The Basics of Filing Taxes in Canada

What is income tax?

Income tax is the tax you pay on your income, typically deducted directly from your paycheque. Every individual who earns income in Canada is obligated to pay income tax.

Income encompasses more than just employment wages and salaries. If you receive rental income from properties you own, investment income, interest on savings accounts or bonds, or any other revenue, you are likely liable for income tax on these earnings.

How are income taxes paid?

For the majority, income tax processes seamlessly. Employers withhold the applicable income tax amount from employees’ paycheques, remitting it to the government without additional steps.

If you are self-employed or work as an independent contractor (such as a driver for a ride-sharing service), the process becomes a bit more intricate. In such cases, you are responsible for reporting your income and settling any owed taxes concurrently. In this case, it is important to plan ahead either by paying in installments or make sure to put some money aside to pay taxes at the end of the year. If you choose to pay at the end of the year, you may be charged interest on the taxes that were owed earlier in the year.

Who needs to file an income tax return?

All Canadian citizens and residents working and living in Canada are required to file an income tax return annually, in most cases before May 1st of the proceeding year. Even citizens and residents who did not engage in employment must file if they received any form of income or compensation during the preceding year, including rental earnings and unemployment benefits.

Individuals working in Canada without a Social Insurance Number (including legal immigrants and undocumented workers) must fulfill their income tax obligations. As some of these workers might lack a Social Insurance Number, they can obtain an Individual Tax Number (ITN) from the Canada Revenue Agency (CRA) for tax reporting purposes.

ITN numbers are exclusively for tax reporting and help undocumented workers comply with income tax regulations.

Canadian Citizens Living Abroad

Canadian citizens residing and working in other countries do not need to file an income tax, unless they earned income that is taxable in Canada.

What do I need to file my income taxes?

In addition to a Social Insurance Number or Individual Tax Number, several forms must be completed and signed for filing income tax.

