Can You Afford To Buy That House?

Buying a home – a long-time cornerstone of personal finance. Buying a home is a huge milestone in anyone’s financial life, but the math behind the transaction can be daunting. In fact, for the average consumer, the purchase of their home is an entirely unique type of financial investment – where just a few thousand dollars can easily add up to 10 times that amount in extra costs or savings.

Can’t view on YouTube? Click Here!

This lesson is designed to help understand the math behind what will likely be the biggest transaction in your life!

Mortgage application ratios

Before you can take out a mortgage, there is a lengthy application process through a bank, credit union, or mortgage loan originator. The application process often takes weeks to complete, as you will be asking a financial institution to let you borrow likely several times your annual earnings – they want to make sure they are going to get paid back.

When you apply for a mortgage loan, your lender is primarily making two decisions: if they are going to lend you money at all, and what interest rate (or other restrictions) will apply to your loan.

Affordability Ratios

The first test a bank will make is to assume that you take out the mortgage loan – are you actually able to afford it? This is decided with ratios – the “28/36 Rule”.

Front-End Ratio – Rule of 28

The first affordability ratio is called the “Front-End Ratio”. This refers to how much of your income is going to be spent on housing costs alone. This means not just the payment made to your mortgage loan, but also any homeowner’s insurance costs, property taxes, homeowner’s association fees, and private mortgage insurance (PMI). It does NOT include other “variable” costs of owning a home (like utilities, maintenance, and repair fees).

Front End Ratio = Monthly Housing Costs / Monthly Gross Income

The “Rule of 28” says that banks typically will not agree to grant a mortgage that has a front-end ratio of greater than 28% – if your housing costs alone are greater than 28%, you are seen as too risky to lend.

Back-End Ratio – Rule of 36

If you pass the Rule of 28 tests, banks will then calculate your “Back-End Ratio”. The back-end ratio adds in any other debt payments you have to get a new ratio of your total monthly debt payments vs your total monthly income.

Back End Ratio = (Monthly Housing Costs + All Other Debt Payments) / Monthly Gross Income

The Back-End Ratio is very closely related to your Debt-to-Income Ratio, and is sometimes used interchangeably. The only difference is that your Debt to Income Ratio does not include the “extra” housing costs (like insurance, PMI, property taxes, etc.).

Lenders are looking for a Back-End Ratio of less than 36% (the Rule of 36) – if your total debt payments is greater than 36% of your monthly income, you would have a very hard time getting approved for a loan.

Mortgage loans that follow the Rule of 28/Rule of 36 are called “Conventional Loans” – these are the standard loans issued by banks and other financial institutions for mortgages. Other “Non-Conventional” mortgages exist for special cases – namely subsidized mortgages sponsored by the Federal Housing Administration (FHA) or special veteran’s programs.

Beyond the Rule of 28/36, financial institutions typically want to see as low of a Back-End Ratio as possible. The lower your Back-End Ratio, the lower risk the bank sees your loan – and likely you will be able to get a lower interest rate on your loan.

Importance of your Down Payment

Your down payment is the single most important consideration in your ability to get – and maintain – a mortgage.

Your down payment refers to how much cash you have today that you can put towards your purchase (meaning home price, plus all closing costs associated with taking out the mortgage). Banks like big down payments – it shows you are financially responsible to save up a large amount of cash yourself, and it means they have less risk in the loan if you fall behind your payments and fail to repay yourself.

Financial institutions generally prefer borrowers who can put 20% (or more) money into their down payment. But it also has a huge financial impact.

Down Payment – Big or Small?

Consider Eric, who is buying a $300,000 home. He has $70,000 in cash available that he has saved up over the last few years to put towards his down payment, and the bank is offering him a 5% interest rate on a 30 year mortgage.

If he chooses to put down exactly 20% ($60,000) so he can keep the extra $10,000 in his emergency fund, this will make his monthly payment just over $1,400 per month. At the end of the 30 years, he will have paid $180,900 in total interest.

