2-00 Chapter 2: How the Stock Market Works and Why It Moves

Now that we are introduced to some of the basic types of investments, we can look into how the stock market actually works, and why prices move.

To understand the basics of the stock market, we need a quick refresher on some core economics – the laws of Supply and Demand.

Supply and Demand In The Stock Market

The stock market is made up of “Sellers” – people who own a stock but would be willing to sell it (if the price is high enough), and “Buyers” – people who want to buy a stock (if the price is low enough).

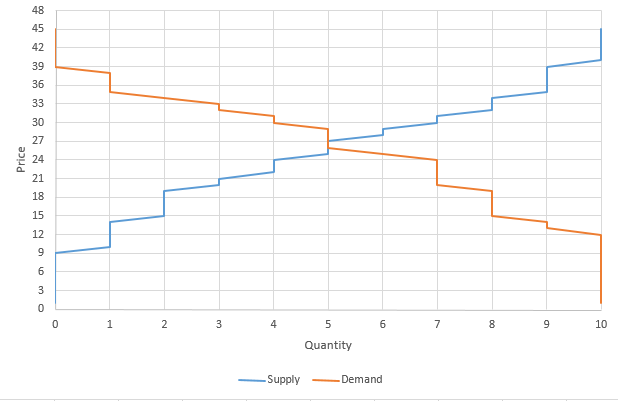

The stock market works by taking all these buyers and sellers, putting their offers together, and making trades. The price for trades is determined by constantly shifting movements in the supply and demand for stocks. The price and quantity where supply is equal to demand is called “Market Equilibrium”, and one major role of stock exchanges is to help facilitate this balance. We can use the stock market to give some great supply and demand examples with buyers and sellers who want different prices.

To see how this works, we can use a simplified example. Imagine there is ABC stock – currently 10 people own 1 share each, and there are 10 people looking to buy one share each.

The Supply of Stock

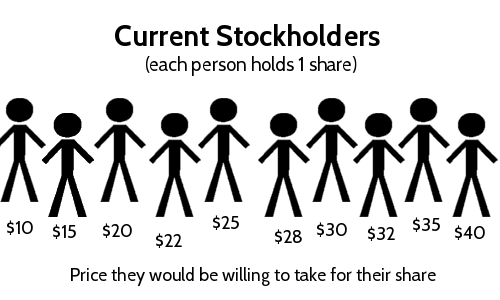

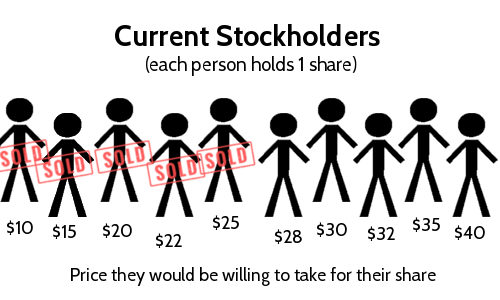

“Supply” refers to the total number of stockholders who would be willing to sell their shares. Every seller is different – some people would be willing to sell for cheap, others want a lot more money.

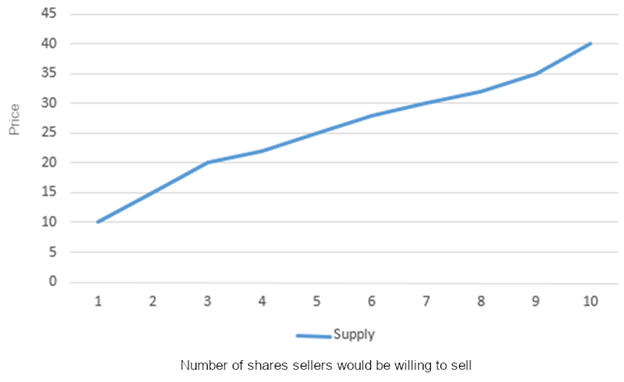

All these sellers “value” their share differently. In stock market terms, their value is their “Ask Price” – the lowest amount they would need to be paid to sell their stock. The shareholders on the left would be willing to take a much lower price for their shares than the sellers on the right. If we look at the whole market for shares, as the price goes up, the total number of shares “supplied” also goes up:

At a market price of $10, only 1 share will be supplied, but at a price of $25, 5 shares would be supplied.

