5-02 Don’t Fall in Love With Your Stocks

Rule #2 – Don’t fall in love with your stock purchases – winners OR losers (particularly losers).

This is often the biggest pitfall to new investors – holding on a stock for too long because you “like it”. You can think of this rule as kind of the opposite of the “Buy what you Know” strategy for picking your first stocks – just because you know and love the company does not mean you need to own the stock.

You might love Coca-Cola, and drink bottles of it per day. You own Coke t-shirts and merchandise, and trash-talk Pepsi at every opportunity. But that does not mean you need to own KO (Coca-Cola’s ticker symbol), and if you already own KO, you should not feel any “betrayal” by selling it if it starts losing you money.

Trust Your Past Self

In the last chapter, we talked about stop and limit orders, and this rule is where they become extremely important. Every time you buy a new stock, you should IMMEDIATELY be setting a stop order or limit order, depending on your strategy. That way you do not need to obsess over that stock, only need check in once in a while and update your orders based on your new strategy.

This should be a great way to protect your losses or lock in your gains, but as soon as your orders trigger a day, week, or month later, you will find yourself second-guessing. Common thoughts you’ll find running through your head include:

But the price keeps going up! What if I am missing out on even more profit?

Remember that every time you sell a stock, someone else bought it. If you set a limit order and the price when up so much that the limit triggered, you sold your stock for a great deal, and the person who bought it is a “sucker”.

Do not get swept up in a short-term price spike. You set your limit, let the other guy be a sucker. If you cool off for a few days and it still looks like it is worth buying again, you can buy it then.

Sure the price fell below my stop price, but I think the price just hit the bottom. It is a great time to buy!

In the investing world, this is known as trying to “Catch a falling knife”. It MIGHT be near the price floor, and it might even be starting to rebound. But you need to trust your judgement from when you put in that stop order, which had none of the emotion you are experiencing now.

This stock just lost you money – stay out for a while and look for alternatives. If a few days later the stock looks like it really is starting to rebound, then you can think about buying again.

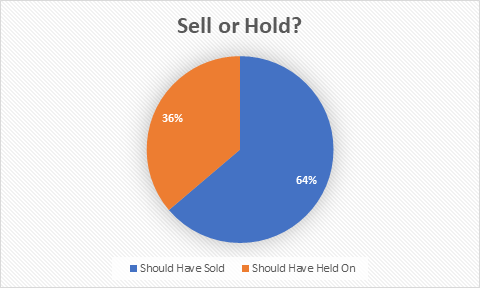

Take a look at the Google Search trends based on whether investors “Should have sold” or “should have held onto my stocks longer”:

Make sure this sinks in – almost 2/3 of the time, investors should have sold off their stocks when they had the chance!

Stocks Are Not Your Friends

You want to be loyal with your friends and family – be there when they are feeling low, support them through thick and thin. Your stocks are not your friends. They do not care whether you make or lose money – and you are not here to support them when they are having a bad day.

Take emotion out of your investing decisions – especially when it comes to selling off an underperforming stock.