However, he could increase his down payment to $70,000. In this case, his monthly payment drops to $1,344, and at the end of the 30 years, he will have paid a total of $173,367 in interest.

At first, it sounds like a bad investment – spending an extra $10,000 only reduced his interest cost by about $7,500. But the key is that that extra $10,000 was not spent – it went towards the principle of his loan. Since he borrowed less, his monthly payments were about $55 less per month – adding up to over $16,600 in lower payments over the course of the loan.

One cannot immediately say if this was a good investment – Eric would need to compare what else he would have done with the money (saved in a savings account, spent on renovations to improve the value of the home before selling it, or some other type of investment) – but it does require careful consideration of how much you choose to put down.

Bank Risk and PMI

A down payment of 20% is a key consideration for the financial institution issuing the loan. This is because if you fail to make your mortgage payments, the bank is forced to foreclose on your property.

This means you get forced out/evicted from your home, and the bank puts it up for a quick sale to whoever is willing to pay for it in order to recoup their money. Since the bank only cares about getting their investment back, they typically will not wait for the ideal sales season or carefully weigh different buyers and offers – they take the first option that comes their way. And because you were failing to pay back the loan to begin with, the bank likely will assume you have been taking less-than-stellar care of the property itself – further hurting how much it will sell for.

These are all risks the bank takes on when it issues the loan. The 20% down payment guideline is basically their assumption that they should not LOSE more than 20% of the home’s value if you fail to pay and they are forced to foreclose – so they should be getting their investment back.

Private Mortgage Insurance

This does not mean that it is impossible to get a mortgage if you do not have enough money for a 20% down payment – it just means that there are extra hoops you need to jump through. The biggest extra consideration is called Private Mortgage Insurance, or PMI.

PMI is an insurance policy that protects the bank – not you – in case you default on your loan. It pays back the bank any difference between the quick-sale price and how much they are still owed on the loan. The PMI payments are typically added to your monthly mortgage payment (making your monthly payments even more expensive). How much the PMI payments will be depends on how much risk the bank is taking with your loan – which usually is determined by how much lower than 20% you put as the down payment.

Once you have built up 20% of equity in your home (either through your regular monthly payments, or extra payments), you will no longer be required to pay PMI.

Equity and Amortization

The equity in your home is effectively how much of your home you “own”, versus how much is still borrowed. When you first make your home purchase, your equity exactly equals your down payment – so if you put a 20% down payment on a $300,000 home, you have exactly $60,000 in equity as soon as you close on the sale.

