How to Read an Income Statement

Businesses keep financial records to understand how their company is performing financially. For publicly traded companies (a business that sells shares of stock to the public on stock exchanges), these records are also shared with investors. The three main financial statements companies use are the income statement, the balance sheet, and the cash flow statement.

The income statement primarily focuses on the company’s revenue and expenses (what they’ve earned and what they’ve paid for) during a particular period of time. The bottom line shows a net profit or a net loss depending on the company’s performance during that period. Companies may complete an income statement whenever they want, but typically they are completed quarterly (every three months) or annually.

Explanation of an Income Statement

Income statements are known by various names including a profit and loss statement, a statement of earnings, a revenue statement, a statement of operations. These names are used interchangeably to describe the same financial statement that summarizes a company’s financial performance over a particular period.

The income statement serves two main purposes:

- It shows managers how the business is performing, and whether sales are keeping up with expenses.

- It provides investors with a snapshot of the overall performance of the company.

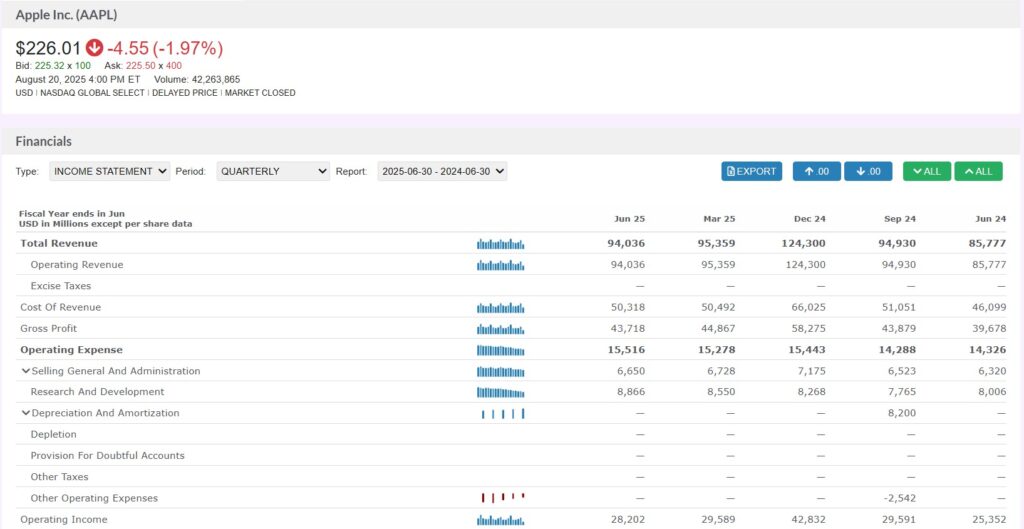

The important thing to remember about an income statement is that it represents profit for a particular period of time (e.g. 2nd Quarter 2025). This contrasts with the balance sheet, which represents a single moment in time. Below you can see the last few quarterly income statements for Apple Inc. (AAPL).

Apple, Inc’s Income Statement

Investors and analysts find the operating section of the income statement interesting because it reveals expenses directly linked to regular business operations such as advertising, sales commissions, and office supplies and equipment. On the other hand, the non-operating section details revenue and expense information about activities unrelated to a company’s regular operations, such as interest revenue, interest expenses, or any losses from lawsuits or other similar activities.

Steps in Understanding the Income Statement

Understanding the key terms in an income statement helps to analyze a company’s financial performance, determine its profitability, and make informed investment decisions. The income statement always follows a specific order since it presents a company’s revenues and expenses over a particular period. Starting with all revenues the company earned, and ending with the net income or profit after all expenses have been removed.

- Date. This will be at the top of the statement, for the period that it was created; such as, For the three-month period ending XYZ Month DD, YYYY.

- Net Sales or Operating Revenue. Refers to the amount of revenue generated from a company’s primary business operations, after deducting any discounts, returns, and allowances.

- Cost of Sales (also known as Cost of Goods Sold, or Cost of Revenue). The direct costs of producing and selling a product or service, including direct labor, and materials.

- Gross Profit or Margin. The amount of sales revenue left over after deducting the cost of goods sold, representing the profit generated from primary business operations before deducting operating expenses.

- Operating Expenses. The total expenses incurred to run a business, excluding cost of goods sold, interest, and taxes. Including rent, utilities, advertising, insurance etc.

- Operating Income. The income generated from a company’s primary business operations after deducting operating expenses.

- Interest Expense. The cost of borrowing money, usually in the form of interest paid on debt.

- Pre-tax Income. The amount of income generated from a company’s operations before accounting for any income taxes.

- Income Taxes. The taxes paid on a company’s income, typically calculated as a percentage of pre-tax income and adjusted for deductions and credits.

- Special or Extraordinary Expenses. Expenses that are considered unusual or one-time charges, such as restructuring costs, asset write-offs, or legal settlements.

- Net Income. The total profit (or loss) generated after deducting all expenses, including operating expenses, interest, taxes, and special expenses, from total revenue.

This order allows for a clear and logical presentation of a company’s financial performance, enabling investors, managers, and other users to make informed decisions.

Main Points to Remember

- The income statement represents how well a company is doing financially during a period of time. It summarizes the revenue, expenses, and profit into one easy-to-read financial document.

- Investors pay close attention to an income statement because it is an accurate snapshot of a company’s performance over a specific period of time.

- Lenders evaluate the suitability of a loan based on the income statement because it shows the profit a company is making.

- Investors pay close attention to the “bottom line” and expect this figure to grow consistently over time. This figure is often the first data point an investor looks at when determining whether or not to invest.

- Comparing income statements from one period to the next is a great indication of the direction a company is heading. If net income is increasing, then the company is heading in the right direction. If it is decreasing, then the company needs to make some changes.

Finding Income Statements

You can find the income statements of every publicly traded company in the United States using the research quoting tools available on our site.

Go to the Investing Research tab on the main menu, and click “Financial Statements” from the dropdown list. You can review the balance sheet, income statement, and cash flow statement for every publicly-traded company in the United States, going back 5 years.