2-06 Bull vs. Bear Markets

Business and economic popular news will often refer to “Bull” or “Bear” markets. You probably already have some idea what this means – “Bull” markets tend to be going up, while “Bear” markets tend to be going down.

What is a Bull Market?

A “Bull Market” means that investors are optimistic that stock prices are generally increasing, and that the market as a whole is growing.

This does not mean that everyone thinks that every stock is likely to go up, nor does it mean everyone thinks the markets are going to hit a new record every day. But it does mean that generally speaking, investors believe that it is a good time to “buy” – because stock prices are likely to continue to increase in the short term.

Bull Markets tend to attract new investors to the market. This can either be young people investing for the first time (because they’ve heard that there is good money to be made by investing), but also investors who had money stored in other assets (like bonds, precious metals, bank accounts, or real estate) moving their money into the stock market to achieve a higher return. This means the number of buyers in the stock market increases – which helps keep prices moving up due to supply and demand.

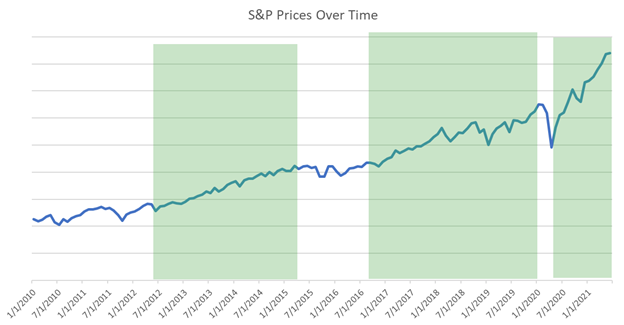

There is not a universally-agreed upon definition of when a Bull Market starts and stops, but take a look at how the S&P 500’s price moved from 2010 through 2021:

The green areas are generally considered “Bull Markets”. The prices of stocks generally increased – even though there were some ups and downs along the way.

Being Bullish

If you read investing news, analysts will often be described as being “Bullish” on a particular stock, instead of the market as a whole. This means the analyst is optimistic about the stock, and it is probably a good time to buy. This does not always mean the analyst is right though! A “Bullish” rating from analysts can make a stock’s price go up, since other investors see the same news that you do. These new investors coming in might be a good time to “sell high” if you think the price is going up too much!

What is a Bear Market?

A “Bear Market” means that investors are generally cautious about stock prices and are unsure if prices will continue to increase in the short- to medium-run. Just like a “bull market” does not mean every stock’s price will go up (or even that the stock market as a whole will increase every day), a “Bear Market” does not mean that prices are crashing. It just means that, on the whole, investors are more skeptical and cautious about investing in stocks.

In a Bear Market, investors believe that stocks are getting riskier – so many investors sell their stocks to move their money into other assets (like bonds, precious metals, bank accounts, or real estate). This is the exact opposite of a Bull Market and has the opposite impact. More sellers and fewer buyers tends to cause prices to go down due to supply and demand.

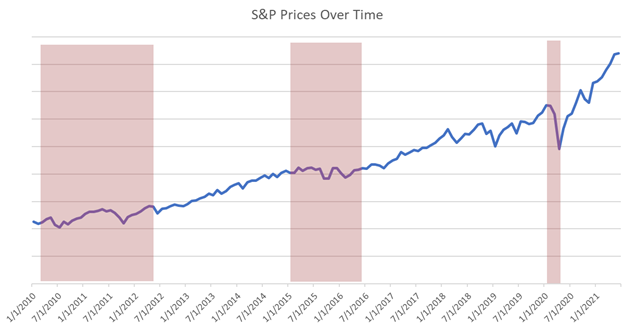

We can also look at the chart of the S&P 500 to see the periods of “Bear Markets”:

The area in 2010-2012 was more “bearish” as the economy was still recovering from the 2008 recession. The period in 2015-2016 is not always considered to be a “bear market”, but we can see that there was more uncertainty, and prices were not on a growth path.

The last big drop in 2020 was a crash caused by the COVID-19 pandemic and related shutdowns of businesses – this caused a huge amount of fear and uncertainty, causing prices to drop quickly in a short period of time.

Being Bearish

Just like an analyst can be “Bullish”, they can also be “Bearish”, which means an analyst thinks that a company is a riskier investment, and their stock might be over-valued. You should always think carefully before taking the advice of analysts – the rest of the world hears them too! An analyst being “bearish” on a company can cause other investors to start selling their stock. If you think that the company itself is still strong, it might be a good time to “buy low”.

The Trend is Your Friend

Both Bull Markets and Bear Markets are trends. The optimism in a Bull Market causes new investors to put their money in stocks, which causes prices to go up, which causes more optimism – a cycle of growth. The fear in a Bear Market causes investors to sell their stocks, which causes prices to go down, which causes more fear. In both cases, the trend is your friend, and you can use this to your advantage.

During times of bull markets, you can think “Buy Low and Sell High” – since the market as a whole is going up, index ETFs and mutual funds become a more attractive investment to keep with the trend. During a Bear Market, index funds might be less attractive, and a savvy investor would focus more on individual companies that show consistent profitability and slower, but more stable, price growth.

Bubbles and Crashes

A “Bubble” is when a bull market gets out of hand – there are WAY more buyers than sellers, and stock’s prices start going up much faster than the actual value of the companies that people are investing in. Fear of “bubbles” is in the back of the mind of every investor in a bull market – everyone is hoping that the price growth is “real”, and not a bubble that can burst.

Crashes are the opposite – suddenly many investors get spooked and all start selling their stocks at once. When there are WAY more sellers than buyers, prices start dropping fast – causing more fear and more people to start selling.

We cover both Bubbles and Crashes in more detail later on in the course.