The Demand For Stock

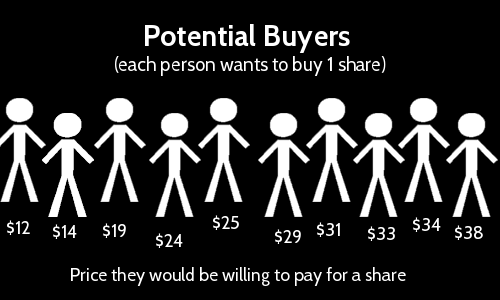

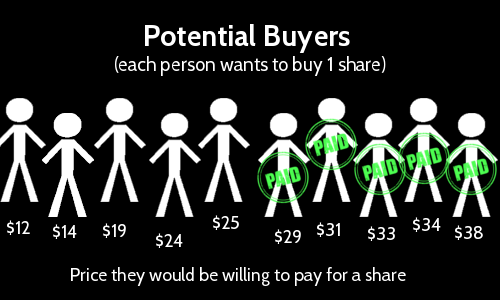

“Demand” refers to the total amount of stock potential buyers would be willing to buy at any price. We can use a similar example to the one above – imagine we have 10 people who want to buy 1 share each, but are only willing to pay a certain price:

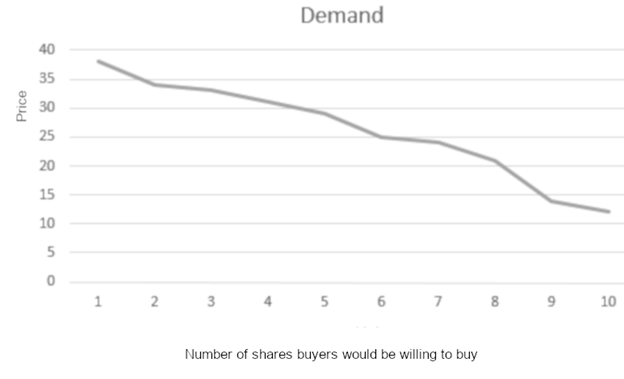

Unlike supply, this means that as the price goes up, fewer people are willing to buy a share. For example, if the price per share was $30, only 4 people would be willing to buy (the 4 on the right side who would be willing to pay $30 or more). The value the Buyers put on their stock is the “Bid Price” – the most amount of money a buyer would pay for a share of the stock.

If we look at the total demand as a graph, it slopes downwards:

Market Equilibrium

“Market Equilibrium” is the point where the supply and demand meet – all the potential buyers and sellers trade until there is no-one left who agrees on price. In a graph, you can see the equilibrium point as where the supply and demand meet.

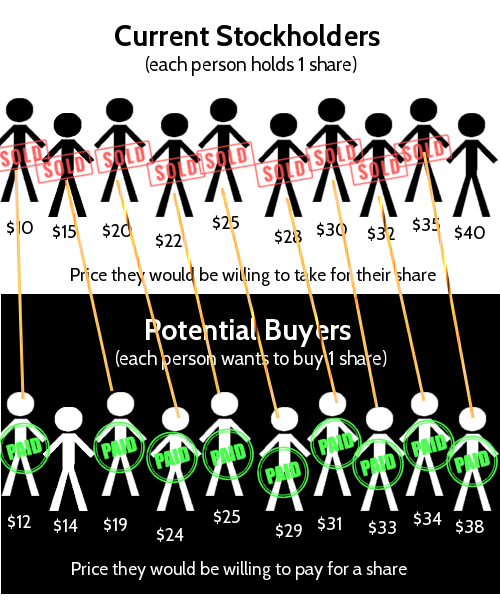

With our example of buyers and sellers, we can see the exact point where the market reaches equilibrium:

At a price of $27 (actually anywhere between $25.50 and $27.50) and a quantity of 5, the supply equals demand and the market is balanced. From a practical standpoint, these are the buyers and sellers who made a trade:

The buyers who wanted the stock the most, and the sellers who were the most eager to get rid of it, made their trade. For the other buyers, no seller was willing to sell their stock low enough for them to want to buy.

The next-lowest seller wants $28 for their stock, but the next-highest buyer will only pay $25, so no more trades will happen.

Efficient Equilibrium

This example makes sense, but why didn’t we have 8 trades instead of 5? If all the highest and lowest buyers and sellers were linked directly, a lot more trades could take place.

Unfortunately, there are some big problems with this. The biggest problem is information: the lowest seller, who sold for somewhere between $10 and $12, can now see that someone else just sold their share for over $35 – all the sellers would only try to sell to the highest buyers, and all the buyers would only try to buy from the lowest sellers. People would hide the true value they put on the stock for fear of getting ripped off.

Stock markets exist to make sure this does not happen. All the buyers and sellers can see what each other is doing by bringing all the buyers and sellers into the same room and having them say specifically what prices they are “Bidding” and “Asking” so everyone gets a fair deal for their trade.

Our next lesson goes into more detail about how stock exchanges and stock markets work!