Balance Sheet

Businesses keep financial records to understand how their company is performing financially. For publicly traded companies (a business that sells shares of stock to the public on stock exchanges), these records are also shared with investors. The three main financial statements companies use are the income statement, the balance sheet, and the cash flow statement.

The balance sheet provides an overview of the value of a company at a specific point in time. It includes a summary of the company’s assets (what they own), liabilities (what they owe), and the owner’s or shareholder’s equity (the assets minus the liabilities, representing the portion of the company that is owned by shareholders).

If the company is privately owned, the term “owner’s equity” will be used. If the company is publicly traded, then the term “shareholder’s equity” will be used. Equity represents the value of the company and is calculated by subtracting liabilities from assets.

The balance sheet is sometimes called the “Statement of Financial Position” because it shows a snapshot of the company’s financial condition at a single point in time. This report uses a simple calculation to determine the financial condition. The calculation is called the accounting equation.

The Accounting Equation

| What we own | What we owe | What we’re worth | ||

| Assets | – | Liabilities | = | Owner’s Equity |

What are the components of a balance sheet?

A standard balance sheet has two sides. The assets are listed on the left side, and the financing is listed on the right. The financing includes liabilities and ownership equity. Assets are listed in order of liquidity. Liquidity means how easy it is to convert the asset into cash. Assets are also broken down into current assets (any asset which is expected to be sold or used within the year) and fixed or non-current assets (a company’s long-term investments and assets that are expected to last many years and can’t be easily converted into cash).

| Current Assets | Fixed Assets |

| Cash | Land and building |

| Accounts receivable | Plant and equipment |

| Short-term investments | Furniture |

| Inventory | Computers |

| Vehicles |

Liabilities are listed on the right side of the balance sheet. They are listed in order of when they are due from the shortest term to longest term. Liabilities are broken down into current liabilities (debts that must be paid within one year) and long-term liabilities (debts that will be paid over a longer period of time).

| Current Liabilities | Long-Term Liabilities |

| Accounts payable | Bonds payable |

| Notes payable | Long-term notes payable |

| Wages payable | Deferred tax liabilities |

| Income taxes payable | Mortgage payable |

| Interest payable |

Why is it called a balance sheet?

Remember the accounting equation, Assets – Liabilities = Owners Equity, another way to look at the equation is that Total Assets = Liabilities + Owner’s Equity. When you look at the equation this way, it tells you how your assets were financed. Did you have to borrow money (liabilities) or did the owners use their own money (owner’s equity)? After entering your numbers on both sides of the balance sheet, the left and right sides should be equal. In other words, they should balance.

Who is interested in the balance sheet?

There are many individuals who are interested in the balance sheet, including:

- Investors: current and future investors will review the balance sheet to view a company’s financial position. The numbers can be used to evaluate a company’s solvency (the ability to meet both long and short-term financial debts and obligations), liquidity (the ability to meet short-term obligations) and capital structure (how a company finances its operations through equity and debt).

- Lenders/Creditors: will use the balance sheet to determine a company’s ability to pay their current obligations before they decide to grant them another loan.

- Management: managers use the balance sheet to keep track of the company’s changing financial position in order to make strategic decisions for growth and to prevent bankruptcy.

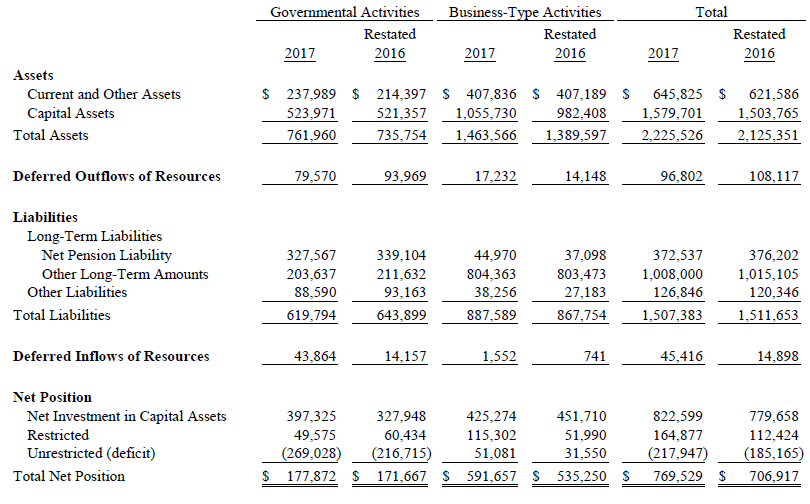

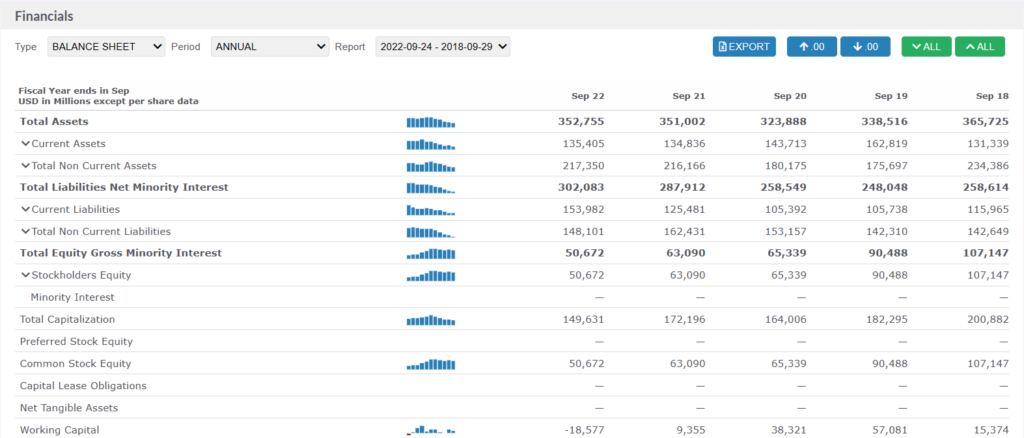

Example Balance Sheet for Apple Inc.

Companies compare balance sheets from one period to another to analyze their financial performance over time and identify changes in their assets, liabilities, and equity. This helps to track the company’s financial position, assess its liquidity and solvency, and make informed decisions about future operations and investments.

Are their current assets growing? Are liabilities decreasing? Have they accumulated more debt?

Understanding this basic financial statement helps company management set goals and make decisions for the coming year.

Where can I find the balance sheet for a specific company?

You can find the balance sheets of every publicly traded company in the United States using the research quoting tools available on our site.

Go to the Investing Research tab on the main menu, and click “Financial Statements” from the dropdown list. You can review the balance sheet, income statement, and cash flow statement for every publicly-traded company in the United States, going back 5 years.