest rate of 21%.

- Adding $200 per month to is minimum payment of $563 means he starts out by making a $763 payment towards his first credit card, and maintaining minimum payments elsewhere.

- After 2 years, his first credit card is fully paid off, so he adds this $763 payment towards his second credit card payment of $90, for an $852 total payment.

- With this larger payment, his second credit card is fully paid off in just 2 months, so he adds his $852 avalanche payment towards his personal loan (which has the next highest interest rate). However, his personal loan gets paid off with just this one avalanche payment.

- Adding his personal loan payment, his avalanche payment grows to $1,013, adding to his car loan minimum payment of $648 gives a total car payment of $1,660.

- And with this large car payment, his car loan gets paid off just a couple short months later. Applying his avalanche payment towards his student loan gives a $1,890 total monthly payment, fully paying off the loan in just under 4 years.

The Bottom Line

There is no right or wrong answer of which approach is “best” – both the Snowball and Avalanche method would save Chet over $13,000 by the time his debts are paid off.

The Debt Avalanche has the advantage of slightly lower total interest paid, saving some money. However, since you are making minimum payments towards most of your debt for longer, the Avalanche lacks some flexibility of the Snowball, where you theoretically could take a month off the debt payment plan and just make minimum payments if you have a major expense or emergency.

Try It!

| Debt Name | Loan Amount | Interest Rate | Loan Term | Current Period | Estimated Monthly Payment | |

|---|---|---|---|---|---|---|