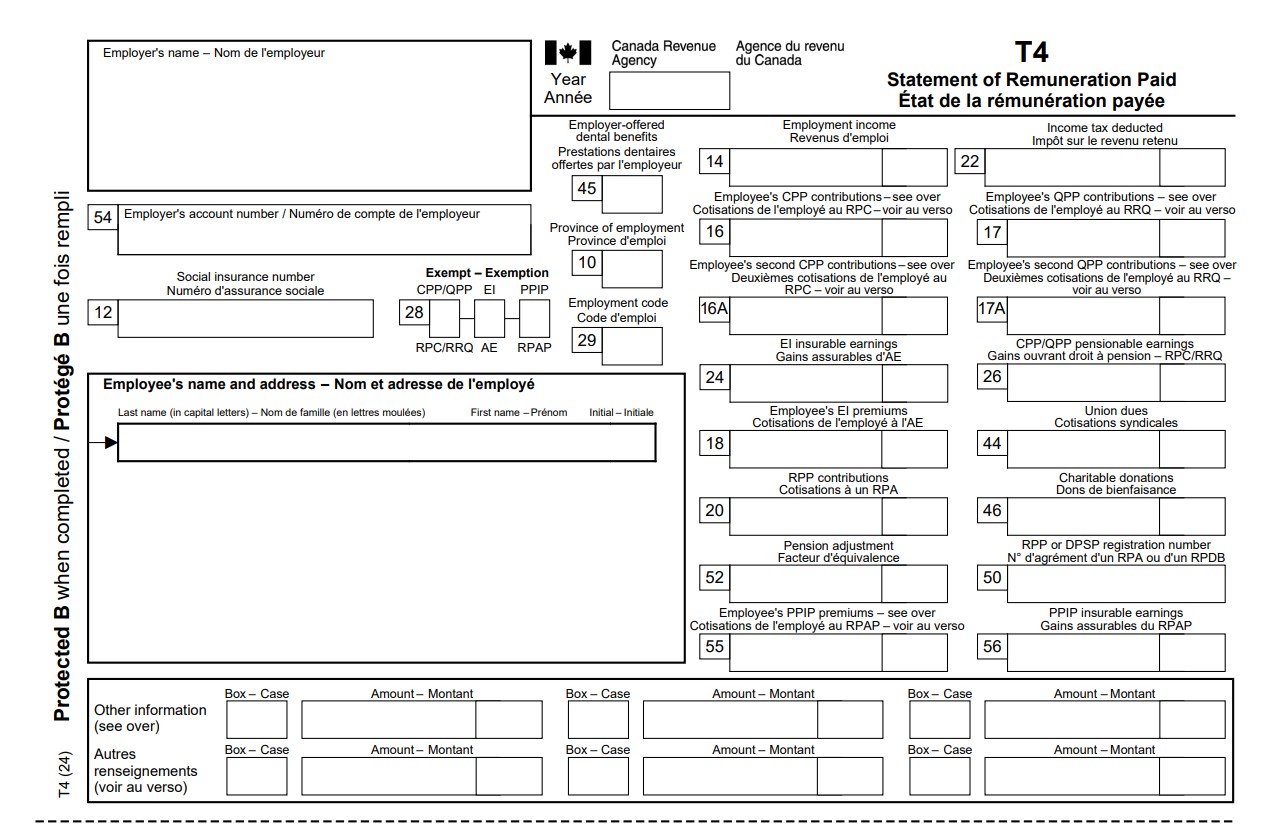

T4 Slip

The T4 slip is a document provided to all hourly and salaried employees by their employer at the end of the year (typically in February, covering the previous year). It outlines the total earnings for the year, including deductions for Canada Pension Plan (CPP), Employment Insurance (EI), and income tax. Employees receive their T4 slip pre-filled by their employer.

You typically receive three copies of your T4 slip: one for your records, one for your federal tax return, and one for your provincial tax return.

You can file your income taxes with just a T4 slip if you did not receive other income or compensation in the previous year.

Other Information Slips

Other information slips, such as T5 for investment income and T3 for trust income, may be required if you have income from additional sources.

The Canadian Income Tax Return: T1 General

The primary income tax return form in Canada is the T1 General form. This form is used to tally all income from various sources, calculate the taxes already remitted, deduct qualifying expenses, and determine the tax refund or liability.

The T1 General is a straightforward one-page tax return. Individuals with uncomplicated financial situations can complete the one-page form and submit it. Those with more complex income and expenses may need to include additional schedules outlining other income and expenses.

Sections of the T1 General

There are four key sections of the T1 General:

- Personal Information: This includes your name, address, and Social Insurance Number. If you are married, you may file the T1 General jointly with your spouse, providing their information as well.

- Income: Information from your T4 slip and any interest tax forms from your bank are included here, along with any unemployment benefits or other taxable benefits received.

- Payments: This section, derived from your T4 slip, indicates the tax withheld and paid to the government directly by your employer. It also allows you to calculate the total tax owed.

- Refund or Tax Owed: The final calculations reveal the expected refund or the amount of income tax due. For those expecting a refund, bank routing information can be provided for direct deposit. If taxes are owed, instructions on payment are included.

Gross, Net, and Taxable Income

When completing your tax returns, distinguishing between gross income, net income, and taxable income is crucial.

- Gross Income: This is the total amount earned in a year, combining earnings from T4, T5, and other investment income.

- Taxable Income: This is the amount subject to taxation. It is calculated by subtracting tax-deductible expenses from gross income.

- Net Income: This represents the final amount earned at the end of the year after all taxes have been paid.

Income Tax Corrections

Taxpayers in Canada have seven years to make corrections. This is commonly done to claim missed deductions or report income later to avoid penalties for tax evasion.

To file an amended tax return, individuals can use Form T1-ADJ, specifically designed for corrections to a prior return.

CRA Corrections

The Canada Revenue Agency may also make corrections based on their own calculations of owed taxes. If adjustments are made, the CRA typically sends a tax assessment letter explaining the disparities along with a process to dispute their calculations.

The CRA may adjust returns both upward and downward, focusing on errors in deduction amounts and arithmetic to ensure accurate processing.

Audits

There is a slight possibility of a tax audit by the Canada Revenue Agency, wherein supporting documents are requested. Audits serve to verify correct values on tax returns and prevent fraudulent claims. Audits can occur up to six years after filing taxes, underscoring the importance of retaining supporting documents for at least that duration.

Provincial Income Taxes

All Canadian provinces impose their own income taxes, each with varying tax amounts and thresholds. The procedure for filing provincial income taxes closely mirrors federal tax filing and generally requires the same documentation (hence the issuance of three copies of a T4 slip).