1-12 Recent Performance of Investments

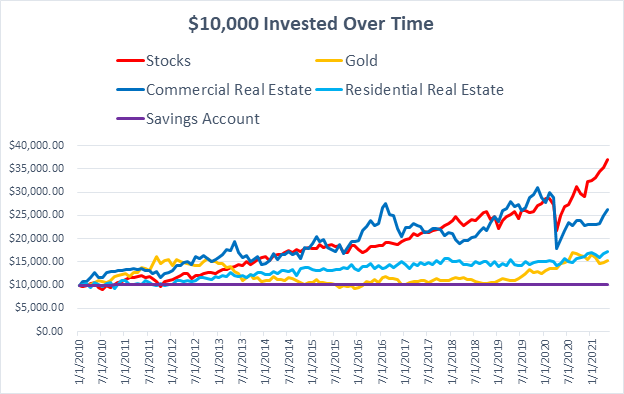

Now that we have looked at several different types of investments, we can compare how they have performed over time.

In this case, we will pretend we invested $10,000 in Stocks, Gold, Commercial Real Estate, Residential Real Estate, and a Savings Account in January of 2010, and pulled our money out at the end of May, 2021. This is how our investments would have grown over time:

That is quite a big difference! Now we can take a closer look at each investment:

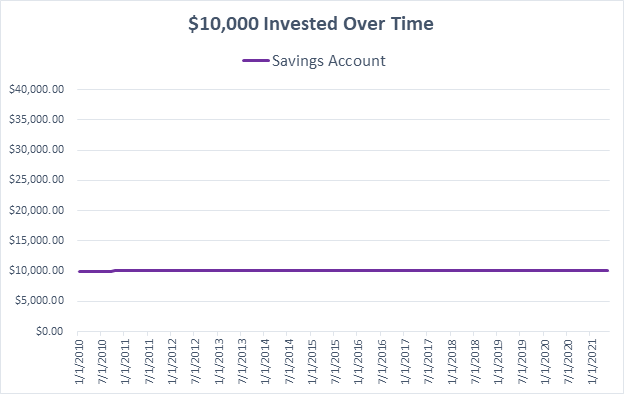

Savings Account

Our savings account grew, but not by much. This calculation is based on the average savings account return over time. For most of this period, interest rates were very low, and we were only earning about 0.06% per year. Our $10,000 investment only grew to about $10,100 over the whole time period.

However, there was no point where our investment ever lost money – so there was no risk at all in this investment.

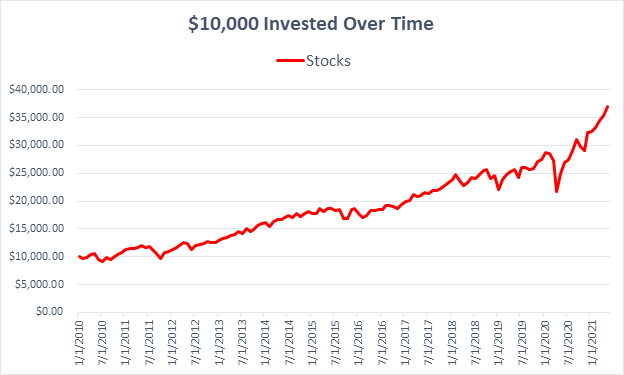

Stocks

Looking only at stocks, we invested just in the S&P 500, the 500 most popular stocks in the United States. Our $10,000 grew to just under $37,000 – a 3.7x increase. Stocks had the biggest growth of any of the investments over this period, but there was also some risk. There were a few months where there were some big dips, and we would have lost a lot of money.

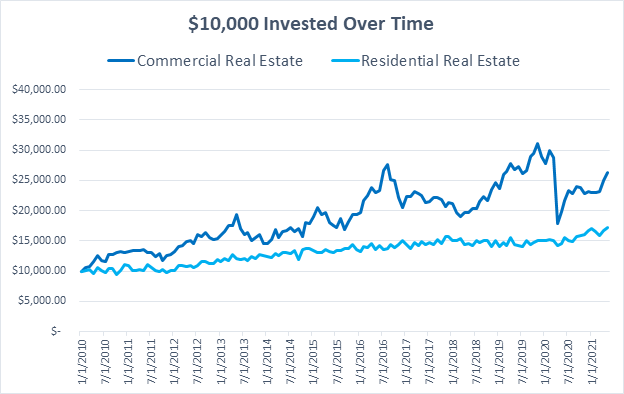

Real Estate

For this comparison, we have two different types of real estate investments.

Commercial REIT

The first is Commercial Real Estate – this is the value if we invested in the REIT “O”, which specializes in renting out commercial retail space. There are many different types of REITs with different specializations, but this is a good comparison because it has been around for a long time.

Our REIT had even more ups and downs than stocks, with some big peaks and big crashes. Overall, our REIT had the second highest return of the investments we looked at, finishing at $26,314.

Residential Property

For residential real estate, the growth is based on the average sale price of new homes in the United States over time. The overall growth is much smaller than stocks or REITs, but it is also far more stable – no big spikes, no big losses. Residential real estate finished at $17,158.

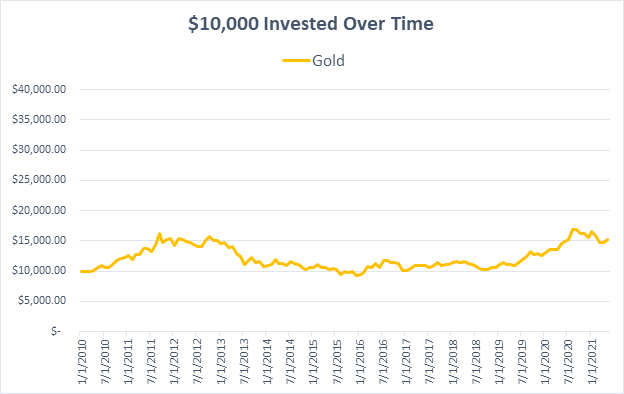

Gold

Last, we can look at an investment in gold. Gold’s price usually goes up when the stock market is very uncertain – so the price increased in 2011/2012 when the stock market was rocky, decreased or stayed stable for several years as the stock market was steadily growing, then increased again in 2021 during the coronavirus pandemic. This was caused both from investors looking for “End of the World” insurance, and because the stock market had some very wild swings. Our $10,000 investment in gold would be worth $15,283 – just a little bit less growth than residential real estate.

So Which Is Best?

Every investment we have looked at has a balance of Risk and Reward. Most of this course going forward focuses on stock market investing, but a healthy investment portfolio will have a mix of different investment types.

Generally speaking, this is the kind of risk and reward balance between the types of investments we have talked about so far:

| Investment | Risk Level | Potential Returns |

| Bank Certificates of Deposit | Very Low | Very Low |

| U.S. Treasury Bonds | Very Low | Low |

| Municipal Bonds | Low | Low – Medium |

| Corporate Bonds | Low – Medium | Medium |

| Real Estate | Low – Medium | Low – Medium |

| Stocks (Mutual Funds, ETFs ) | Medium | Medium – High |

| Precious Metals (Gold, Silver) | Medium – High | Medium – High |

| Leveraged ETFs | High | High – Very High |

| Options | High – Very High | Very High |

| Currency FX | Very High | Very High |