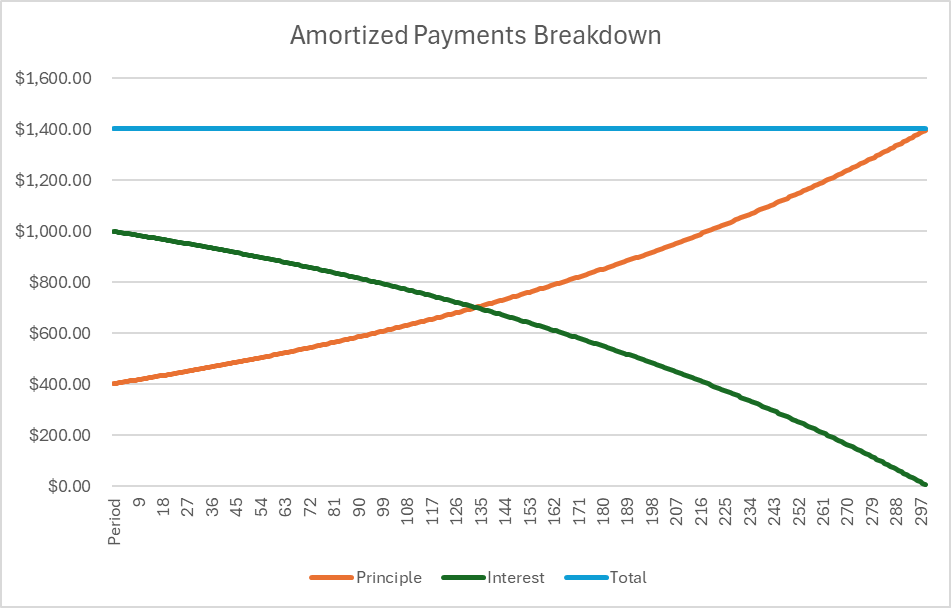

Every time you make your monthly mortgage payment, you are paying off a bit of your loan – so your equity goes up. However, even though all of your mortgage payments are equal, the equity they build does not. This is because your mortgage is an amortized loan (or a loan of exactly equal payments).

Amortized loans are balanced so that early in the loan, most of your payments go towards the total interest owed for the entire lifetime of the loan. At the end of the loan, most of the interest is paid off, so most of the payment’s value goes straight to your equity.

Here is the breakdown in the loan above in chart form:

This means for the first few years of your loan, you are building very little equity (unless you make extra payments on the side)

Sales and Refinancing

How much equity you have built directly impacts how much cash you get when selling your home. When you sell your home (if your mortgage has not been paid off yet), your profit comes from this formula:

Take-Away Cash = Sale Price – Initial Loan Amount + Your Equity

In our example with Eric, let’s say that he sells his home after 5 years, for $310,000. His initial loan amount was $240,000, and he originally had a $60,000 down payment. After 5 years of making his regular monthly payments, he has built an additional $27,407 in equity, bringing his total equity to $87,407.

From the formula above:

Take-Away Cash = $310,000 – $240,000 + $87,407 = $157,407

Home Equity Loans and Refinancing

If instead of selling his home, Eric also has the option to take a second mortgage, or a home equity loan. What this means is he has the option to borrow against the equity he has built up in his home – with the catch that he still needs to maintain 20% equity unless he wants to pay PMI.

This means that the bank will calculate your new percentage equity in the value of the home. They do this by comparing against the original purchase price and how much equity you have built up, then find that as a percentage of the new home price.

Original Home Price = $300,000

Current Equity = $87,407

Equity Percentage = $87,407 / $300,000 = 29%

New Home Price = $310,000

Potential Equity Value = $310,000 * 29% = $90,321

From here, the financial institution will still require that you maintain 20% equity (at the new price).

Potential Minimum Equity = $310,000 * 20% = $62,000

Since the equity you would have when refinancing is greater than this, it opens the possibility of taking out a second mortgage against this equity. This is called a Home Equity Loan.

Maximum Home Equity Loan amount = $90,321 – $62,000 = $28,321.

If Eric chooses to take on a home equity loan, he will have a second mortgage payment to make for the additional borrowed amount. The interest rate and term of the second mortgage would be negotiated when he takes on the new loan. Home equity loans are typically used for renovations or home improvements that add even more value to the home, often in anticipation of selling the home once the renovations are complete.

Refinancing

Instead of taking out a home equity loan, Eric may also want to restructure his original loan so his monthly payments are lower. It may be that interest rates fell since he originally took his first loan, or he may want to put in even more cash to have more equity to start with (or both). In either case, this is known as refinancing.

Refinancing may or may not consider the current market value of the home, but it basically works like taking an entire fresh mortgage from the start – but with a new interest rate and new down payment. Refinancing is very common whenever the prevailing interest rates go down.

Try It!

This mortgage calculator will show you the breakdown of payments for the entire duration of the mortgage loan, so you can see clearly how much of each payment goes towards principle vs interest. Note: if you choose a low down payment, PMI will be added to your total (equivalent to 1% of your loan amount per year) until you have built up 20% equity.

Mortgage Calculator

Result

| Purchase Price | $300,000 |

|---|---|

| Down Payment | $60,000 |

| Loan Amount | $240,000 |

| Interest Rate | 8% |

| PMI Required | No |

| Total Interest + PMI over the life of the loan | $0 |