3-03 Types of Orders-Market, Limit, Stop

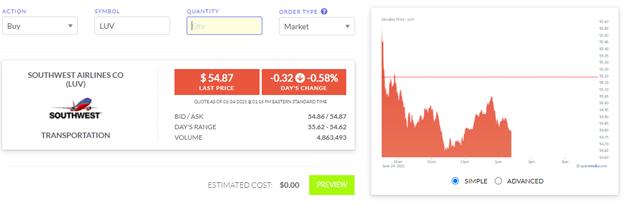

Once you have the ticker symbol for the company you wish to trade, you are ready to place your first order.

Go to your virtual trading account and you’ll see several options for order type—market, limit, stop, and trailing stop.

You have already found the symbol to trade “LUV” and you can enter any quantity of shares to buy. Many virtual trading accounts implement a position limit that forces you to diversify so you can buy up to 25% of your portfolio value. At real-money brokers, of course, you can “put all of your eggs in one basket” and buy as many shares of a stock as your cash and buying power will allow.

There are several different types of orders you can use when you place a trade. A few of the most popular and those you should become familiar with include:

Market Order

A “Market Order” says “I want to make this trade right now, give me the best price on the market”. Your order is processed immediately. If you are buying, you will pay the current “Ask” price, if you’re selling you will get the current “bid” price.

When people first think about investing, this is what comes to mind. However, exclusively using Market orders to manage your portfolio means you need to keep a constant watch on your stocks – and be ready to log into your brokerage account at a moment’s notice to make a trade based on current market news. Savvy investors can use some of the other order types to make portfolio management much less stressful.

Limit Order

With a limit order, instead of saying “Trade Now”, you instruct your brokerage to make the trade only if the price is right. “Limit Orders” are used by investors trying to maximize the profit made from every trade:

Buy – Limit

With a Buy – Limit order, you would set a price that is below the current price of this stock. If the stock’s price falls below the price you set, your order will execute. An investor would use a Buy – Limit order if they have a stock they want to buy, but think it is currently over-priced. They are instructing the brokerage to buy the stock if the price falls to what they think is a good deal.

Sell – Limit

With a Sell – Limit order, you would set a price that is above the current price of this stock. If the stock’s price goes above the price you set, your order will execute. An investor would use a Sell-Limit order if they already own a stock, and want to sell it if the price goes high enough – then cash out their earnings. Setting the Sell-Limit order means that this will happen automatically – you don’t need to constantly check the stock price.

Stop Orders

“Stop” orders are the opposite of limit orders. These are used by investors who are trying to protect against loss:

Buy – Stop

With a Buy – Stop order, you would set a price that is above the current market price. If the stock’s price rises above your Stop price, your order will execute. An investor would use a Buy – Stop order if there is a stock they are not sure they want to buy just yet – they aren’t sure if the price will go up or down. But by setting a Buy-Stop order, they will automatically buy the stock if the price starts going up above their price setting.

Sell – Stop

With a Sell – Stop order, you would set a price below the current market price. If the stock’s price falls below this price, you will automatically sell it. An investor would use a Sell-Stop order if they own a stock and want to keep it, but want to put protection in place in case the price starts to suddenly fall. If the price starts dropping below their threshold, it automatically sells, and the investor limits their loss.

Trailing Stop Orders

Trailing stop orders are a more advanced version of stop orders. Instead of saying “If stock XYZ falls below $50, sell it”, you can instead say “If stock XYZ falls by $5, sell it”. This is important because a trailing stop’s “trigger price” moves with the stock’s price.

For example, let’s say you bought stock XYZ at $60, and you set a stop price for $50. The next day, the stock does great – the price rises to $75. But the day after was terrible – the stock’s price dropped to $45. Thanks to your “stop order”, you sold automatically, and only took a $10 loss.

Instead, in the same scenario let’s say you used a $5 trailing stop order. In this case, when the price went up to $75, your “trigger price” became $70 automatically. When the stock’s price started to fall, it sold off at $70 – and you kept a net profit of $10, even though the price continued to fall.