Get Practice Filing a Sample Tax Return

To file income tax in the United States, you will need to use “Form 1040” – the standard income tax return worksheet from the IRS.

Below is a sample 1040 to try to fill out on your own for practice. This is the scenario for this exercise – try to complete the income tax return based on this scenario:

- Your name is Alex Smith, from Springfield, USA. All of your contact information is pre-filled, so no need to re-enter it.

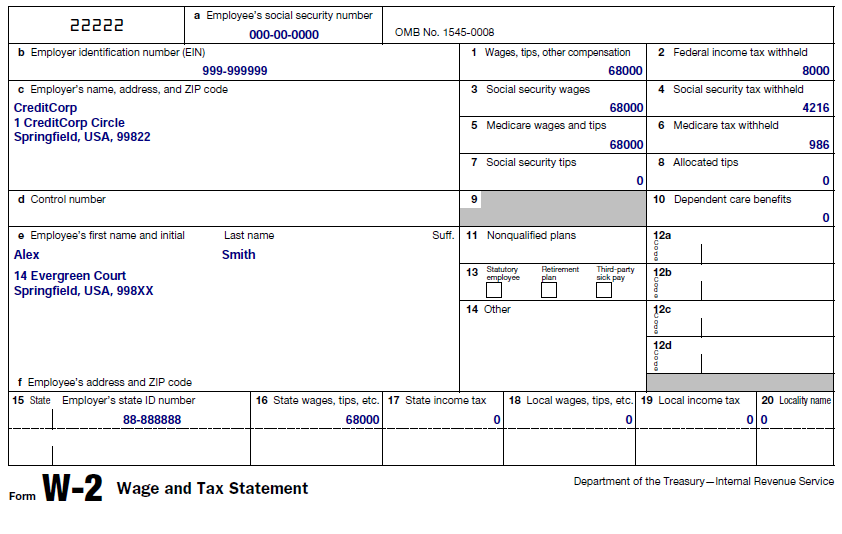

- You have a regular employment job, which sent you a W-2 last year that accounts for most of your income. You can find a button to view your W-2 form below.

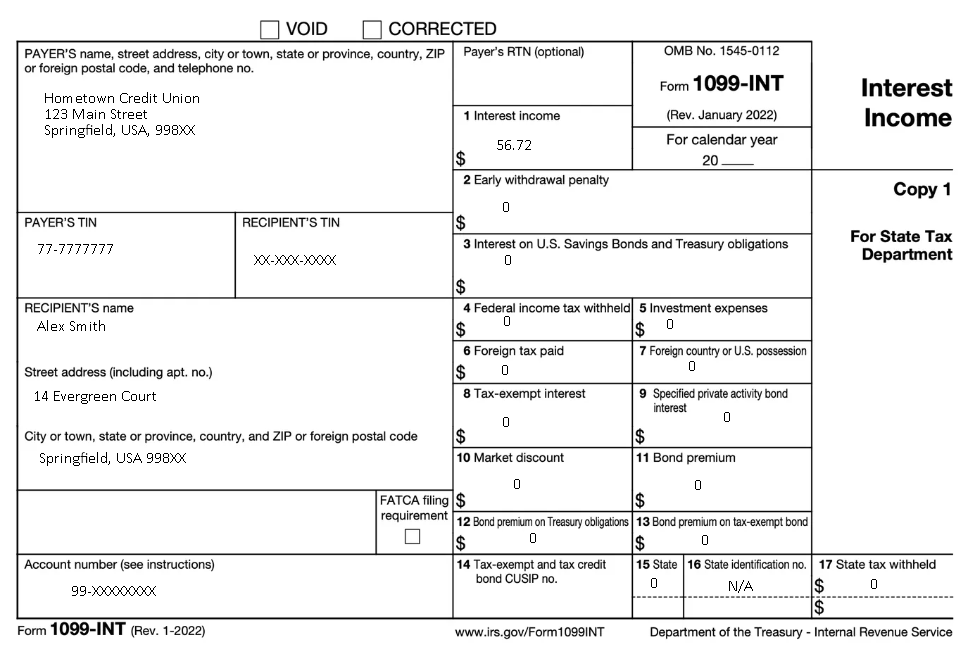

- You also have a savings account – your bank sent you a Form 1099-INT showing the interest earned on your savings account. You can find a button to view your 1099-INT below.

- You are going to file your taxes as a single adult, and nobody can claim you as a dependent.

- Next to most fields you can find a “?”, giving you more information about what this means and how you should enter it.

- You have no other special income, expenses, or forms/schedules besides your W-2 and 1099 (so you will skip a lot of the fields).

Good luck – hopefully you’ll get a tax return, and not need to pay extra!

Check only one box

Filing Your Income Taxes

To file income tax in the United States, you will need to use “Form 1040” – the standard income tax return worksheet from the IRS.

This exercise will have you fill out your taxes, with all the information you need to succeed.

See InstructionsInstructions – Page 1

Your name is Alex Smith, from Springfield, USA. All of your contact information is pre-filled, so no need to re-enter it.

You are going to file your taxes as a single adult, and nobody can claim you as a dependent.

Instructions – Page 2

You have a regular employment job, which sent you a W-2 last year that accounts for most of your income. You can find a button to view your W-2 form below.

You also have a savings account – your bank sent you a Form 1099-INT showing the interest earned on your savings account. You can find a button to view your 1099-INT below.

You have not recieved any other “Forms”, and have no other special income.

Instructions – Last Page

Fill out the Form 1040 below with the information provided.

Next to most fields you can find a “?”, giving you more information about what this means and how you should enter it.

All fields must be entered to continue – enter 0 where applicable. If you have an error in any entry you make, you will be prompted with a hint for correction.

Tax Tip: “Forms” are sent to you by mail (almost always by February, with taxes due in April). “Schedules” are other tax forms that you need to fill out before completing the 1040, which detail other special circumstances. In this scenario, no “schedules” will apply to you, but we do explain what they are.