5-05 Know When to Hold’em, Know When to Fold’em

So far, we have talked about riding your winners and ruthlessly selling off your losers. Now we need to think about those pesky in-betweeners; the stocks that are not really losing your money but have not been performing very well either.

Keep To Your Objectives

Protecting against losing 10% was easy with stop orders, but we also need to worry about our opportunity cost – the other things you could be doing with that money. Let us consider a classic example – Yahoo versus Google.

It is January, 2009. As an investor, you were interested in buying one of these tech stocks. Google has been taking Yahoo’s market share, but Yahoo has been gaining steam with its Yahoo Finance research tools. After doing your own research, you think that Yahoo is poised for a comeback, and so you buy $1000 in Yahoo stock at the beginning of February.

This is your big-play tech stock – the goal in your portfolio is big growth, and you are expecting some ups and downs.

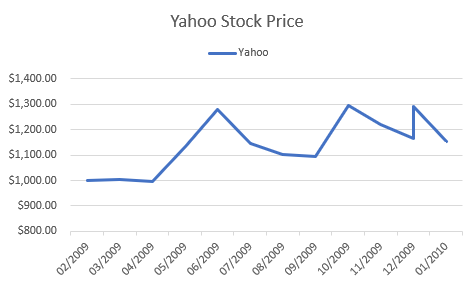

This is what your 12 month return looked like:

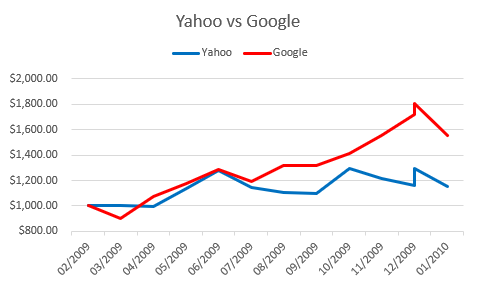

Your $1000 investment is now worth $1150. A 15% return is not bad. But when we compare this Google, we see a problem.

A Google investment of $1000 over the same period would be worth over $1500 – more than a 50% return. Now your 15% with Yahoo looks pretty sad – you really missed out. Your objective was looking for a big-play tech stock with big growth – by September, it was pretty clear that Yahoo was relatively flat compared to some of the other tech stocks, and so keeping with your original objective you should have sold it off and looked elsewhere.

Not because you were dumping a loser, but because it was not fulfilling the role in your portfolio that you were originally going for.

Bringing It All Together

Knowing when to hold ‘em and when to fold ‘em brings together a lot of the other concepts we have already been talking about.

- First, make sure your portfolio is well-diversified. This will let you have the best of both worlds, and you can adjust between them as time goes on.

- Second, ride your winners. If you invested $500 in both Yahoo and Google, by September or October it would have been pretty clear that Google was the star – you could sell off some (or all) of your Yahoo stock and invested in Google. To keep yourself diversified, you would begin the hunt for another big-growth tech stock to take Yahoo’s place.

- Third, have no favorites. Maybe you simply liked Yahoo better – you used its Yahoo Finance platform when doing your stock research and thought they really did have potential. But you cannot get sentimental, and the numbers do not lie.

The Exception – Market Tops

As you become more experienced, you’ll get a “feel” for those times when one of your winners is at a “market top.” As you watch stocks day after day and month after month, you will get the feel that a stock has gone too far too fast and it just has to come back down a bit. This is the time to consider just selling your winners, (or tightening up your stop-loss order to 4%) so you can increase your cash holdings so that you can find another stock that’s on the way up.

This also comes back to strategy – you should have an objective for every stock you are holding. If a stock’s price hits your original objective, it is time to re-evaluate its role in your portfolio. Did the price grow better than you expected because their sales and revenue have been growing like crazy, or did nothing fundamentally different change, and this is probably a price spike that will crash later?